-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Kyiv Ready for Ceasefire, Russia Sceptical

MNI China Daily Summary: Wednesday, March 12

MNI BRIEF: EU Targets Retaliation Tariffs On US Red States

MNI ASIA MARKETS ANALYSIS - Sell The Bounce?

US TSY SUMMARY: Strong Month-End Bounce

Tsys rebounded after Thursday's histrionics (post-7Y auction buy-strike or who wants to catch falling knife when Fed not wanting to stand in way of higher yields). Or Is month-end bid an opportunity to Sell? Monday will tell.

- Yield curves bull flattening (5s30s appr 25bp off Wed's 266.5 high last seen Aug 2014) with long end outperforming heading into month-end. S&P and Nasdaq futures trading firmer (+16.0, +200.0 respe) while DJIA traded weaker: -225.0. Vix receded to around 26.5 after topping 30.80 vs. 31.16 high on Thu, off late Jan highs of 37.51.

- The week's sell-off in rates as well as equities, accelerated sharply Thursday, catching may off guard. Societe Generale strategists take on the the spike in 5Y Tsy yields (0.6113 low to 0.8617 high after the poorly received $62B 7Y note auction tailed 4bp) "seems to be challenging the Fed's 'lower for longer' mantra."

- June futures took lead quarterly while late rolls from March continued to boost volumes. Light deal-tied flow, but decent short end rate paying in 2s-5s as swap spds widened 1.5-3.5bp.

- Another HEAVY option volume session, low delta puts dominating both Eurodollar and Treasury options as accts took advantage of rebound in underlying to buy cheaper rate-hike insurance covering mid-2022 through mid-2024 sector of curve.

- The 2-Yr yield is down 2.9bps at 0.1426%, 5-Yr is down 6bps at 0.7602%, 10-Yr is down 7bps at 1.4495%, and 30-Yr is down 8.4bps at 2.1891%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00362 at 0.08400% (+0.00587/wk)

- 1 Month +0.00337 to 0.11850% (+0.00305/wk)

- 3 Month -0.00212 to 0.18838% (+0.01313/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00237 to 0.20300% (+0.00700/wk)

- 1 Year +0.00350 to 0.28375% (-0.00275/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $243B

- Secured Overnight Financing Rate (SOFR): 0.03.%, $896B

- Broad General Collateral Rate (BGCR): 0.02%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $332B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $49.547B submission

- Next scheduled purchases:

- Mon 3/1 1100-1120ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 3/2 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 3/3 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 3/4 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/5 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- 6,000 Jun 92/short Jun 92 put spds

- Block, 5,000 Green Jun 93/96 3x2 put spds, 11.0 vs. 99.26

- +15,000 short Sep 92/95 put spds, 3.25 legs

- Block, +45,000 Red Sep'22 95 puts, 12.0 vs. 99.67/0.35% at 1010:50ET

- Block, +21,000 Green Jun 93 puts, 19.5 adds to +10k at 17.5 earlier

- Block, 15,500 short Dec 91/93 put spds, 4.0 vs. 99.57.5/0.16% at 1008:31ET adds to 20k at 4.5 earlier

- Block, 20,000 short Dec 91/93 put spds, 4.5 vs. 99.55/0.16% at 0927:15ET

- Block, 10,000 Green Jun 93 puts, 17.5

- Block, 20,000 Blue Dec 83/80 put spds, 10.5

- 12,000 Green Jun 93/95 1x2 call spds, 0.5

- -2,000 Green Dec 90 straddles, 33.5 over 86 puts

- -4,000 Red Dec 92/97 put spds, 15.0

- Overnight trade

- +32,000 short Sep 96/97 put spds 3.5 over 98 calls, Ongoing downside skew play/theme: blocked +20k short Sep put spd 2.0 over calls on Thu, +30k short Dec put spd 2.5 over calls on Wed

