-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Durable Goods Weak, Dallas Fed Mfg Up

US TSY SUMMARY: Durable New Orders Much Weaker Than Expected

Tsys climbed off opening lows following weaker than expected Durable New Orders for March: +0.5% vs. +2.5% est, analysts cited nagging supply chain constraints, and volatile aircraft orders.

- Bonds lead the rally through midmorning and stalled after US APRIL DALLAS FED MANUFACTURING INDEX AT 37.3 -- well above 30.0 estimate (28.9 in March). Rates held higher levels on narrow range through the FI close.

- Week's Tsy auctions front-ended to accommodate Wednesday's FOMC policy annc.

- The $60B 2Y note (91282CBX8) auction tailed slightly with high yield of 0.175% vs. 0.170%, matching last Decembers 0.5% tail. Bid-to-cover lowest since June 2020 at 2.34x vs. 2.56x 5 month average.

- The $61B 5Y note (91282CBW0) auction came in near on-the-screws with high yield of 0.849% vs. 0.850% WI. Bid-to-cover lowest since July 2020 at 2.31x vs. 2.34x 5 month average.

- Late headline re: 2020 Census, House announces apportionment changes for next decade: rejiggering number of House seats may be boon for GOP.

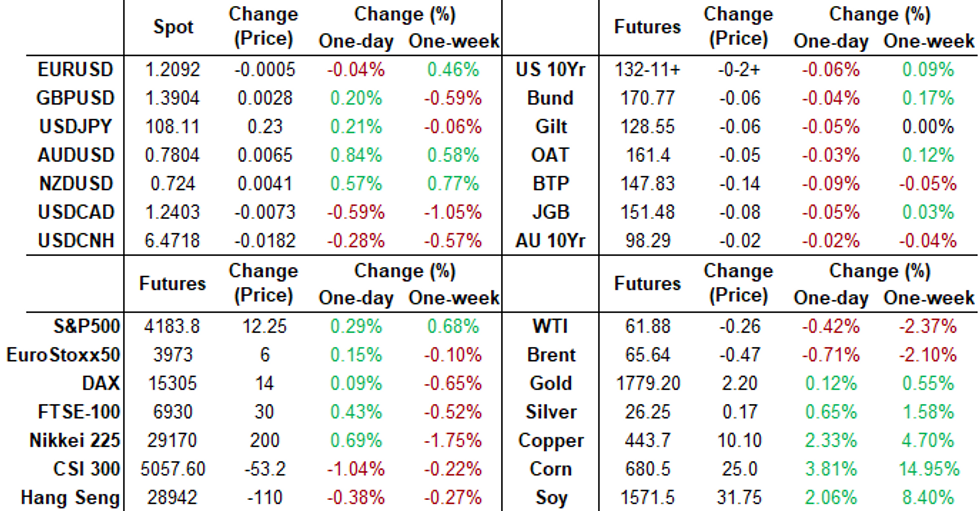

- The 2-Yr yield is up 1.2bps at 0.1697%, 5-Yr is up 1.5bps at 0.8311%, 10-Yr is up 1.1bps at 1.5684%, and 30-Yr is up 0.9bps at 2.243%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N +0.00037 at 0.07375% (+0.00063 total last wk)

- 1 Month +0.00000 to 0.11100% (-0.00488 total last wk)

- 3 Month +0.0262 to 0.18400% (-0.00687 total last wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month -0.00225 to 0.20188% (-0.01950 total last wk)

- 1 Year +0.00112 to 0.28200% (-0.01150 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.01%, $871B

- Broad General Collateral Rate (BGCR): 0.01%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $352B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $9.100B submission

- Next scheduled purchases:

- Tue 4/27-Wed 4/28 Pause for FOMC

- Thu 4/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 short Mar 96/97 1x2 call spds, 1.5 at 1103:30

- +10,000 Red Mar'23 92/93/95/96 put condors, 1.5

- +20,000 short Dec 97/98 call strip, 2.5 vs. 99.55/0.20%

- Overnight trade

- +1,500 Green May 99.18/99.31/99.44 call flys, 4.0

- -8,000 TUM 110.37 calls mostly at 2 (-1k 2.5 earlier)

