-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

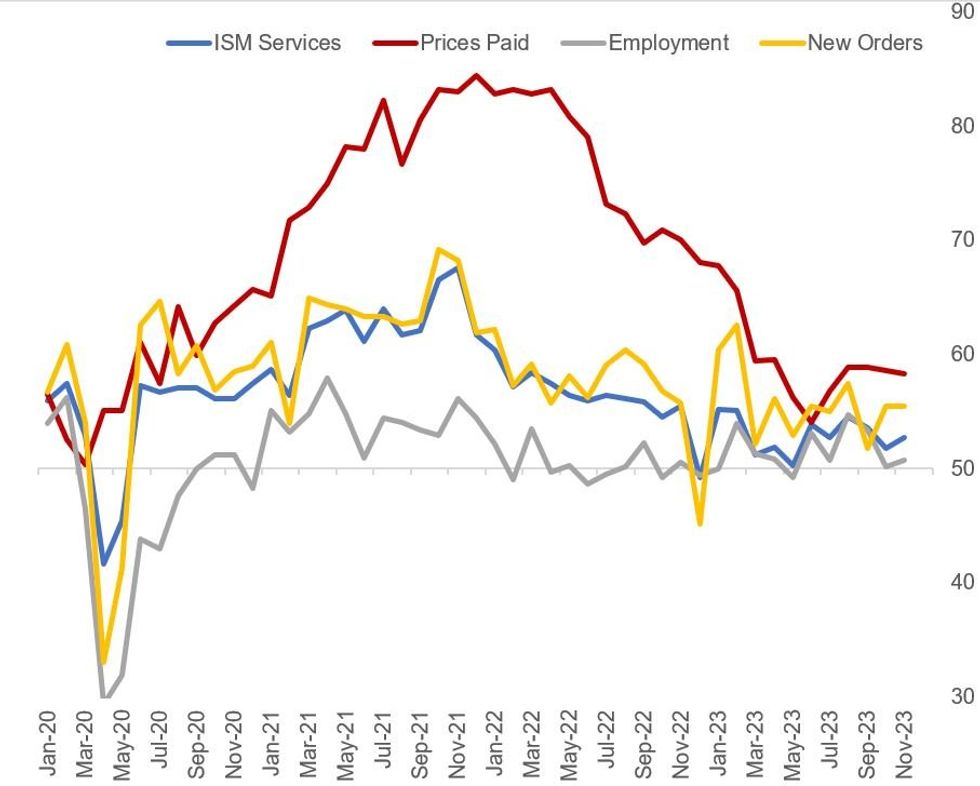

Free AccessISM Shows Pickup In Services Activity, But Overshadowed By Jobs Data

November's ISM Services report came in better than expected across the headline figure and subcategories - with the notable exception of Employment.

- The Services PMI accelerated to 52.7 (52.3 expected, 51.8 prior), with new orders steady at 55.5 (54.9 expected, 55.5 prior), and prices paid dipping to 58.3 (58.0 expected, 58.6 prior).

- The Employment gauge improved from October but failed to beat consensus at 50.7 (51.4 expected, 50.2 prior). That reading - when taken in conjunction with a much sharper-than-expected drop in JOLTS job openings data released concurrently - probably helped trigger a softening in US rates, in the context of Friday's November nonfarm payrolls report.

- But overall the report provided evidence that activity in the crucial Services sector remains healthy, and is even potentially accelerating going into year-end, in stark contrast to last week's poor ISM Manufacturing report which missed expectations and showed all major components in contraction.

- All categories apart from supplier deliveries (indicating that supplier delivery performance was ‘faster’ in contrast to the ‘slowing’ status in September.) and backlogs were above 50.0 (respondents commented: “Due to supply chain improvement, backlogs are under control” and “Suppliers are making good progress clearing up back orders.”).

- 15 industries reported growth, with 3 (information, mining, professional/scientific/technical services) reporting a decline.

- Even the softer rise in employment than had been expected may be due in part to continued supply-side constraints - the proportion seeing "lower" employment fell to a 3-month low 13.8% , though the proportion seeing "higher" activity remains fairly stagnant, with the vast majority seeing "same".

- Anecdotally: “We have lost employees due to normal attrition and are having issues backfilling these positions” and “The labor market remains very competitive.” Also: “Trying to get to full staff levels.”

Source: ISM, MNI

Source: ISM, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.