-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: FOMC Rate, Monthly Bond Buying Steady

US TSY SUMMARY: Substantial Further Progress Needed

Rates finish near late session highs after choppy, post-FOMC trade as markets took some time to digest steady rate and $120B monthly bond buy-backs. Inflation rising but still deemed transitory while employment metrics have improved.- Rates finally broke range, surged higher after Fed Chairman Powell press conf 30 minutes after policy annc. No time to talk about tapering on the back of transitory inflation providing tail wind for rates here. Equities also making new all-time highs ESM1 4193.75 before paring gains late. US$ initially rallied but reversed move on Powell presser that "substantial further progress" will "take some time."

- On unemployment, Powell suspects "insurance benefits will run out in September. To the extent that's a factor, which is not clear, it will no longer be a factor fairly soon. My guess is it will come back to this economy where we have equilibrium between labor supply and demand. It may take some months, though."

- Focus turns to US Pres Biden address to Joint Session of Congress: tonight at 0900ET (broadcast on all major networks and streamed live on internet) to propose his $1.8T Family plan that includes education, child care and paid leave spending.

- The 2-Yr yield is down 1.6bps at 0.1641%, 5-Yr is down 2.7bps at 0.854%, 10-Yr is down 1.4bps at 1.6076%, and 30-Yr is down 0.8bps at 2.2858%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00087 at 0.07313% (-0.00025/wk)

- 1 Month +0.00300 to 0.11325% (+0.00225/wk)

- 3 Month +0.00837 to 0.18550% (+0.00412/wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month -0.00825 to 0.20600% (+0.00188/wk)

- 1 Year +0.00112 to 0.28375% (+0.00288/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $65B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $265B

- Secured Overnight Financing Rate (SOFR): 0.01%, $879B

- Broad General Collateral Rate (BGCR): 0.01%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $354B

- (rate, volume levels reflect prior session)

- No buy operations Tuesday and Wednesday, Pause for FOMC

- Next scheduled purchases:

- Thu 4/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

US TSYS/OVERNIGHT REPO: GC Back to 0.00%

Holding steady to Monday's levels, 10s lead specials. Bills reverse Monday bounce, current levels:

T-Bills: 1M 0.0025%, 3M 0.0076%, 6M 0.0304%; Tsy General O/N Coll. 0.00%

| Duration | Current | Old Issue |

| 2Y | -0.03% | -0.01% |

| 3Y | -0.01% | -0.09% |

| 5Y | -0.11% | -0.04% |

| 7Y | -0.03% | -0.06% |

| 10Y | -0.11% | -0.09% |

| 30Y | -0.08% | -0.06% |

MONTH-END EXTENSION ESTS: Preliminary Barclays/Bbg Extension Estimates for US

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.16Y; Govt inflation-linked, 0.17. Note broad decline in Govt/Credit and Intermediate credit from year ago levels, while MBS extension est surges.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.08 | 0.13 |

| Agencies | 0.06 | 0.04 | 0.03 |

| Credit | 0.07 | 0.1 | 0.2 |

| Govt/Credit | 0.08 | 0.09 | 0.17 |

| MBS | 0.25 | 0.06 | 0.05 |

| Aggregate | 0.12 | 0.08 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.06 |

| Iterm Credit | 0.08 | 0.08 | 0.2 |

| Interm Gov | 0.09 | 0.08 | 0.1 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.15 |

| High Yield | 0.09 | 0.11 | 0.08 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 short Sep 96 puts, 4.5 -- total volume >23.4k

- +5,000 Blue Sep 80/90 put over risk reversals, 1.5 -- up over +100k since early last week

