-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Late Risk Squaring Weighs On Stocks

US TSY SUMMARY: Tsys Well Bid On Late Equity Selling

Bonds leading late session rally, levels back up to early overnight highs, yield curves flatter as equities extended session lows after the bell (ESZ0 -23.0).

- Decent overall volumes a little deceiving as session rather a quiet late week affair -- is tied to broad pick-up in Dec/Mar rolling with limited time ahead first notice on Nov 30 w/ Thanksgiving holiday next Thu (Friday early close). Near 350,000 TYZ/TYH and 375 FVZ/FVH rolls traded by the bell.

- Data-lite session, there were several Fed speakers on the session largely repeating the company line of lower for longer, general willingness to extend duration. Chicago Fed Evans on CNBC earlier: Extending maturity of asset purchases 'part of the tool kit'; can increase the size of the balance sheet more quickly if appropriate.

- Evans also said that 13-3 facilities have been "helpful" as a "backstop", says the Treasury's decision not to extend beyond end-year is "disappointing". Says Fed providing substantial monetary support.

- Late headline announced Fed Chair Powell and Tsy Sec Mnuchin will testify before the Senate Banking Committee on Dec 1.

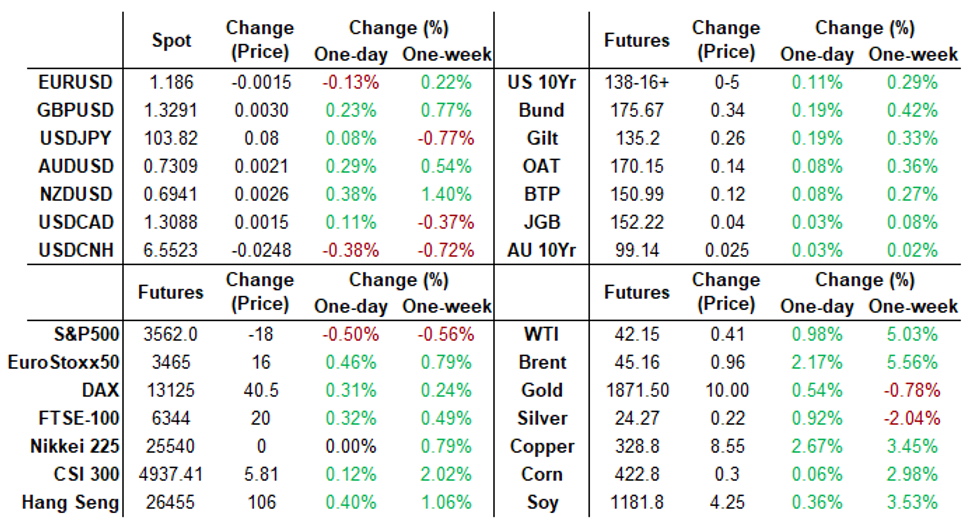

- The 2-Yr yield is down 0.2bps at 0.1594%, 5-Yr is down 0.1bps at 0.3715%, 10-Yr is down 0.3bps at 0.826%, and 30-Yr is down 1.8bps at 1.5273%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08263% (-0.00062/wk)

- 1 Month +0.00463 to 0.15013% (+0.01375/wk)

- 3 Month -0.00775 to 0.20488% (-0.01712/wk)**

- 6 Month -0.00675 to 0.24875% (+0.00275/wk)

- 1 Year -0.00213 to 0.33650% (-0.00288/wk)

- ** 3M New record Low 0.20488% on 11/20/20 (prior 0.20500% on 11/9/20)

- Daily Effective Fed Funds Rate: 0.08% volume: $62B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $182B

- Secured Overnight Financing Rate (SOFR): 0.06%, $911B

- Broad General Collateral Rate (BGCR): 0.04%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $316B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $32.255B submission

- Next scheduled purchases:

- Mon 11/23 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US EURODOLLAR/TREASURY OPTIONS SUMMARY

Better put and put spd buying in Eurodollar and 10Y Tsy options.

Eurodollar Options:

- 15,000 Red Dec 98/100 call spds, 1.0

- +5,000 Red Dec'21 100/100.25 call spds, 1.0

- -3,000 Green Mar 93/95 put strips, 3.25

- +4,000 Sep 96/97 1x3 call spds, 0.0 adds to earlier Block

- -11,000 Sep 97 puts, 2.0

- +2,500 Jun 97/98 1x2 call spds, 3.5

- -2,000 long Red Jun'22 96/97 2x1 put spds, 3.0

- 1,500 Sep 97/98/100 call flys

- Overnight trade recap:

- Block, 5,000 Sep 96/97 1x3 call spds, 0.5 net, 3-leg over at 0733:27ET

- 2,000 short Mar 97/98 call spds

- 1,000 Red Mar'22/long Green Dec'22 96 put spd

Tsy Options:

