-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - US$ Bounce, Heavy Month End Rebal

US TSY SUMMARY: Active Start To Week, Heavy Month End Rebalance

Nice start to the week, a definite pick-up in action after last week's Thanksgiving holiday torpor.

- Eurodollar futures volume surged (EDH2 over 585k) after the Fed annc to extend LIBOR transition from end of 2021 to June 2023. Nevertheless, "agencies encourage banks to cease entering into new contracts that use USD LIBOR as a reference rate as soon as practicable and in any event by December 31, 2021, in order to facilitate an orderly—and safe and sound— LIBOR transition."

- Choppy Tsy futures despite expected lending facility extension of four emergency lending facility annc that Tsy Sec Mnuchin requested back on Nov 19. Tsy futures volumes spiked again on the closing bell on Heavy month end rebalancing w/near 500k TYH in last 20 minutes (1.565M total/day), 225k FVH, 95k USH and 75k WNH over same period.

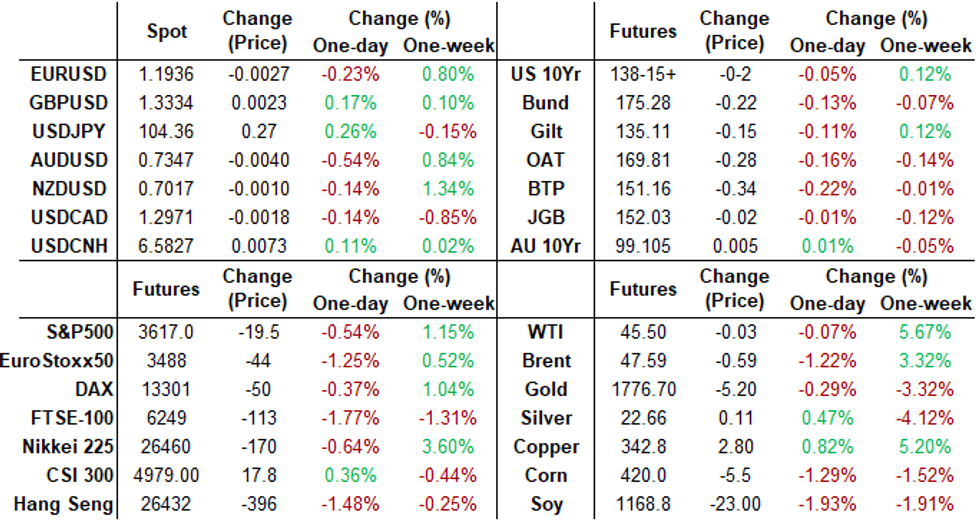

- The 2-Yr yield is down 0.6bps at 0.1466%, 5-Yr is down 0.2bps at 0.3624%, 10-Yr is up 1bps at 0.8471%, and 30-Yr is up 0.7bps at 1.5771%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00475 at 0.08500% (-0.00238 last wk)

- 1 Month -0.00137 to 0.15338% (+0.00462 last wk)

- 3 Month +0.00225 to 0.22763% (+0.02050 last wk)

- 6 Month -0.00238 to 0.25500% (+0.00863 last wk)

- 1 Year -0.00013 to 0.33025% (-0.00612 last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $190B

- Secured Overnight Financing Rate (SOFR): 0.08%, $900B

- Broad General Collateral Rate (BGCR): 0.06%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $326B

- (rate, volume levels reflect prior session)

FED: NY Fed operational purchase:

Tsy 20Y-30Y, $1.733B accepted vs. $6.165B submission

- Tue 12/01 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 12/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 12/03 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Mon 12/07 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 12/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 12/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 12/10 1010-1030ET: TIPS 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsys 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- BLOCK, 30,000 Green Jun'21 87/91/95 put flys, 3.0 net, opener at 1105:43ET

