-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Stimulus Hopes Outweigh Data Metrics

US TSY SUMMARY: Fiscal Stimulus Hopes Continue To Push Markets

Good is Bad / Bad is Good theme held (at least for rates in the first half) on premise bad data improves chances on the margin of robust fiscal stimulus. Disappointing weekly claims (+13K TO 861K), Jan Housing Starts below expected at 1.58M, weighed on rates in the first half. But equities, US$, gold and WTI crude all traded weaker as well (though equities were recovering losses in second half: ESH1 3915.0 vs. 3881.0 low. Bbg headline noted US vaccine supply more than double by April.- Midmorning reversal: Tsys have bounced back into mildly higher territory after nearly trading through late Tue lows (Yds neared 1Y highs tapped late Tue: 10YY 1.3159H vs. 1.3310% late Tue; 30YY 2.099% vs. 2.110% late Tue). Gold bounced off lows around the same time while US$ and equities remained weaker.

- Sources report real$ buying 10s, rolling in 20s as rates consolidated on equity weakness on desk said. Mar/Jun rolls continue at slower than expected pace.

- Some chatter made the rounds that another duration drop on Tue's magnitude could usher in mortgage convexity selling (unlikely). Some insurance portfolio unwinds in swaps Tuesday did add to the rout, however. Yield curves back to bear steepening mode, futures volumes picking up while Mar/Jun rolls improved: TYH >1.8M; TYH/TYM> 96k.

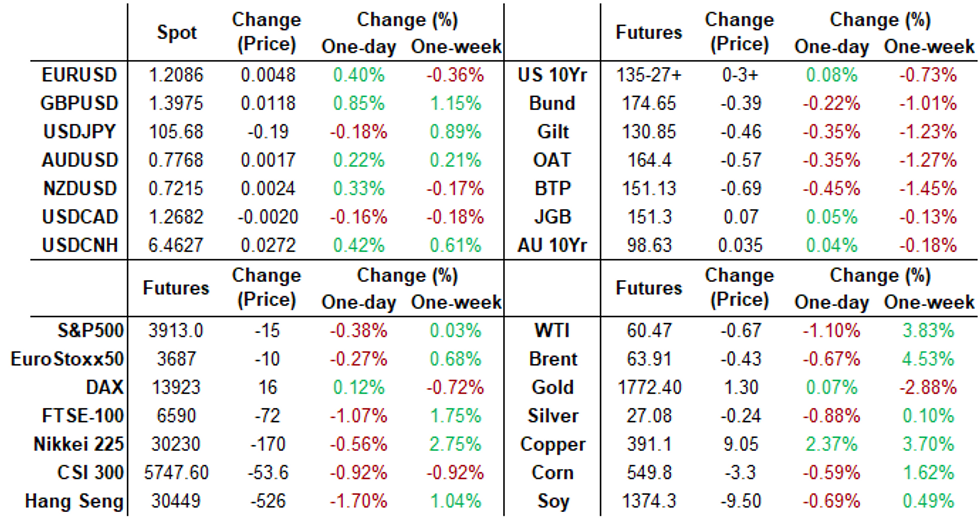

- The 2-Yr yield is up 0.4bps at 0.1069%, 5-Yr is up 0.3bps at 0.5497%, 10-Yr is up 1.5bps at 1.2855%, and 30-Yr is up 3.7bps at 2.0745%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.08013% (+0.00050/wk)

- 1 Month +0.00013 to 0.11113% (+0.00375/wk)

- 3 Month +0.00100 to 0.18238% (-0.01137/wk) ** (Record Low 0.18138% on 2/17/21)

- 6 Month -0.00087 to 0.19688% (-0.00387/wk)

- 1 Year -0.00513 to 0.29100% (-0.00875/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $66B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $199B

- Secured Overnight Financing Rate (SOFR): 0.06%, $957B

- Broad General Collateral Rate (BGCR): 0.05%, $373B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $22.626B submission

- Next scheduled purchase:

- Fri 2/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- -10,000 Blue Mar 90/93 2x1 put spds, 20.0

- +5,000 Gold Sep 82 puts, 17.5

- -5,000 Gold Jun/Gold Sep 85 put spds, 4.5 net/Sep over

- +3,000 Blue Sep 88 straddles, 40.0

- +10,000 Red Jun'22 97 straddles, 13.0

- +5,000 Blue Mar 88/90 2x1 put spds, 0.25

- Overnight trade

- 2,000 Blue Apr 90/91/92 put trees

- 3,000 Gold Jun 82 puts

- 2,000 Gold Jun 86/88/90 broken call flys

- +5,500 FVJ 125.5 calls, 8

- +5,000 FVJ 123/123.75 2x1 put spds, 0.5

- +3,000 TYH 136 calls, 2

- +2,500 TYK 137.5 calls, 5

- -2,000 TYJ 133.5/134.5 put spds, 20

- -1,500 TYJ 134/134.5 put spds, 11

- +3,700 TYJ 132.5 puts, 9

- +2,500 TYH 136/136.25 1x2 call spds, 2

- Overnight trade

- +14,000 FVK 121.5 puts, 1.5

- 5,000 TYJ 133/134 put spds

- Block, -10,000 TYJ 133/133.5/134.5 1x1x1 put fly, 26

- Block, 3,000 TYJ 133.5/134.5 put spds, 18

BONDS: EGBs-GILTS CASH CLOSE: BTPs Underperform In Broad Selloff

Gilts and BTPs underperformed Thursday, with the FI space getting hit despite a simultaneous decline in equities. No particular trigger for today's moves, more of an exaggerated continuation of trends in the past few sessions (Italy spread widening, core bear steepening).