- Update, +9,000 TYF 136/137 put spds, 7/64

- Seller TYH 138 straddles, 151

- Overnight trade

- total 10,900 TYZ 138.75 calls, 1, half tied to 138.75/139 1x2 call spds

- +9,700 TYG 135.5/136.5 put spds 2 over TYF 139.5 calls, adds to 10k BLOCK early O/N

- -5,000 TYF 139/TYG 140 call spds

- +3,500 TYF 138 puts, 27-32

- +2,500 TYF 138.5 calls, 20

- +4,200 FVF 125.5 puts, 4

US: JPMorgan Forecasts GDP Contraction In Q1 2021, Rebound Thereafter

In its 2021 US economic outlook, JPMorgan argues that "recent restrictions on activity associated with the latest surge in [COVID] case counts will likely deliver negative growth in 1Q21", at a -1.0% annualized rate for the quarter (following a forecast +2.8% in Q420).

- However, JPM sees a bounce back thereafter in part due to recent "favorable news on the vaccine trials", and an anticipated further $1trn in fiscal support ("with the most likely timing on agreement being late 1Q21"). So +4.5% growth in Q2, and +6.5% in Q3.

- However inflation to remain subdued, with lingering labor market slack keeping inflation within a 1.5-2.0% range next year "despite the long-speculated death of the Phillips Curve". Core PCE to hit 2% in mid-2021 for a few months before falling back below target by end-year.

- This will keep the Fed "mostly out of the picture", with no rate hikes at least through end-2022. But notes that they recently changed their call for the Dec 2020 FOMC, now seeing an extension of maturity of purchases.

- And if unemployment looks to be heading below 5% by mid-2022, "this could start discussions late next year of the dreaded T-word: tapering".

EGBs-GILTS CASH CLOSE: Resolving In A Bullish Direction To End The Week

Bunds and Gilts ultimately resolved in a bullish direction for the most part, with an early move lower in yields reversing only temporarily in the early afternoon. Periphery spreads a little wider.- Focus is swiftly turning to next week's political agenda with EU budget negotiations and another fraught schedule of Brexit talks (reports out of this morning's briefing to EU ambassadors on progress of the talks were mixed).

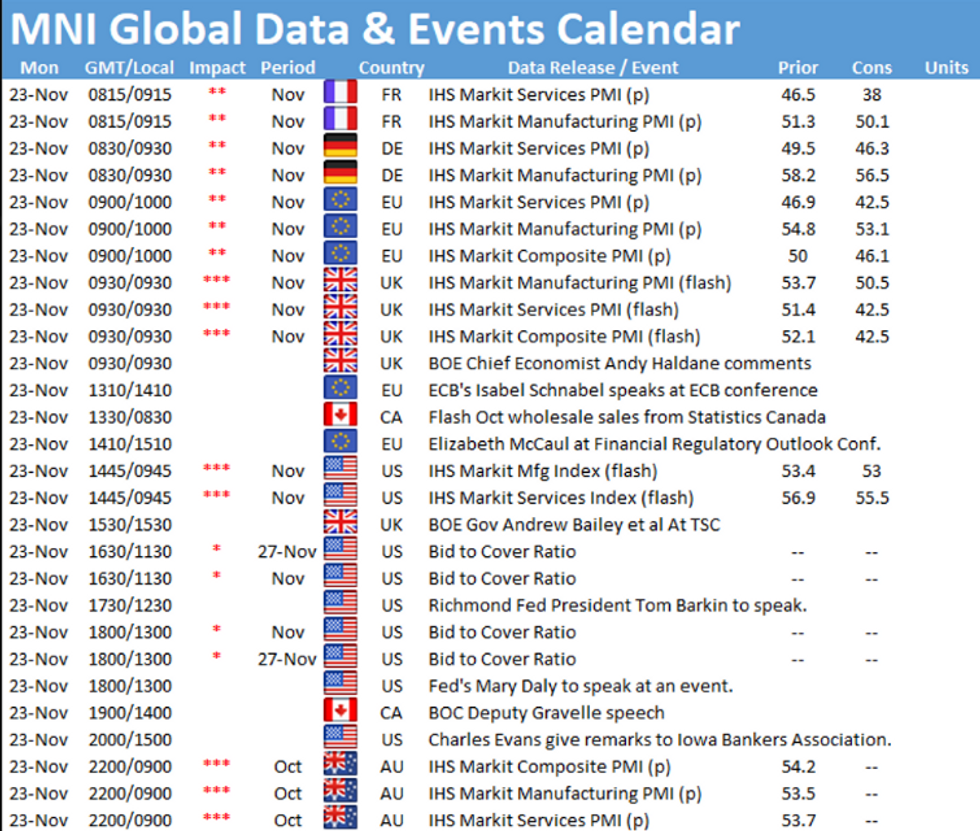

- Also of note Monday will be Flash November PMIs.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.6bps at -0.751%, 5-Yr is down 1.3bps at -0.761%, 10-Yr is down 1.2bps at -0.583%, and 30-Yr is down 0.2bps at -0.176%.

