-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS: Fed Optimism Vs. Russia Tensions

US TSY SUMMARY: Fed Optimism vs. Russia/Ukraine Geopolitical Tension

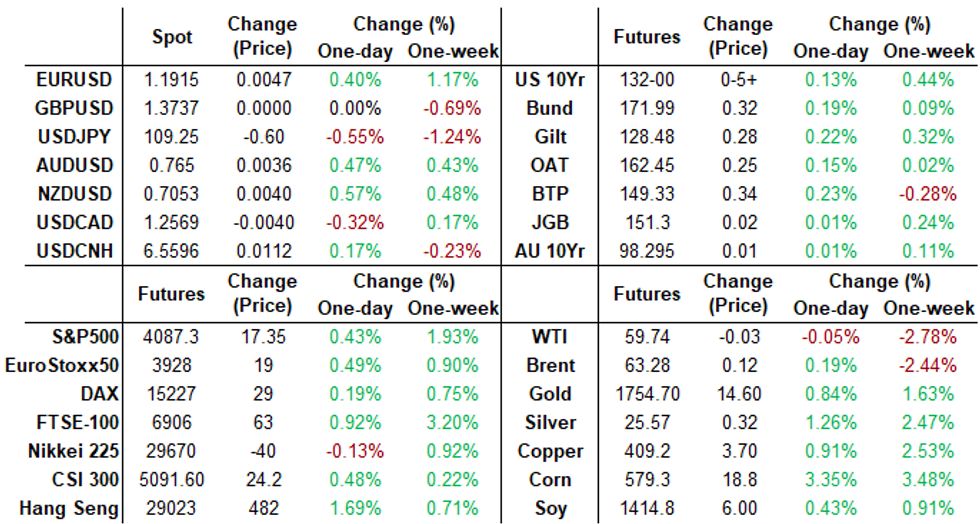

Rates traded sideways after the long Bond hit session highs around 1000ET Thu, moderately bid near top end of range on rather subdued volumes, TYM1 just over 985k after the close. S&P eminis trading firmer but off new all-time high 4092.75 tapped overnight.

- No significant market reaction to weekly claims: +16k to 744k, continuing claims -0.016M to 3.734M. But rates did climb to session highs by midmorning, partially tied to safe haven buying due to increasing geopolitical tensions between Russia and Ukraine as the former builds up military presence near Donbass region.

- News wires reported German Chancellor Merkel "TOLD PUTIN TO REVERSE UKRAINE TROOP BUILDUP" Bbg around the time. Not eliciting much additional safe haven support, but late CNN headline report U.S. CONSIDERING SENDING WARSHIPS INTO THE BLACK SEA. Which makes some wonder why equities can continue to make new highs if a hot war in the region is a real concern.

- Fed speak: Fed Chair Powell at IMF virtual forum, is looking for several more strong job reports like last Fri's (+916k for Mar) before judging the economic recovery has shown progress toward full employment, adding that conditions remain uneven.

- MN Fed Pres Kashkari raised a few eyebrows late in day that "he would not panic if he saw a 4% inflation rate" DJ while tolerating "near-term inflation overshoot", Bbg.

- The 2-Yr yield is down 0.6bps at 0.1468%, 5-Yr is down 3.1bps at 0.8383%, 10-Yr is down 4.4bps at 1.6298%, and 30-Yr is down 4.4bps at 2.3176%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00137 at 0.07488% (+0.00013/wk)

- 1 Month -0.00200 to 0.11050% (+0.00012/wk)

- 3 Month -0.00588 to 0.18775% (-0.01200/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00075 to 0.21075% (+0.00950/wk)

- 1 Year +0.00150 to 0.28675% (+0.00625/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $73B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.01%, $924B

- Broad General Collateral Rate (BGCR): 0.01%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $341B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, appr $2.401B accepted vs. $4.808B submission

- Next scheduled purchase:

- Fri 4/09 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

US TSYS/OVERNIGHT REPO: Slight Moderation

Slight moderation, 10s continue to lead specials, but cooling slightly. Bills at basement levels, current levels:

