-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEUROPEAN MARKET ANALYSIS: Risk Sentiment Improves In Asia

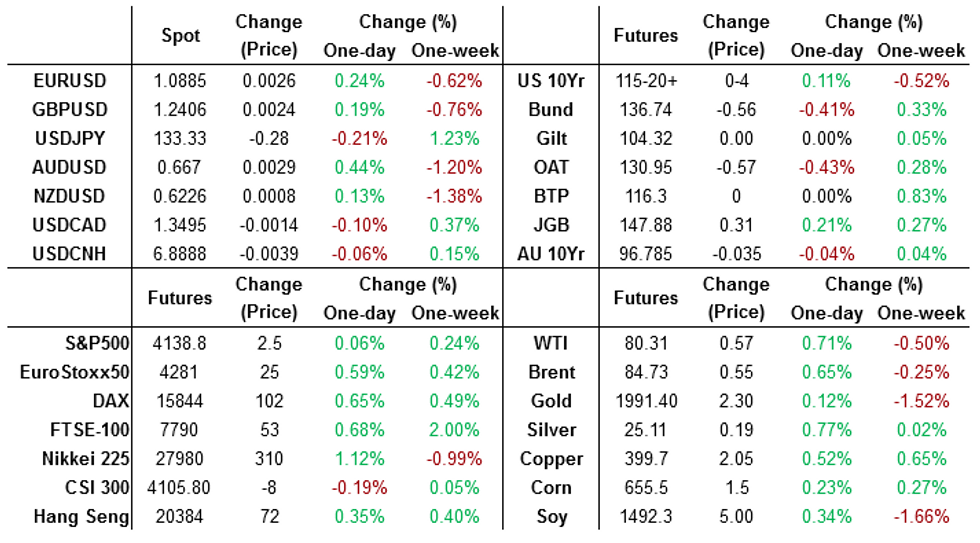

- Risk sentiment improved in Asia today, the USD was moderately pressured and regional equities rose as BOJ Gov Ueda pledged to continue easing.

- Core global FI saw some light richening.

MARKETS

US TSYS: Marginally Richer In Asia

TYM3 deals at 115-19+, +0-03, a touch off the top of the 0-06 range on volume of ~55k.

- Cash tsys sit 1-3bps richer across the major benchmarks, light bull steepening has been observed.

- Asia-Pac participants faded Monday's cheapening in early trade, perhaps using the opportunity to close out short positions/enter fresh longs.

- Gains marginally extended as the USD was moderately pressured, regional equities firmed and Chinese data showed producer prices fell at their fastest pace since June 2020.

- Tsys then dealt in a narrow range with little follow through on moves for the remainder of the session.

- Flow wise a block buyer in TU (6,400 lots) was the highlight.

- Eurozone Retails Sales and NFIB Small Business Survey headline an otherwise thin docket, we also have the latest 3-Year supply. Fedspeak from Chicago Fed President Goolsbee will cross.

AUSSIE BONDS: Weaker, But Off Cheaps

ACGBs sit (YM -7.0 & XM -4.5) slightly off session bests but 5-6bp off cheaps. US Tsy yields are 1-2bp lower in Asia-Pac trade as Chinese data showed producer prices falling at their fastest pace since June 2020. ACGB nonetheless remain weaker versus the midnight Thursday close ahead of the extended Easter holiday as the local market plays catch-up to US Tsys’ reaction to the unexpected decline in the US unemployment rate to 3.5% on Friday.

- Cash ACGBs are 4-6bp cheaper with the 3/10 curve 2bp flatter and the AU-US 10-year yield differential -7bp at -18bp.

- Swap rates are 4-5bp higher with the 3s10s curve 1bp flatter and EFPs little changed.

- Bills strip pricing is -5 to -9 with late whites the weakest.

- RBA dated OIS is 6-8bp firmer for meetings beyond August. A 25% chance of a 25bp hike in May is priced with year-end easing expectations at 21bp versus 29bp ahead of the Easter holiday.

- Tomorrow, RBA Deputy Governor Bullock will be taking part in the WEAI Monetary Panel ahead of March's Employment data on Thursday.

- In anticipation of Wednesday's release of the US CPI and FOMC minutes for March's meeting, investors might opt to remain on the sidelines.

NZGBS: Near Bests, Outperforming US Tsys

NZGBs closed at or near session bests with US Tsys firmer (yields 2-3bp lower) in Asia-Pac trade as Chinese data showed producer prices falling at their fastest pace since June 2020. At the close, the 2-year and 10-year NZGB benchmarks were respectively flat and 3bp cheaper. The NZ/US 10-year yield differential narrowed 8bp to 57bp.

- Swap rates were flat to 1bp cheaper, implying a slightly tighter long-end swap spread.

- RBNZ dated OIS closed little changed across meetings with 19bp of tightening priced for May. 45bp of easing is priced for Feb-24 off a terminal OCR expectation of 5.46% (July).

- The local calendar is slated to release March Retail Card Spending data tomorrow with a boost from high inflation and post-cyclone pricing expected. March Manufacturing PMI and February Net Migration data are scheduled for release on Friday. The local market will be keen to see if the recent strong net inflows continue with the border now open.

- With the global calendar relatively light today, Euro Area Retail Sales and US NFIB Small Business Optimism as the highlights, global investors may stay close to the sidelines ahead of Wednesday’s release of US CPI and FOMC minutes for the March meeting.

FOREX: Greenback Moderately Pressured As Risk Sentiment Improves

The USD is moderately pressured in Asia as risk sentiment improves in todays Asian session. Regional equities are firmer, Nikkei is up ~1.3% as BOJ Gov Ueda pledged to continue easing, and e-minis are ~0.1% firmer.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD prints at $0.6665/70 ~0.4% firmer on Tuesday. April Westpac Consumer Confidence rose 9.4% to 85.8, the highest print since mid 2022. NAB March Business Confidence rose to -1 from -4 and business conditions fell a touch to 16 from 17 in Feb.

- Kiwi is ~0.2% firmer, NZD/USD last prints at $0.6225/30. The pair sits a touch below its 20-Day EMA having found support ahead of $0.62 in early trade.

- Yen is also firmer, USD/JPY has marginally pared some of yesterdays gains and last prints at ¥133.40/50.

- Elsewhere in G-10 EUR and GBP are both ~0.2% firmer as the broad based USD weakness is reflected across G-10.

- Cross asset wise; BBDXY is ~0.2% softer and 2 Year US Treasury Yields are ~3bps lower.

- In Europe today Eurozone Retail Sales headlines an otherwise thin docket.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 11/04/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 11/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/04/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 11/04/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/04/2023 | 1730/1330 |  | US | Chicago Fed's Austan Goolsbee | |

| 11/04/2023 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.