-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBOC Vows To Step Up Monetary Support

EXECUTIVE SUMMARY

- PBOC VOWS INCREASED MONETARY POLICY SUPPORT

- PBOC FIX FALLS WITHIN CLOSE PROXIMITY TO AVERAGE ESTIMATE

- BEIJING TO COVID TEST MOST OF CITY AS LOCKDOWN SPECTRE LOOMS (BBG)

- TWITTER ACCEPTS ELON MUSK’S $44BN TAKEOVER OFFER (FT)

- RUSSIA FOREIGN MIN LAVROV: DO NOT UNDERESTIMATE THREAT OF NUCLEAR WAR (RTRS)

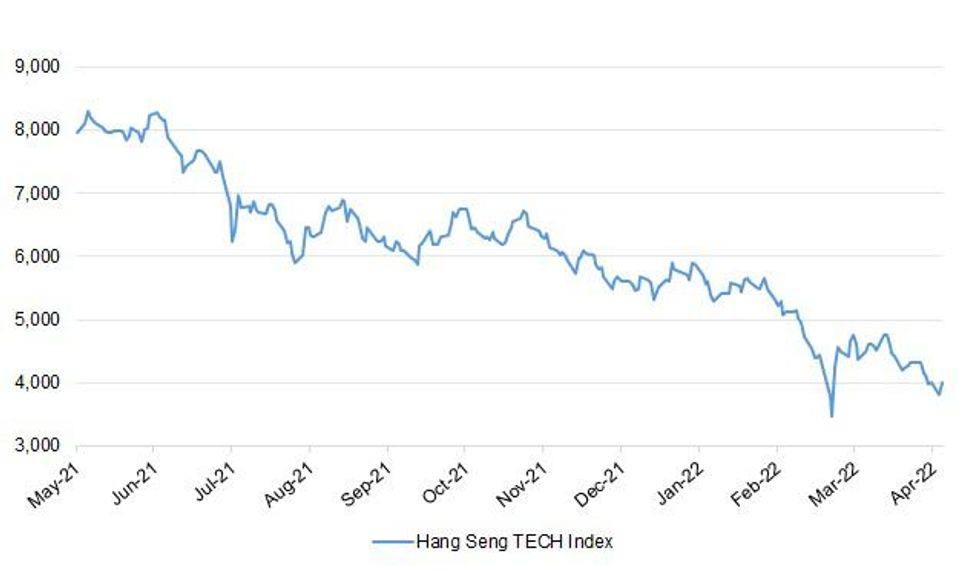

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The UK’s top civil servant has privately warned Boris Johnson against forcing government workers back to the office amid growing anger in Whitehall over “scare tactics”, the Guardian has learned. Spot checks on office working by Jacob Rees-Mogg, including “sorry you were out when I visited” notes left on empty Whitehall desks, have seen the Cabinet Office minister branded “the milk monitor” by disgruntled officials. (The Guardian)

EUROPE

EU: EU lawmakers backed on Monday new rules to curb acquisitions or bids for public contracts by subsidised foreign companies, part of a general push to ensure an economic playing field that is level and not distorted by Chinese and other firms. The European Parliament's trade committee voted unanimously in favour of a tighter version of a law proposed by the European Commission in May 2021 to allow it to investigate the role of foreign subsidies in the EU single market. (RTRS)

GERMANY/UKRAINE: Germany will decide soon on whether to approve the delivery of 100 old Marder infantry fighting vehicles to Ukraine, a government spokesperson said on Monday, in what would be the first German heavy weapons shipment to Ukraine. German defence company Rheinmetall has requested approval to export the vehicles to Ukraine, a defence source told Reuters on Monday, aiming to restore them over the coming months before shipping them. Rheinmetall has also requested approval to export 88 old Leopard 1A5 tanks to Ukraine, German newspaper Die Welt reported, citing documents. (RTRS)

POLAND/UKRAINE: Poland has sent tanks to Ukraine, Polish Prime Minister Mateusz Morawiecki said on Monday without giving any further details. (RTRS)

UKRAINE: All tariffs on goods coming to Britain from Ukraine under an existing free trade deal will be axed to help the Ukrainian economy, the British government announced on Monday. London said tariffs would be reduced to zero and all quotas removed following a direct request from Ukraine's President Volodymyr Zelenskiy, saying the move would provide a boost for Ukrainian businesses involved in key exports such as barley, honey, tinned tomatoes and poultry. (RTRS)