T-Bills: 1M 0.0051%, 3M 0.0076%, 6M 0.0254%; Tsy General O/N Coll. 0.02%

| Duration | Current | Old Issue |

| 2Y | 0.01% | 0.01% |

| 3Y | -0.12% | -0.17% |

| 5Y | -0.04% | -0.12% |

| 7Y | 0.01% | -0.07% |

| 10Y | -0.35% | -0.11% |

| 30Y | -0.15% | -0.06% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Blue Apr 85 puts, 3.0 vs. 98.585/0.30%

- +5,000 short Dec 95 straddles, 25.5

- +4,000 Green Dec 82/93 strangles, 12.5

- +9,000 short Dec 93 puts, 7.5 vs. 99.535/0.25$

- +3,600 Jun 95/96/97 put flys, 2.5

- +2,000 Dec 97/98 1x2 call spds, 0.0

- -4,000 Blue Sep 90 calls 2.0 over 2,000 Blue Sep 78/83 2x1put spds

- 10,000 long Green Sep 98 calls, 4.5

- -5,000 short Dec 97/98 call spds, 1.0

- Note, implieds have come off after some +40,000 Green Jun 92 straddles bought Wed from 21.25 to 22.5, current mkt 21.0 bid/at 21.5

- Overnight trade

- 12,000 Gold Jul 70/72/75/77 put condors, 5.5

- 4,100 Green May 99.25/99.37 2x1 put spds

- 4,000 Green May 99.18/99.31/99.43 1x3x2 call flys, 1.0

- 4,000 short Dec 95 puts, 10.0-10.5

- +5,600 TYM 127 puts, 3

- Update, 3,100 USM 158/162 1x2 call spds, 40

- -7,300 TYK 133 puts 3 over TYK 132.5 puts

- +3,000 TYK 134 calls 4 over TYK 134 calls earlier

- +9,800 USM 162 calls, 20

- -5,000 TYM 134a calls, 11

- -2,000 FVM 123.25 puts, 14.5-15

- -5,000 FVM 122.5/123 put spds, 5

- Overnight trade

- 10,000 FVM 122/123 put spds, 8.5-9.0

- 8,000 FVM 125/127 call spds, 3.5

- 3,000 TYK 131/131.25/131.75 put trees, 0.0

EGBs-GILTS CASH CLOSE: BTPs Outperform

Though few themes stood out Thursday, core FI was in favour in the afternoon, handily reversing early losses. Gilts saw steady gains all day with bull flattening in the curve, outperforming Bunds.

- Italy outperformed in the space as a whole, though beyond BTPs, periphery EGB spreads were mixed.

- German Feb factory orders data missed slightly. Little impact from ECB meeting minutes (Gov Council saw broad consensus for PEPP pace pickup). BoE's Tenreyro told the FT that negative rates would work in the UK.

- Today saw supply from Spain, France and the UK. EU sent an RfP for E5bn in funding in coming weeks.

- Friday sees some industrial production / retail sales data, and ECB's de Guindos speaks.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.1bps at -0.714%, 5-Yr is down 1.1bps at -0.668%, 10-Yr is down 1.2bps at -0.336%, and 30-Yr is down 0.7bps at 0.224%.

- UK: The 2-Yr yield is down 1.8bps at 0.046%, 5-Yr is down 1.8bps at 0.34%, 10-Yr is down 2.4bps at 0.749%, and 30-Yr is down 3.1bps at 1.284%.

- Italian BTP spread down 1.9bps at 99.8bps / Spanish spread up 0.4bps at 67bps

OPTIONS/EUROPE SUMMARY: Bund Put Diagonals, Large Sterling Flies

Thursday's options flow included:

- RXN1 171.50 /RXM1 167.00 put diagonal bought for 57 in 1k

- RXN1 168.00 /RXM1 167.00 put diagonal bought for 10 in 1k

- DUK1 112.20/112.10ps. 1x2, sold at 4 in 4k

- DUK1 112.10p, bought for 2in 5k

- 0RU1 100.37/100.50/100.62c fly 1x3x2, bought for -0.5 (receive) in 2.5k

- 0RN1 100.37/100.50/100.62c fly 1x3x2, bought for 0.25 in 2.25k

- 3RU1 with 3RZ1 100.37/100.50/100.62c fly 1x3x2 strip, bought for 1.25 in 1k

- 0LZ1 99.75/99.87/100.12 broken call fly, bought for -0.75 in 20k

- 0LZ1 99.62^ vs 99.50p, sold at 18.25 in 20k

- 0LZ1 99.50/99.00ps, bought for 6.75 in 10k (ref 99.645)

