-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

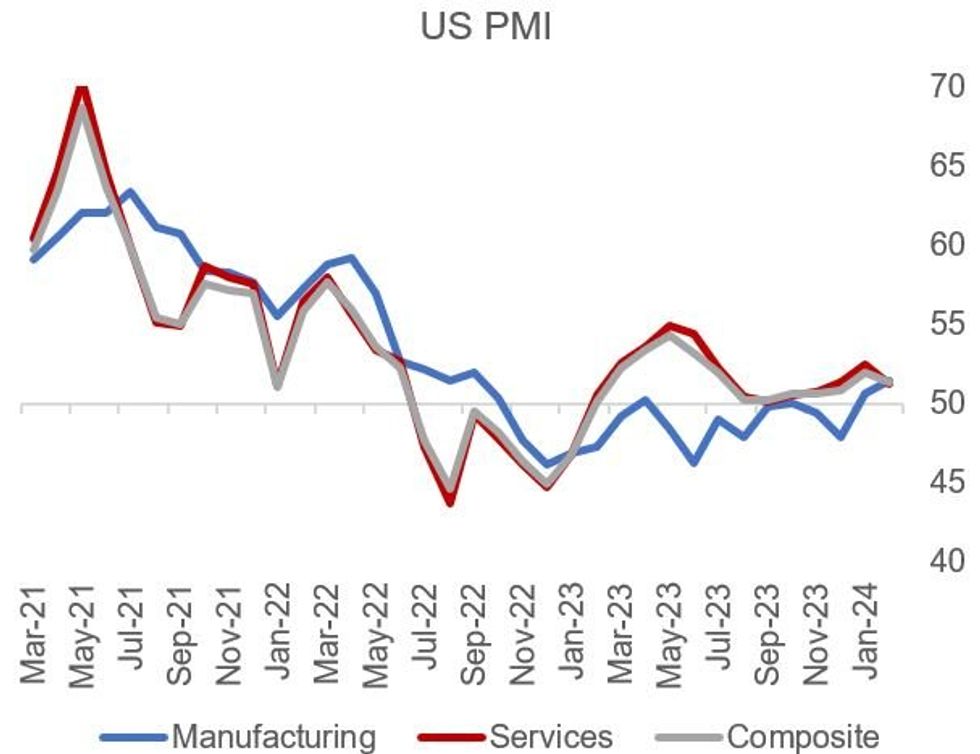

Free AccessMixed PMI Data Overall Consistent With "Soft Landing" Narrative

The US February flash PMI readings were mixed though on balance weaker than expected, signaling still-solid but slowing growth and potentially softer price pressures.

- Manufacturing was stronger than expected at 51.5 (50.7 expected, 50.7 prior), but Services disappointed by the most vs survey median since March 2023 at 51.3 (52.3 expected, 52.5 prior). This left the Composite reading at 51.4 (51.8 expected, 52.0 prior).

- The subcomponents of the S&P Global report will largely be seen as favorable from a Fed "soft landing" perspective: expansion continued though more slowly than in January, helped by manufacturing supply chains recovering from adverse weather conditions (i.e. another supply-side improvement that could benefit inflation dynamics as well as activity).

- The report also noted that "demand conditions improved further, but at a softer rate as a less marked increase in service sector new business offset an improvement in manufacturing." While service firms had an uptick in new business, goods producers saw the strongest rise in new orders since May 2022.

- This meant a "slightly reduced rate" of hiring and "dampened confidence in the outlook for output over the next year".

- And on inflation itself, "cost burdens rose at the slowest pace since October 2020. Although selling price inflation picked up slightly, the rate of increase was the second slowest since mid-2020."

- 2024 Fed cut pricing ticked marginally higher upon the release, but the move quickly dissipated as it became evident that this report wouldn't change the narrative greatly for an FOMC that is already effectively forecasting a "soft landing". Indeed, the report suggested the PMI levels were consistent with annualized GDP growth of 2% in Q1 along with 2% inflation: basically, a "soft landing" scenario.

Source: S&P Global

Source: S&P Global

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.