-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Surge While SPU's Top 4,000

US TSY SUMMARY: Tsys Strong Ahead March NFP, S&P futures Top 4,000

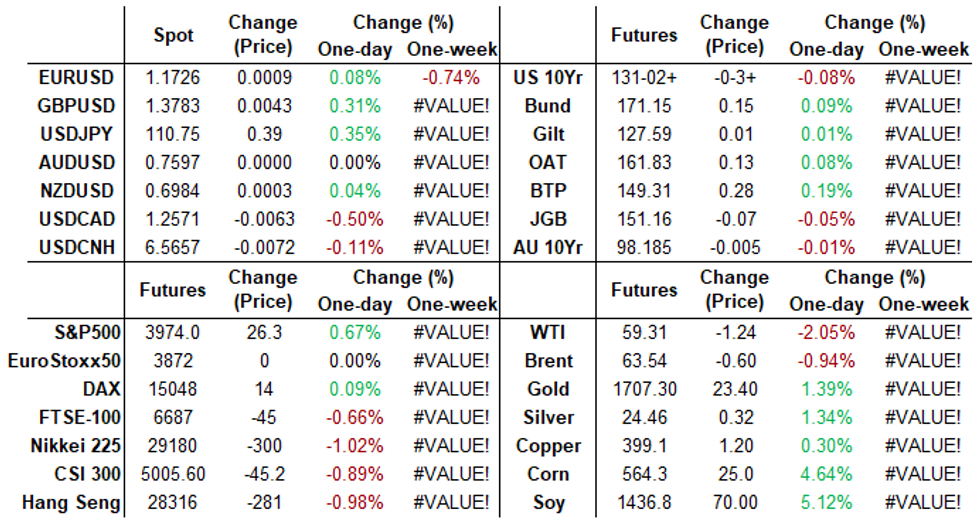

Steady move higher from early overnight to around noon Thursday, Tsys traded sideways/holding near top end of range through the close as equity futures topped 4,000 for the first time, yld curves bulll flattened.- Post-Claims Bid: Slight delay post data before bid on decent volumes, futures made new session highs after wkly claims came out higher than exp (719k vs. 675k est), continuing claims pretty much in line at 3.794M. , yld curves bull flattening:

- All better reads on Mfg ISM data drew immediate selling followed by brief buying on the follow, some desks posited data was miss vs. whisper number on the heels of Wed's 5pt beat on Chicago PMI.

- Treasury sources report waves of real$ buying in long end as yield curves resume bull flattening, foreign acct buying intermediates, sporadic month end buying in the mix vs. swap-tied selling in 5s-10s.

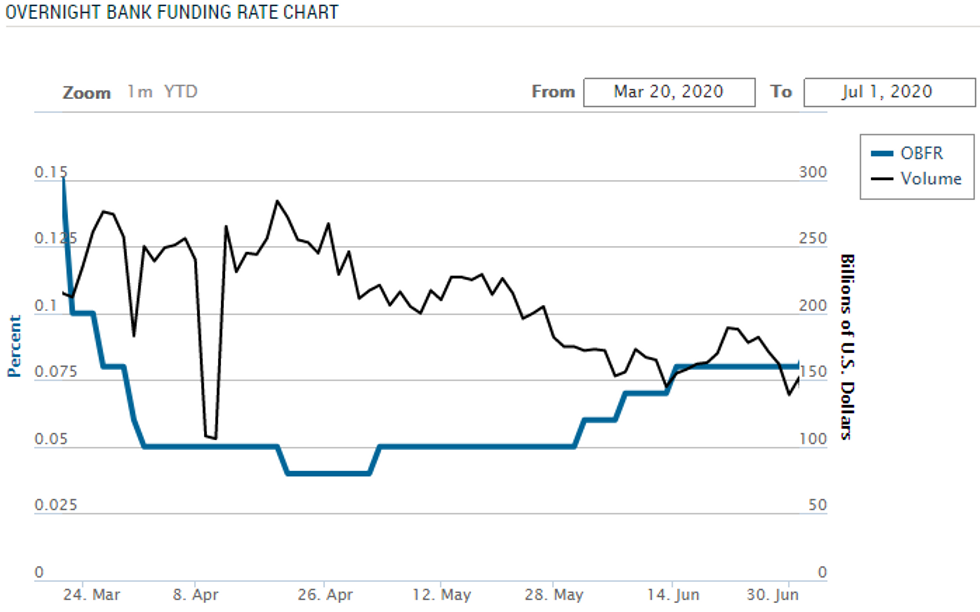

- FRBNY EFFR for prior session: Daily Effective Fed Funds Rate: 0.06% volume: $56B; Daily Overnight Bank Funding Rate: 0.05%, volume: $148B. Relevance:

- Last year, OBFR dipped to 0.05% on April 1 as well and stayed there through June 1 with a brief dip to 0.04% on April 21 to May 1. Focus is speculation whether the Fed will raise IOER if EFFR dips below 5bps or less.

