-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - England Lockdown Ordered

US TSY SUMMARY

Rates bounced off early weakness to new session highs by midday as equities steadily reversed gains into the close.

- Decent jump in volumes: (TYH>1.15M after the bell), early surge as futures sell-off, long end leading move (10Y B/E rate 2Y high at 2.0025%; 10YY +.0317 at 0.9448%; 30YY +.0355 at 1.6804%). No obvious driver on early rate sales, potential unwind of extension trades going into year end, participants eager to get 2021 underway.

- Steady risk-on unwind followed as equities came under consistent sell pressure all day: likely combination of position squaring ahead GA run-offs Tuesday, political sideshow Wednesday w/electoral vote count; ongoing angst over Covid lockdown measures w/UK PM Johnson calling for national lockdown starting Tuesday.

- More practical position squaring ahead Friday's Dec employ data (+62k est vs. +245k prior).

- Jump in corporate issuance after weeks of inaction, over $27B issuance spurred deal-tied hedging in second half.

- The 2-Yr yield is down 0.8bps at 0.1132%, 5-Yr is down 1bps at 0.3513%, 10-Yr is unchanged at 0.9132%, and 30-Yr is up 0.7bps at 1.6522%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00700 at 0.08463% (-0.00337 net last wk)

- 1 Month -0.00413 to 0.13975 (-0.00123 net last wk)

- 3 Month -0.00113 to 0.23725% (-0.00173 net last wk)

- 6 Month -0.00175 to 0.25588% (-0.00903 net last wk)

- 1 Year -0.00125 to 0.34063% (+0.00150 net last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $34B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $76B

- Secured Overnight Financing Rate (SOFR): 0.07%, $1.095T

- Broad General Collateral Rate (BGCR): 0.06%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $340B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $21.593B submission

- Next scheduled purchase:

- Tue 1/05 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options

- +25,000 Block/pit short Apr 96/97/98 2x3x1 put flys, 4.5

- +4,000 Mar 99.687/99.75/99.812 put trees, 0.5

- Block 10,000 Apr 99.75/99.81/99.87 1x3x2 call flys, 1.0

- Overnight

- 5,000 Jun 97/99.812 1x2 call spds

- 3,500 Jun 99.75/99.812 2x1 put spds

- 4,000 Jun 97 puts, 0.75

- 1,600 Red Dec 99.87/100.12 call spds

- 1,500 TYH/TYG 136.5 put spds, 12

- +2,000 TYH 138/139 1x2 call spds, 9

- +1,300 TYH 136/140 put over risk reversals, 4

- 3,000 TYG 136.25/149.25 strangles, 9

- +17,000 wk3 137.5 puts, 19

- Overnight

- Block, +20,000 TYG 135.5 puts, 2

- Block, +5,000 TYG 137/139 put over risk reversals, 5

- Block, +5,000 TYG 137 puts, 13

- over 5,000 USG 176 calls, 28

EGBs-GILTS CASH CLOSE: Strong But Shaky Start To 2021

After a sharp rally on the Gilt open, core Europe FI spent most of the rest of the session fading before rallying anew mid-afternoon.

- The catalyst for the late-day rebound was news of a nationwide England lockdown announcement set to be announced by UK PM Johnson at 2000GMT (following Scotland's decision to do the same). Equities fell to session lows while GBP weakened.

- The early FI bid was helped by weaker-than-expected Italy/Spain Dec PMIs.

- Lots of syndications announced: Ireland and Slovenia 10-Yr, Italy 15-Yr, plus Slovenia 2050 Tap.

- ECB's Lane speaks at 2045GMT. France flash CPI early Tues. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 2.2bps at -0.722%, 5-Yr is down 2.4bps at -0.762%, 10-Yr is down 3.5bps at -0.604%, and 30-Yr is down 3.8bps at -0.196%.

- UK: The 2-Yr yield is up 0.7bps at -0.153%, 5-Yr is down 1.8bps at -0.103%, 10-Yr is down 2.4bps at 0.173%, and 30-Yr is down 2bps at 0.73%.

- Italian BTP spread up 4bps at 115.2bps / Spanish up 1.1bps at 62.7bps.