- Some moderation of moves in the latter 2 hours of the session, with Gilt and Bund yields coming off highs. BTPs were an exception, with 10Y spreads finishing just under the 100bps handle.

- Bond supply seen as a contributory factor: France sold E10bn and Spain E5.1bn this morning.

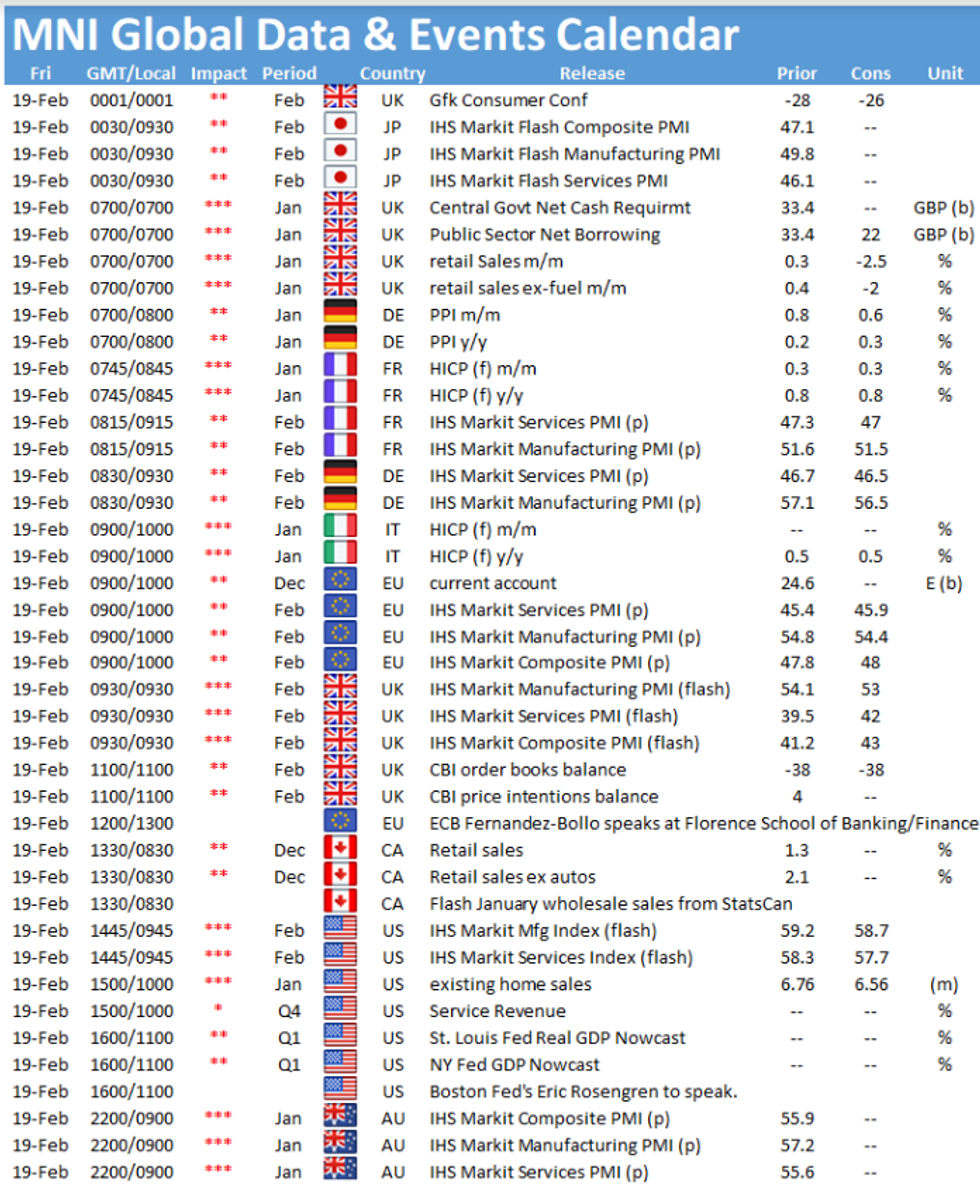

- Friday sees UK retail sales data and prelim PMIs.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1bps at -0.688%, 5-Yr is up 2.1bps at -0.629%, 10-Yr is up 2.2bps at -0.346%, and 30-Yr is up 2bps at 0.157%.