- +6,000 wk1 TY 133.5/134.25/135 call flys, 9

- +20,000 TYJ 134.5/135.5 call spds, 6

- Block, -15,000 TYJ 133.5 puts 1-7 over TYK 131/132 put spds

- 8,000 FVK 123/123.5 put spds, 9.5

- +13,000 TYM 135.5 calls, 22-24

- Block, -20,000 FVJ 124.5 puts, 41/64 at 0937:41ET

- 5,000 FVJ 122/125 risk reversals from 1 over to put to 1 over to calls

- Overnight trade

- Block, 10,000 TYJ 131/132.5/133.5 put flys, 2.0

- +5,000 FVJ 125 calls 6.5-9.5

BONDS/EGBs-GILTS CASH CLOSE: ECB Talk Calms Yields

EGBs recovered some of the substantial ground lost Thursday, helped by multiple ECB officials (Lane and Schnabel in the morning, Stournaras in the afternoon) making soothing remarks on the outlook for Eurozone monetary policy.

- The German curve bull flattened in strong fashion (5s30s at 2-week low).

- Conversely, the UK curve out to 10 years weakened, failing to partake in the the global rally, hurt by comments on upside inflation risks by BOE's Haldane.

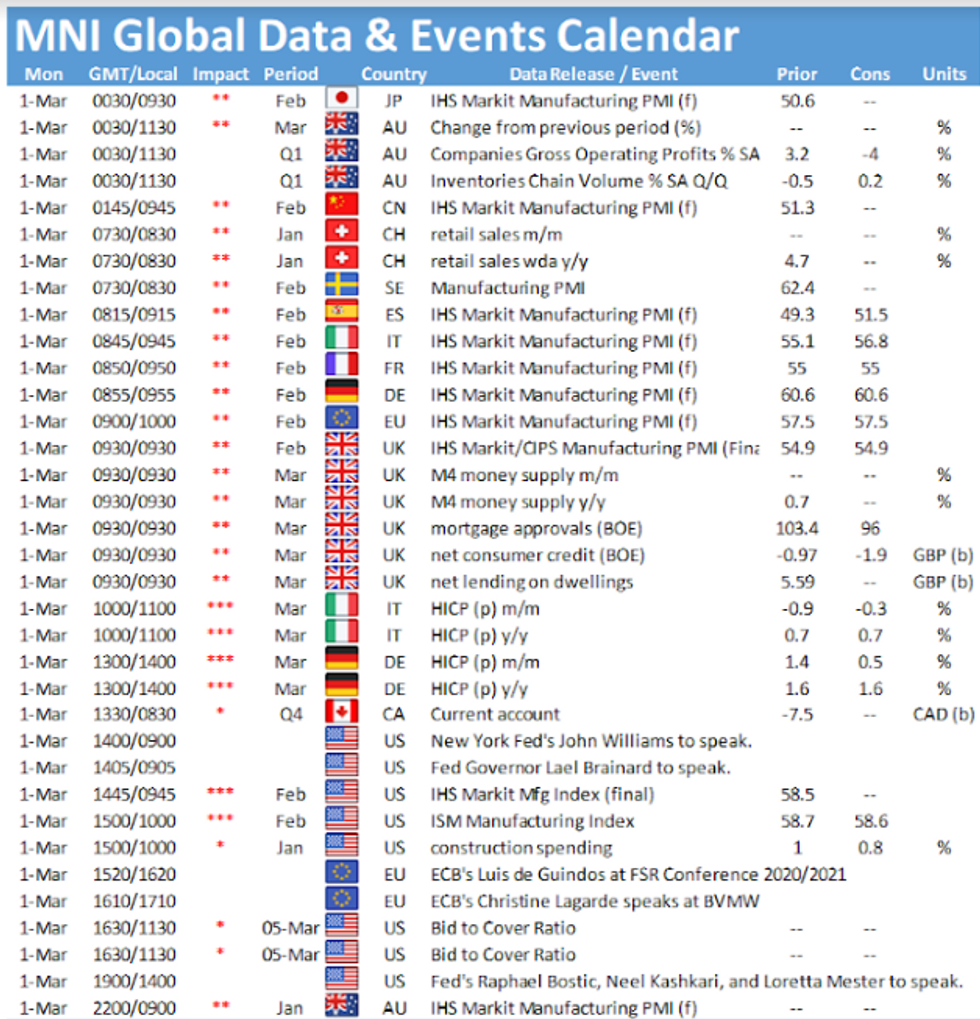

- Some PMI data and inflation figures in focus for next week; Monday's speakers include ECB's de Guindos and Villeroy.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.1bps at -0.663%, 5-Yr is down 2.3bps at -0.568%, 10-Yr is down 2.8bps at -0.26%, and 30-Yr is down 5bps at 0.194%.