EUROPE OPTIONS: Summary

Feb Bund Puts Galore. Monday's options flow included:

- RXG1 176.50/175.50ps 1x2, bought for 5 in 1.5k

- RXG1 177/175.50/175.00p ladder, bought for 16 in 2.6k

- RXG1 178.00/177.00/176.00 put fly bought for 16.5 in 2k

- RXG1 177.50/176.50ps, bought for 23 in 1k

- RXG1 177/176/175p fly, bought for 10 in 1k

- RXG1 178/178.5cs, trades 24.5 in 2.5k

- RXH1 176/174.50ps, bought for 18.5 in 2k

- DUG1 112.30p, sold at 3 in 6k

- ERM1 100.37/100.25/100.12p ladder, bought for1.5 in 1.5k

- LU1 99.875^ v 100.125 call sold at 15.5 in 17k

- LH1 100.125 call bought for 1.75 in 7.5k

- LH1 100.00/99.875 put spread bought for 3.25 in 3k

- LZ1 100/100.112^^, sold at 13.5 in 1k

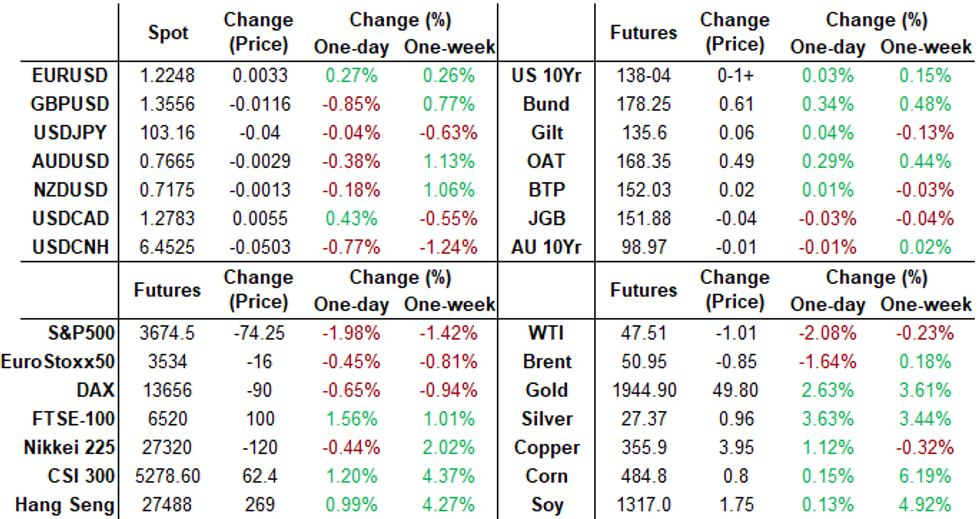

FOREX: Risk-Off/Safe Haven Turnaround

The Greenback was a beneficiary as virus fears hit global sentiment and risk was trimmed. Global indices remained heavy throughout the US morning and the Dollar Index reversed all prior losses to briefly turn positive on the day. * EURUSD after trading with a bid tone all morning, marginally failed to make a new recent high at 1.2309 and finally gave in to the equities weakness, trading back down to 1.2255 amid the USD demand. USDJPY remained stable and flat on the session as haven flows into both currencies limited the pair's range.

- GBP came under heavy pressure as UK's Johnson announced he will address the nation later today to announce further restrictions. As the case count continues to mount, the BBC have reported he is likely to announce a lockdown similar to measures imposed in March. Cable is down 0.85% having briefly tested above the 1.37 handle earlier in the day. EURGBP has seen a larger move and is currently up 1.2% at 0.9045.

- AUD(-0.53%), NZD(-0.42%) and CAD(-0.46%) all saw outflows as Equities traded lower, having previously traded higher following positive sentiment during Asia and European sessions.

- A sharp move lower in WTI Crude futures (Down 2%) translated into a turnaround in currencies such as USDBRL (+1.31%), with EURNOK and USDRUB reversing and both ending towards their best levels.