- +5,000 Red Dec 95/97 call spds, 1.5

- +7,000 Blue Jul 80/83 put spds 4.5 over 86/88 call spds

- -10,000 Gold Sep 72/85 call over risk reversals, 1.0 98.015/0.35%

- Block, total +39,333 short Dec 97 calls, 2.0 vs. 99.55-.555/0.17%

- -20,000 short Jul/short Sep 96 put strips 9.5-9.0

- -1,000 Gold May 81/82 strangles, 13.5

- -3,000 short Dec 96/97 1x2 call spds, 2.5

- +4,000 Blue May 82/83 put spds

- 2,250 Green Dec 93 calls

- Overnight trade

- 2,000 Red Jun 97/Red Sep 97/Red Mar 96 put strip

- 2,000 Red Dec 92/93/95 call flys

- 2,000 Blue Jun 80 puts, 1.0

- 1,000 Green Jun 93/95 call spds

- +5,000 wk5 FV 123.5 puts, 2

- -3,500 TYM 132/132.5 strangles, 100

- -12,000 wk1 TY 131 puts 2 over wk5 131.5 puts vs. various from -21.5 to -24

- 3,000 USM 154 puts 26-25

- BLOCK, -10,000 FVN 122.5 puts 10 over FVM 122.75/123 put strips

- -10,000 FVM 122.75 puts, 3.5

- 2,000 FVN 122.25/123.25 2x1 put spds, 6.5 net 1-leg over

- Overnight trade

- 3,000 TYM 127/128 put spds

- 1,300 USM 162/164 call spds, 6

- 10,000 TYQ 129 puts

- 7,000 TYM 131 puts, 20

- Block, 10,000 TYM 133.5 calls, 9, more on screen at 8

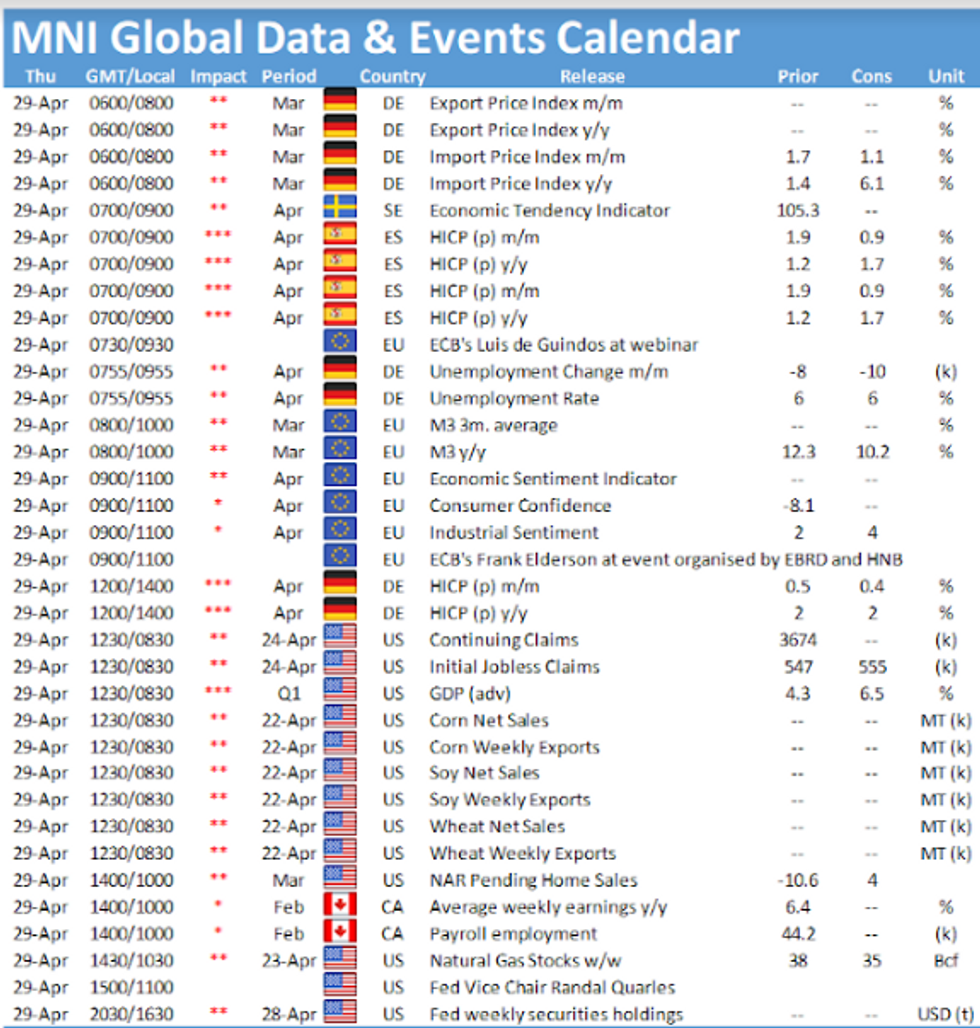

EGBs-GILTS CASH CLOSE: Recovering Early Losses Pre-Fed

A bit of bear steepening in both the UK and German curves Wednesday, ahead of the US Fed decision and Italian supply Thursday.