UKRAINE: Ukraine’s foreign minister on Monday urged the U.N. chief to press Russia for an evacuation of the besieged port of Mariupol, calling it something the world body is capable of achieving. Foreign Minister Dmytro Kuleba told The Associated Press in an interview he was concerned that by visiting Moscow on Tuesday before traveling to Kyiv, U.N. Secretary-General Antonio Guterres could be vulnerable to falling into a Kremlin “trap” in the war. “Many other foreign officials were trapped visiting Moscow and played around just to show the supremacy of Russian diplomacy and how great they are and how they dictate the world how to behave,” he said. (AP)

UKRAINE: The Russian invasion of Ukraine has significantly disrupted Ukrainian agricultural production, the UK's Ministry of Defence tweeted in a regular bulletin on Monday. "Ukrainian grain harvest for 2022 is likely to be around 20% lower than 2021 due to reduced sowing areas following invasion," it said. The reduced grain supply from Ukraine will generate inflationary pressures, elevating the global price of grain, British military intelligence said. (RTRS)

UKRAINE: The United States will host an expected gathering of more than 40 countries on Tuesday for Ukraine-related defense talks that will focus on arming Kyiv so it can defend against an unfolding and potentially decisive Russian onslaught in the east, U.S. officials said. U.S. Defense Secretary Lloyd Austin is holding the event at Ramstein Air Base in Germany following a trip to Kyiv where he pledged additional support to Ukrainian President Volodymyr Zelenskiy's war effort. (RTRS)

UKRAINE: U.S. Senate Majority Leader Chuck Schumer on Monday said he expected "swift, bipartisan" passage of another bill to aid Ukraine in its fight against Russia once President Joe Biden submits a new funding request. While Schumer did not provide any details on the possible size of such a package, he said, "We must continue helping the people of Ukraine in their fight against Russian aggression" and, "I expect swift bipartisan cooperation to get it done." Senator Richard Shelby, the senior Republican on the Senate Appropriations Committee that oversees the doling out of federal dollars, told reporters that $5 billion in new aid for Ukraine was being discussed. "I expect Ukraine is going to need more help, both military and humanitarian," Shelby said. (RTRS)

U.S.

FED: Federal Reserve Chair Jerome Powell is set to hold his first in-person press conference since the pandemic began, meeting reporters following the conclusion of the U.S. central bank’s two-day policy meeting. (BBG)

FED: The Senate on Monday advanced President Biden’s nominee to serve as the Federal Reserve Board’s number two, teeing her up for final confirmation votes as soon as this week. Senators voted 54-40 to end debate on Lael Brainard’s nomination to be Fed vice chair, with several Republicans crossing party lines to support her nomination. (Hill)

ECONOMY: About 40% of U.S. small businesses intend to raise selling prices by 10% or more amid decades-high inflation, according to a survey from the National Federation of Independent Business. Overall, more than two-thirds of the respondents plan to increase prices in the next three months, according to the survey, conducted between April 14 and April 17 among 540 business owners. (BBG)

FISCAL: Democratic Senator Joe Manchin is exploring an energy and climate package aimed at winning enough Republican support to skirt the partisan budget reconciliation process that has held hostage hundreds of billions of dollars in potential spending on related priorities. “If I can find something bipartisan, we don’t need reconciliation,” Manchin, of West Virginia, said in an interview on Monday. A bipartisan energy package, like the infrastructure bill passed last year, could undercut the broader Democratic agenda but give President Joe Biden an election-year victory on an issue voters care about. (BBG)

EQUITIES: Twitter’s board has agreed to sell the company for roughly $44bn to Elon Musk, a deal that would result in the world’s richest man seizing control of the influential social media platform. Announcing the deal, Musk said “free speech is the bedrock of a functioning democracy” and described the social media platform as “the digital town square where matters vital to the future of humanity are debated”. Musk’s take-private of Twitter could turn the chief executive of Tesla, who has used the platform to attack regulators and critics, into a new-age media baron given that millions of people rely on the San Francisco-based platform for news. Shareholders of the platform will receive $54.20 in cash for each share of Twitter common stock that they own upon closing of the transaction. The purchase price represents a 38 per cent premium to the company’s closing price on April 1, the day before Musk revealed he had built a 9 per cent stake in the company. (FT)