- UK: The 2-Yr yield is down 1.3bps at -0.042%, 5-Yr is down 1.5bps at -0.007%, 10-Yr is down 2.1bps at 0.302%, and 30-Yr is down 3.1bps at 0.889%.

- Italian BTP spread up 0.3bps at 121.6bps

- Spanish bond spread up 0.7bps at 64.8bps

- Portuguese PGB spread unchanged at 60.6bps

- Greek bond spread up 1.6bps at 127.8bps

EUROPEAN OPTIONS SUMMARY: German Jan/Feb 21 Downside Plays

Today's options flow included:

- LM1 99.75/99.875/100.125/100.25 call condor bought for 10.25 in 10k

- LM1 100.125/100.375 2x3 call spread bought for 4.25 in 2.25k

- 3RF1 100.37/100.25ps 1x1.5, bought for 1 in 4,880

- 3RG1 100.37/100.25ps, bought for 1.75 in 4.5k

- DUG1 112.30/20/00 broken put fly, bought for 1.5 in close to 40k total

- DUH1 112.30/112.20/112.00 broken p fly, bought for 1 in 5k

- RXF1 177.50/176.50ps, bought for 30 in 3k

- RXG1 174/172ps, bought for 10 in 3k

- RXG1 172p, bought for 6.5 in 4.75k

FOREX: NZD/USD Hits Multi-Year High

Strength in antipodean FX persisted throughout the Friday session, prompting a new multi-year high in NZD/USD printed up at 0.6950, clearing the best levels seen in 2019 to narrow the gap with December 2018 high of 0.6970.

- Initial USD weakness faded into the Friday close as EUR/USD was sold into the Friday WMR fix. Ranges, however, were tight, providing few new technical or fundamental signals as markets begin to hone in on the December FOMC meeting as the next flashpoint for price action.

- NZD, AUD and GBP were the strongest Friday, with SEK, EUR the weakest.

- Focus turns to global prelim November PMI numbers, IFO numbers from Germany and FOMC minutes. Thanksgiving holidays in the coming week, however, could keep market action light.

OPTIONS: Expiries for Nov23 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E1.1bln), $1.1800-10(E563mln), $1.1850(E564mln)

- USD/JPY: Y105.15-25($540mln)

- GBP/USD: $1.3295-1.3304(Gbp546mln-GBP calls)

- EUR/GBP: Gbp0.8990(E659mln)

- USD/CNY: Cny6.65($600mln)

EQUITIES: Indices Consolidate Into the Friday Close

Following the late-Wednesday sell-off, equity markets stabilized further into the Friday close, with ineffectual data and limited news flow keeping a lid on volatility.

- European equity markets were broadly higher, but gains were slight. Peripheral European markets outperforming, prompting a 0.6-0.8% rise in Italian, Spanish indices, while the FTSE-100 in the UK lagged, rising just 0.2%.

- In the US, utilities and communication services traded well while industrials, financials dragged on the S&P500. Notable outperformers included video game makers Take Two and Activision Blizzard, while travel names including Carnival and Alaska Air traded very heavy.

PIPELINE: Issuance Running Total $109.48B For Month

Date $MM Issuer (Priced *, Launch #)

- 11/20 $Benchmark Rep of Serbia investor calls

- -

- $7.555B Priced Thursday; $65.13B/wk

- 11/19 $3B *Charter Comm's $1B +11Y +147, $650M tap 30Y +207, $1.35B +40Y +227

- 11/19 $1.8B *AES Corp $800M 5Y +100, $1B 10Y +160

- 11/19 $1.2B *Allstate 5Y +40a, 10Y +70a

- 11/19 $555M *Uzbekistan 10Y 3.7%

- 11/19 $500M *Goldman Sachs +5Y +255

- 11/19 $500M *Massachusetts Electric 10Y +88

COMMODITIES: Front-end Flattening in Crude Futures Curve This Week

WTI traded inside the week's range Friday, providing few new technical signals in either direction. News flow was light and a lack of movement in the USD saw markets consolidate into the close, with much of the price action happening earlier in the week as commodities more broadly rallied on vaccine optimism. The WTI futures curve flattened markedly, with contracts out to Aug'21 rising over $1 or more per bbl.

- A similar story in gold, as spot recovered further from the Thursday low, but stopped short of any major test on the week's best levels at $1899.15.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.