June 12, 2024 02:04 GMT

CPI Pressures Remain Benign, PPI Aided By Higher Commodities, Base Effects

CHINA DATA

DataEM BulletHomepagemarkets-real-timeCommoditiesEmerging Market NewsMetals bulletEnergy BulletsData BulletBulletMarketsFixed Income BulletsForeign Exchange Bullets

China May inflation data was close to expectations. Headline CPI rose 0.3% y/y, against a 0.4% forecast and 0.3% in April. The PPI was -1.4% y/y, against a -1.5% forecast and -2.5% prior.

- The detail on the CPI still suggests quite a benign domestic price backdrop. In m/m terms prices fell 0.1%. Consumer good prices were flat in y/y terms, services were 0.8% y/y, unchanged from April. Goods price deflation has ended, but services prices are off the pace from the second half of 2023.

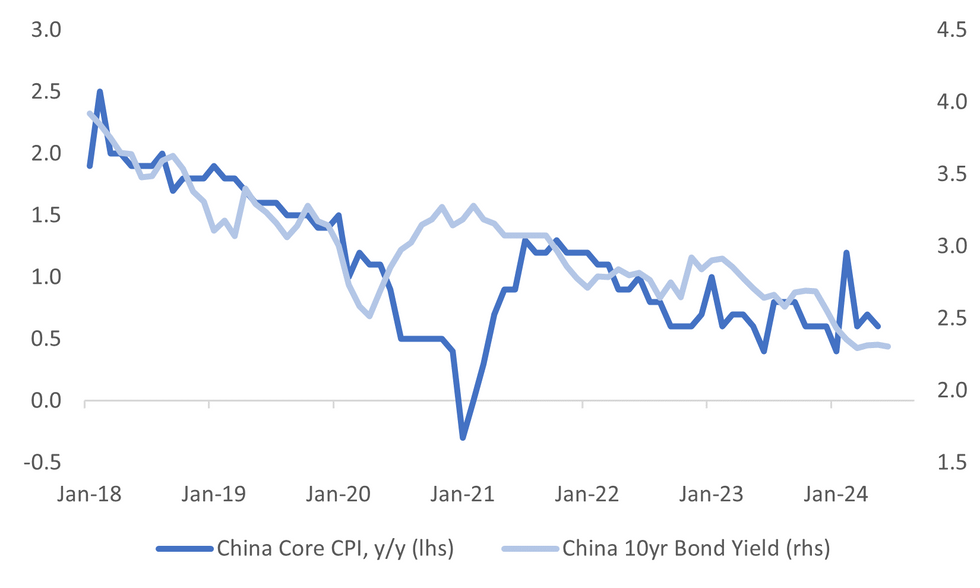

- Core inflation (ex food and energy) was 0.6% y/y, down slightly from April's 0.7% pace. The trend remains benign, albeit up from recent lows. The chart below overlays the 10yr CGB yield against core CPI y/y.

- In terms of the sub categories, we saw drags from food and transport. The main positives were clothing, recreation and the other segment. Only one category saw a pick up in y/y pace versus the April outcome, which was food, but it remained negative in an outright sense.

Fig 1: China Core CPI Y/Y Versus 10yr CGB Yield

Source: MNI - Market News/Bloomberg

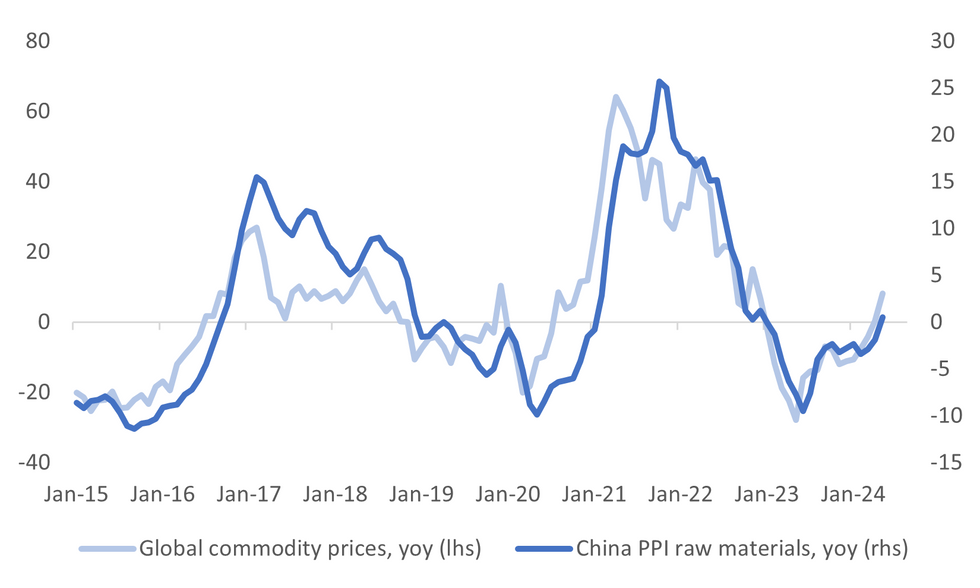

- For the PPI, base effects are favorable for a further improvement in y/y momentum over the next few months.

- The global commodity price backdrop is also helping. The second chart below plots the raw materials sub index of the PPI (which ticked up into positive territory, +0.5% y/y), against spot global spot commodity price changes y/y. Mining and manufacturing PPI's were also less negative in y/y terms in May.

- Consumer goods remained negative and close to the April y/y pace.

Fig 2: China PPI Raw Materials & Global Commodity Prices Y/Y

Source: MNI - Market News/Bloomberg

Keep reading...Show less

300 words