-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

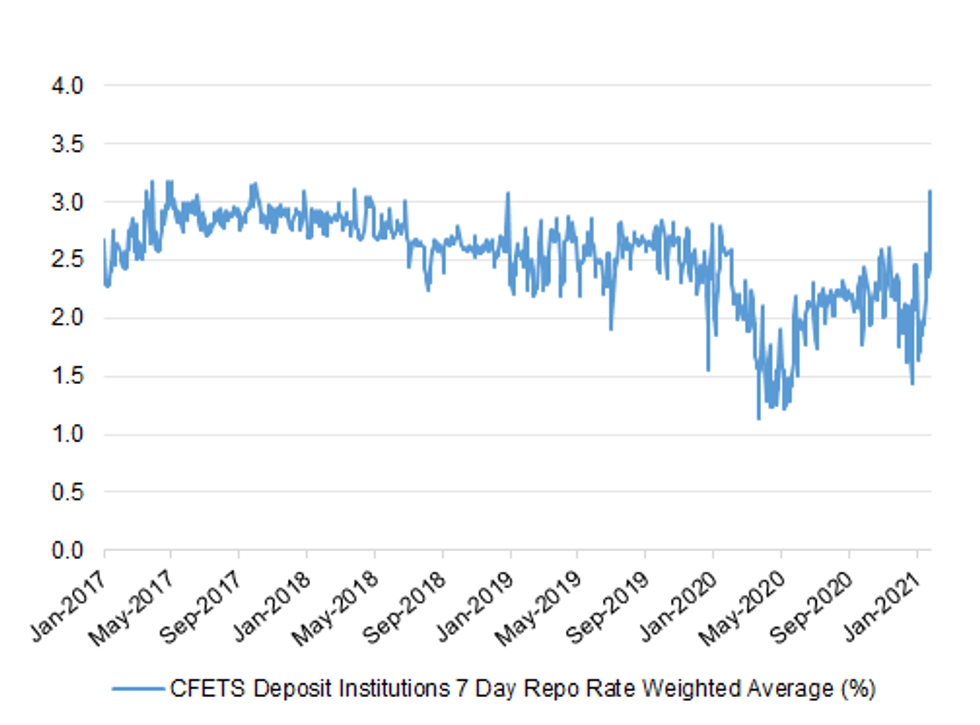

MNI Analysis: Noise From The Chinese Money Markets

The Issue

Chinese money markets have caught the eye in recent days, with worry surrounding PBoC liquidity provisions covering the lunar new year period front and centre. This has pushed the CFETS deposit institutions 7-day repo rate to fresh multi-year highs in weighted average terms.

Interest in the space picked up earlier this month, when the PBoC offered a smaller than expected round of mid-month liquidity provisions under the 1-year MLF mechanism, with the CNY500bn offered representing a net drain of CNY40.5bn when accounting for the cumulative CNY540.5bn of 1-Year MLF & TMLF that has matured during January. This represented the first monthly net drain via MLF operations in 6 months.

Token liquidity injections via open market operations (OMOs) were also apparent around the time of the mid-month MLF ops (with the PBoC offering CNY2bn of reverse repos on some days, smaller than the usual minimum increment of CNY5bn), as the Bank looked to assure the market that it stood ready to act, if required. The PBoC then beefed up its liquidity provisions around the time of the cut off for tax payments (20th January).

This was followed up by surprise OMO net drains on Tuesday and Wednesday of this week (totaling a cumulative CNY178bn), as some of the liquidity provisions afforded around the aforementioned tax payment deadline were withdrawn, providing fresh tightening impetus to the shorter end of Chinese money market curves.

Fig. 1: CFETS Deposit Institutions 7-Day Repo Rate Weighted Average (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

The Drivers

There have been several potential driving factors outlined:

- The aforementioned seasonal tax payments

- Worry re: PBoC normalisation. Recent comments from PBoC MPC member Ma Jun caught the eye, as he flagged the need for appropriate adjustments to monetary policy given the swift increase witnessed in macro leverage ratios, while he warned of bubbles in the Chinese property and equity markets. Still, we would suggest that incremental tightening is more of an issue here, as opposed to outright normalisation, given the PBoC's ample liquidity mantra and policymakers stressing that there will not be any sharp turns in broader macro policy during 2021. On that front PBoC Governor Yi has recently stressed that the central bank will balance the issues of growth stabilisation and curbing risks, while underlining the notion that the bank will not exit it supportive policies in a premature manner.