OTHER

GLOBAL TRADE: The Biden administration is carefully studying the inflationary impact of tariffs imposed on China by former President Donald Trump's administration given a surge in consumer prices, White House press secretary Jen Psaki said on Monday. Psaki said she had no news on tariff reductions since U.S. Trade Representative Katherine Tai is still reviewing Trump-era tariffs on Chinese goods. But she made clear that higher inflation was a factor in the deliberations. "This is an ongoing process, and we're certainly looking at where we see costs being raised and, at a time where we're seeing heightened inflation, certainly that's on our minds," Psaki said. She said the review was also looking at larger issues, such as China's behavior in global markets and the impact of tariffs on wages, job opportunities and America's competitive edge. (RTRS)

ECONOMY: The Biden administration is weighing swift action to ramp up global food assistance amid rising concern that Russia’s invasion of Ukraine is stoking a hunger crisis in many poorer nations, according to people familiar with the discussions. The White House is considering attaching a global food aid request to the military aid package for Ukraine that President Joe Biden is preparing to send to Congress as a means to move the relief quickly. (BBG)

GEOPOLITICS: The 193 members of the United Nations General Assembly will vote on Tuesday (Apr 26) on a resolution that would require the five permanent members of the Security Council to justify their use of the veto in future. Discussions of veto reform are rare and controversial, but have been revived by Russia's invasion of Ukraine. Directly targeting the United States, China, Russia, France and the United Kingdom - who are the only holders of the veto right - the measure would "make them pay a higher political price" when they opt to use their veto to strike down a Security Council resolution, said an ambassador from a country that does not have the veto, and who asked to remain anonymous. Critics call the measure, introduced by Liechtenstein, a "simple procedural reform". (AFP)

NATO: Finland and Sweden will together express their wish to join NATO in May, tabloid newspapers Iltalehti in Finland and Expressen in Sweden reported on Monday, citing sources close to the matter. Despite tightening cooperation with the military alliance since Russia annexed Crimea in 2014, the Nordic countries had both opted to stay out. But Russia's invasion of Ukraine, which it calls a "special operation", has forced Sweden and Finland to examine whether their longstanding military neutrality is still the best means of ensuring national security. (RTRS)

JAPAN: Japan’s Finance Minister Shunichi Suzuki denies a report saying he discussed the possibility of currency intervention with U.S. Treasury Secretary Janet Yellen. Following Suzuki’s meeting with Yellen in Washington D.C. last week, broadcaster TBS reported that they had discussed the possibility of coordinated currency intervention and that the U.S. side’s tone was that of “positive consideration”. (BBG)

JAPAN: Japan’s Health Ministry found one probable case of the mysterious severe acute hepatitis affecting children in the U.S., the U.K. and 10 other countries, raising concerns that the disease is spreading outside of Europe and the U.S. The infection, likely the first case in Asia, was found in a young child. (BBG)

AUSTRALIA: Australian Prime Minister Scott Morrison is running out of time to improve his standing in the electorate ahead of an election due to be held on May 21, with new opinion polling showing his center-right Liberal National Coalition badly trailing the opposition Labor Party. A Newspoll survey published by The Australian newspaper on Monday night showed Morrison had failed to make up any ground against Labor in the past week, with the opposition still leading the government 53% to 47%. A separate opinion poll by Ipsos released in the Australian Financial Review had Morrison’s party in a worse position, with Labor in front 55% to 45%. However neither Morrison or opposition Labor leader Anthony Albanese are popular with voters, according to polling. Both Morrison and Albanese have a negative approval rating in the new opinion surveys, with Newspoll placing both leaders net approval at -12. Meanwhile Ipsos said Morrison is the least trusted prime minister in 27 years, while just 31% said Albanese had a “firm grasp on economic policy.” (BBG)

SOUTH KOREA: South Korea’s Finance Minister nominee Choo Kyung-ho says he’ll seek to lower the top rate of corporate tax to help strengthen international competitiveness, Korea Economic Daily says, citing a statement submitted ahead of his parliament hearing. Incumbent President Moon Jae-in’s administration had raised the top end of corporate tax rate to 25% from 22%. Choo also says he plans to ease regulations for companies in line with global standards. (BBG)

