-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Familiar Themes Dominate Ahead Of FOMC

- Positive U.S. fiscal mood music continues to do the rounds overnight, although core markets show little reaction to headline flow.

- Sino-Aussie Tensions continue to ratchet up.

- The FOMC is likely to adopt new guidance on asset purchases at its December meeting, but will fall short of adjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step.

BOND SUMMARY: Low Conviction Ahead Of FOMC

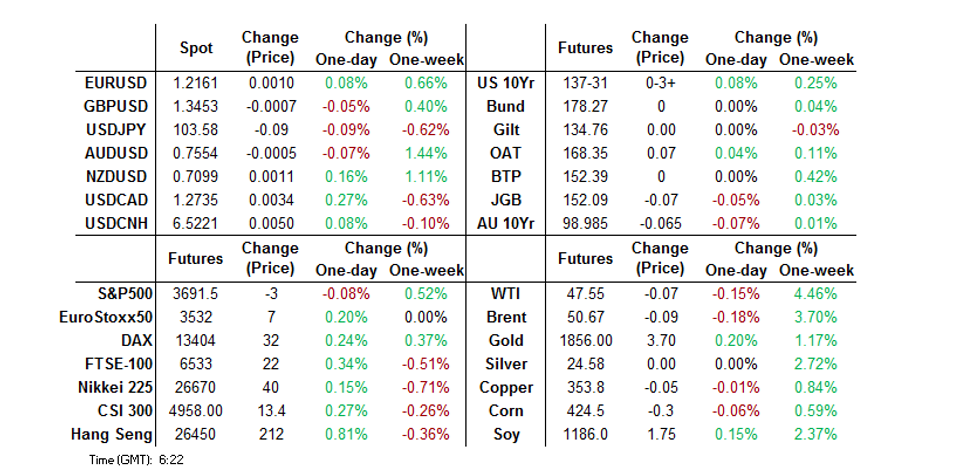

U.S. Tsys showed nothing in the way of a meaningful reaction to the latest round of positive fiscal rhetoric out of DC, with Congressional leaders set to reconvene on Wednesday morning. T-Notes last +0-03+ at 137-31, while cash Tsys run little changed across the curve as we come to the end of what has been a limited pre-FOMC Asia-Pac session. 30K worth of TYF1 139.00 call block flow has provided the highlight thus far, with the trade looking like short cover. The final FOMC decision of '20 headlines on Wednesday (see our full preview for further details), with local retail sales and flash PMI readings also due.

- JGB futures softened in afternoon trade, finishing -7, as the details of the BoJ's latest round of 1-10 Year Rinban ops revealed an uptick in the offer/cover ratios across the 3 buckets that cover that sector of the curve, while the purchase sizes were left unchanged. Cash JGBs lacked any clear sense of direction during the session. Local headline flow has been light, with comments from Economy Minister Nishimura confirming the suspension of the Go To travel campaign over the new year period and offering little new re: broader fiscal matters. Local data had no impact on the space. Late in the day saw local news reports suggest that Japan will draft a record sized budget for the upcoming fiscal year, which isn't a surprise given the ongoing COVID-19 uncertainty.

- In Australia, YM finished +0.1 with XM +0.2, as the latter ticked away from lows as we moved through the Sydney session. The slow uptick was perhaps linked to headlines which revealed that Australia will lodge a complaint with the WTO re: Chinese barley tariffs, reserving the right for further WTO actions against China in future. The move shouldn't really come as a surprise but does represent the latest escalation in Sino-Aussie tensions. Local data provided no real impetus for the space. Australia's flash PMI readings showed a continued uptick in the rate of expansion for both the manufacturing and services metrics, with the release noting that "not only was the Australian economic recovery sustained in December, but growth also gathered momentum as the loosening of COVID-19 restrictions underpinned further improvements in demand for goods and services. As such, private sector output expanded at the quickest pace in five months. The preliminary PMI results also brought good news regarding employment."

FOREX: US Dollar Main Driver Of Price Action; US Political Accord And FOMC Eyed

The main driver of price action in the Asia-Pac session was the US dollar which resumed its move lower as hopes for a stimulus package increased after Senate Majority Leader McConnell acknowledged Biden as the President-elect and said the Senate would not adjourn for the year without a relief package.

- There was limited price action in JPY pairs; the BoJ Rinban operations were in line with previous purchases while data earlier in the session showed that exports fell more than forecast at -4.2% against an expectation of +0.4%, imports also fell more than expected at -11.1% compared to -9.5% expected. The data was ignored despite the negative implications of weaker global economy (lower exports) and weak domestic demand (lower imports). USD/JPY last at session lows of 103.49, down 18 pips on the day.

