-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: Vaccine Positives Outweigh Risks

US TYS SUMMARY: Overcoming Vaccine Induced Vol

Rates and equities held moderate gains after the bell Monday, off early lows following negative vaccine related headlines for Astrazeneca. Italy, Germany and Spain suspended use earlier, now awaiting word from France (expected to make announcement later). Latest headline from Germany weighing on broader equities:

GERMANY'S VACCINE REGULATOR PAUL EHRLICH INSTITUTE SAYS MORE THROMBOTIC EVENTS HAVE BEEN REPORTED SINCE THURSDAY AFTER VACCINATION WITH ASTRAZENECA, Rtrs- Rates and equities rebounded late morning after: EMA REITERATES BENEFITS ASTRAZENECA VACCINE OUTWEIGH RISKS, Bbg

- Otherwise, fairly sedate session, two-way positioning on net as markets await the next FOMC policy annc on Wednesday. Deal-tied hedging in the mix, better buying upside calls as well.

- Some trepidation ahead Tuesday's 20Y auction re-open: If last week's auctions are any indicator, there is some trepidation over how well Tuesday's US Tsy $24B 20Y bond auction re-open will be received. WI currently running 2.280% / 2.275%.

- This compares to the Feb 17 auction when Treasuries gapped lower after WEAK US Tsy $27B 20Y bond auction (912810SW9) draws 1.920% vs. 1.897% WI, bid/cover 2.15% (2.28% previous).

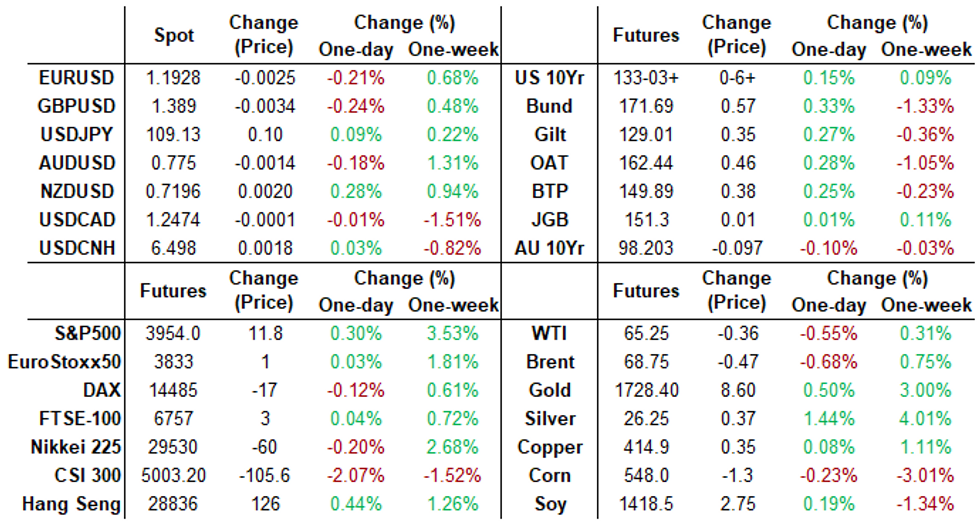

- The 2-Yr yield is up 0.4bps at 0.151%, 5-Yr is down 1bps at 0.8305%, 10-Yr is down 1.6bps at 1.609%, and 30-Yr is down 0.5bps at 2.3722%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N -0.00013 at 0.07800% (+0.00050 total last wk)

- 1 Month +0.00137 to 0.10750% (+0.00288 total last wk)

- 3 Month -0.00750 to 0.18200% (+0.00412 total last wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00350 to 0.19750% (-0.00188 total last wk)

- 1 Year +0.00287 to 0.28100% (+0.00038 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $63B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $217B

- Secured Overnight Financing Rate (SOFR): 0.01%, $889B

- Broad General Collateral Rate (BGCR): 0.01%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $342B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.743B accepted vs. $6,725B submission

- Next scheduled purchases

- Tue 3/16 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 3/17 No buy operation due to FOMC

- Thu 3/18 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Still Hot, But 10Y Improving

Overnight repo remains at special across the curve, but 10Y continues to improve (>-4.0 beginning of month). Current levels:

T-Bills: 1M 0.0203%, 3M 0.0253%, 6M 0.0431%; Tsy General O/N Coll. 0.03%

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.01% |

| 3Y | 0.02% | -0.14% |

| 5Y | -0.19% | -0.09% |

| 7Y | -0.11% | 0.00% |

| 10Y | -0.13% | -0.10% |

| 30Y | 0.00% | -0.05% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 short Sep 96 puts, 7.5 vs. 99.675/0.40%