NORTH KOREA: North Korea will speed up development of its nuclear arsenal, leader Kim Jong Un said at a military parade that displayed intercontinental ballistic missiles (ICBMs), state media reported on Tuesday. "The nuclear force of the Republic must be ready to exercise its responsible mission and unique deterrence anytime," Kim told the gathering, according to KCNA.The fundamental mission of the North's nuclear force is to deter war, but that may not be the only use if other countries impose undesired circumstances, he added. (RTRS)

HONG KONG: Hong Kong is ready to launch yuan-denominated stock trading to cater to investors in Shanghai and Shenzhen, with final clearances from regulators in mainland China expected in the second half of the year, according to people familiar with the matter. The city’s own infrastructure is largely ready to accommodate trading of shares in the Chinese currency via the southbound Stock Connect link, but bourses in the mainland and clearing houses need more time for testing and final preparations, according to people familiar with the matter who asked not be named discussing confidential information. The process is being slowed by the pandemic situation and lockdown in Shanghai, the people said. (BBG)

HONG KONG: Hong Kong’s leader said there were no plans to further relax border controls, as the city continues to chart a cautious approach to Covid-19 despite plunging cases. Hong Kong Chief Executive Carrie Lam told a regular news briefing Tuesday that the government would continue to press ahead with a three-stage easing announced last month. Phase two of that plan will begin in the second half of next month. (BBG)

PHILIPPINES: The Philippine central bank may consider raising its key interest rate in June, central bank Governor Benjamin Diokno said. “Our next meeting is on May 19th, and so we will look at new data. And hopefully it will show a first quarter growth of may be around 6%-7%, and on the basis of that maybe we will wait another cycle,” Diokno said in a Bloomberg Television interview with Kathleen Hays late Monday in New York. “We have another meeting in June. And may be that’s the time when we will consider the increase in policy rate.” “We can afford to wait as to what will be the move of the Fed in the next two meetings,” Diokno said. “Right now, there is no evidence of second round effect on the demand side.” (BBG)

MEXICO: Mexico’s government is seeking a pact with private companies to limit price increases of basic items, in a bid to tame inflation that has failed to budge from two-decade highs, the president’s spokesman Jesus Ramirez told Bloomberg News. The potential deal, which could be announced by President Andres Manuel Lopez Obrador as early as Tuesday, aims to focus on the roughly 25 items that are part of Mexico’s basic basket of goods, Ramirez said in a phone interview, adding that it’s not yet decided which goods will be included in the agreement. Lopez Obrador’s government has met with representatives of leading companies to discuss the plan, said two sources familiar with the talks, who asked not to be named discussing private conversations. (BBG)

U.S./BRAZIL: U.S. State Department officials held their first high-level talks with the Brazilian government since 2019 on Monday, reinforcing ties between the Western Hemisphere's two largest democracies despite their differences over the Ukraine war. While Brazil's far-right President Jair Bolsonaro has not condemned the Russian invasion of Ukraine, U.S. Under Secretary of State for Political Affairs Victoria Nuland thanked Brazilian diplomats for voting with the United States at the United Nations Security Council. "In a time when the world is in turmoil, the United States and Brazil need each other," she told reporters, saying that Russia was "undermining the principles that the U.S. and Brazil stand for." (BBG)

RUSSIA: Russia stands for ruling out the threat of nuclear conflicts despite high risks at the moment and wants to reduce all chances of "artificially" elevating those risks, Foreign Minister Sergei Lavrov said in a television interview aired late on Monday. "This is our key position on which we base everything. The risks now are considerable," Lavrov told Russia's state television, based on a transcript provided on the ministry's website. "I would not want to elevate those risks artificially. Many would like that. The danger is serious, real, And we must not underestimate it." (RTRS)

RUSSIA: Deliveries of Western weaponry to Ukraine mean that the NATO alliance is "in essence engaged in war with Russia" and Moscow views these weapons as legitimate targets, Russian Foreign Minister Sergei Lavrov said in an interview aired on Monday. (RTRS)

RUSSIA: Vladimir Putin at a meeting of the Council of Legislators may express his attitude towards the possible abolition of direct elections of governors. According to RBC sources, among the options are the temporary abolition of direct elections and the transfer of elections to legislative assemblies. (RBC)

