-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: Active FOMC Session For No Pol Change

US TSY SUMMARY: Early Risk-Off Sees Sub 1% 10YY; Fed On Hold

Rates trade firmer after the bell -- but well off midmorning session highs, even after equities trade broadly weaker, near late session lows (ESH1 -93.0).

- Chair Powell Q&A ongoing covers broad subject range: racial equality root of employ mandate, housing bounce ephemeral, signs of stronger H2, Fed not out of tools.

- Rates had held narrow range/near highs in 4+ hour lead-up to FOMC annc., break lower late. Not much of a react to steady FOMC policy annc, patient Fed view on inflation, ending term repo ops, too soon to consider tapering QE, econ recovery tied to progress in vaccines/getting virus spd under control.

- Early risk-off on headlines re: EU concern over Astrazeneca vaccine supply.

- On Tsy futures rally to session highs, 10YY dropped below 1.0% to 0.9992% for first time since Jan 6 after spending much of 2020 between 0.90%-0.55%. Robust volumes on muted risk appetite, TYH1 >750k (>100k on initial move) off of ECB headlines re: officials say markets underestimate chances of rate cuts.

- The 2-Yr yield is down 0.2bps at 0.1191%, 5-Yr is up 0.4bps at 0.4129%, 10-Yr is down 1.4bps at 1.0212%, and 30-Yr is down 0.4bps at 1.7865%.

MONTH-END EXTENSIONS: UPDATED Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS -0.16Y; Govt inflation-linked, 0.23. Note Agencies extend duration from 0.12 prelim to 0.16.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.09 | 0.07 |

| Agencies | 0.16 | 0.06 | -0.03 |

| Credit | 0.09 | 0.09 | 0.09 |

| Govt/Credit | 0.09 | 0.09 | 0.07 |

| MBS | 0.06 | 0.06 | 0.07 |

| Aggregate | 0.08 | 0.08 | 0.08 |

| Long Gov/Cr | 0.09 | 0.09 | 0.05 |

| Iterm Credit | 0.1 | 0.08 | 0.09 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.08 |

| High Yield | 0.11 | 0.08 | 0.09 |

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00088 at 0.08375% (-0.00250/wk)

- 1 Month -0.00500 to 0.12250% (-0.00225/wk)

- 3 Month -0.00700 to 0.21150% (-0.00375/wk)

- 6 Month +0.00150 to 0.23450% (-0.00150/wk)

- 1 Year -0.00075 to 0.31150% (-0.00075/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $213B

- Secured Overnight Financing Rate (SOFR): 0.03%, $926B

- Broad General Collateral Rate (BGCR): 0.02%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $321B

- (rate, volume levels reflect prior session)

- No buy Wednesday due to FOMC annc

- Next scheduled purchases:

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +10,000 Green Jun 95 puts, 3.0

- Block, +25,000 Green Jun 92/93/95/96 put condors, 3.0 adds to 5k prior

- +5,000 Green Jun 92/93/95/96 put condors, 2.5

- +4,000 Blue Mar 88/91 put spds, 1.25

- +2,500 short Mar 95/96/97 put flys, 0.25

- +4,000 Green Mar 99.81 calls, 1.0

- +5,000 Blue Sep 86/90 2x1 put spds, 3.0

- Overnight trade

- 4,250 Blue Dec 98.50 puts, 7

- 3,800 Blue Jun 86/88/91 put flys

- 2,500 Blue Mar 92/97 1x2 call spds

- 2,000 Mar 99.87 calls vs. 4,000 Apr 99.87/99.937 call spds

- Block 10,000 Mar 98 calls, cab

- +3,000 FVJ 125.5 puts, 11.5

- +5,750 TYH 136.5/137.25 2x1 put spd w/ TYH 135/136.25 2x1 put spd strip, 1 total db

- +3,500 TYH 136.5/137/137.5 put flys, 4

- +3,000 TYH 136.5/137.25 2x1 put spds, 3

- >+10,000 wk5 TY 137.5 straddles 28-30

- +40,000 TYH 138 calls, 11-18, 18 last

- 1,500 TYH 138/138.5/139 call flys

- Overnight trade

- 8,300 FVJ 126 calls, 7-8

- 5,500 TYH 137 puts, 19

- Block, +10,000 TYJ 133.5/138 put over risk reversals, 1

- Another +12k TYJ 133.5/138 put over risk reversals on screen, 0.0

EGBs-GILTS CASH CLOSE: A Session That Had It All

Wednesday's risk-off session had it all, from large supply (incl syndications from Greece, Austria, Slovenia), to diplomatic intrigue over COVID vaccines pitting the EU against supplier AstraZeneca.

- But the highlight was a BBG report mid-afternoon citing unnamed officials as saying the ECB have agreed to push back on market rate cut skepticism.