- +2,000 TYM 131/132 3x2 put spds, 25

- +3,000 TYM 130 puts, 5 vs. 132-09/0.08%

- -5,000 TYN 129.5/133.5 strangles, 37

- +5,000 FVN 123 puts, 24.5 vs. 123-30/0.40%

- Overnight trade

- +6,500 TYM 131.25/132 put spds, 2cr

- +2,500 TYM 130.5/130.75/131.75 broken put flys, 14

- +5,000 TYM 129.5 puts, 3

- 5,600 TYN 129 puts, mostly 15, 17 last

- 5,000 TYM 133/133.5 call spds

- 1,100 TYM 130/131/132 put flys, 13

EGBs-GILTS CASH CLOSE: ECB Goes Bigger On PEPP

Bunds and Gilts traded mixed to start the week, starting weak but rallying from lows from midday. All the while, with no real conviction or apparent drivers. Periphery spreads were mixed as well.

- Data showed the ECB posted the highest net PEPP purchases last week (E22.2bn) since the week ending June 26, 2020 (and the highest overall net buys since that date too). It was the biggest week for PSPP purchases since the first week of December 2020.

- German IFO data came in on the weak side of expectations.

- ESM sold E2bn of 2031 bonds. Italy mandated banks for a 3-/30-Yr USD BTP sale.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.2bps at -0.689%, 5-Yr is up 0.5bps at -0.6%, 10-Yr is up 0.4bps at -0.253%, and 30-Yr is down 0.2bps at 0.288%.

- UK: The 2-Yr yield is up 1.5bps at 0.051%, 5-Yr is up 1.9bps at 0.327%, 10-Yr is up 1.2bps at 0.756%, and 30-Yr is up 0.6bps at 1.283%.

- Italian BTP spread up 1.4bps at 105.2bps / Spanish spread down 0.1bps at 65.4bps

OPTIONS/EUROPE SUMMARY: Mostly Downside (And SONIA Options Too)

Monday's options flow included:

- RXM1 172c, bought for 27.5 in 3k and 33.5 in 3k (6k total)

- RXM1 169/168ps 1x2, bought for 2.5 in 1k

- RXN1 170/169.50/169/168.50p condor, bought for 3.5 and 4 in 5k

- 3RU1 100.125/100/99.87p ladder, bought for-0.25 in 10k

- 0LM1 99.62/99.75/100.12/100.25c condor, sold at 10.25 in 4k (ref 99.765, 30 del)

- 2LZ1 99.00/98.50ps vs 99.62/99.87cs, bought the ps for 1 in 2.5k

- SFIH2 99.9/99.85/99.80p fly bought for 1 in 500

FOREX: Commodity Hot Streak Buoys Antipodeans

- AUD and NZD carried their outperformance throughout the European morning, trading well alongside industrial metals as the likes of copper, steel and iron ore shot higher. Expectations of better global growth in H2 this year were cited behind the move, with copper clearing 2021's earlier highs to strike the best levels in a decade. AUD/USD topped 0.78 at the London close, eyeing clustered resistance at 0.7815/16.

- The greenback held its ground for much of the European trading day, before selling pressure became evident ahead of the WMR fix, pressuring the USD index to its lowest levels since early March.

- Reflecting the better outlook for global trade, Chinese currencies put in a strong performance, helping USD/CNH and USD/CNY slip to the lowest levels in over two months.