- Early close Friday w/March NFP at normal 0830ET, median est +650k.

- The 2-Yr yield is down 0.2bps at 0.1585%, 5-Yr is down 3.5bps at 0.9042%, 10-Yr is down 6.3bps at 1.677%, and 30-Yr is down 7.1bps at 2.3392%.

Federal Reserve Bank of New York

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N -0.00588 at 0.07475% (+0.00137/wk)

- 1 Month -0.00075 to 0.11038% (+0.00313/wk)

- 3 Month +0.00550 to 0.19975% (+0.00075/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00400 to 0.20125% (-0.00200/wk)

- 1 Year -0.00263 to 0.28050% (-0.00025/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $56B

- Daily Overnight Bank Funding Rate: 0.05%, volume: $148B

- Secured Overnight Financing Rate (SOFR): 0.01%, $931B

- Broad General Collateral Rate (BGCR): 0.01%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $324B

- (rate, volume levels reflect prior session)

- Scheduled purchases resume next week:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Tue 4/06 1010-1030ET: Tsys 20Y-30Y, appr $1.750B

- Wed 4/07 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Fri 4/09 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

US TSYS/OVERNIGHT REPO: Steady, 10s Remain Hot

Overnight repo remains at special across the curve, heating up slightly in 10s. Current levels:

T-Bills: 1M 0.0076%, 3M 0.0127%, 6M 0.0304%; Tsy General O/N Coll. 0.03%.

| Duration | Current | Old Issue |

| 2Y | 0.02% | 0.02% |

| 3Y | -0.18% | -0.25% |

| 5Y | 0.01% | -0.15% |

| 7Y | 0.02% | -0.12% |

| 10Y | -0.46% | -0.14% |

| 30Y | -0.02% | -0.16% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +7,500 short Mar 91/93 put spds 4.5 over 97 calls

- 1,750 Mar 100 calls

- -5,000 Dec 97 straddles, 8.5

- Block -15,000 Blue Jun 83/86 put spds, 12.0 vs. 98.49/0.22%

- +15,000 Green Apr 90/91 put spds, 1.5

- 3,000 Dec 92 puts, 1.0

- -3,000 Blue Sep 24-24.5

- +2,000 Blue Sep 63 puts, 2.0

- -5,000 Green Sep 87 puts, 10.5

- -15,000 Blue Sep 83 conversions vs. 97.855/1.00%

- 15,000 Green Apr 90/91 put spds, 1.5

- +10,000 short Mar 97/98 call spds, 1.5

- Block, +14,000 Green Dec 87 puts, 23.0 vs. 99.41/0.46%

- Block, 10,000 short Mar 90/92 put spds 2.0 over 96/97 call spds vs. 99.39/0.25% vs

- Block, 10,000 short Jun 96/97 put spds, 4.5 vs. 99.705/0.38%

- +20,000 Green Jun 99.562 calls on screen, +8k in pit

- Overnight trade

- Block, +6,000 short Dec 91 puts, 6.0 at 0716:38ET

- +4,000 TYM 127/128 put spds, 4

- >+10,000 TYM 127 puts, 6

- 2,000 USK 153/154 put spds, 18

- -1,500 USK 152 puts, 16

- +20,000 wk3 TY 129/129.5/130/130.5 put condors5

- >33,000 FVM 124 calls, 19.5-19

- 10,000 TYM 133.5 calls, 12

- >10,000 FVK 122.5 puts, 4

- 2,500 TYM 129/130 put spds, 13

- 2,000 FVK 122.25/122.5/123 broken put flys

- 5,000 TYM 127 puts, 6

EGBs-GILTS CASH CLOSE: Entering Easter Weekend On A High

Bunds and Gilts went out on a high (with yields on lows) going into the 4-day weekend, with curves bull flattening despite strengthening equities. Periphery spreads ended mixed.

- Fairly orderly price action throughout the session, with European fixed income markets closed Fri and Mon.

- Potentially some position squaring / short cover ahead of Friday's US employment report. Indeed, US Tsys leading global yields lower.

- Final Manuf PMI data this morning, but first/only readings came in at/above expectations for Spain and Italy.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.7bps at -0.708%, 5-Yr is down 3.1bps at -0.659%, 10-Yr is down 3.6bps at -0.328%, and 30-Yr is down 3.2bps at 0.226%.

