-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMester Joins In Rate Cut Pushback...But Few Are More Dovish For 2024

Cleveland Fed Pres Mester joined with colleagues in a pushback against market cut repricing after last week's FOMC meeting, telling the FT in an interview published this morning that the implied path of rates was "a little bit ahead" of where the Fed sees things - "They [markets] jumped to the end part, which is ‘We’re going to normalize quickly’, and I don’t see that.”

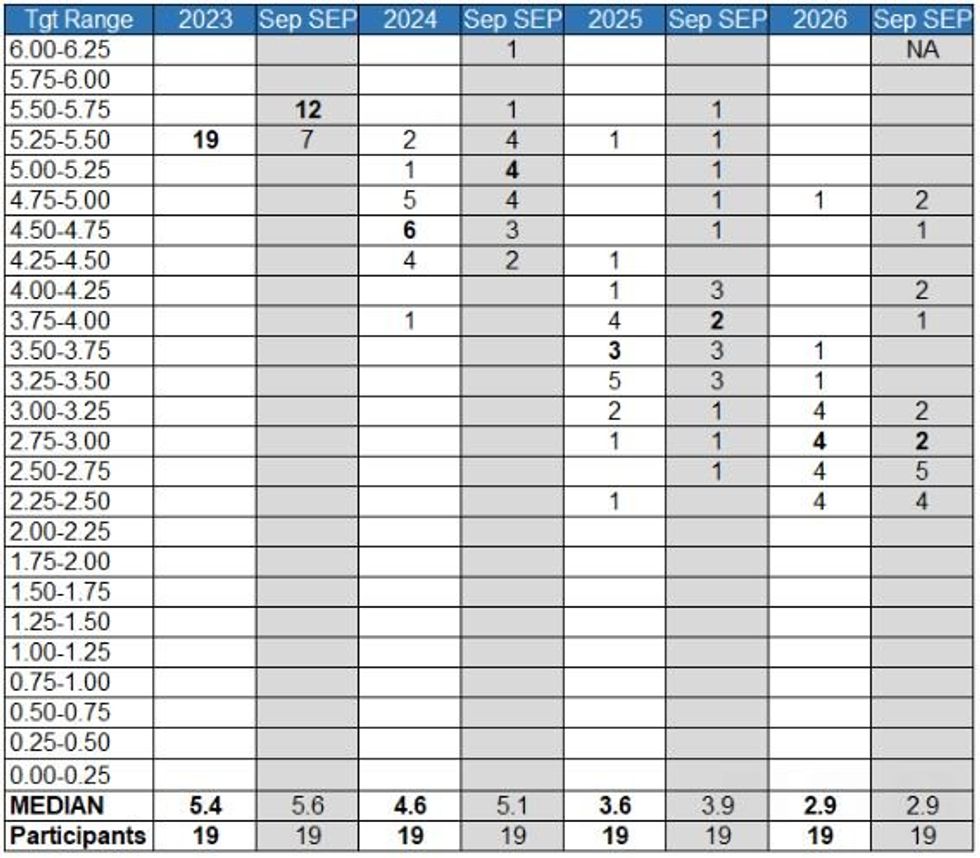

- The near 150bp of 2024 cuts currently priced is clearly too much for the FOMC to countenance right now. That being said, as among the more hawkish members of the Committee, it's notable that Mester says she pencilled in three 25bp cuts in 2024 in her Dot Plot, implying a 4.50-4.75% range, in what she called a soft landing. (She's a 2024 FOMC voter but has to retire in June.)

- That's in line w the median Dot and doesn't look that far removed from a dovish pivot across the Committee - in October she "suspected" another rise might be coming by end-2023 (and note Atlanta's Bostic had looked for no change in rates through 2024 but said Friday he now sees 50bp in cuts). Indeed only 5 of 18 FOMC members see rates lower than Mester at end-2024.

- Her logic: "If you don’t take action as expected inflation comes down, then you’re really firming policy...you don’t want to inadvertently become more restrictive than you think is appropriate.”

- That sounds very much like the pretext for cutting used by Chair Powell, Gov Waller, and NY Pres Williams among others. Also echoing Powell's comments last week on the current "question" facing the FOMC, Mester told the FT: "The next phase is not when to reduce rates, even though that’s where the markets are at. It’s about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2 per cent."

- While the messaging the past few days from across the FOMC Hawk-Dove spectrum has been to push back on market cut pricing after Powell's dovish press conference, we wouldn't characterize the messaging as being that much different from what Powell actually said (same with Williams last week) - but more a walkback of Powell's fairly breezy tone in discussing easing scenarios.

December 2023 FOMC Dot Plot Distribution - Federal Reserve / MNI

December 2023 FOMC Dot Plot Distribution - Federal Reserve / MNI

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.