- 4,000 Red Jun'22 93/95/96/97 put condors, 3.5

- -10,000 Blue Dec 93/95 put spds, 1.5

- +7,500 Sep 96/97 put spds, 1.5

- hear sale Red Mar'22 96 straddles prior to the Fed LIBOR annc

- -3,000 Blue Dec 92/93/95/96 put condors, 9.5

- small buyer long Green Jun'23 96 straddles, 33.5

- 5,000 TYG 138/139 1x2 call spds, 7

- 5,000 TYF 137.5 puts, 13

- 4,600 TYG 139/140 1x2 call spds

- +2,500 USF 180 calls, 11/64

- Overnight trade

- -6,500 TYF 139.5 calls, 4/64

- -1,000 TYF 138 calls, 19

- + FVF 126/126.5/127 1x3x2 call flys, 6/64

- 4,000 USF 171/173 put spds, 27

EGBs-GILTS CASH CLOSE: Month Ends On A Weak Note

The week opened and the month ended with Bund/Gilt selling down the curve for most of the session following a fleeting rally around the open. Periphery spreads widened as BTPS weakened following a brief move into record-low territory for the 10-Yr yield (0.585%).

- Hard to find any coherent drivers of the move (flash Nov inflation data was mixed and did not move markets), with equities under pressure esp in the afternoon, and little new on the Brexit front. Doesn't appear that month-end rebalancing buying materialized.