- UK: The 2-Yr yield is down 2.8bps at 0.076%, 5-Yr is down 2.8bps at 0.366%, 10-Yr is down 5bps at 0.795%, and 30-Yr is down 5.4bps at 1.343%.

- Italian BTP spread down 0.1bps at 95.9bps / Spanish up 0.7bps at 63.6bps

OPTIONS/EUROPE SUMMARY: Long-Dated Rates Plays

Thursday's options flow included:

- 0RH2 100.375 put (v 100.49) with 2RH2 100.25 put (v 100.365) bought for 16 in 7.5k

- 3RM1 100.25p vs 2RM1 100.37p spread, bought for 2.5 in 3k

- 3RU1 100.12/100ps, bought for 2.5 in 4k

- 2LM1 99.25/99.00ps, bought for 2.5 in 4.5k

- 3LZ1 99.00/98.75ps, bought for 8.25 in 4k

- 0LZ1 99.75/99.87/100.12c fly 1x3x2, bought for -0.5 (receives) in 11k (ref 99.60, 5 del)

- 0LZ1 99.87c, bought for 3.75 in 4.5k (ref 99.625)

- 0LH2 99.87c, bought for 5.5 in 1.5k (ref 99.555)

FOREX: USD Rolls Off Cycle High Pre-Payrolls

- After holding its ground for much of the early session, the greenback turned lower after the London close, dragging the USD index off the 2021 highs printed earlier in the week. News catalysts were few and far between, with traders focusing on the extended weekend and the looming payrolls release. Nonetheless, equities continued their charge higher, with the S&P 500 breaking above 4,000 to hit new all-time highs.

- NZD and EUR traded most firmly Thursday, securing the fourth consecutive session of losses for AUD/NZD, which confirms a bearish reversal off the 2021 highs printed on Monday at 1.0947.

- Focus turns to Friday's payrolls release, which may see a muted response given the sporadic market closures across the US and full market closures across the European continent.

- Survey stands for the US to have added 650k jobs across March, pressuring the unemployment rate to new post-pandemic lows of 6.0%.

FX OPTIONS: Expiries for Apr02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.00($585mln)

- USD/CNY: Cny6.58($1.4bln)

PIPELINE: Total $232.62B High-Grade Debt Issuance for March

March leads 2021 with stellar $232.62B high-grade corporate issuance vs. $275.48B for Mar 2020 (second to all-time record of $401.325B in April 2020). Q1'21 ahead last years pace $618.03B vs. $548.16B -- but April 2021 will be hard pressed to match last years record $401.32B for a single month!

| Mar'21 | $232.62B |

| Feb'21 | $157.86B |

| Jan'21 | $227.55B |

| 2020 Recap: | Record $2.196T |

| Dec'20 | $52.24B; $796.54B H2 2020 |

| Nov'20 | $126.83B |

| Oct'20 | $111.65B |

| Sep'20 | $207.82B |

| Aug'20 | $204.50B |

| Jul'20 | $93.50B |

| Jun'20 | $180.50B; Record $1.40T H2 2020 |

| May'20 | $270.90B |

| Apr'20 | $401.32B |

| Mar'20 | $275.48B |

| Feb'20 | $107.50B |

| Jan'20 | $165.18B |

EQUITIES: S&P Tops 4,000 as Bull Markets Rolls On

- US equity markets trade uniformly positively Thursday, with tech outperforming to help the NASDAQ rise over 1.5%. Gains of close to 1% in the S&P 500 helped tip the index over 4,000 to hit new all-time highs.

- Better oil prices helped flatter energy names, which was the top performing sector in the S&P 500 Thursday. Communication services and tech weren't far behind, with defensive utilities and healthcare the sole sectors in the red.

- Across Europe, continental stocks saw decent support, with broad-based gains across French, German and Swiss equity markets. Spain's IBEX-35 lagged slightly, closing broadly flat.

COMMODITIES: OPEC Hesitance Boosts Crude Benchmarks

- Both WTI and Brent crude futures traded solidly into the Thursday close, with the OPEC+ meeting signalling to markets that supply curbs would only be very gradually eased as Coronavirus continues to dampen demand for energy globally. Markets may have been harbouring outside expectations that OPEC+ would accelerate output in the coming months after reports that the US had emphasised their preference for 'affordable' energy in a call with Saudi Arabia.

- Brent crude futures rose just over $2/bbl as markets look to secure a close above the 50-dma at $63.12. Resistance remains in tact at the mid-week highs of $65.46/bbl.

- After a soft start, both Gold and Silver saw decent support into the US close as the greenback turned lower. The USD index eased off the mid-week highs, which coincided with 2021 cycle highs for the greenback. Both metals registered gains of well over 1% apiece.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.