-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ignoring Hawkish Fed Comments

Ignoring Hawkish Fed Comments, For Now

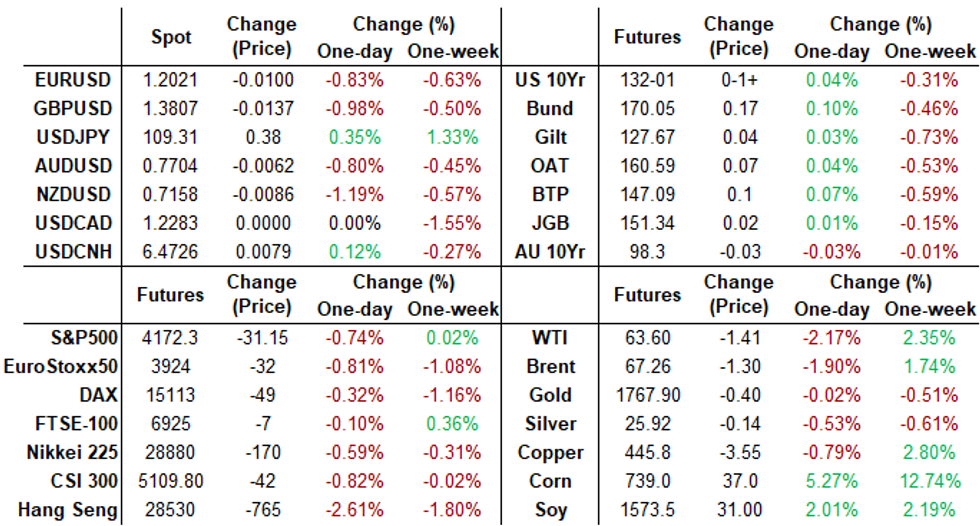

Mildly choppy session for rates, Tsys posting modest gains after the close, near top end Friday's range. Equities a little weaker but bouncing after the bell, S&P eminis -26.0 at 4177.5 -- vs. Thursday's all-time high of 4208.0.- Apparently taking Dallas Fed Kaplan (hawk, non-voter) comments that the Fed should start talking about tapering bond buying soon in stride. MNI interview w/former NY Fed pres Dudley warned the Fed may need to raise interest rates to at least 3.5% and perhaps even above 4% because its new framework will generate lags in responding to inflation that require more aggressive tightening later.

- Mixed data: MNI Chicago Business Barometer Surges to Near 38-Year High: 72.1 vs. 66.3 in March. Meanwhile, Personal Income/Spending And PCE Price Data In Line. Focus turns to next week Friday's employment data for April, current mean estimate: 975k job gains, +895k for private sector.

- Otherwise, generally quiet two-way month-end trade, broad decline in Govt/Credit and Intermediate credit extensions from year ago levels, while MBS surged (0.05 to 0.25).

- Salient Eurodollar options trade: late blocks pushed session volume buyer of Red June 99.37/99.62 put spds to near 90,000 from 2.5-3.0.

- The 2-Yr yield is down 0.2bps at 0.1604%, 5-Yr is down 1bps at 0.8541%, 10-Yr is down 0.5bps at 1.6294%, and 30-Yr is unchanged at 2.2982%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00150 at 0.07125% (-0.00212/wk)

- 1 Month -0.00288 to 0.10725% (-0.00375/wk)

- 3 Month +0.00075 to 0.17638% (-0.00500/wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month -0.00150 to 0.20488% (+0.00075/wk)

- 1 Year -0.00025 to 0.28113% (+0.00025/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $72B

- Daily Overnight Bank Funding Rate: 0.05%, volume: $269B

- Secured Overnight Financing Rate (SOFR): 0.01%, $838B

- Broad General Collateral Rate (BGCR): 0.01%, $373B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $47.196B submission

- Next scheduled purchases:

- Mon 5/03 1100-1120ET: Tsys 2.25Y-4.5Y, appr $8.825B

- Tue 5/04 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 5/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

US TSYS/OVERNIGHT REPO

Holding steady, 5s, 10s and 30s lead specials. Other current levels:

T-Bills: 1M 0.0025%, 3M 0.0076%, 6M 0.0279%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.00% | -0.03% |

| 3Y | 0.00% | -0.07% |

| 5Y | 0.00% | -0.09% |

| 7Y | 0.00% | -0.07% |

| 10Y | -0.10% | -0.09% |

| 30Y | -0.10% | -0.06% |

MONTH-END EXTENSION ESTS: UPDATED Barclays/Bbg Extension Estimates for US

Updated Forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; Govt inflation-linked, 0.17. Note broad decline in Govt/Credit and Intermediate credit from year ago levels, while MBS extension est surges.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.08 | 0.13 |

| Agencies | 0.05 | 0.04 | 0.03 |

| Credit | 0.06 | 0.1 | 0.2 |

| Govt/Credit | 0.08 | 0.09 | 0.17 |

| MBS | 0.25 | 0.06 | 0.05 |

| Aggregate | 0.12 | 0.08 | 0.08 |

| Long Gov/Cr | 0.06 | 0.09 | 0.06 |

| Iterm Credit | 0.08 | 0.08 | 0.2 |

| Interm Gov | 0.09 | 0.08 | 0.1 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.15 |

| High Yield | 0.1 | 0.11 | 0.08 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +90,000 Red Jun 93/96 put spds, 2.5-3.0 (30k late session block)

