-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMilei Meets w/France's Macron Amid Deteriorating Bilateral Relations

Argentinian President Javier Milei has hastily moved up his meeting with his French counterpart Emmanuel Macron to today amid a significant deterioration in bilateral relations. Following its Copa America win earlier in July the Argentine national football team was captured on camera singing a racist chant referencing African-born French players. French and global footballing authorities swiftly condenmed the players actions.

- The incident widened into a diplomatic furore this week when Argentinian Vice President Victoria Villarruel posted on X: “No colonialist country is going to intimidate us for a [chant] or for telling the truths that they do not want to admit. Enough of simulating indignation, hypocrites,”

- As France24 reports Milei "...has sought to walk a fine line — nodding to the upswell of nationalism buoying the Argentina team while attempting to curb diplomatic backlash." Milei's spox and his sister have both sought to distance the gov't from the VP's comments.

- France is not the only EU country with which bilateral relations are in a dire state. Milei's comments regarding Spanish PM Pedro Sanchez's wife (who Milei called 'corrupt') have seen intergovernmental ties with Madrid damaged.

- Alongside Spain and France, relations with Brazil are also in the deep freeze.

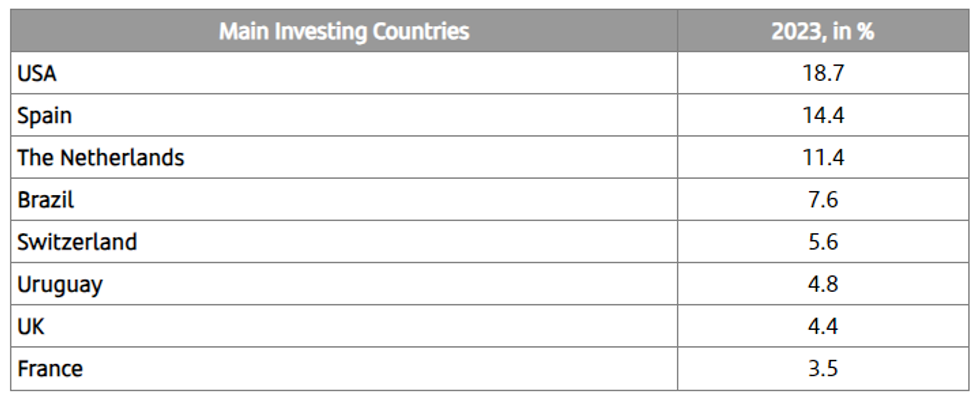

- Combined, the three nations noted above accounted for 25.5% of all FDI stocks in Argentina in 2023 (see table below). As France24 notes, the deteriorating relations come as "Argentina seeks to lobby for support from major shareholders of the IMF, including France and the U.S., to reach a new deal for extra funds."

Source: Central Bank of Argentina, Santander

Source: Central Bank of Argentina, Santander

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.