- +5,000 short Sep 99.68/99.75/99.81 call trees, 1.0

- +10,000 Green Jun 93/95 1xx2 call spds, 1.75

- -5,000 short Sep 91/96 put spds, 5.5 vs. 99.675/0.32%

- 2,300 long Green Sep 95/96/97/98 call condors, checking levels

- Overnight trade

- +11,800 Blue Sep 90/91 call spds, 2.0 vs. 98.405/0.05%

- 4,300 Green Apr 90/91/92 put flys

- 5,000 Jun 100 calls, 0.25

- +4,250 Jun 99.75/99.81 1x2 put spds, 2.25

- 1,600 Sep 99.75/99.81 1x2 put spds

- -2,000 TYM 132 straddles, 153

- -1,300 FVJ 124 straddles, 40

- 1,500 TYJ 131.5 puts 9 over 3,000 TYJ 132.75/133.5 call spds

- -4,000 USK 157 calls, 134-137

- -1,000 TYK 131.5/132.5 strangles, 125

- Buyers TYK 133 calls, 27

- Overnight trade

- +10,000 wk3 FV 124

- +3,000 TYM 130/130.5/131.5/132 put condors, 5

- Block, -7,500 TYK 131/132 put spds, 25

- Block, -5,000 TYK 131.5/132 put spds, 13

- 5,000 FVJ 124.5 calls, 2.5-3, part tied to 124.25/124.5/124.75 call fly

EGBs-GILTS CASH CLOSE: EU Legal Action Further Undermines Future Deal On Financial Services

The gilt sell-off peaked at midday and then recovered back towards Friday's close.

- The EU has launched legal action against the UK after Westminster unilaterally decided to extend the grace period for checks on goods passing through Northern Ireland. The move has been widely suspected in recent weeks and comes amid conflict over the distribution of Covid vaccines and the regulation equivalency for the financial services sector.

- The BoE earlier purchased GBP1.48bn of short-dated gilts with offer-to-cover of 2.87x.

- Focus this week will be on the Bank of England, which comes in a week of heavy central bank activity that includes Federal Reserve and Bank of Japan monetary policy meetings.

FOREX: Oxford Vaccine Questioned, Keeping EU Rollout Lumpy

- The USD was mixed ahead of the Fed's Wednesday rate decision, with the USD index creeping very slightly higher, but failing to make any progress beyond Friday's high.

- Vaccine politics became a market focus as the session progress, with Germany, France and Spain adding their names to the list of countries to pause the rollout of the AstraZeneca COVID vaccine. The EMA issues their ruling decision Tuesday, but have already reiterated that the benefits outweigh the risks.

- Scandi currencies underperformed, with both NOK and SEK among the poorest performers in G10 for relatively idiosyncratic reasons. Firstly, Swedish CPI came in well below expectations, with prices rising just 0.3% on the month vs. Exp. 0.6%.

- In Norway, concerning COVID virus figures are emerging from Oslo, in which the reproduction rate has risen to 1.5 - prompting the authorities to introduce the strictest measures since the beginning of the pandemic.

