-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIndonesia Scrambles To Boost Covid-19 Vaccinations After Daily Case Count Hits New Record

Spot USD/IDR has crept higher, with participants weighing Indonesia's accelerating vaccination drive against a record increase in new infections reported on Sunday. The pair last sits +25 figs at IDR14,450, with bulls looking for a move through Jun 23/May 3 highs of IDR14,468/14,475, followed by Apr 28 high of IDR14,518. Bears need a dip through the 50-DMA (IDR14,377) & 200-DMA (IDR14,353) to regain poise.

- USD/IDR 1-month NDF last seen +12 figs at IDR14,513, still trapped within an ever-narrower range. A break above Jun 21 high of IDR14,578 would clear the way to Apr 21 high of IDR14,615. Bears keep an eye on IDR14,438, which limited losses on Jun 18.

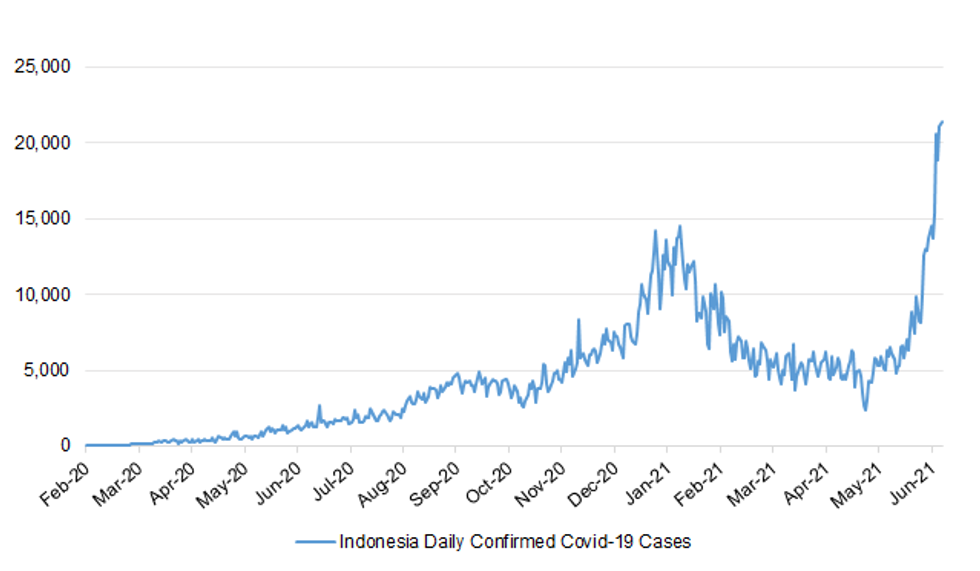

- Health Min Sadikin confirmed that the gov't has met the target of administering 1mn vaccinations per day and has enough supply of jabs to maintain the current rate of 1.3mn jabs/day. This comes after Indonesia expanded loosened vaccination eligibility criteria and allowed all adults to register. Officials are scrambling to secure swift distribution of vaccines after the country declared a record increase in new Covid-19 cases (21,342) on Sunday.

- Bank Indonesia Exec Director for Financial Market Development Hutabarat said last Friday that the central bank will include more currencies (e.g. MYR, CNY, JPY) in its DNDF to support FX market stability and improve monetary policy transmission. Elsewhere, BI may implement local currency settlement with China as soon as next month.

- Bank Indonesia said that its weekly survey estimated June CPI at +1.38% Y/Y and -0.11% M/M, amid monthly declines in the prices of chillies, chicken and intercity fare.

- As a quick heads-up, comments are due today from BI Gov Warjiyo (meeting with media editors) & Tourism Min Uno (weekly press briefing).

Fig. 1: Indonesia Daily Confirmed Covid-19 Cases

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.