- UK: The 2-Yr yield is up 2.1bps at 0.128%, 5-Yr is up 3.4bps at 0.4%, 10-Yr is up 3.6bps at 0.82%, and 30-Yr is down 0.3bps at 1.386%.

- Italian BTP spread down 1bps at 102.1bps / Spanish spread down 2.5bps at 68.3bps

OPTIONS/EUROPE SUMMARY: Flurry Of Sterling Put Spreads

Friday's options flow included:

- RXJ1 173.5c, bought for between 18-19 in 25k (ref 170.76, 12 delta)

- RXJ1 170p sold at 86 in 10k

- RXJ1 172.50/173.50/175 brken c fly, sold at 6 in 2.5k

- RXM1 173/172ps 1X2, bought for 1 in 1.5k

- RXM1 169/167.5ps 1x1.5, bought for 17.5 in 6k

- OEJ1 135.00/135.50cs, bought for 10 in 4k

- OEJ1 133.5/135.5 RR, bought the put for 3.5 in 2.5k

- DUM1 112.00^, sold at 11 in 10k

- 0RZ1 100.62/100.50ps 1x2, sell the 2 at half in 4.25k

- 0LU1 99.87/99.75ps 1x2, bought the 2 for 5 in 2k

- 2LM1 99.25/99.00 put spread bought for 3.75 in 10k

- 2LM1 99.50/99.25/99.00/98.75p condor, sold at 7 in 11.5k

- 2LM1 99.00/98.75ps, bought for 2 in 17k

- 2LM1 99.375/99.125 put spread bought for 5.75 in 5k

- 3LM1 99.125/98.875 put spread bought for 7 in 5k

- 3LU1 99.00/98.625 put spread bought for 9.25 in 5k

- 3LZ1 98.875/98.50 put spread bought for 9 in 2k

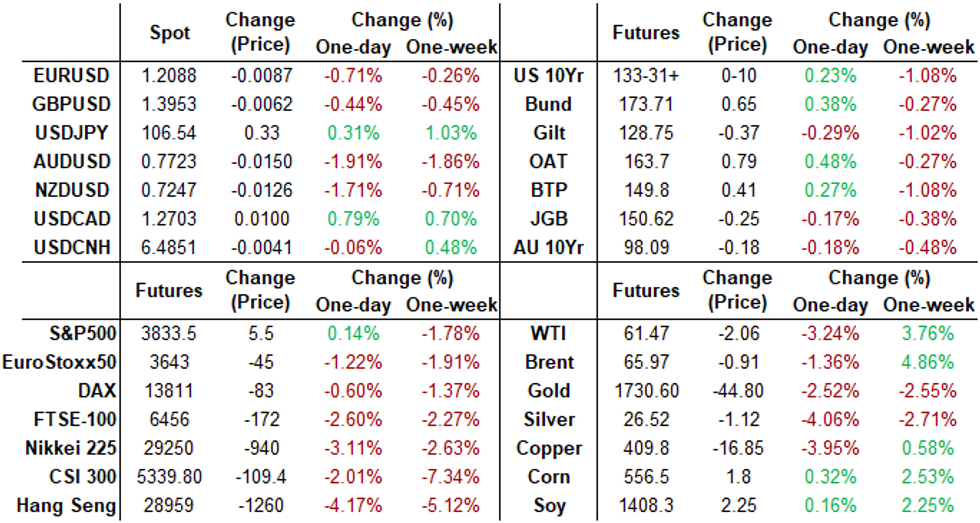

FOREX: USD Dominant, Could Revisit Feb Highs

The USD rallied for a second session Friday, boosting the USD index to new weekly highs and narrowing the gap with February's best levels and the 100-dma - both of which remain key levels of resistance. Despite a calmer day for US bond markets (which had been subject to acute volatility earlier in the week), there remained pockets of volatility in currency markets, with AUD selling off aggressively alongside NZD.