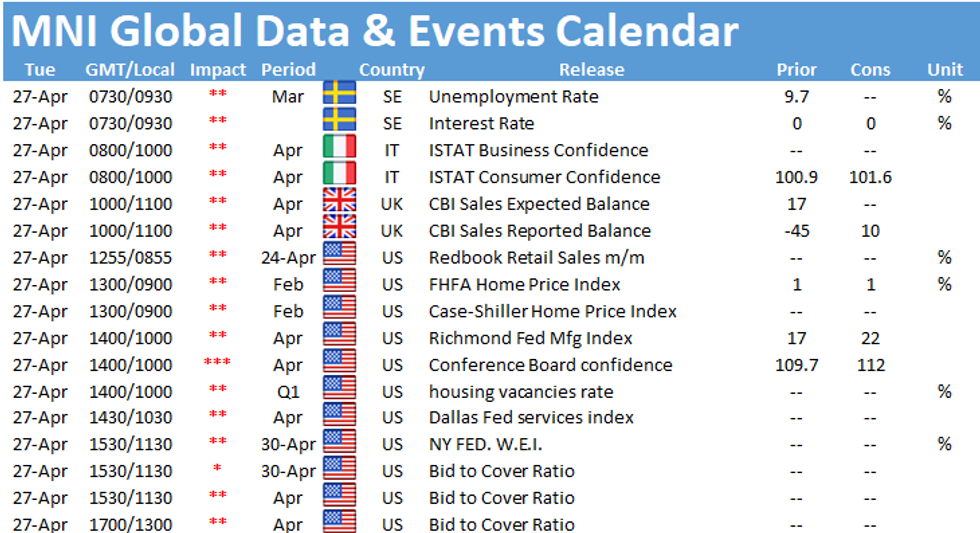

- Focus Tuesday turns to Italian and US consumer confidence numbers, with the Bank of Japan rate decision also due. Bank of Canada's Macklem is scheduled to speak as well as ECB's de Cos.

FX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1935-50(E1.0bln), $1.2000(E727mln), $1.2070-75(E767mln), $1.2100-25(E1.6bln-EUR puts)

- USD/JPY: Y108.74-75($1.5bln-USD puts), Y109.00-10($1.3bln-USD puts), Y109.45-65($906mln), Y109.70-85($1.8bln)

- AUD/USD: $0.7710-25(A$1.4bln-AUD puts), $0.7830-35(A$1.1bln-AUD puts)

- USD/CAD: C$1.2500($602mln), C$1.3050($676mln)

- USD/CNY: Cny6.52($710mln)

PIPELINE: Supra-Sovereigns Keep Issuance Running

- Date $MM Issuer (Priced *, Launch #)

- 04/26 $2B #NBN $750M 5Y +67, $1.25B 10Y +107

- 04/26 $1.25B #Ukraine 8Y 6.875%

- 04/26 $1B #Natura 7Y 4.125%

- 04/26 $Benchmark Maldives 5Y Tap Sukuk 10.5%a

- Later this week

- 04/27 $Benchmark Italy 3Y +60a, 30Y +200a

- 04/27 $Benchmark Development Bank of Kazakhstan 10Y investor calls

- 04/?? $Benchmark OQ (Oman energy co) 7Y

- 04/?? $Benchmark Abu Dhabi Ports 10Y

EQUITIES: US Hours Add Much Needed Direction After Slow Start

- Global stock markets got off to a mixed start on Monday, with European hours seeing relatively non-directional trade. This soon changed after the Wall Street opening bell, which added some much-needed direction to keep last week's all time highs under pressure ahead of the US close.

- The S&P 500 traded in minor positive territory, fuelled by gains in energy, financials and materials names. The upside momentum was somewhat countered by a softer showing from consumer staples and utilities, but this helped underline a bullish tone despite Monday's slightly slower progress.

- This week is the busiest for US corporate earnings of the quarter, with Tesla due after market and Alphabet, Amazon, Apple and Microsoft all due in the coming few sessions.

- On the continent, strength in Banco Santander and BBVA helped drive the IBEX-35 outperform, while Germany's DAX lagged slightly, while closing higher by 0.1%.

COMMODITIES: Copper Leads The Monday Charge, Oil Recovers Losses

- Copper rose to best levels seen in a decade amid renewed optimism for strong seasonal demand from top consumer China as well as fresh supply concerns in Chile. Benchmark copper on the London Metal Exchange (LME) reached levels above $9,754, soaring more than 2% to the highest level since August 2011.

- A potential gridlock between President and Congress over a third pension withdrawal in Chile, has prompted mining unions to announce strikes, muddying the waters surrounding potential supply concerns. The news spurred an ongoing rally, that has benefitted from buoyant equities and a softer US dollar.

- The US dollar reversed early gains which provided precious metals with enough of a recovery to close marginally in the green on Monday. Spot gold rose 0.15% to trade at $1,780 an ounce after trading down to lows of $1,769. Spot silver gained 0.55% to trade at $26.15.

- Oil benchmarks completed a full U-turn as losses were erased following headlines from the OPEC+ meeting. The OPEC+ panel's global demand growth estimate for 2021 was confirmed at 6 million barrels a day. The level was up from its projection last month, though in line with OPEC's April monthly report.

- The psychological impact of the higher forecast was enough for benchmarks to retrace 2% losses back to broadly unchanged levels on Monday.

- OPEC Secretary-General Mohammad Barkindo said that the group sees "positive signals" in the global economy, but that there are factors in the oil market that require ongoing vigilance.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.