RUSSIA: Police in the Moldovan separatist region of Transnistria, where Russia has stationed troops, say several explosions hit the Ministry of State Security building Monday that are believed to be from rocket-propelled grenades. No injuries were immediately reported in the alleged attack, which took place on the Orthodox Easter Monday holiday in the city of Tiraspol when the building would presumably be more empty than usual. No one immediately claimed responsibility for the incident. Moldova’s Office for Reintegration Policy said it was “concerned” about the incident. “The aim of today’s incident is to create pretexts for straining the security situation in the Transnistrian region, which is not controlled by the constitutional authorities,” the Moldovan Foreign Ministry said in a statement. (The Washington Post)

PALM OIL: Global edible oil consumers have no option but to pay top dollar for supplies after Indonesia's surprise palm oil export ban forced buyers to seek alternatives, already in short supply due to adverse weather and Russia's invasion of Ukraine. The move by the world's biggest palm oil producer to ban exports from Thursday will lift prices of all major edible oils including palm oil, soyoil, sunflower oil and rapeseed oil, industry watchers predict. That will place extra strain on cost-sensitive consumers in Asia and Africa hit by higher fuel and food prices. "Indonesia's decision affects not only palm oil availability, but vegetable oils worldwide," James Fry, chairman of commodities consultancy LMC International, told Reuters. (RTRS)

PALM OIL: Indonesia is prepared to widen a palm oil export ban, which currently only applies to refined palm olein, if local shortages of derivative products used in cooking oil occur, according to details of an official meeting with companies. The world's biggest palm oil exporter plans from Thursday to stop shipments of refined, bleached and deodorised (RBD) palm olein but will allow exports of crude palm oil or other derivative products, senior government official Musdhalifah Machmud said on Tuesday. However, authorities will strictly monitor domestic supply of refined palm oil and crude palm oil, which are used as raw materials to make RBD olein, according to details in a government presentation which was verified by Machmud. "If there is shortage of refined palm oil, then further export bans can be carried out," read one slide, which was presented to palm oil companies on Monday. (RTRS)

OIL: A supertanker delivered U.S. crude oil to Spain for the first time in more than six years as Europe increasingly relies on American energy to replace supply disruptions from Russia’s war in Ukraine. Vessel Solana delivered some of its 2 million barrels of crude into the Spanish port of Bilbao in mid-April before unloading additional oil in Wilhelmshaven, Germany, and Rotterdam, tracking data show. Solana had received its U.S. oil cargo from smaller vessels while in the U.S. Gulf of Mexico before departing for Europe. Supertankers will increasingly be “used to send U.S. crude to Europe as the continent’s buyers seek to max out alternatives to Russian oil,” said David Wech, chief economist for analytics firm Vortexa. (BBG)

OIL: Asian oil refiners are shunning a major export grade from the Russian Far East due to sanctions on a tanker company that ships the cargoes. Buyers are now trying to back out of purchases of Sokol, which was sold outfor May-loading two weeks ago, said people with knowledge of the matter. At least one shipment of the variety for loading in end-May has been canceled, with several other refiners trying to wind back purchases for June, said the people who asked not to be named due to the sensitivity of the information. Sokol is being avoided due to the involvement of Sovcomflot PJSC, a Russian state-controlled firm that transports the crude produced at the Sakhalin-I project from the De-Kastri export terminal to customers in North Asia. The company’s tankers are struggling to get insurance from international firms after it was added to a list of U.K.-sanctioned entities, the people said. (BBG)

CHINA

PBOC: China’s central bank pledged to increase support for the economy, seeking to reassure investors as financial markets take a hammering from a worsening growth outlook and threats of widespread Covid lockdowns. The People’s Bank of China “will step up the prudent monetary policy’s support to the real economy, especially for industries and small businesses hit hard by the pandemic,” it said in a statement on Tuesday. (BBG)

PBOC: The Chinese central bank says recent market fluctuations were driven by investor expectations and sentiment, and vows to promote “healthy and stable” financial market development, according to a statement from PBOC. PBOC vows to keep liquidity reasonably ample. PBOC promises to increase support for the real economy via prudent monetary policy, especially for industries hit hard by the pandemic and smaller businesses. PBOC vows to complete rectifications of major platform companies as quickly as possible, statement says, without giving a timetable.PBOC will increase 100b yuan of relending quota for coal mining, use and storage. PBOC will also add relending quota for aviation sector, statement says, without offering value. (BBG)

