-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessLittle Reprieve For OATs Vs. Iberian Paper, Even As OATs/Bunds Narrows A Little

10-Year OAT/Bunds edges away from last week’s multi-year closing wides as weekend risk premium comes out of French paper. However, there hasn’t been much respite for OATs on an equally weighted fly vs. 10-Year SPGBs & PGBs.

- Iberian fiscal & sovereign credit rating trajectories keep that fly at levels not seen since pre-GFC times, with little reason to fade the move at this juncture.

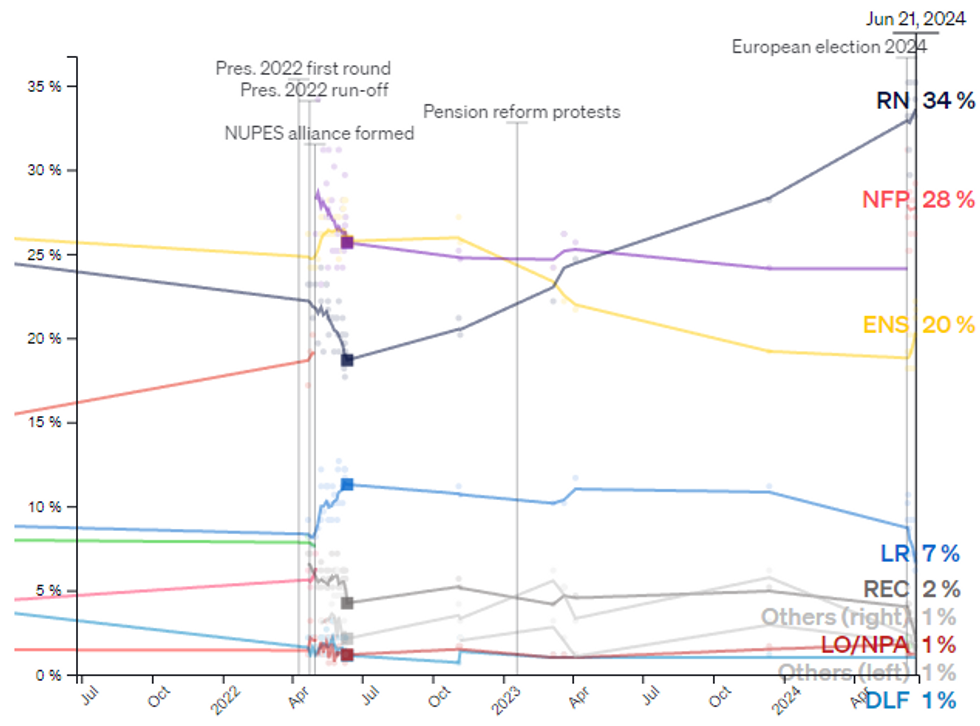

- There wasn’t any meaningful movement in the French political situation over the weekend, with RN cementing their opinion poll advantage ahead of the first round of voting in the French lower house elections (Sunday 30 June).

- Macron’s party trails both RN & the leftist bloc in the opinion polls, increasing the risk of political & fiscal paralysis, with French fiscal angst already heightened.

- Le Pen has suggested that Macron may need to resign if political paralysis becomes apparent, Macron has played this idea down on several occasions.

- Some pollsters have suggested that RN may achieve an absolute majority in the lower house, although the two-stage polling system complicates projections.

- Potential lower house governing agreements between the left & right have also been touted in the case that a party/group fails to win an absolute majority. This seems quite unlikely to us at this stage, with that idea limited to some political watchers as opposed to the mainstream/parties.

- Any such governing alliance would likely trigger further OAT spread widening, given the uncertainty related to the stark opposing views of the parties when it comes to key policy pillars.

Fig. 1: 10-Year SPGB/OAT/PGB Butterfly (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Fig. 2: POLITICO Poll Of Polls - France

Source: POLITICO

Source: POLITICO

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.