- That pushed Bunds and Gilts to session highs, with peripheries largely keeping pace. However the move has since retraced and we are only slightly stronger in the UK and German curves.

- Attention turns to the US Federal Reserve decision after hours.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.8bps at -0.741%, 5-Yr is down 1.7bps at -0.751%, 10-Yr is down 1.3bps at -0.546%.

- UK: The 2-Yr yield is up 0.7bps at -0.131%, 5-Yr is up 0.8bps at -0.055%, 10-Yr is up 0.4bps at 0.269%, and 30-Yr is down 0.6bps at 0.832%.

- Italian BTP spread up 2.1bps at 120.1bps / Spanish up 1.4bps at 62bps

EUROPE SUMMARY: Large Short Cover In Short-Sterling

Wednesday's options flow included:

- DUH1 112.30/20/10p fly, bought for 2 in 5k

- RXH1 176.00/174.50ps, sold at 12.5 in 1k

- RXH1 177.00/176.00/175.00p fly, bought for 12.5 in 8k

- RXH1 177/176ps 1x1.5, bought for 16 in 1.8k

- RXH1 178.0/178.5 call spread bought for 23 in 1k

- RXH1 177.00/175.50/172 put fly sold at 16.5 in 1k

- ERM2 100.25/99.75/99.25p fly, bought for 0.75 in 1k

- ERH2 100.25/100.00/99.75p fly, bought for 0.5 in 1k

- 3RM1 100.375/100.25ps vs 100.50/100.625cs, bought the ps for net 0.75 in 6.4k

- LH1 100.00 call sold at 2 in 29.5k (v 99.995)

- LM1 100.12/100.25c strip, bought for 3.5 in 4k

- 0LU1 99.625 puts bought for 1.25 in 30.8k - short cover (from 99.625p/100.125c combo)

- 0LZ1 100.00 calls bought for 11 in 3k (vs 99.96)

- 3LM1 99.625/99.375 put spread v 2LM1 99.75 put, pays 0.75 for the blue in ~5k

- 2LU1 99.75/99.50ps with 99.62/99.37ps, bought for 8.25 in 5k

- 3LZ1 99.50/99.12ps vs 2LZ1 99.62p, bought the blue for half in 2k

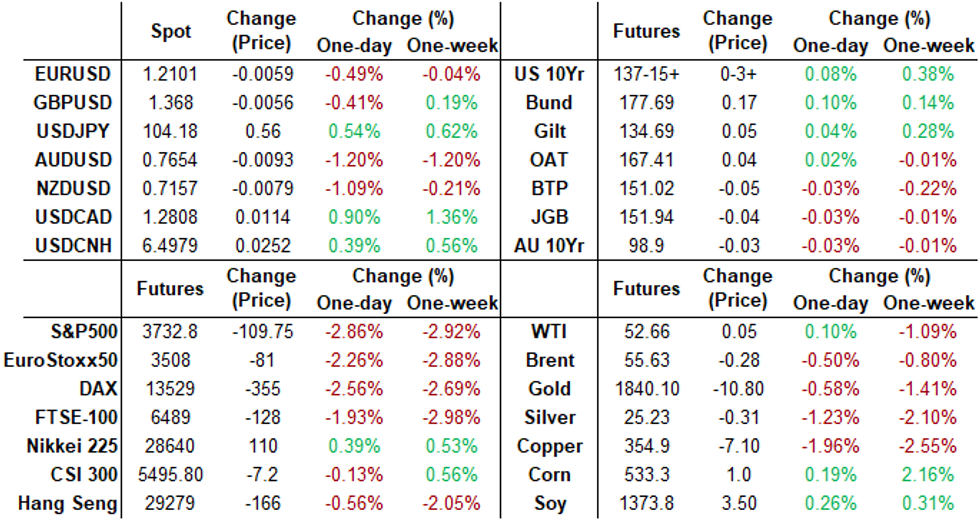

FOREX: USD Firms Pre-Fed, Powell Says Little To Soften Blow

The greenback out-traded all others Wednesday, with the bulk of the move coming ahead of the Fed rate decision. Another ECB sources story added weight to EUR/USD, with Bloomberg reporting that the ECB are agreed on pushing back against market expectations that the bank will not cut key interest rates further. The headlines added extra weight to the EUR, which slipped to 1.2059 and in close proximity to the 2021 low at 1.2054.

- The Fed decision was unchanged - as expected - and despite Powell stressing that any talk of policy exit at present is premature, the USD remained strong and equities suffered. This worked against growth proxy currencies, with AUD, NZD and NOK all slipping.

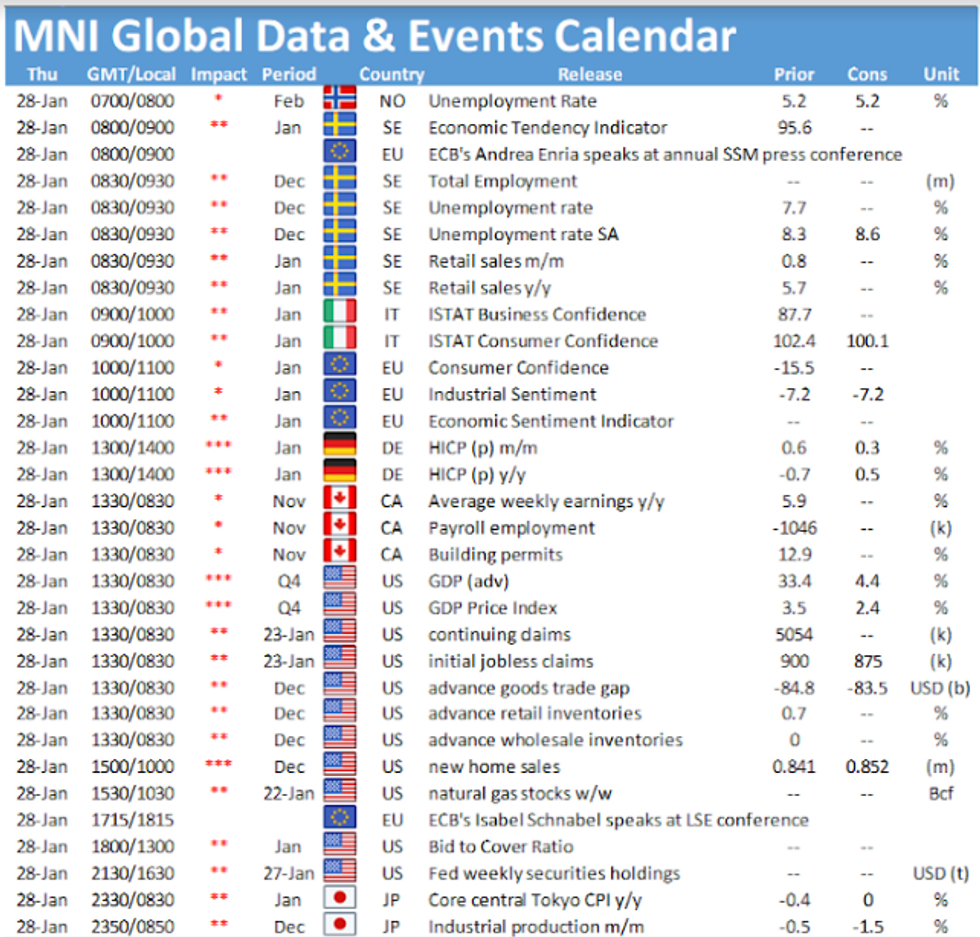

- Focus Thursday turns to weekly jobless claims numbers, regional German CPIs and the advance reading of Q4 US GDP. ECB's Schnabel is due to speak.

PIPELINE: $10.95B 7-Eleven 8-Part Jumbo Leads

- Date $MM Issuer (Priced *, Launch #)

- 01/27 $10.95B #7-Eleven 8-part jumbo: $1.5B 1.5NC.5 FRN SOFR +45, $1.25B 2NC1 +55, $2.25B 3NC1 +65, $1.25B 5Y +60, $1B 7Y +65, $1.7B 10Y +80, $750M 20Y +100, $1.25B 30Y +105

- 01/27 $4.5B *ADB 5Y +5

- 01/27 $800M *Liberty Mutual investor 40NC5 4.3%

- 01/?? $Benchmark IDB 5Y +5a

EQUITIES: Stocks Sour On Small Cap Turmoil, Hedge Fund Squeeze

The S&P 500 fell sharply Wednesday, with the index dropping over 2.5% as turmoil in smaller-cap stocks undermined investor confidence that had resulted in new all time highs earlier in the week.

- The e-mini S&P shed close to 100 points, narrowing the gap with the 50-dma support at 3706.10, a level not broken since late October.

- Rallies in some of the most-shorted stocks in the US including Gamestop, AMC and BlackBerry resulted in further pain for short-selling hedge funds. This raised speculation that these funds could be forced to bailout of longs among the larger-cap names in order to finance margin calls and other loss-making positions.

- Communication services and consumer discretionary names were hit the hardest, but all sectors traded lower Wednesday.

Oil Slips on USD Strength, Countering Big Draw in Inventories

Both WTI and Brent crude futures gave up early gains to trade lower in the NYMEX close. The weekly DoE crude oil inventories numbers proved bullish, prompting a decent recovery from lows for the energy complex: headline inventories saw a draw of near 10mln bbls, but a build in gasoline stocks and a decent rally in the greenback countered any oil strength.

Gold and silver both traded lower on the day following the over-riding USD strength. Precious metals failed to garner any form of safe haven bid despite soft equities stateside, as the S&P500 opened a decent gap with the all time highs printed earlier in the week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.