- 2LM1 99.62/99.50ps vs 99.87c, sold the ps at 7 in 4.5k

- 3LZ1 99.62/99.75cs vs 0LZ1 99.87/100cs, sold the 3yr at 0.25 in 2k

FOREX: USD Fades Further, Hits April Low

- The greenback faded further Thursday, prompting the USD index to retreat further below the 200-dma and narrow in on next support at 91.50. The move was mirrored in EUR/USD, which climbed to the best levels of the month and extended the recovery from last week's lows to close to 2%. 1.1975 is the next level of interest, despite some sell-side analysts now citing the EUR strength as over-done in the near-term.

- Initial weekly jobless claims came and went with little focus, despite the numbers coming in above expectations. Some WMR fix related demand for the greenback was also well absorbed, keeping focus on Fedspeak and the continued strength in the US vaccine programme relative to the UK & EU rollout.

- USD and NOK were the session's poorest performers, while SEK and CHF traded well.

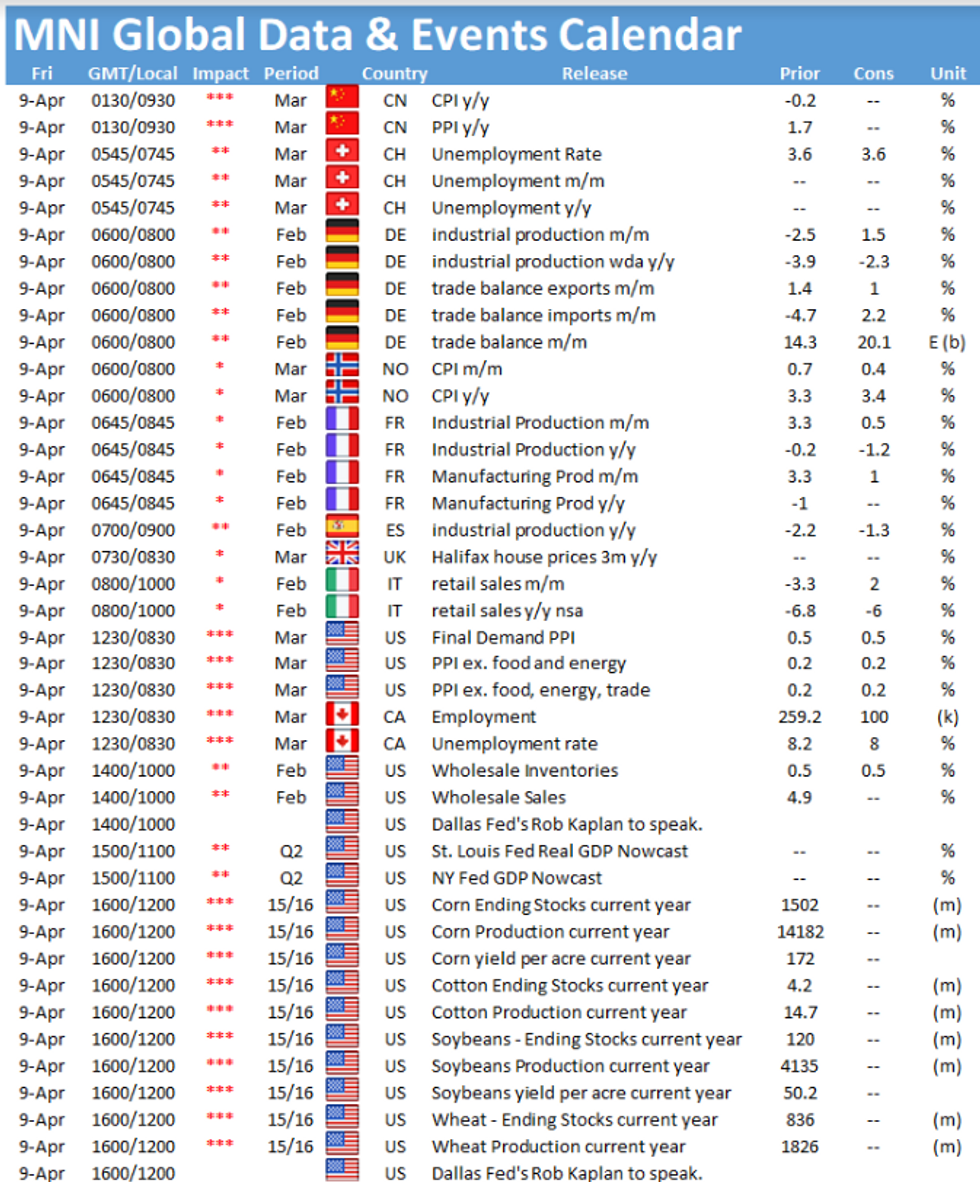

- Focus Friday turns to Chinese inflation data, with both PPI and CPI numbers expected to shoot higher. German & French industrial production data is also due in Europe, followed by US PPI and the Canadian jobs report. ECB's de Guindos and Fed's Kaplan are the only central bank speakers of note.

FX OPTIONS: Expiries for Apr09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E904mln), $1.1780-00(E1.6bln), $1.1850(E1.2bln-EUR puts), $1.1885-00(E843mln), $1.2000(E583mln)

- USD/JPY: Y109.15($1.3bln), Y109.35-50($679mln), Y109.75($632mln), Y110.45-55($765mln)

- NZD/USD: $0.6948-50(N$1.35bln-NZD puts)

- USD/CAD: C$1.2600 ($1.2bln-USD puts)

PIPELINE: MassMutual Launched, Rounds Out $16.52B Total Issuance/Day

- Date $MM Issuer (Priced *, Launch #)

- 04/08 $5B *KFW 2Y -2

- 04/08 $4.1B #Organon $2.1B 7NC3 4.125%, $2.0B 10NC 5.125%

- 04/08 $4B #Japan Bank of Int Cooperation (JBIC) WNG $1B 3Y +4, $3B 10Y +24