ECONOMY: China should stabilise the economy via employment, taming prices, and ensuring supply, as unexpected changes in domestic and foreign situations have led to renewed downward pressure, Xinhua News Agency reported citing Premier Li Keqiang speaking at a work conference on Monday. Policies have already been announced should be implemented as soon as in H1 to help offset severe challenges, while local governments should shoulder the responsibility of safeguarding food and energy security as well as stabilising the industrial and supply chains, Xinhua cited Li as saying. (MNI)

FOREX: The People’s Bank of China could use more tools to stabilise the yuan after it cut the foreign currency reserve requirement for banks by one percentage point to 8% on Monday, the Securities Daily reported citing Chang Ran, senior researcher of Zhixin Investment Research Institute. The cut is relatively cautious, compared with the two 2-pps hikes last year in response to the strong appreciation of yuan, Chang was cited as saying. The 1pps cut can release about USD10.5 billion of foreign exchange liquidity, which will promote the basic stability of yuan and meet the funding needs of repaying foreign debts, the newspaper said citing analysts. (MNI)

EQUITIES: The A-share market may fall further in the short-term amid epidemic outbreaks and U.S. tightening expectations before the Fed rate meeting in May, the Securities Times reported citing analysts. Some listed companies or important shareholders have repurchased and increased their holdings to buoy sluggish stock prices, while more than 2,500 stocks dropped over 8% on Monday with the Shanghai Composite Index down 5.13%, the biggest one-day drop in more than two years, the newspaper said. (MNI)

CORONAVIRUS: Beijing started mass testing millions of its residents as part of an unprecedented scheme designed to identify and squash omicron’s stealthy spread before it spirals out of control in the Chinese capital. Nearly 20 million people will undergo three rounds of Covid testing through the weekend as Beijing’s municipal government expands the effort that started in the eastern Chaoyang district, where most cases in the recent flareup have emerged. The broader testing will encompass 10 other administrative districts and an economic development zone, which houses the headquarters for the e-commerce giant JD.com Inc. and other high-tech firms. The scale of the program is unparalleled in Beijing, even as China has kept Covid in check since early 2020 thanks in large part to massive testing efforts that repeatedly spotted tiny incursions of the pathogen in the world’s most populous country. (BBG)

OVERNIGHT DATA

JAPAN MAR JOBLESS RATE 2.6%; MEDIAN 2.7%; FEB 2.7%

JAPAN MAR JOB-TO-APPLICANT RATIO 1.22; MEDIAN 1.22; FEB 1.21

NEW ZEALAND MAR CREDIT CARD SPENDING +3,4% Y/Y; FEB +1.1%

NEW ZEALAND MAR CREDIT CARD SPENDING +3.2% M/M; FEB -2.7%

SOUTH KOREA Q1, A GDP +3.1% Y/Y; MEDIAN +3.0%; Q4 +4.2%

SOUTH KOREA Q1, A GDP +0.7% Q/Q; MEDIAN +0.6%; Q4 + 1.2%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7820% at 09:49 am local time from the close of 1.6323% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday vs 45 on Sunday.

PBOC SETS YUAN CENTRAL PARITY AT 6.5590 TUES VS 6.4909

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5590 on Tuesday, compared with 6.4909 set on Monday marking the biggest daily drop since Aug 13,2015.

MARKETS

SNAPSHOT: PBOC Vows To Step Up Monetary Support

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 180.69 points at 26772.11

- ASX 200 down 145.778 points at 7327.5

- Shanghai Comp. up 27.42 points at 2955.932

- JGB 10-Yr future up 1 ticks at 149.28, yield down 0.2bp at 0.245%

- Aussie 10-Yr future up 2 ticks at 96.84, yield down 0.9bp at 3.121%

- US 10-Yr future down 35.9375 ticks at 119.25, yield up 3.88bp at 2.8586%

- WTI crude up $0.98 at $99.52, Gold up $3.89 at $1901.71

- USD/JPY up 4 pips at Y128.18

- PBOC VOWS INCREASED MONETARY POLICY SUPPORT

- PBOC FIX FALLS WITHIN CLOSE PROXIMITY TO AVERAGE ESTIMATE

- BEIJING TO COVID TEST MOST OF CITY AS LOCKDOWN SPECTRE LOOMS (BBG)

- TWITTER ACCEPTS ELON MUSK’S $44BN TAKEOVER OFFER (FT)

- RUSSIA FOREIGN MIN LAVROV: DO NOT UNDERESTIMATE THREAT OF NUCLEAR WAR (RTRS)

BOND SUMMARY: Core FI Lose Allure As Sentiment Recovers

Recovery in broader risk appetite pulled the rug from under core FI as the PBOC pledged a more proactive approach to supporting domestic economy via monetary policy tools.