- Bunds and Gilts weakened early, but pared losses in the afternoon.

- ECB's Lagarde and Schnabel (among others) made comments this afternoon but nothing really different from what we've heard before. No reaction in bond markets, and although the EUR appreciated sharply this was seen as a dollar-led move.

- Beyond the Fed Wednesday evening, Thursday sees April eurozone flash inflation data and BTP supply.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.3bps at -0.685%, 5-Yr is up 1.5bps at -0.584%, 10-Yr is up 1.8bps at -0.231%, and 30-Yr is up 1.9bps at 0.311%.

- UK: The 2-Yr yield is down 0.6bps at 0.059%, 5-Yr is up 1.2bps at 0.356%, 10-Yr is up 2.3bps at 0.797%, and 30-Yr is up 1bps at 1.311%.

- Italian BTP spread up 3.2bps at 110.2bps / Spanish down 0.1bps at 66.4bps

OPTIONS/EUROPE SUMMARY: Big Euribor Risk Reversals Continue

Wednesday's options flow included:

- DUN1 112.10 put bought for 6 in 4k

- RXM1 170.5/169.0/167.5p fly, sold at 37 in 2k

- ERU2 100.50^ sold at 20 in 2k and 20.25 in 2.5k (4.5k total)

- 0RZ1 100.50/100.37/100.25p ladder, bought for 1.25 in 5k

- 0RH2 100.37/100ps, bought for 5 in 2k

- 0RH2 100.375/100.125 put spread bought for 4.25 in 3k

- 0RH2 100.37/50/62c fly 1x3x2, bought for up to 1.5 in 4.5k

- 3RU1 99.875p/100.375c RR, bought the p for 0.25 in 45k just today (130k+ total have been done)

- 3RU1 99.875/100.375 combo bought for 2.5 in 7.2k (bought the put)

- 3RZ1 100.00/99.75 put spread v 100.375 call bought for up to 2.5 in 7.2k (bought the p/s)

- 3RU1 100.00/99.75 1x1.5 put spread bought for 2 in 10k

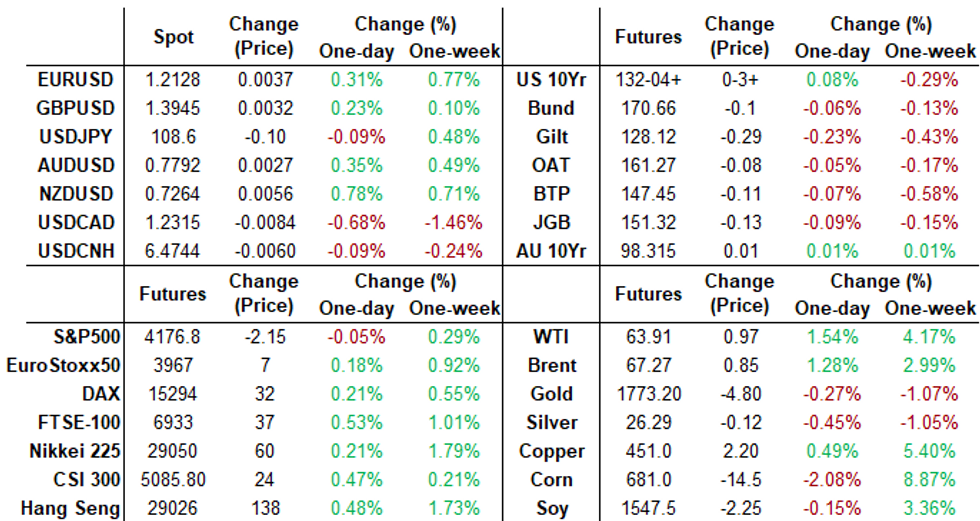

FOREX: Dollar Stymied as Fed Quells Taper Talk

- The greenback initially firmed on the FOMC statement, in which the board seemed to acknowledge the gathering pace of the US economic recovery. This price action revered throughout the presser, however, as Fed Chair Powell remained adamant that it was too soon to consider any tapering of asset purchases until 'substantial' further progress was made.

