-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIndustrial Weakness Likely To Maintain Disinflationary Impulse

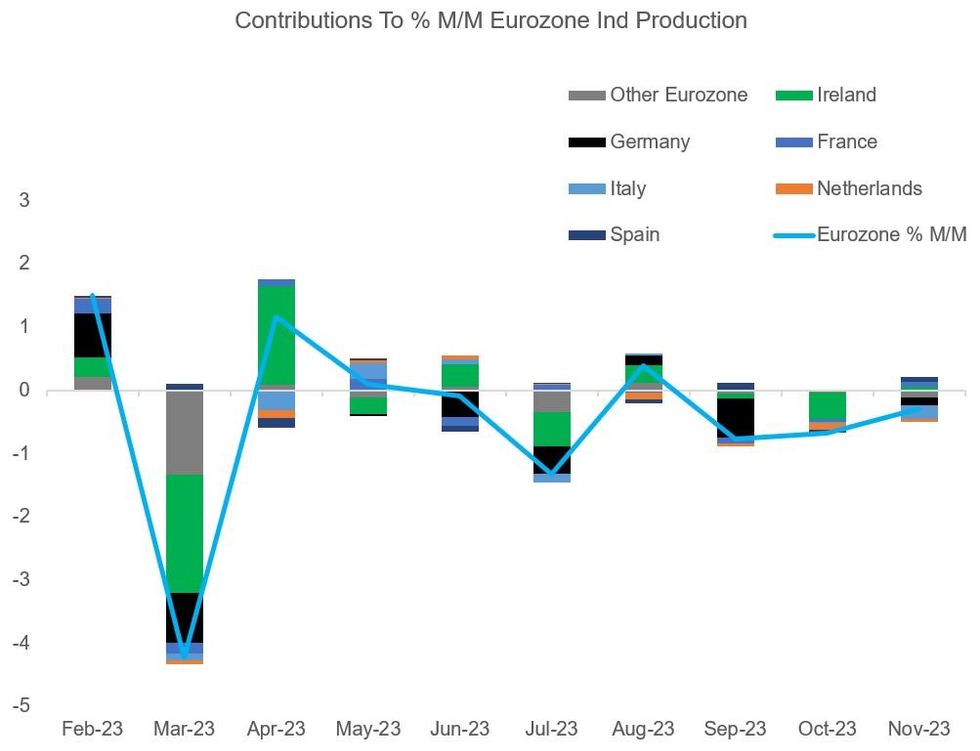

Eurozone industrial production contracted on a monthly basis in November for the 5th month in the past 6, at -0.3% M/M (-0.7% prior), matching consensus expectations - though the -6.8% Y/Y working day adjusted reading was weaker than had been anticipated (-6.0% survey, -6.6% prior).

- The monthly decline was driven by Italy's -1.5% M/M outturn, the biggest drop for Italian production since April 2023. Germany (-0.3%) and the Netherlands (-1.0%) also saw drops on the month, with France (+0.5%) and Spain (+1.1%) seeing expansion after drops in October. (Unusually given recent outsized volatility, Ireland IP had very limited impact on the Eurozone-wide figure in November.)

- From a sectoral perspective, energy output accelerated for a 2nd consecutive month (+0.9% M/M vs +0.6% prior), with non-durable consumer goods production remaining positive at +1.2% (+1.2% prior). Otherwise, there was broad weakness: intermediate goods production was down -0.6% M/M (-0.7% prior), capital goods -0.8% (-1.1% prior), with durable consumer goods production seeing the largest monthly drop since April 2023 (-2.0%, vs +0.1% prior).

- With the drop on the month, Eurozone industrial production levels have set a fresh post-Oct 2020 low, and are down 8% from the September 2022 peak.

- Forward-looking indicators show little impending improvement in activity, including the European Commission's industry confidence measure (which in December posted a 5th consecutive month at a stable but recessionary level) indicated a continued decline in order books.

- With weakness in activity and demand, and EC industrial sector selling price expectations remaining below the longer-term average, the goods sector is likely to continue exerting disinflationary impulses on the eurozone economy, in potential contrast to services where price expectations continue to tick higher.

Source: Eurostat, MNI Calculations

Source: Eurostat, MNI Calculations

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.