-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Trudeau- Trade War Lasting Into Foreseeable Future

MNI BRIEF: Trudeau Adds CAD37B Daycare Spending Over Five Yrs

Imports Deterioration Further Sign of Subdued Demand

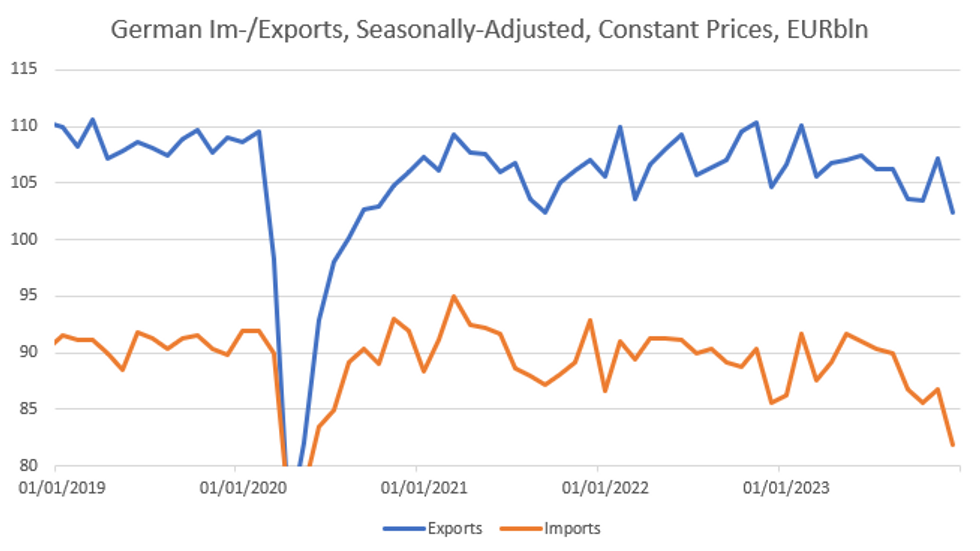

The German trade surplus for December came in at +E22.2bln (seasonally-adjusted; vs E19.0bln cons; E20.8bln prior, revised from E20.4bln) according to data published on Monday. This was the biggest monthly surplus since November 2017. The widening of the surplus was driven by imports declining even faster than exports, with imports at -6.7% M/M (sa; vs -1.9% cons; +1.5% prior, revised from +1.9%) and exports at -4.6%% M/M (sa; vs -2.8% cons; +3.5% prior, revised from +3.7%).

- For 2023 in total, nominal imports to Germany fell by -9.7% Y/Y. Exports fell -1.4% Y/Y in the same period. The value of imports in December was the lowest since September 2021, and the value of exports was the lowest since March 2022.

- Looking at a geographical split, trade declined faster in December with other EU-members than with third party countries; import declines from other EU-members and from third party states were -7.4% M/M (vs +2.4% M/M) and -5.9% M/M (vs +1.5% prior), respectively; exports declined -5.5% M/M (vs +5.2% M/M) to other EU states and -3.5% M/M (vs +0.4% prior) to third party countries.

- Exports to the US - which continues to be the largest single buyer of German exports (E12.6bln) - decreased by -5.5% M/M in December (vs -2.3% prior). The biggest single source of imports is China (E11.6bln); their value declined -8.5% M/M (vs +1.2% prior). Chinese imports to Germany are now -35% lower than at their all-time high in April 2022.

- Also in real terms, the trade balance widened in December, driven by strongly declining imports (see below). Recent disruptions in the red see might have had a stronger impact on German imports than exports (as per them being more Asia-centric then exports).

- Nonetheless, the impact on Q4 GDP may have been positive from a national accounts perspective, but is perhaps more indicative of ongoing weak demand in the German economy - December retail sales for example were weak.

MNI, Destatis, Bundesbank

MNI, Destatis, Bundesbank

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.