-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEconomist Claims State Banks Sold FX Via Backdoor Channels Following Erdogan's New Policy

- Turkish Economist Ugur Gurses Claims State Banks Have Been Selling FX Via Backdoor Channels to Support the Lira Following Erdogan’s FX-Deposit Plan - T24 News (translated with Google tools)

- With the announcement of the "FX-protected TL deposit" mechanism announced by President Erdoğan on Monday evening, the dollar rate, which had increased to 18 TL, decreased to 12-13 TL. Although the hours of this announcement were when the markets in Turkey were closed, transactions could be made on international trading platforms

- It was observed that the exchange rates declined due to the "announcement effect" of the President's statements. Some economists have defined it as "disguised interest rate hike". However, at that time, some bankers were saying that public banks were seen selling foreign currency on platforms as in the past.

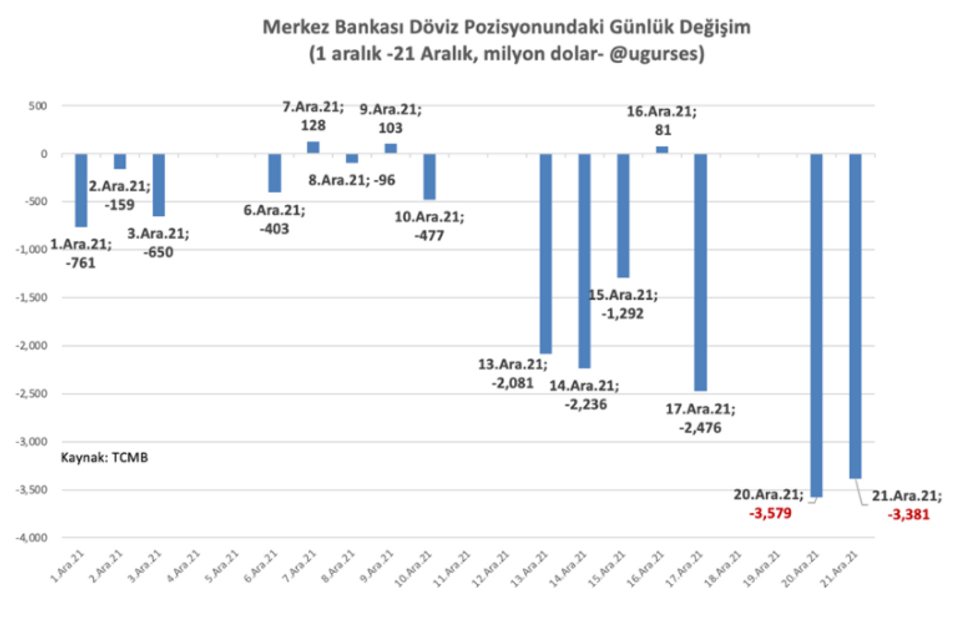

- The bank's data shows that the Central Bank sold $3.5 billion on Monday and $3.4 billion on Tuesday.

- The summary is as follows: While 7 billion dollars were sold in order to reduce it from 18 TL to 12-13 TL, it was explained that "citizens sold" alone, without ever mentioning public foreign exchange sales in propaganda channels.

- It is known that on the 20th and 21st of December, the Central Bank did not directly intervene in foreign exchange sales. Thus, it is obvious that a total of 7 billion dollars in these two days was sold through public banks "through the back door". These were the strongest sales in the last month.

- Ugur’s sources noted that some private banks have been "convinced" to engage in "backdoor" operations, as have public banks.

- In the last 3 months, the Central Bank has accelerated the escape from the TL by pulling the interest rate below the inflation rate. In December, starting with foreign exchange sales interventions, it sold 17 billion dollars in 21 days. Gross foreign exchange reserves, on the other hand, decreased to 113 billion dollars as of the end of 21 December.

- LINK: https://t24.com.tr/yazarlar/ugur-gurses/arka-kapid...,33564

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.