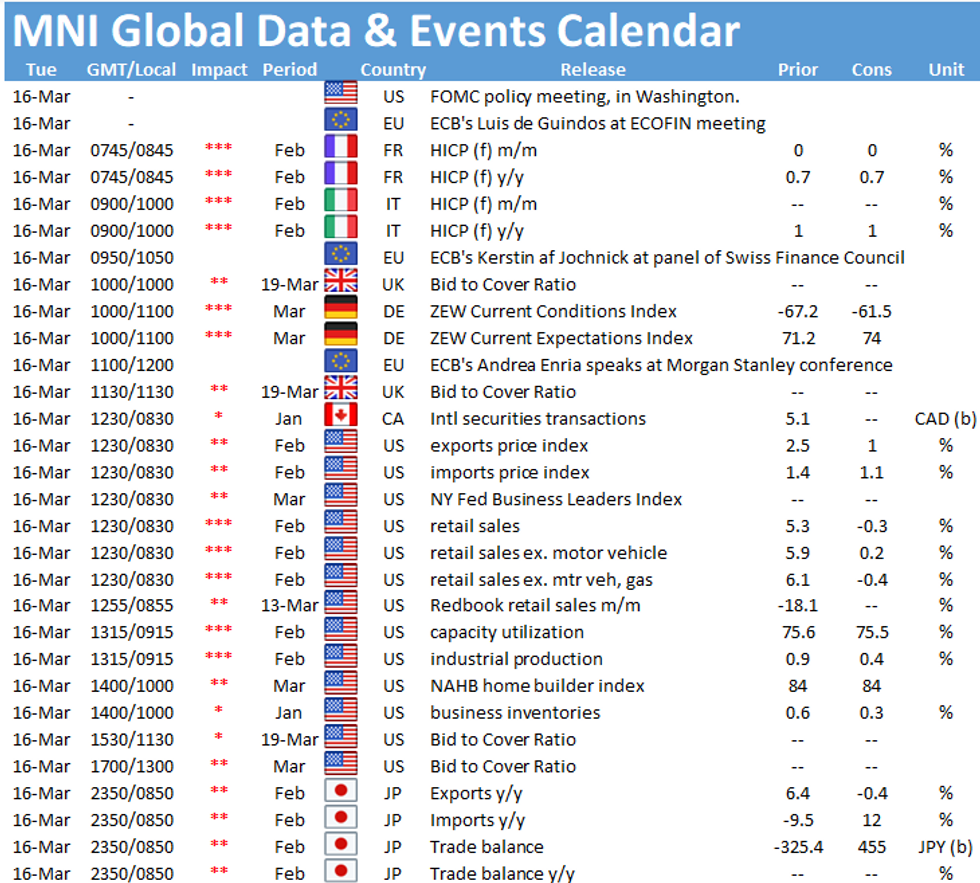

- Focus Tuesday turns to Germany's March ZEW survey, US retail sales and import/export price indices. Market moves could be muted, however, with all focus on Wednesday's Fed decision.

FX OPTIONS: Expiries for Mar16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E691mln), $1.2050(E662mln), $1.2175(E652mln)

- USD/JPY: Y106.00($1.6bln), Y107.00($1.45bln), Y107.85-00($996mln), Y109.00-15($920mln)

- GBP/USD: $1.3750(Gbp797mln-GBP puts)

- AUD/USD: $0.7500(A$1.2bln), $0.7650(A$1.4bln), $0.7695-00(A$649mln), $0.7770(A$755mln)

- USD/CAD: C$1.2530-50($970mln), C$1.2800($1.15bln)

PIPELINE: $8.2B To price Monday

- Date $MM Issuer (Priced *, Launch #)

- 03/15 $2.5B #NextEra Energy $2B 2Y +50, $500M 2Y FRN SOFR+54

- 03/15 $2.5B #Charles Schwab NC5 4.0%

- 03/15 $1B #Anglo American Capital $00M 7Y +107, $500M 10Y +130

- 03/15 $900M #Northwestern Mutual Life 30Y +112

- 03/15 $800M #Tampa Electric $400M 10Y +83, $400M 30 Y+108

- 03/15 $500M #CBRE Services 10Y +107

- On tap for Tuesday:

- 03/16 $Benchmark African Development Bank (AFDB) 5Y +6a

EQUITIES: Cautious Progress Ahead of the Fed

- Stock markets stateside inched higher Monday, with the Dow Jones touching a new all time high in the process. The tech sector bounced slightly, leading the NASDAQ 100 to outperform, although last week's highs were out of reach.

- In the US, utilities and real estate led gains, with energy and financials - last week's outperformers - at the bottom of the pile.

- Travel names performed very well, with United Airlines and American Airlines among the best performers in the S&P 500.

- Across Europe, early strength faded into the close, with most major indices closing with losses of 0.2-0.3%.

COMMODITIES: Oil Falls 3% From Highs Then Stabilises, Precious Metals Remain Rangebound

- Supportive price action from the open dissipated during the New York session. Risk sentiment was slightly soured by negative headlines regarding concerns over the Astrazenca vaccine. The move lower seemed technically driven, accelerating through Friday's worst levels. Despite the near 3% sell-off, crude futures bounced as global equity indices also recovered. Both WTI and Brent Crude futures are exhibiting losses ~0.6% as we approach the close.

- A resumption of Brent (K1) weakness would open $65.04, the 20-day EMA. The bull trigger is at $71.38, Mar 8 high. In WTI (J1) a deeper pullback would open $61.92, the 20-day EMA. Key resistance is at $67.98, Mar 8 high.

- Precious metals remained rangebound during the US session. Prices are shrugging off the slight improvement in the USD index seen on Monday. Silver is outperforming modestly, higher by 1.2%, but prices remain well below last week's highs printed mid-week at $26.459, which remain the primary target.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.