-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

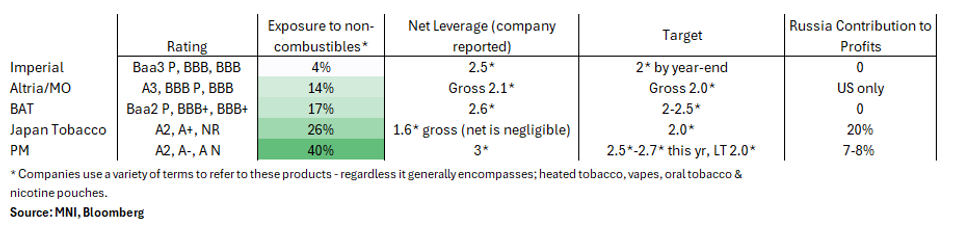

Free AccessImperial Brands (IMBLN; Baa3 Pos/BBB S/BBB S) 1H24 (6m ending March)

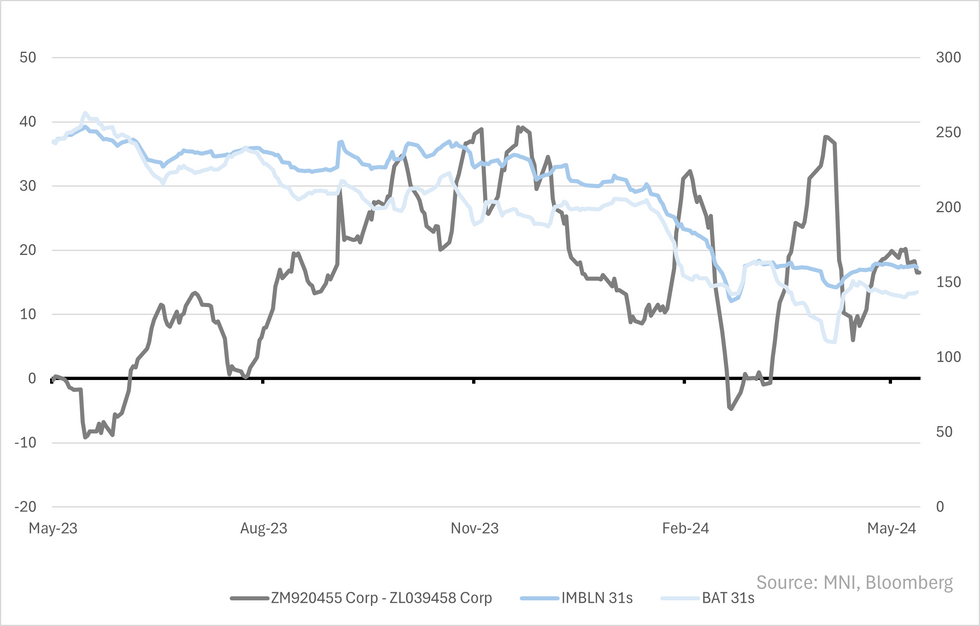

Aggressive pricing helping it hold onto organic growth (for now). Imperial, similar to BAT, is geographically diversified but that's where the positives stop - it has the lowest non-combustibles exposure (below) and this should leave it well wide of comps regardless of leverage goals. 33s look tad rich on this note, 31s look fair now (below). For those eyeing carry our preferred name in BBB tobacco remains BAT, bar those with a firm view to avoid Euro regulation/markets (rotate to Altria then). Again normal disclosure that Tobacco tends to underperform on spread sell-offs. Its already let a £600m line roll-off and YE leverage target will require gross debt to come down more. With only a $1b line still due this year (June), we don't expect € supply.

- On sales: headline revenue at £15.1b (-2.3%yoy) & net revenue at £3.6b (-0.7% gross, cc+2.8%). Organic growth from pricing (+8.6%) offsetting volume (-6.3%) which it says was on industry contracting.

- On Market share; gains in US (+5ps), Spain (+50bps) & Australia (+10bps) offsetting declines in Germany (-25bps) & UK (-40bps). Europe made up 40% of sales (18% in Germany, 7% in UK & 5% in Spain), US 33% & remainder 25% in Africa, Asia, Australasia & Central & Eastern Europe.

- On Next Generation products (i.e. non-combustibles); revenue rose +16.8% & it says makes up 7% of European revenues. It has entered the US market with "Zone" - its oral nicotine brand, NGP's current make up 1% there and 1% in other 25% (see above). It has bumped group exposure by 1ppt to 4%, still well shy of comps (below).

- On BS: cash conversion 97% over last 12m, adj. net debt at £10.1b leaving leverage at 2.5x (flat yoy) & is targeting 2x leverage by year-end. £1.1b buyback in place this year of which £605m completed, £ interim dividend given 4% bump its paid out £914m this half. Targets £6b in equity returns over 3yr period.

- On Guidance: Deliver LSD cc growth in tobacco & NGP net revenues & MSD growth in adj. operating profit. Expects 2% headwind from FX on revenue & 3-3.5% headwind to operating profit. Net of FX, guidance looks flat on sales (in-line with consensus) & LSD positive on operating profit (tad above consensus).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.