- Demand for cash ahead of the lunar new year break (which gets underway on 11th February), although this could be more limited than usual, given the COVID related travel restrictions in place in China at present.

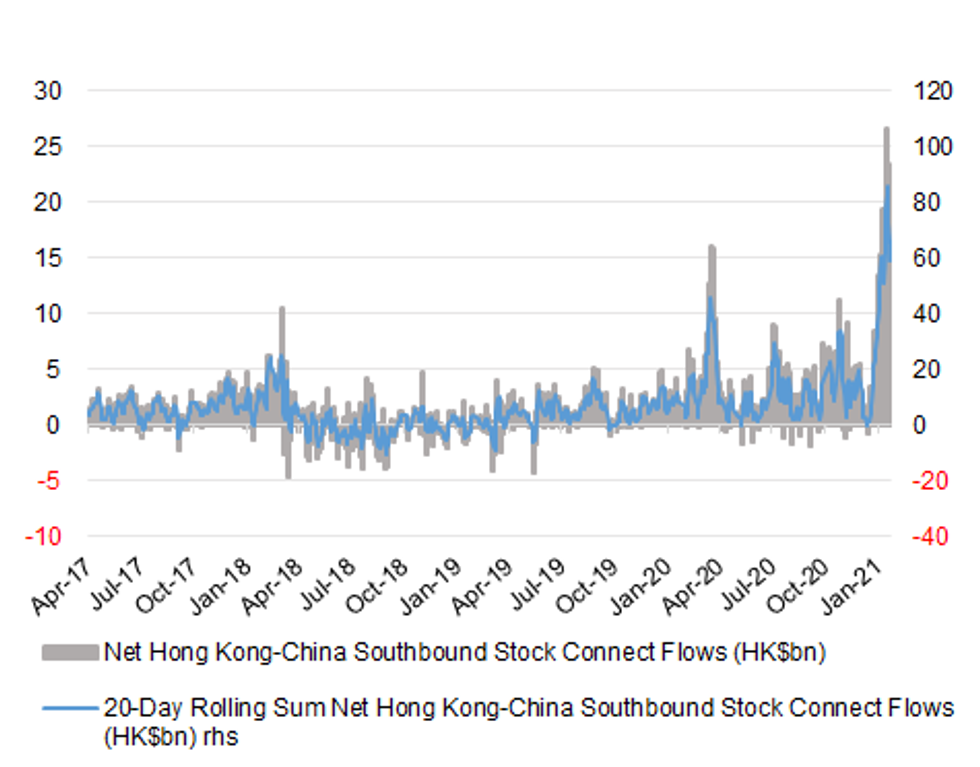

- Heavy outflows via the southbound leg of the Hong Kong-China stock connect scheme. Recent days have seen the 20-day rolling sum of the metric hit levels that have not been witnessed previously, with the 7 largest days of net southbound flows on record lodged in the month to date.

Fig. 2: Net Hong Kong-China Southbound Stock Connect Flows (HK$bn)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

What To Look For Next

Today's liquidity operations will be scrutinised, with CNY250bn worth of OMOs set to roll off.

General expectations look for the PBoC to provide a liquidity bridge to cover the lunar new year period in the coming weeks, which should include a mix of OMOs (likely 14-day reverse repos) and MLF operations (with CNY200bn of 1-Year MLF set to mature in the month of February).

Ming Ming, chief analyst at CITIC Securities, has suggested that the PBoC may need to inject around CNY900bn into the financial system around the lunar new year period, although stressed that the central bank will want to avoid flooding the market with credit.

This train of thought was further bolstered by a recent MNI insight piece, in which policymakers told us that the Bank is likely to rely on short-term facilities to address tightening liquidity before the Chinese New Year holiday rather than cutting banks' reserve requirement ratios as Covid prevention measures subdue demand for cash and monetary policy makers remain wary of feeding financial bubbles.

State-run media remains at ease for now, with a recent commentary piece in the Securities Times urging investors to avoid over-exaggerating the impact that the Bank's short-term liquidity operations have on stock and bond markets.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.