- T-Notes reversed earlier gains and sank into negative territory. TYM2 last changes hands -0-09+ at 119-10, pulling back from its earlier session high of 119-26+. Eurodollar futures deal 0.5-5.5 ticks lower through the reds. Cash U.S. Tsy yields bounced in the Tokyo afternoon and last sit 1.9bp-4.0bp higher, with the curve running a tad flatter. Looking ahead, durable goods orders, Conf. Board Consumer Confidence & new home sales provide local data highlights on Tuesday, with 2-Year Tsy auction also up today.

- JGB futures dipped as the BoJ conducted its regular Rinban operations and the final iteration of pre-announced fixed-rate JGB purchases. The contract extended losses after the Tokyo lunch break and last operates at 149.26, a tick shy of previous settlement. Cash JGB yields recovered towards neutral levels, albeit 30s still outperform. Japan's unemployment rate unexpectedly slipped in March, but the data is unlikely to move the needle on Thursday's BoJ policy meet. Re: today's Rinban ops, they yielded the following offer/cover ratios:

- 3- to 5-Year: 1.80x (prev. 2.32x)

- 5- to 10-Year: 2.71x (prev. 2.40x)

- 25+ Year: 5.20x (prev. 4.73x)

- 10-Year JGBis: 4.63x (prev. 2.08)

- Aussie bond futures sold off late doors in tandem with major peers, YM last +5.0 & XM +10.0 (both near session lows). Bills run -1 to +9 ticks through the reds. Cash ACGBs caught a bid as Sydney trading resumed after the ANZAC Day, but trimmed gains later in the day. Yields sit 0.8bp-4.2bp at typing, curve runs steeper as the short-end leads gains. Domestic headline flow was sparse, with all eyes already on the quarterly CPI report, due for release on Wednesday.

EQUITIES: Mostly Higher In Asia; Chinese Equities Rebound As PBoC Wades In

Major Asia-Pac equity indices are mostly higher following a positive lead from Wall St. and PBoC pledges of support for the Chinese economy, putting regional equity indices on track to snap a collective three-day streak of lower closes as seen in the MSCI Asia Pacific Index.

- The Australian ASX200 remains the sole index in the red today, dealing 2.0% lower at typing on losses in virtually every constituent sub-index. Energy and material names were notable underperformers, likely facing drag from energy and commodity prices having declined over the weekend (and over Monday’s Anzac Day national holiday).

- The CSI300 reversed earlier losses of as much as -0.6%, and sits 1.4% better off at typing. Chinese stocks received a boost early in the session after the PBoC renewed pledges to increase support for the economy while promoting the health and stability of financial markets, coming after Monday’s sell-off left Chinese benchmarks within ~10% of COVID-era lows by the close of the session. High-beta equities and tech stocks were notable beneficiaries of the improvement in sentiment, with Chinese liquor stocks leading gains (particularly Kweichow Moutai), while the ChiNext trades 2.0% higher at typing.

- The Hang Seng Index outperformed, adding 1.9% at typing. China-based technology stocks outperformed, with the Hang Seng Tech Index sitting 5.4% firmer, operating a touch below session highs at writing. On the other hand, the financials sub-index struggled, bucking the broader trend of gains in the index as Chinese authorities appear to be widening a crackdown on corruption in the industry.

- U.S. e-mini equity index futures deal 0.2% to 0.3% higher apiece at typing, reversing losses earlier in the session on tailwinds from aforementioned PBoC messaging.

OIL: WTI Reaching For $100; Beijing Lockdown Speculation Simmers

WTI is ~+$1.10 and Brent is ~+$1.40, printing $99.60 and $103.70 respectively and operating around session highs at typing.

- To recap, both benchmarks rose from worst levels on Monday to ultimately close between ~$3.50 to ~$4 lower apiece, with downward pressure coming from elevated worry re: impacted Chinese energy demand as well as a continued rally in the USD (DXY), with the latter hitting two-year highs during the session.

- Looking to China, the COVID outbreak in the nation’s capital has expanded, with 33 fresh cases reported for Monday, spurring authorities to announce mass testing for most of Beijing’s population (~21mn). Some media reports have pointed to limited stockpiling behaviour amongst residents in preparation for a lockdown (a possible scenario given current “dynamic COVID-Zero” posture), although no such measures have been announced so far.