- +14,000 Green Jun 99.375/99.437 1x2 call spds, .75cr

- +7,000 Green Jun 99.43/99.50/99.56 1x3x2 call flys, 0.0

- +10,000 Blue Sep 81/83 put spds 0.25-0.00 over Blue Sep 86/88 call spds, adds to +10k Block earlier paying 0.5

- Block +10,000 Blue Sep 81/83 put spds 0.5 over Blue Sep 86/88 call spds at 0856:49ET, familiar theme better put skew buying for 2024

- +5,000 Dec 99.75/99.81 call strip 1.0 over Oct 99.75/99.81 call strip

- +5,000 Red Mar 98 calls, 2.5

- -5,000 Blue Jun 82/90 strangles, 3.75

- +2,000 Green Jul 88 puts 0.5 over Blue Jul 80 puts

- +2,000 Green Jun 99.312 straddles, 16.0

- -3,000 Blue Aug 95 straddles, 38.5

- +12,000 wk2 TY 131 puts, 9

- 7,500 TYM 133.5/134.5 1x2 call spds

- -5,000 wk5 TY 132 calls, 4 -- expire today

- +7,500 TYM 131/132 1x2 call spds, 8

- +1,250 TYM 132 calls, 33 vs. 131-30/0.49%

EGBs-GILTS CASH CLOSE: Month Ends With Modest Strength

EGBs and Gilts largely drifted in the afternoon (shrugging off weakness in US Tsys on strong MNI Chicago PMI and hawkish comments by Fed's Kaplan), with Bunds seeing support from large Month End extensions. Periphery spreads ended flat/marginally wider.

- Early focus was on eurozone data: flash 1Q GDP were mixed (France stronger, Italy a bit above consensus, Spain in line, Germany weak in Q/Q terms) - and EZ as a whole contracted for the 2nd consecutive quarter.

- Otherwise, flash Apr inflation data and Spain retail sales had little market impact.

- A few ratings decisions after hours Friday, none expected to have major impact (Germany, Italy among others). Monday sees a UK holiday and thus likely subdued trading volumes; attention will turn quickly to Thursday's BoE decision.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.4bps at -0.682%, 5-Yr is down 1.5bps at -0.577%, 10-Yr is down 0.9bps at -0.202%, and 30-Yr is down 0.3bps at 0.357%.

- UK: The 2-Yr yield is up 0.2bps at 0.08%, 5-Yr is up 0.3bps at 0.39%, 10-Yr is down 0.1bps at 0.842%, and 30-Yr is down 0.5bps at 1.342%.

- Italian BTP spread unchanged at 110.6bps/ Spanish spread up 1bps at 67.8bps

OPTIONS/EUROPE SUMMARY: Downside In Euribor Blues Remains The Theme

Friday's options flow included:

- RXM1 169/167.5/166p fly, sold at 18 in 1k

- RXM1 170/169ps 1x2, sold at 3 in 3k

- RXM1 170.5/171.5/172.5c fly sold at 17 in 2.5k

- RXN1 168.00p, was bought for 25 in 10k

- RXU1 169.50/167.50ps vs 175.50c, bought the ps for 2 in 3k

- RXU1 172/169.5ps 1x1.5, bought for 50.5 in 2k

- ERH3 100.375^ bought for 31.75 in 1k

- 2RU1 100.25/100.125 ps vs 100.50/100.625 cs, bought the ps for 1 in 5k

- 3RU1 100.12/100ps vs 100.25/100.37cs, bought the ps for 0.25 in another 5k, 25k+ on the day (v 100.145)

- LZ1 100/100.12/100.25c ladder, sold at flat in 6k

- LZ1 99.62p, bought 1.25 in 3k

- 0LZ1 993.62/99.87cs 1x2 with 99.75/99.87cs 1x2 as a strip, sold the 1s at 4.5 in 3k

- 2LU1 99.62/99.37ps vs 3LU1 99.12/98.87ps, sold the 2yr at 7 in 5k

- 2LU1 99.25p bought for 9.5 in 5k

FOREX: USD Bounces Well, Runs Against Month-End Assumption

- Running against most sell-side month-end models, the USD firmed smartly into the Friday close, running against the trend observed across the week.

- This put EUR/USD through first key support, with the pair looking to close back below the 100-dma of 1.2056. The downside pressure Friday makes the formation of a death cross (50-dma < 200-dma) more likely in the coming week, which would be the first since June 2018.

- CAD moved from strength-to-strength, with a market-wide commodity rally helping support oil- and commodity-tied currencies. This puts USD/CAD again at multi-year lows, narrowing the gap with key support at the 2018 low of 1.2251.

- Focus in the coming week turns to the US jobs report. Having added close to a million jobs last month, the US are expected to keep up the pace in April, with 965k jobs added over the month. The unemployment rate is seen edging lower by 0.3 ppts, dropping to a new post-pandemic low of 5.7%.

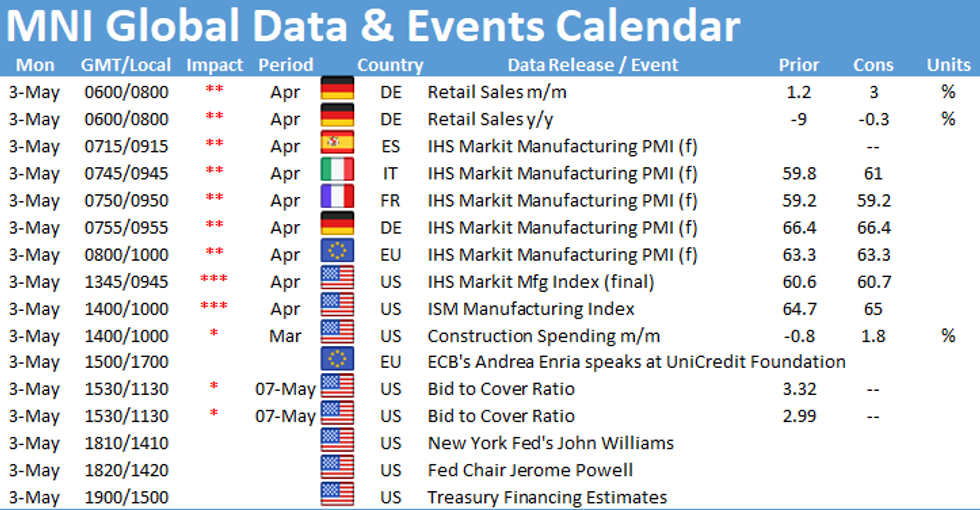

- Outside of data, central bank decisions are due from Australia, the UK, Brazil and Turkey.

FX OPTIONS: Expiries for May03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E881mln), $1.1950(E653mln), $1.2045-50(E765mln)

- USD/JPY: Y108.50($580mln), Y108.80($600mln)

- GBP/USD: $1.3700(Gbp1.3bln), $1.4300(Gbp1.1bln)

- AUD/USD: $0.7790-00(A$824mln)

PIPELINE: MoM High-Grade Issuance Review

April 2021 comes in third place so far this year with $183.4B -- and well off last year's all-time record of $401.325B. March still leads 2021 with stellar $232.62B high-grade corporate issuance vs. $275.48B for Mar 2020. Q1'21 ahead last years pace $618.03B vs. $548.16B.

| Apr'21 | $183.4B |

| Mar'21 | $232.62B |

| Feb'21 | $157.86B |

| Jan'21 | $227.55B |

| 2020 Recap: | Record $2.196T |

| Dec'20 | $52.24B; $796.54B H2 2020 |

| Nov'20 | $126.83B |

| Oct'20 | $111.65B |

| Sep'20 | $207.82B |

| Aug'20 | $204.50B |

| Jul'20 | $93.50B |

| Jun'20 | $180.50B; Record $1.40T H2 2020 |

| May'20 | $270.90B |

| Apr'20 | $401.32B |

EQUITIES: Markets Settle Close to Week's Low

- Despite the solid rally late on Thursday, equity markets sank on Friday to settle close to the week's lowest levels. The Doe Jones underperformed thanks to sizeable down-point contributions from Goldman Sachs, Chevron and Visa.

- Across the S&P 500, energy names led losses, with materials and communication services not far behind. Twitter was the largest decliner in the index, shedding over 10% after earnings.

- Continental markets were almost uniformly lower, with the EuroStoxx50 shedding 0.5%. UK's FTSE-100 was the standout, closing higher by 0.1% amid more broad GBP weakness.

- Earnings season isn't over, however, with reports still due from Berkshire Hathaway, Pfizer, T-Mobile US and PayPal among others. Full earnings schedule here: https://roar-assets-auto.rbl.ms/documents/9732/MNI...

COMMODITIES: Dollar Bounce Halts Momentum Of Strong April Rally

- A strong US dollar and heavy equity indices kept risk on the backfoot on Friday, weighing on energy prices. Oil prices succumbed to the poorer sentiment, with both WTI and Brent crude falling around 2% approaching the close, however, held on to 3% gains for the week.

- Month end profit taking may have been a contributing factor as benchmarks are likely to post a rally in the region of 6% for the month of April. Analyst's views remain upbeat as Chinese and U.S. demand recovery in the next three months alone is likely to be above 1 million barrels per day and offset the widely expected drop in Indian demand.

- Levels as we approach the close in active futures contracts: WTI $63.60 / Brent $67.33

- