-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2.011% 30Y Yields At One Yr Highs

US TSY SUMMARY: Bear Steepening Following European Risk-On

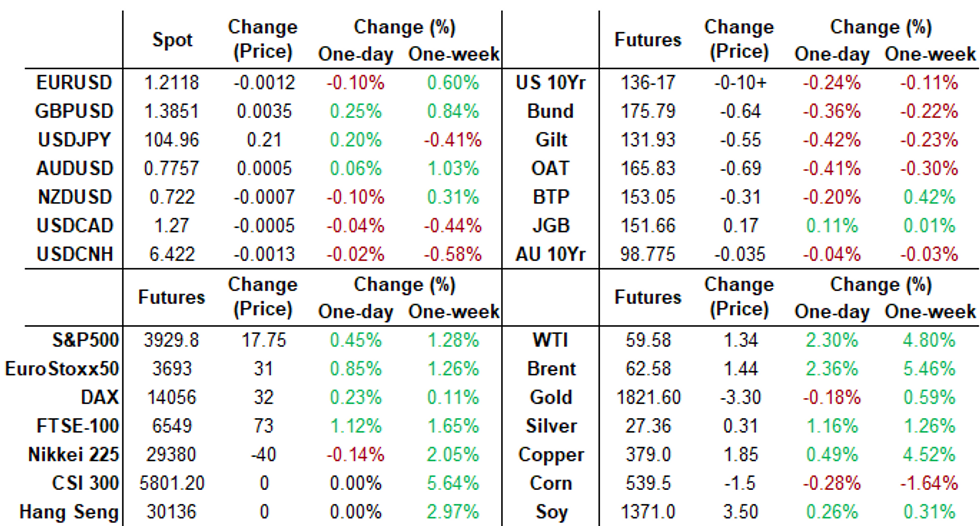

USTs have sold off and the curve has bear steepened heading into the long weekend and followed through from the risk-on theme that materialised during the European session.

- UST cash yields are 1-5bp higher on the day with the curve 4bp steeper. Last yields: 2-year -0.7133%, 5-year -0.6854%, 10-year -0.4290%, 30-year 0.0764%.

- TYH1 trades at 136-17, marking the low of the day.

- SPX has traded sideways for most of the session while still eking out gains on the day.

- The FDA agreed that Modern can increase the dosage of the coronavirus vaccine in each bottle, which could help drive up supplies of vaccines.

- The University of Michigan Consumer Sentiment index for February came in below expectations at 76.2 vs 80.9 survey.

- Donald Trump's defense team has finished making arguments in the Senate impeachment trial.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00012 at 0.07963% (-0.00225/wk)

- 1 Month -0.00487 to 0.10738% (-0.01150/wk)

- 3 Month -0.00388 to 0.19375% (+0.00287/wk) ** Record Low on 2/05/21: 0.19088%

- 6 Month -0.00763 to 0.20075% (-0.00625/wk)

- 1 Year -0.00388 to 0.29975% (-0.00438/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $67B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $206B

- Secured Overnight Financing Rate (SOFR): 0.06%, $891B

- Broad General Collateral Rate (BGCR): 0.04%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $332B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $49.153B submission

- Next scheduled purchases:

- Tue 2/16 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 2/17 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 2/18 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 2/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EGBs: Bear steepening drives EGB

Bear steepeners have taken center stage this afternoon.

- Big bear steepening across the board, after the last few days flattening was mostly seen as more corrective, especially in the outright trade higher in Bunds.

- Some position squaring ahead of a longer weekend for the US, with Holiday on Monday.

- German 5/30s test highest levels since June 2020,

- UK 5/30s highest since December 2018.

- Peripheral spread are generally tighter, with Greece leading at 3.5bps.

- Looking ahead, after market, Moody on Ireland and DBRS on Belgium.

FOREX: Dollar Weakens on Late Risk-On Wave

The greenback started the Friday session stronger, gaining against most others in G10. This effect faded sharply into the US close, however, as a wave of risk-on buoyed equities, with the E-mini S&P bouncing around 20 points just after the London close.

- Separately, GBP traded well despite a mixed start, with EUR/GBP once again testing the year's lows of 0.8739. A break through here would mark new multi-month lows for the cross.

- Scandi currencies were the best performer Friday, with NOK reversing early weakness to finish stronger on a decent snapback and resumption of the uptrend for Brent crude futures.

- The coming week should get off to a slow start, with US President's Day keeping US assets closed on Monday. Across the week, data releases pick up, with Eurozone GDP, Germany's ZEW survey, UK inflation and US retail sales all due. Global prelim PMI data for February also crosses.

FX OPTIONS: Expiries for Feb15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2045-55(E528mln), $1.2300(E931mln)

- EUR/GBP: Gbp0.8725(E520mln), Gbp0.8800-10(E1.0bln-EUR puts)

- AUD/USD: $0.7730(A$648mln), $0.7850(A$609mln)

EQUITIES: Stocks Solid into the Close After Shaky Start

After a shaky start to the Friday session, a short, sharp bout of risk-on boosted equities well out of negative territory ahead of the close, with US indices leading. The e-mini S&P rallied 20 points or so after the London close, challenging 3920.50 - a break through which would open the all time highs of 3928.50.

- Energy and materials outperformed, benefiting from the bounceback in crude oil prices, while utilities and real estate traded softest. Across Europe, UK stocks outperformed, with the FTSE-100 top of the pile while German, Spanish stocks lagged.

COMMODITIES: Crude Reverses Early Weakness, Resumes Bulltrend

The recent rally in oil prices appeared to stall late Thursday/early Friday, with Brent and WTI crude futures headed into the US session in negative territory. A short, sharp bout of risk-on reversed this price action, with both Brent and WTI hitting new cycle highs ahead of the NYMEX close. This resumes the uptrend for oil prices, narrowing the gap with next resistance at the psychological $60/bbl handle.

- Gold and silver got a firm tailwind on dollar weakness ahead of the US close, with silver spiking to session highs of $27.44. This helped spot gold chew through the day's losses to hit daily highs of $1830.79. MNI Tech flags resistance at the 50-day EMA of $1856.2

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.