- Elsewhere, RTRS and BBG source reports have pointed to Russian oil giant Rosneft’s difficulty in awarding a tender for at least ~37mn bbls of Urals crude for May and June after demanding prepayment in roubles, giving a glimpse into the potential for disruptions in Russia crude supplies as European buyers continue to stay away.

- A note that this comes amidst BBG source reports of some Asian buyers shunning Russian Sokol-grade crude in the country’s east primarily over marine insurance concerns after sanctions were imposed on a Russian tanker company used to ship the crude, highlighting another possible avenue for supply disruption.

GOLD: A Little Higher In Asia; One-Month Low Remains Level To Watch

Gold is ~$4/oz firmer at writing to print $1,902/oz, extending a move away from 1-month lows made on Monday (at $1,891.7/oz) as nominal U.S. Tsy yields and the USD (DXY) have ticked lower in Asia-Pac dealing, with the former broadly continuing to back away from recent cycle highs.

- To recap, the precious metal closed ~$34/oz lower on Monday, with the move lower facilitated by a broad uptick in U.S. real yields and the USD (DXY).

- Heightened worry in recent sessions re: Fed tightening in the upcoming May 4 FOMC is evident, with gold extending a pullback from near the $2,000/oz mark despite a notable rise in geopolitical risks re: stagflation, as well as events (and consequences) surrounding China’s ongoing COVID outbreak and the Russia-Ukraine conflict.

- May FOMC-dated OIS continue to price in a shade over 50bp of tightening, possibly locking in expectations for a 50 bp hike for that meeting, with the pre-FOMC media blackout having kicked in.

- From a technical perspective, the pullback from recent highs at $1,998.4/oz (Apr 18 high) continues to represent a bearish threat. Gold has held key support at $1,890.2/oz (Mar 29 low and bear trigger) for now, although a break below that would open up further support at $1,878.4/oz (Feb 24 low).

FOREX: PBOC Pledges More Monetary Policy Support, Risk Switch Flicked To On

The PBOC soothed the nerves by vowing to increase its support for the economy via monetary policy tools and promote healthy and stable development of financial markets. Risk sentiment gradually firmed as a result, with U.S. e-mini futures moving into the green.

- Antipodean currencies staged a comeback as the broader risk backdrop improved, with regional liquidity boosted as Australia and New Zealand returned from holidays. With participants already awaiting the release of Australian CPI data on Wednesday, AUD/USD overnight implied volatility printed a fresh multi-week high.

- Safe havens lost their initial appeal, even as the yen outperformed in early Tokyo trade, which allowed USD/JPY to show at its worst levels in a week. Japan FinMin Suzuki reiterated that officials are watching FX moves with "vigilance," but also denied last week's report of his alleged talks with U.S. Tsy Sec Yellen on a joint currency intervention. Separately, former MoF FX czar Watanabe told BBG that the government likely does not intend to intervene now.

- The greenback was the main casualty of newly reduced demand for safer assets. It underperformed all of its major peers, while the dollar index (DXY) extended its pullback from yesterday's cycle highs.

- Offshore yuan took a hit as the PBOC fix fell virtually in line with expectations, indicating the central bank's reluctance to use this tool for pushing back against redback depreciation. It regained poise as the session progressed, with participants mulling PBOC comments. Spot USD/CNH plunged into negative territory, which sets it on track to snap a five-day winning streak.

- U.S. Conf. Board Consumer Confidence, new home sales & flash durable goods order as well as comments from ECB's de Cos & Villeroy will provide interest going forward.

FOREX OPTIONS: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-10(E802mln), $1.0725-50(E2.1bln), $1.0785-05(E2.6bln), $1.0800-05(E1.0bln), $1.0900-10(E560mln)

- USD/JPY: Y125.00($1.2bln), Y126.00-20($1.2bln), Y126.75-80($850mln), Y128.00($575mln)

- AUD/USD: $0.7150-70(A$771mln), $0.7220(A$1.2bln), $0.7350-70(A$1.1bln)

- USD/CAD: C$1.2675($655mln), C$1.2785($575mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 26/04/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 26/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/04/2022 | 1245/0845 |  | CA | BOC Deputy Lane panel talk | |

| 26/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/04/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/04/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/04/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/04/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/04/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.