- NZD/USD pushed back over the 0.71 handle, last up 20 pips at 0.7108, helped by the resumption of the downtrend in DXY. Earlier in the session the New Zealand Treasury released its half year economic fiscal update. The release initially had little effect on markets but seems to be supporting risk sentiment as the session wears on. The release outlined a slightly more positive case than the previous update. 2020/21 annual average GDP growth is forecast at 1.5% compared to the previous estimate of -0.5%, while the 2020/21 bond programme forecast has been cut to NZD 31.7bn. Forecasts for unemployment were downgraded to 6.9% from 7.8%.

- AUD/USD came off session lows, last flat on the session at 0.7559. Upside has been limited in the pair as tensions between Australia and China continue to simmer. Earlier Australian Trade Minister Birmingham said Australia will approach the WTO to challenge tariffs imposed by China on its barley exports. He added Australia reserve the right to invoke further WTO action against China.

- Bank of Canada Governor Macklem said recent CAD strength against the USD is material and is on their radar, however USD/CAD was unmoved on the news.

- Little by way of Brexit news flow, the FT reported the UK is compiling plans to turn London into a shipping hub that will rival Singapore. GBP/USD moving towards session highs at 1.3460 last.

- The PBOC fixed USD/CNY at 6.5355, 79 pips lower than the previous day and resuming the trend of a stronger yuan, after a weaker fix yesterday.

- Market focus will no doubt be on the FOMC meeting. The Fed are expected to keep rates on hold, some are expecting an increase in asset purchases or a version of operation twist where short term bonds are sold to buy longer term bonds.

FOREX OPTIONS: Expiries for Dec16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950(E970mln-EUR calls), $1.2000(E1.2bln), $1.2070(E820mln-EUR calls), $1.2100(E1.1bln), $1.2150(E450mln), $1.2200-10(E496mln-EUR puts)

- USD/JPY: Y103.50-60($510mln), Y103.90-104.00($580mln)

- GBP/USD: $1.3190-1.3200(Gbp508mln), $1.3300(Gbp566mln)

- EUR/GBP: Gbp0.9000(E616mln)

- AUD/USD: $0.7450-60(A$1.2bln), $0.7500(A$1.2bln)

- AUD/JPY: Y78.30-35(A$664mln-AUD puts)

- USD/TRY: Try8.50($500mln-USD puts)

EQUITIES: Mixed

The major e-mini contracts coiled during Asia-Pac hours, with the latest round of positive fiscal rhetoric out of DC ultimately failing to inspire a meaningful bid overnight, as the contracts consolidated the bulk of their Tuesday gains (which were themselves largely driven by hope surrounding support for a slimmed down fiscal support package in DC).

- The major regional equity indices clung to the coattails of Tuesday's Wall St. rally, however, the ratcheting up of Sino-Aussie tensions and MSCI's notice of removal from the relevant indices re: the securities of the Chinese cos referenced in U.S. President Trump's executive order barring U.S. investment applied some counter pressure.

- Nikkei 225 +0.2%, Hang Seng +0.8%, CSI 300 +0.3%, ASX 200 +0.7%.

- S&P 500 futures -3, DJIA futures -36, NASDAQ 100 futures +18.

GOLD: Better Bid Within Established Range

The latest round of USD weakness and softening of U.S. real yields has allowed bullion to push higher over the last 24 hours, although spot continues to operate in familiar territory, last printing around the $1,855/oz mark. Resistance is located at $1,875.4/oz, the Dec 8 high/bull trigger.

OIL: Very Narrow In Asia

WTI & Brent sit ~$0.10 below their respective settlement levels, holding to extremely narrow sub-$0.20 ranges thus far. This comes after the broader risk-positive tone supported the benchmarks on Tuesday.

- The latest round of weekly API inventory estimates hit after hours on Tuesday and was headlined by a surprise build in crude stocks, alongside a much larger than expected build for distillate stocks. We shall see if Wednesday's DoE inventories data point in a similar direction.

- Elsewhere, Tuesday saw WSJ sources suggest that "Iran has circumvented U.S. sanctions and exported more oil to China and other countries in recent months, providing a lifeline for its struggling economy and undermining the Trump administration's so-called maximum pressure campaign against Tehran."

- Tuesday also saw the release of the IEA's latest oil market report, in which the Agency cut its '20 & '21 global crude demand forecasts, following other industry bodies.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.