- 04/08 $1B #MassMutual $400M 3Y +32, $600M 3Y FRN SOFR+36

- 04/08 $1B #Canadian Pension Plan (CPPIB) WNG 3.5Y +1

- 04/08 $920M #Sumitomo Life Insurance 60NC10 3.375%

- 04/08 $500M *AIIB WNG 5Y FRN SOFR+22

EQUITIES: Stocks Hit Fresh Highs as Focus Turns to Earnings

- The e-mini S&P edged higher still Thursday, topping out at new record highs of 4092.75. This cements further the bull trend, with prices rising over 6% since the late March lows. Markets await any signs of overbought conditions, with the RSI edging toward the highest levels of the year so far.

- The VIX broke lower still, hitting 16.55 and the lowest level since late February last year. The index has now wholly erased the pandemic-induced lurch higher.

- In cash markets, tech firms surged, helping NASDAQ gains outstrip both the S&P 500 and the DJIA. The energy was the laggard, with large cap names ExxonMobil and Chevron slipping close to 1.5% as oil prices moderated further.

- Earnings season kicks off next week, with the likes of JPMorgan, Wells Fargo, Goldman Sachs and Bank of America on the docket.

COMMODITIES: Precious Metals Enjoy Weaker Dollar

- WTI and Brent crude futures traded broadly unchanged Thursday, with the moderately weaker USD countered by more positive comments from Iran, as their lead negotiator stated that talks are underway for a single-step sanctions removal - prompting markets to consider a boost in crude supply in the near future.

- Thursday's NatGas storage change numbers saw a slightly smaller than expected build in supply, at 20BCF vs. Exp. 22.4BCF. This helped support prices into the NY close having traded underwater for much of the early US session.

- Precious metals generally fared well. The downbeat greenback helped boost prices with gold topping $1750 and hitting the best level in over a month in the process. Next resistance cuts in at the 50-dma at $1761.04, not topped since early February.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.