-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Analysis: USD/CNY: A Less Managed Float

MNI Analysis: USD/CNY: A Less Managed Float

A RTRS sources piece hit the wires after Beijing hours on Tuesday suggesting that "the PBoC has neutralized the counter-cyclical factor in its daily yuan midpoint fixing… The PBoC has asked some of the 14 midpoint contributing banks to submit and adjust their models to better reflect flexibility in the exchange rate and let the currency become more market-driven."

The move was subsequently confirmed by CFETS, as the body noted that the adjustment will improve the transparency and efficiency of the CNY fixing and the market's role in the FX self-discipline mechanism.

Recent PBoC action surrounding FX market mechanics, in addition to the rhetoric that it has chosen to deploy, has highlighted/promoted the need for 2-way market activity, while justifying the recent multi-month yuan rally as fundamentally driven.

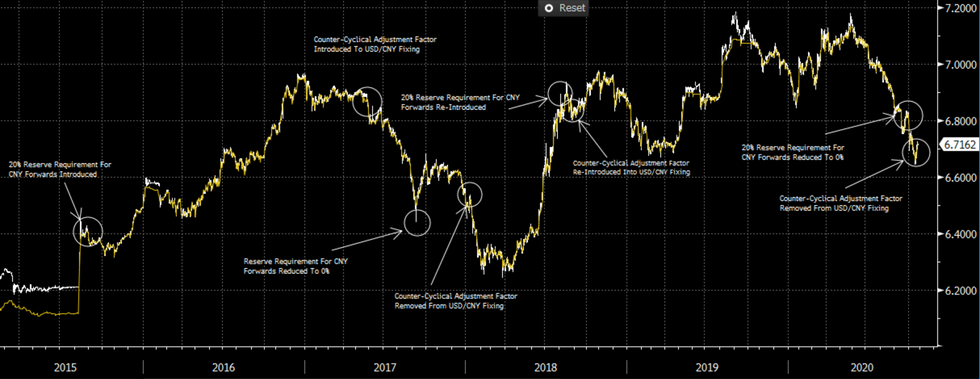

Fig. 1: USD/CNY (White Line) Vs. Daily PBoC USD/CNY Mid-Point Fix (Yellow Line)

Source: Bloomberg

Source: Bloomberg

The benchmark CFETS CNY basket has moved back towards its 2019 & 2020 highs, was the removal of the counter-cyclical factor a way for the PBoC to say that it has witnessed enough CNY strength for now?

Not necessarily, the move doesn't mean that the PBoC is against further CNY appreciation per se. It will be looking for less of a straight-line trajectory for CNY (especially ahead of the U.S. election), as Bank officials have recently alluded to.

As a reminder, the PBoC function for the daily USD/CNY mid-point fixing was:

closing price + movements of a basket of currencies + counter-cyclical factor

The removal of the factor pushes the rate towards a more market-based mechanism (which the PBoC wants), while retaining its status as a 'managed float.' The Bank could also choose to reintroduce the factor as and when it sees fit.

A reminder that the counter-cyclical adjustment factor was re-deployed back in August 2018, hot on the heels of one of the high profile breakdowns in the Sino-U.S. trade talk saga, with the mechanism used as a proverbial footbrake to slow the rate of CNY weakening.

The factor can be used as a form of expectation management and can therefore limit the velocity/ultimate size of international capital flows in and out of China, particularly in times of notable CNY pressure (with an asymmetric deployment of the measure, favouring guarding against CNY weakness, noted since August 2018). The PBoC has clearly learnt its lesson here, given the 2015 instance of CNY devaluation and the equity market turmoil/capital flow pressure that surrounded that particular move.

To conclude, while the USD/CNY knee-jerk reaction to the initial RTRS sources piece was to move higher (which is understandable given that the PBoC has removed the major component of leaning against CNY weakness in its daily USD/CNY fixing), the PBoC has focused on two-way market dynamics in recent rhetoric and this move (coupled with the recent removal of the reserve requirement ratio for CNY forward trading and SAFE's pledge to allocate larger QDII quotas) is a further step towards that.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.