- This reversal in growth-proxy and commodity-tied currencies followed a pause in the bull trend for industrial metals and oil, most of which hit new multi-year cycle highs mid-week.

- The pullback in both GBP/USD and AUD/USD this week was particularly eye-catching, with both pairs off as much as 350 pips from the week's best levels. Markets look for confirmation on whether the moves have been corrective, or are the beginning of a trend reversal.

- Focus in the coming week turns to Chinese PMI data, Canadian GDP and the February Nonfarm Payrolls report. The US are expected to have added 150,000 jobs over the month, with the unemployment rate inching 0.1 ppts higher to 6.4%.

- The RBA rate decision is due, in which markets will be watching for any comment on the recent sharp increase in Australian yields.

FX OPTIONS: Expiries for Mar 01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2200(E1.3bln), $1.2245-55(E1.6bln)

- USD/JPY: Y104.95-00($517mln), Y105.55-57($2.0bln), Y106.20-25($1.5bln), Y106.45($1.65bln), Y106.75-85($616mln)

- AUD/USD: $0.7770(A$2.1bln)

- NZD/USD: $0.7350(N$1.6bln-NZD puts)

- AUD/NZD: N$1.0730-35(A$567mln)

- USD/CAD: C$1.2500($1.25bln)

- USD/CNY: Cny6.40($520mln)

PIPELINE: Total $157.865B High-Grade Issuance For February

- Date $MM Issuer (Priced *, Launch #)

- 02/26 $1.7B #Centerpoint Energy $700M 2NC.5 +60, $1B 2NC.5 FRN LIBOR+50

- 02/26 $800M #State Street 10Y +78

- $5.67B Priced Thursday; $42.27B/wk

- 02/25 $3B *Daimler Finance $1.5B 3Y +48, $1B 5Y +70, $500M 10Y +95

- 02/25 $1.25B *Truist Financial 6NC5 fix-FRN +50

- 02/25 $900M *Williams Cos 10Y +115

- 02/25 $520M *Development Bank Japan (DBJ) 3Y +14

EQUITIES: Mixed Friday as Selling Pressure Eases

After Thursday's tumultuous session, Friday price action was more consolidative, with a mixed performance on Wall Street. The hard-hit tech sector recouped some lost ground, prompting the NASDAQ to slightly outperform, while the Dow Jones slipped, albeit by a very small margin.

- Across the US, energy and financials suffered Friday while tech and communication services made ground. Social media firms including Facebook and Twitter enjoyed a strong session, with shares rising as much as 5%. Travel names including Carnival Corp and Expedia also rallied, with the reflation / reopening theme present below the surface.

- The VIX gave up Thursday gains, retreating back below 30 points as the selling pressure eased. The drop in volatility was no sufficient, however, to put the gauge below the 2021 average, proving markets remain cautious given recent realised vol.

COMMODITIES: Soft Risk Sentiment And Firmer US Dollar Prompts Turnaround

- The spike in government bond yields and subsequent sell-off in equity markets caused the broad-based rally in commodity prices to reverse Thursday/Friday.

- Metals were hit hardest by the reversal with Silver suffering 4% losses on the session. Copper was close behind (-3.75%) as a mixture of profit taking and opportunistic selling produced a sharp move to the downside. Gold followed suit, shedding 2.5%.

- Despite the volatile retracement, Copper futures (HG1) are still posting 0.66% gains on the week, indicating the underlying optimism for the bellwether metal.

- Both WTI and Brent crude futures have suffered as well losing between 1.5-2% on the day. In similar fashion, both post weekly gains in the region of 5% and there is a strong argument that recent price action is a consolidation from overbought conditions.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.