-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessDecember Dot Plot: How Many 2024 Cuts? (1/2)

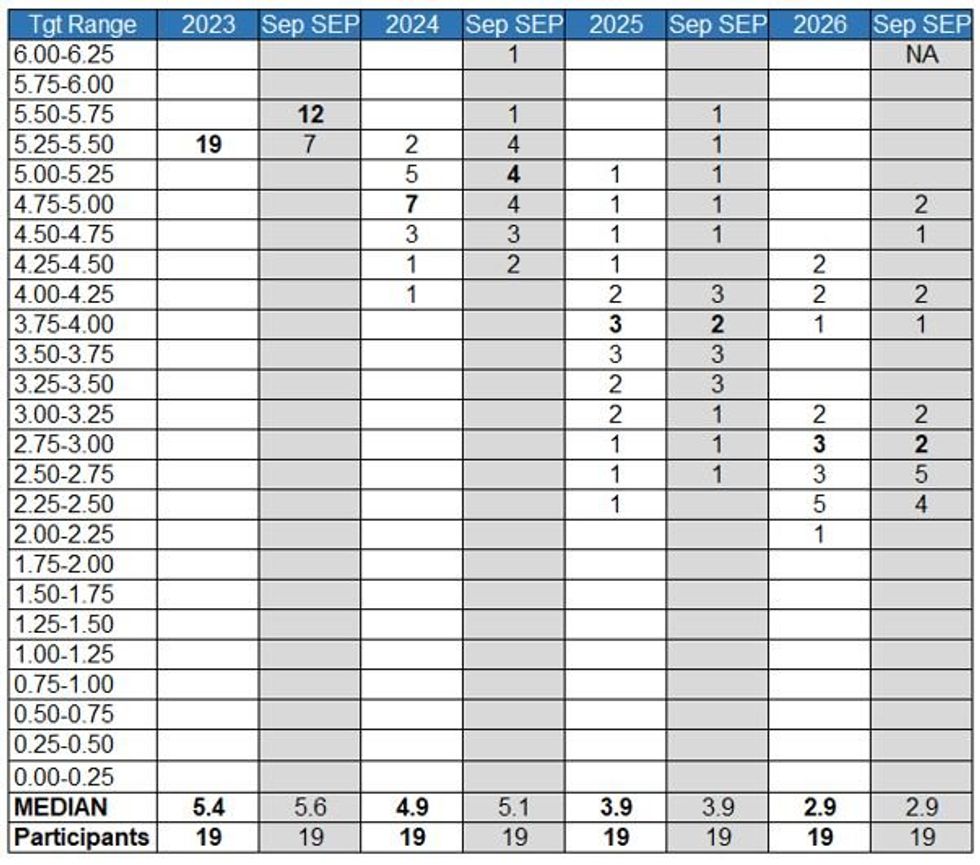

In general, MNI's Markets Team expects December's Dot Plot to push at least slightly against market expectations for substantial cuts next year, with a few members seeing just one or no cuts. (Link to September SEP)

- 2024: The FOMC’s 2024 Fed funds median will be the most closely-scrutinized aspect of the December meeting projections. It’s widely expected that participants will project cuts from the end-2023 level of 5.25-5.50% (equating to a 5.4% rounded midpoint) next year, with consensus appearing to expect that at least two reductions will be penciled in. That would leave the median at 4.75-5.00% (4.9%). That would represent the same 50bp of cutting that had been seen in the September projections albeit those were from a higher starting point of 5.50-5.75%.

- We also note that in September, 9 of 19 members already saw rates at 4.9% or below – meaning that there is likely very little resistance to a lower median. We think that 50bp is basically the level of signalled cuts that says “we acknowledge market pricing and the downward surprises to incoming inflation data but we retain our softening bias toward the next move being a hike”.

- A 5.1% median (ie 25bp cuts) would be extremely hawkish in this context, and 4.6% (ie 75bp cuts) would only be moderately dovish – particularly if it’s widely supported. The latter is about as close to market pricing that the FOMC will get at this point.

- The distribution could thus be important here, and our Instant Answers look for the number of participants eyeing steady/higher rates by end-2024 (>5.125%), and those who see more cuts than the consensus 50bp to be pencilled in (<4.875%) or more than 75bp (<4.625%).

- In the September projections, at least 13 and as many as 17 of 19 members anticipated rate cuts in 2024, with a range of 4.4% (lowest) to 6.1% (highest). That range is due to shift down to 4.1% to 5.4% in our view – meaning the biggest dove(s) sees 100bp of cuts and the biggest hawk(s) no longer see further hikes.

Source: MNI Expectations For December "Dot Plot" Distribution; Federal Reserve

Source: MNI Expectations For December "Dot Plot" Distribution; Federal Reserve

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.