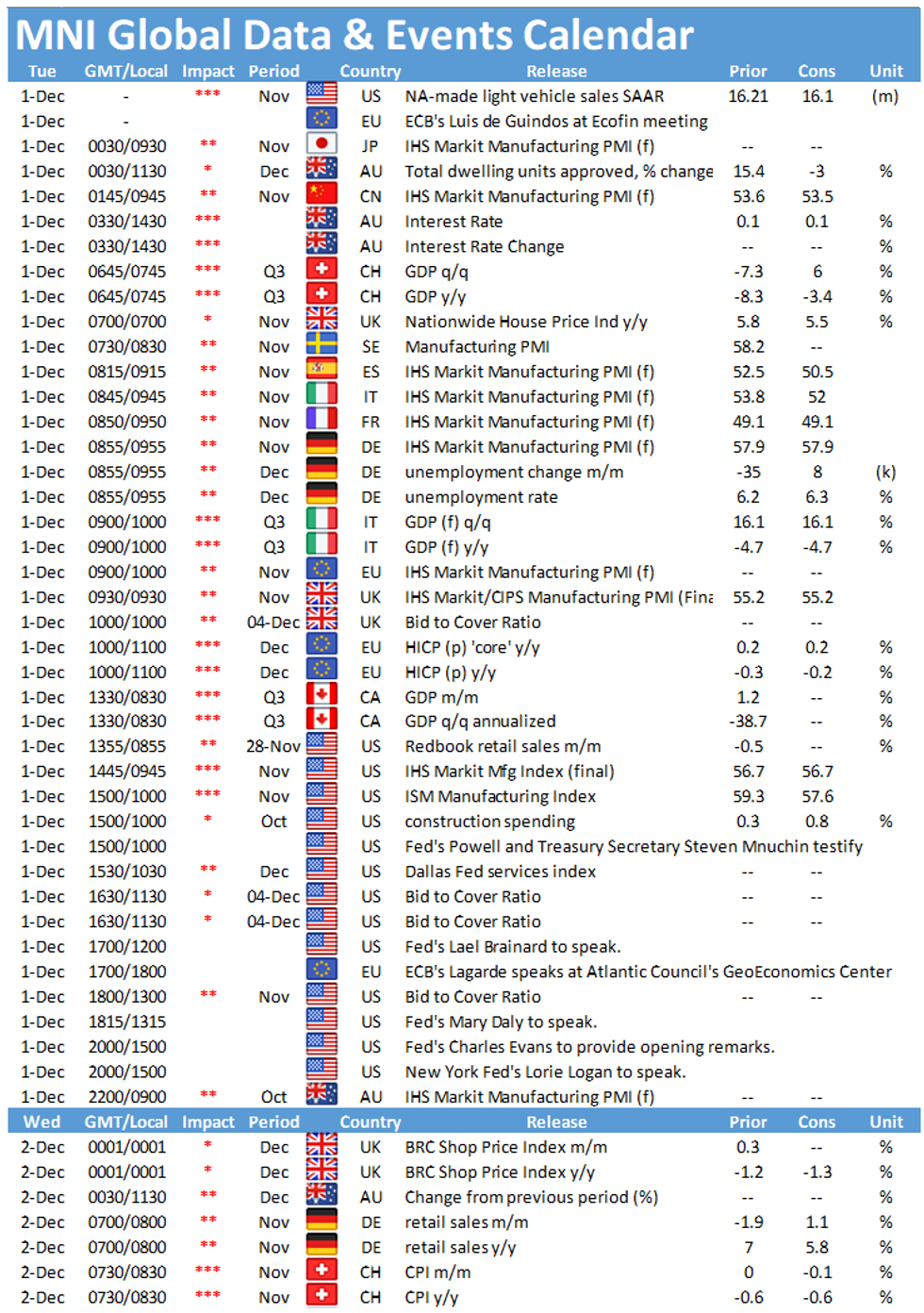

- Tuesday sees Italy and Spain PMIs and EZ flash inflation, plus another appearance by ECB's Lagarde, and Gilt supply.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.2bps at -0.743%, 5-Yr is up 1.7bps at -0.753%, 10-Yr is up 1.7bps at -0.571%, and 30-Yr is up 1.6bps at -0.166%.

- UK: The 2-Yr yield is up 2.1bps at -0.022%, 5-Yr is up 1.9bps at 0.008%, 10-Yr is up 2.1bps at 0.305%, and 30-Yr is up 2.1bps at 0.852%.

- Italian BTP spread up 1.5bps at 119.7bps

- Spanish bond spread up 0.6bps at 65.2bps

- Portuguese PGB spread up 0.4bps at 60.5bps

- Greek bond spread down 3bps at 121bps

EUROPE FLOW SUMMARY: July Plays In EGBs, Mids In Sterling

Monday's options flow included:

- 0LU1 99.62/100.12 combo bought for 2.25 in 1k (bought the call) (vs 99.92, 43d)

- 2LH1 99.875/99.75/99.625 put fly sold at 2.25 in 5k (v 99.885)

- 2x 3LM1 100.125 call v 0LM1 100.125 call, sells the blue at 2.75 in 1k x 0.5k

- RXF1 177.00/176.00/175.50 broken put fly bought for 15.5

- DUF1 112.40/112.50 1x2 call spread bought for 1 in 1.8k

- IKF1 125.00 put bought for 2 in 2k (note ref 151.23)

FOREX: USD Follows the Flow into Month-end

The greenback played catch-up with month-end flows throughout the Monday session, after initially coming under considerable selling pressure as most models pointed to USD sales into the fix. This put the USD index at fresh multi-year lows ahead of the London close, before swiftly reversing once the flow had, presumably, been absorbed.- As a result, USD swung from being the poorest performer in G10 to mid-table in US hours, leaving Scandi currencies, the JPY and EUR the softest.

- GBP traded constructively, but stopped short of a broad rally as ITV political correspondent Peston wrote that current negotiations are "grounds for optimism that a compromise is within reach."

- The RBA rate decision, China's Caixin manufacturing PMI and manufacturing ISM numbers for November are the highlights Tuesday. Speakers include Fed's Powell and ECB's Lagarde.

