-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI GLOBAL MORNING BRIEFING: German CPI Seen Lower, US GDP Up

Following yesterday’s FOMC decision, US GDP will be closely watched this afternoon. German CPI data for July will also be a key highlight, as the ECB shifts into a more hawkish gear.

Sweden GDP / Economic Tendency Indicator (0700/0800 BST)

Positive growth remains on the cards for Sweden in Q2, anticipated to advance by +0.7% q/q following the contraction of -0.4% q/q of Q1. Also of significance will be the Economic Tendency survey, whereby a 1.9-point weakening to 104.0 is expected for July. Swedish data can be interpreted as an advance proxy for Eurozone data.

France PPI (0745 BST)

France will be looking for another month of decelerating factory-gate inflation in June, edging down from +27.3% y/y from May and further away from the April peak as commodity prices ease.

Eurozone Business/Consumer/Economic Sentiment (1000 BST)

Economic confidence is anticipated to weaken again in July, seen stepping down by 2 points to 102.0. Industrial, services and consumer confidence will also be due, the latter being the final print. Industrial sentiment is forecasted at 5.7 (vs 7.4 in June), services at 13.3 (vs 14.8 in June) and consumer sentiment should confirm the record low of -27.0.

Yesterday saw German, French and Italian consumer confidence levels drop, as inflation woes escalate and German consumers in particular flag concerns regarding future gas supplies. With the war in Ukraine continuing to boost price pressures and drag down economic outlooks for the closely tied Eurozone, a breakthrough in the situation is likely required to see improvements.

Germany CPI (1300 BST)

Following the slew of regional cpi readings (NRW 0530, Hesse/Bavaria/Brandenburg 0900, Saxony 1000), the German July prelim print is due at 1300. The consensus is looking for CPI to edge down in July, by 0.2pp to +7.4% y/y and by 0.1pp to +8.1% y/y for the harmonised print. This would be the second month of decline for the headline figure.

On the month some acceleration is likely to continue at +0.6% m/m and +0.4% m/m (harmonised), a faster pace than in June. Effects of the 9-euro monthly transport ticket and energy subventions have generated downwards price pressure. With the energy cost relief package due to finish in August, slowing inflation could prove temporary.

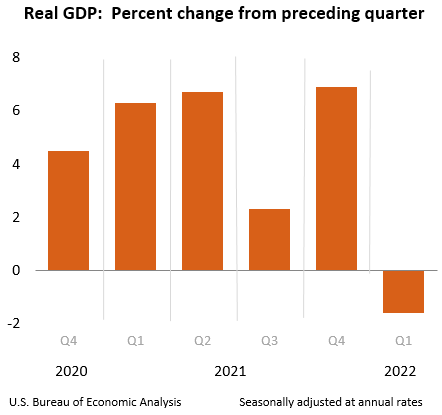

US GDP (1330 BST)

All eyes will be on the US Q2 advance GDP release this afternoon, as markets look for official signs of a technical recession. The consensus is still looking for modest positive growth of +0.4% q/q, following the Q1 contraction of 1.6% q/q. Expectations saw substantial upwards swings following yesterday’s June prelim wholesale inventories and durable goods orders come in substantially stronger.

The advanced personal consumption data will also be due, alongside the weekly jobless report. Personal consumption growth is projected to weaken to around +1.2% q/q, from +1.8% q/q in Q1.

The only key policymaker appearance on today’s schedule is Secretary of the Treasury Janet Yellen hosting a press conference at the Treasury Department to discuss the state of the U.S. economy.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/07/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/07/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/07/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/07/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2022 | 0800/1000 |  | DE | CPI Hesse | |

| 28/07/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/07/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/07/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/07/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/07/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/07/2022 | 1730/1330 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.