April 22, 2024 00:56 GMT

First 20-days Of April Trade Shows Healthy Export Trend, But Wider Trade Deficit

SOUTH KOREA

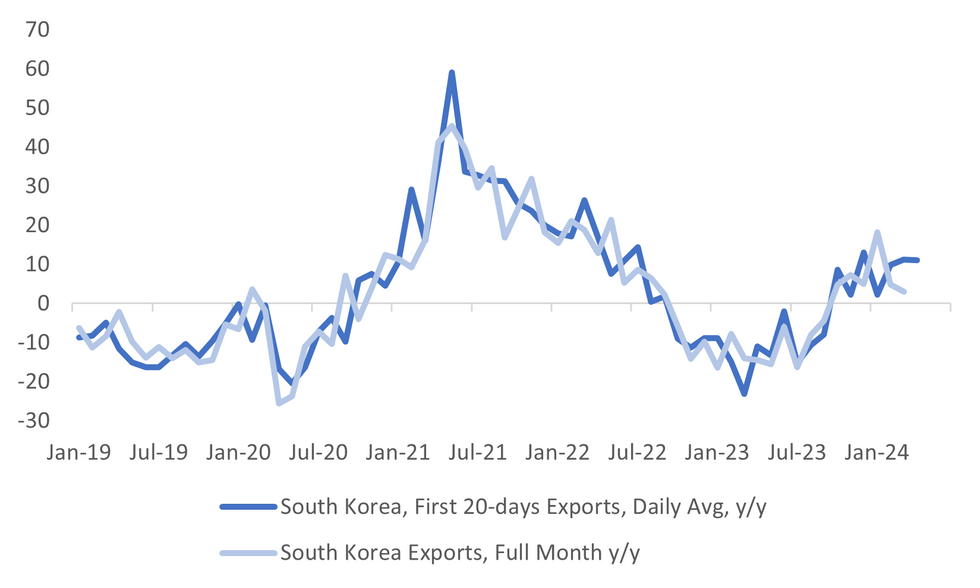

The first 20-days of trade data for April held close to equivalent March levels, the print coming in at 11.1% y/y (11.2% for first 20-days of March). Imports were up 6.1% y/y, while the first 20-days trade deficit was -$2.65bn. Note for the first 20-days of March the trade deficit was -$711mn.

- The trade position does tend to improve in the final 10 or so days of the month. For the full month of March the trade position was a surplus of just under $4.3bn. Still, some deterioration in April is consistent the recent move lower in South Korea's terms of trade proxy (per Citi).

- This, at the margins, is taking the gloss of the continued export recovery. The chart below plots the first 20-days of exports y/y (in daily average terms) versus full month exports y/y.

- The detail looked firm in terms of the export rise, with chip exports up 43% y/y, albeit down slightly from the 46.5%y/y rise seen in March (first 20 days). Exports to China also rose 9% y/y in the first 20 days of the month, versus 7.5% prior. To the US, exports rose 22.8% y/y, also a step up from the prior month.

- Won weakness looks stretched in y/y terms compared with the improved export backdrop, although other factors are clearly providing an offset -pushing out of easier Fed expectations coupled with rising energy costs/Middle East tensions.

Fig 1: South Korea Exports Y/Y First 20 days & Full Month

Source: MNI - Market News/Bloomberg

Keep reading...Show less

260 words