May 30, 2024 13:04 GMT

Consumption Drives Downward Q1 GDP Revision

US DATA

DataEM BulletHomepagemarkets-real-timeCommoditiesEmerging Market NewsMetals bulletEnergy BulletsData BulletBulletMarketsFixed Income BulletsForeign Exchange Bullets

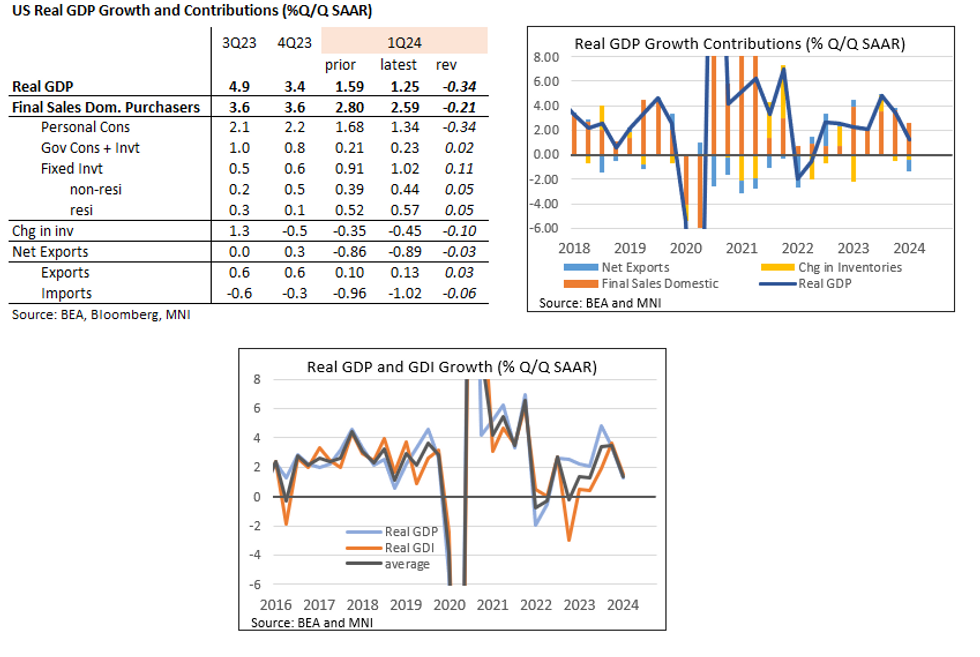

The second estimate of Q1 GDP was 1.3% Q/Q SAAR, in line with consensus and below the advance estimate of 1.6%.

- Final sales of domestic purchases contributed 2.59pp to the overall GDP print (vs 2.80pp in the advance reading).

- Fed officials regard this as a key indicator of underlying growth, so the softer print (alongside a slightly softer PCE deflator) represents a marginally dovish development.

- This reflected a -0.34pp downward revision to personal consumption (which rose 2.0% Q/Q SAAR vs 2.0% cons, 2.5% advance), offset slightly by a 0.11pp upward revision to fixed investment.

- The revisions to consumption are unsurprising following downward revisions to February and March retail sales.

- Inventories were revised 0.1pp lower, contributing -0.45pp to real GDP, while net exports saw a -0.03pp revision to contribute -0.89pp overall.

- Notably, Q4 GDI saw a -1.2pp downward revision to 3.6% Q/Q. Q1 GDI rose 1.5% Q/Q.

- The Q1 core PCE index registered an 8bp downward revision to 3.65% Q/Q, which may impact the monthly profile in tomorrow’s PCE release.

179 words