Expiries for Dec1 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E1.2bln), $1.1850-60(E545mln), $1.1900(E509mln), $1.1950(E642mln), $1.2000-10(E995mln)

- USD/JPY: Y103.00($504mln), Y104.85-00($973mln)

- GBP/USD: $1.2800(Gbp511mln), $1.3215-30(Gbp545mln)

- EUR/GBP: Gbp0.8900(E630mln)

TECHS: Key Price Signal Summary

- Gold is soft. The focus is on $1763.5, 50.0% of the Mar - Aug rally and $1747.6 - Low Jun 26. Oil markets appear to be correcting. Support to watch in Brent (G1) is $45.87, Nov 27 low and in WTI (F1) at $43.33, Nov 11 high and $42.82, Nov 24 low. Copper (H1) continues to defy gravity and targets $353.66 next, 1.382 projection of the Oct 2 - 21 rally from Nov 4 low.

- In the FX space, EURUSD is closing in on this year's 1.2011 high from Sep 1. USDJPY key support lies at 103.18, Nov 11 low. Initial support is 103.65, Nov 18 low. Key EURGBP trendline resistance drawn off the Sep 11 high, intersects at 0.8995. The trendline capped gains Friday and is under pressure today. It remains a pivotal resistance. 0.8995/9000 is a key intraday hurdle. The major resistance for bulls in Cable is 1.3421, a multi-year trendline drawn off the Nov 2007 high.

- Key FI resistance levels: Bund fut: 175.73, Nov 20 high and 176.08, 76.4% of the Nov 4 - 11 sell-off. Gilts (H1): are off to the races again and eying 134.70 next, 1.00 proj of the Nov 16 - 23 rally from Nov 25 low. Treasuries (H1): 138-09+, the 20-day EMA.

- E-Mini S&P is still trading below 3668.00, Nov 9 high. Support to watch this week is 3506.50. {EU} EUROSTOXX50 focus is on 3553.05, Feb 27 high.

EQUITIES: Wave of Weight at Month-End

- European stock markets ebbed lower into the close, with a wave of selling pressure accompanying the US market open - from which stock markets failed to really recover. This did, however, cap an exceptionally strong month for equity markets. Bourses from UK to France enjoyed their best month in decades across November - and some, including Spain's IBEX-35, had the best month ever, so some profit-taking into the monthly close troubled few.

- The e-mini S&P was sold alongside the open, with some of the downside coinciding with headlines that the US were sanctioning China's CEIEC for helping to support the Venezuela's Maduro when he was in office.

- Energy and consumer discretionary firms led the decline on Monday, with tech at the other end of the table. Notable individual movers included Airlines and travel firms, who slipped lower, while Apple, Pfizer and Electronic Arts were among the best performers.

PIPELINE: National Securities Clearing Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/30 $1.75B #National Securities Clearing $1B 3Y +25, $750M 5Y +45

- 11/30 $1.5B #Santander 10Y +190

- 11/30 $750M #Bank of NY Mellon 3Y +20

- 11/30 $650M *Con Edison WNG 3NC1 +47

- 11/30 $500M *McKesson WNG 5Y +55

- 11/30 $Benchmark Istanbul Metro Muni 5Y investor call

- 11/30 $Benchmark Banco Continental investor call

- 11/30 $Benchmark VakifBank 5Y investor call

- Rolled to Tuesday

- 12/01 $Benchmark KBN (Kommunalbanken Norway) 3Y +6a

COMMODITIES: Another Day Passes With No OPEC Deal

- Oil traded poorly as internal resistance to OPEC+'s proposals to extend a series of output curbs failed to find its way through the committee. Sources reported that the group were deferring any such decision, keeping focus on any comments emerging from the group over the next few days.

- WTI crude futures initially benefited from USD weakness Monday, prompting a test on last week's highs of 46.26, before prices reversed into the close and energy markets were contained.

- Copper continues to outperform, with fresh multi-year highs printed at 349.85 for the active contract. The continued outperformance of copper over precious metals (particularly gold) has put the copper/gold ratio at it's highest since June last year, with the rotation into growth assets persisting following the vaccine news over the past few weeks.

- Gold weakness extended below the 200-dma after Friday's break, putting the metal at its lowest since early July.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.