-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

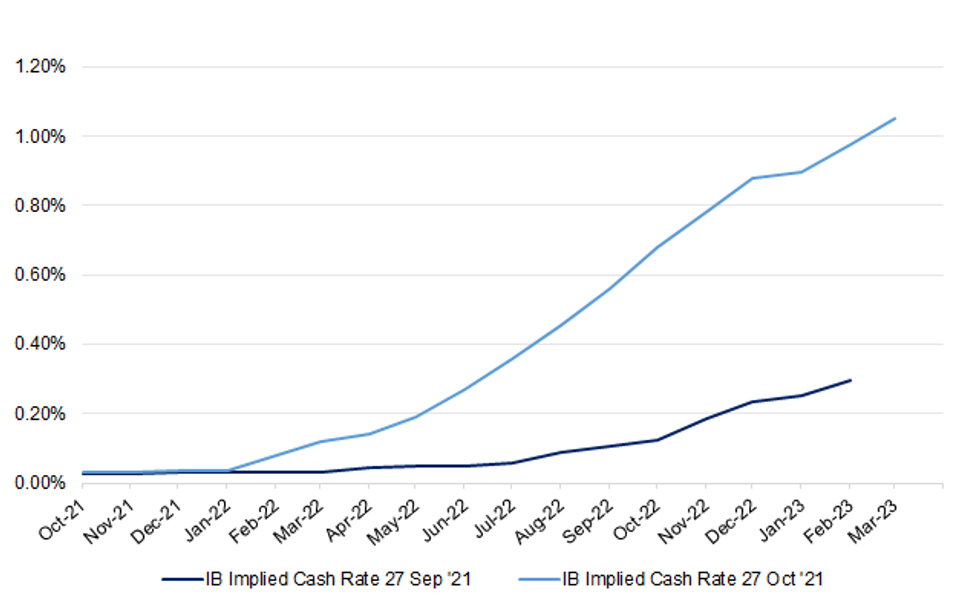

IB Pricing Looks Aggressive, But That Doesn’t Guarantee a Quick Rebound

The below chart outlines the extreme repricing re: the RBA in the IB strip over the last month. The divergence between market pricing and RBA guidance (the Bank's central scenario points to a hike in '24) is stark, with recent communique on the inflation front (a need to see inflation sustainably within the target band and even some allowance for inflation to run above 3.0% for a while, per Governor Lowe) suggesting that pricing re: a May hike may be over aggressive (16bp of tightening vs. the current effective cash rate was priced as of yesterday's settlement). The RBA has continued to deploy a glass half full approach re: the economy, although when it comes to inflation and wage growth, the Bank retains a sanguine view.

- As we mentioned yesterday, the Q3 CPI print may result in the Bank tipping its hat to heightened risks surrounding its central view via next week's raft of communique (Tuesday's monetary policy meeting will be supplemented by the quarterly SoMP on Friday), with the Bank set to pay close attention to wage growth dynamics and the stickiness of the recent uptick in underlying inflation over the coming months.

- A reminder that our policy team ran a piece flagging their understanding that yesterday's CPI reading is unlikely to change the RBA's view on the timing of any future interest rate hike. Still, there have been a couple of notable sell side names that have rolled forward their cash rate hike calls (as shown in previous bullets).

- Ultimately the Bank will have to trade off the benefits of potentially letting inflation run hot for a little while after missing its target for years (prior to Q321 underlying inflation had not been within the Bank's 2-3% target band since Q415) and potentially tightening policy before notable wage growth has taken hold.

- Even though market pricing re: the prospects of a cash rate hike seem a little aggressive, that does not guarantee a quick rebound in isolation.

Fig. 1: IB Strip Pricing Of RBA Hikes 27 Sep '21 vs. 27 Oct '21

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.