- UK: The 2-Yr yield is up 0.6bps at -0.038%, 5-Yr is up 3.3bps at 0.14%, 10-Yr is up 5bps at 0.622%, and 30-Yr is up 4.8bps at 1.202%.

- Italian BTP spread up 4bps at 99.4bps / Spanish spread up 3bps at 68.6bps

OPTIONS: EUROPE SUMMARY: More Sterling, More Blues

Thursday's options flow included:

- RXJ1 173.5/175cs, bought for 24-24.5 in 25k

- RXJ1 173/174 call spread bought for 20/21 in 3.75k

- RXJ1 175.00/173.50/172.00 put fly bought for 10 in 2k

- RXJ1 171.50/170.00/169.00 broken put fly bought for 30.5 in 1k

- RXJ1 172.00 put sold at 100 in 5k

- RXJ1 173.50/174.50/175.50 call ladder bought for 10 in 2k

- RXM1 172/168ps 1x3, bough for 61 now in 1k (8k total) ; started at 56.5 this morning

- 2LJ1 99.50 puts now bought for 2.5 in 9.5k (also for 2.25 and 2.5 in 5k earlier)

- 2LM1 99.50/99.25 put spread bought for up to 3.25 in 23k

- 3LJ1 99.25p, bought for 2.5 in 2.5k

- 3LM1 99.87c, bought for 1.75 in 4k (ref 99.50, 11del)

- 3LM1 99.37/99.62 RR, bought the put for flat in 1k (ref 99.51)

- 3LU1 99.375 puts sold from 16.25 to 17 in 4k

- 3LZ1 99.00/98.62ps with 98.87/98.50ps, bought for 9.5 in 2.5k

- 3LZ1 99.00/98.87ps vs 99.75/99.87cs, bought for 0.25 and 0.5 in 20k all day

FOREX: GBP/USD Narrows Gap With $1.40

GBP/USD traded particularly well Thursday, with the pair hitting new cycle highs and narrowing the gap with the $1.40 handle - a level not topped since early 2018 and major psychological resistance. Continued strength in the UK vaccine rollout twinned with further pricing out of negative interest rates remain the key drivers, with EUR/GBP also looking unapologetically bearish.

- The USD lagged, recoupling with equity markets which traded in the red across both the continent and the US. The gravitational pull of the 50-dma in the USD index continues to draw influence at 90.421, with the 90.05 support seen as key.

- Elsewhere, commodity-tied currencies trade softer alongside a modest pullback in WTI and Brent crude futures prices. CAD was one of the poorest performers Thursday.

- Focus Friday turns to UK and Canadian retail sales as well as prelim manufacturing and services PMIs globally.

FX OPTIONS: Expiries for Feb19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-15(E525mln)

- USD/JPY: Y104.95-10($643mln), Y105.40-50($951mln)

- AUD/USD: $0.7650(A$671mln), $0.7690-00(A$650mln)

- USD/CNY: Cny6.37($1.3bln), Cny6.38($970mln), Cny6.41($777mln), Cny6.45($2.1bln), Cny6.46($640mln)

- USD/CAD: C$1.2720-35($1.3bln)

PIPELINE: $3B Charter Comm's Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/18 $3B #Charter Comm $1.5B 20Y +162.5, $1B 30Y +183, $500M 2061 Tap +205

- 02/18 $1.5B #Masco $600M 7Y +60, $600M 10Y +80, $300M 30Y +105

- 02/18 $1.5B *Prov of Ontario 10Y +26

- 02/18 $1.25B #BNP Paribas PerpNC10 4.625%

EQUITIES: Indices Slip, Tech Underperforms

Stocks slipped throughout the Thursday session both on the continent and stateside, with tech names underperforming and leading the NASDAQ to slip further relative to the S&P500.

- Selling pressure was orderly and gradual, with no protracted weakness, but a decent ~80 point gap has now opened with the all time highs posted earlier in the week in the e-mini S&P.

- The energy sector traded poorly as the fierce rally in WTI and Brent slowed, pressing oil services firms to trade with losses of as much as 5%.

- In Europe, UK's FTSE-100 edged lower by 1.4%, with GBP strength a major factor. Germany's DAX was spared from the bulk of the losses and traded lower by 0.2% at the close.

COMMODITIES: WTI, Brent Lower as Multi-Decade High Overbought Condition Weighs

After hitting new cycle highs in Asia-Pacific hours, WTI and Brent crude futures moderated into the close to nurse small losses on profit-taking, position squaring and hopes that inclement weather conditions in the southern US states should abate at the weekend.

- The moves coincide with overbought conditions reaching a new extreme - the WTI crude futures RSI hit the highest level since the 1990 oil price shock, which saw prices double over the course of a few months.

- Gold and silver shrugged off both a weaker global equity market as well as the softer USD to trade in the red ahead of the Thursday close, with silver the laggard. Clustered support at and around $26.84 should provided some support ahead of any test on the 50-dma at $26.14.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.