- EUR/USD was a notable beneficiary for the weakness in the greenback, with the pair extending gains through the week's high to touch the best levels since late February. Feb 25th's 1.2243 now looks achievable should short-term momentum persist.

- Oil-tied currencies traded particularly well Wednesday, with CAD and NOK among the session's best performers as both hit multi-year highs against the greenback. A firming crude futures curve was largely responsible, with the week's DoE data showing a far larger than expected draw in distillates reserves.

- Focus Thursday turns to weekly jobless claims data, advance Q1 US GDP and regional German CPIs. Speeches from Fed's Quarles, ECB's de Guindos, Elderson, Holzmann and Weidmann are due.

FX OPTIONS: Expiries for Apr29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E758mln), $1.1850(E1.5bln), $1.1875-85(E1.1bln), $1.1890-1.1905(E1.4bln-EUR puts), $1.1940-50(E589mln), $1.2095-1.2105(E988mln)

- USD/JPY: Y106.25($1.3bln), Y106.60-70($1.5bln-USD puts), Y106.85-107.00($1.5bln), Y108.00-15($817mln), Y108.45-50($1.2bln-USD puts), Y109.00($1.3bln-USD puts)

- EUR/JPY: Y129.85-95(E1.1bln-EUR puts)

- GBP/USD: $1.3500(Gbp613mln)

- EUR/GBP: Gbp0.8500-20(E777mln)

- USD/CHF: Chf0.9200($1.1bln-USD puts)

- AUD/JPY: Y81.00(A$1.1bln-AUD calls)

- USD/CAD: C$1.2400($615mln), C$1.2450($815mln), C$1.2550($1.15bln-USD puts)

- USD/CNY: Cny6.4500($570mln)

- AUD/USD: $0.7600(A$925mln)

PIPELINE: $3.45B Coca-Cola 3Pt Leads Issuers

- Date $MM Issuer (Priced *, Launch #)

- 04/28 $3.45B #Coca-Cola $2B +10Y +65, $750M 20Y +70, $700M 30Y Tap +80

- 04/28 $950M #Waste Mngmnt $475M 8Y +70, $475M 20Y +80

- 04/28 $800M #Omnicom 10Y +97

- 04/28 $750M #OQ (Oman energy co) 7Y 5.125%

- 04/28 $500M *Kookmin Bank 5Y +55

EQUITIES: Reassured by Fed, US Stocks Hit New Highs

- After shrugging off what could have been construed as a hawkish policy statement, US equity markets shot higher during Powell's press conference as the Fed chair reassured investors that it is still not the time to be talking about any tapering of asset purchases.

- Grilled on what conditions would be required to pressure the Fed to reduce asset purchases, Powell cemented his view that 'substantial' further progress is still needed. As such, equity markets rallied, with the e-mini S&P showing above the week's highs to hit another record.

- Energy and communication services names led gains, while financials' gains on a steeper yield curve were tempered by the slip in 10yr yields.

- The VIX traded under pressure as equities resumed their climb, inching back into negative territory ahead of the close.

COMMODITIES: WTI Crude Futures Print Fresh April Highs, Post 1% Gains

- Oil Benchmarks extended higher for a second consecutive session. WTI futures made new highs for the month at $64.53 before paring some of the gains as we approached the FOMC rate decision.

- Little fresh news kept price action muted but signals of growing optimism allowed oil prices to consolidate gains on Wednesday. WTI - $63.84 (+1.43%) Brent - $67.23 (+1.22%)

- A fairly volatile day for precious metals, largely tracking movements in the US dollar. An initial bid let both gold and silver to their lowest levels for the week, before post-fed USD selling spurred a recovery to broadly unchanged levels.

- Spot gold $1,780.20 (+0.21%), Spot Silver $26.2230 (-0.17%)

- Similar price action for Copper. An easing of the tensions in Chile prompted port workers to halt protests. Comments that there were no immediate reports of disruptions to copper exports made prices retreat during the early part of the session, however a pre and post fed rally kept the red metal's persistent rally intact, gaining 0.57% to trade at $4.51 per pound.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.