FX OPTIONS: Expiries for Jan 5 NY cut 1000ET (Source DTCC)

- AUD/JPY: Y79.10-20(A$569mln-AUD puts)

- AUD/NZD: N$1.0485(A$960mln-AUD puts), N$1.0665(A$480mln-AUD puts)

- Larger Option Pipeline

- EUR/USD: Jan06 $1.2300(E1.1bln-EUR puts); Jan07 $1.2155(E1.3bln-EUR puts); Jan11 $1.2295-1.2300(E2.6bln-EUR puts), $1.2310-15(E1.1bln-EUR puts)

- USD/JPY: Jan06 Y104.00($1.1bln); Jan07 Y104.00($1.2bln); Jan12 Y104.00($1.2bln-USD puts); Jan13 Y103.00($1.1bln)

- GBP/USD: Jan11 $1.3700-05(Gbp928mln-GBP puts)

- EUR/GBP: Jan07 Gbp0.8800(E1.1bln-EUR puts)

- AUD/USD: Jan11 $0.7625(A$1.1bln-AUD puts), $0.7725(A$1.1bln-AUD puts)

PIPELINE

2021 Starts off with a surge in high-grade debt issuance: $27.5B

- Date $MM Issuer (Priced *, Launch #)

- 01/04 $10B #Broadcom $750M 7Y +135, $2.75B 10Y +155, $1.75B 12Y +170, $3B 20Y +185, $1.75B 30Y +210 (last year May 5, AVGO issued $8B: $1B 3Y +200, $2.25B 5Y +280, $2.75B 10Y +350, $2B 12Y +365)

- 01/04 $3B #Mexico 50Y 3.75%

- 01/04 $3B #Toronto Dominion (TD) $1.15B 2Y +18, $600M 2Y FRN SOFR+24, $1.25B 5Y +43

- 01/04 $3B #Home Depot $500M 7Y +35, $1.25B 10Y +52, $1.25B 30Y +77 (last year, Mar 26, HD issued $5B: $750M 7Y+190, $1.5B 10Y+195, $1.25B 20Y+195, $1.5B 30Y+200)

- 01/04 $2.5B #Sumitomo Mitsui Fncl Grp (SMFG) $500M 3Y +35, $1B 5Y +60, $500M 10Y +80, $500M 20Y +85

- 01/04 $2B #Metropolitan Life $625M 3Y +25, $625M 3Y FRN SOFR+32, $750M 10Y +68

- 01/04 $1.5B #John Deere 5Y +37, 10Y +57

- 01/04 $1.5B #Athene Global Funding $750M 3Y +80, $250M 3Y FRN L+73, $500M 5Y +110a

- 01/04 $1B *Exp/Imp Bank of India 10Y +145

- On tap for Tuesday:

- 01/05 $1B European Inv Bank (EIB) 5Y +7

EQUITIES: Weak Start For US Indexes

- Japan's NIKKEI down 185.79 pts or -0.68% at 27258.38 and the TOPIX down 10.09 pts or -0.56% at 1794.59

- China's SHANGHAI closed up 29.889 pts or +0.86% at 3502.958 and the HANG SENG ended 241.68 pts higher or +0.89% at 27472.81

- The German Dax up 7.96 pts or +0.06% at 13726.74, FTSE 100 up 111.36 pts or +1.72% at 6571.88, CAC 40 up 37.55 pts or +0.68% at 5588.96 and Euro Stoxx 50 up 11.75 pts or +0.33% at 3564.39.

- Dow Jones mini down 557 pts or -1.83% at 29978, S&P 500 mini down 76 pts or -2.03% at 3677, NASDAQ mini down 269.25 pts or -2.09% at 12635.5.

COMMODITIES: Gold Surges

West Texas Crude under pressure (-2.08%). Surge in Gold leads rally in precious metals, focus is on $1965.6, Nov 9 high and a key technical resistance.

- WTI Crude down $1.02 or -2.1% at $47.48

- Natural Gas up $0.04 or +1.54% at $2.575

- Gold spot up $42.12 or +2.22% at $1940.68

- Copper up $3.95 or +1.12% at $355.75

- Silver up $0.8 or +3.03% at $27.2105

- Platinum down $3.56 or -0.33% at $1069.52

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.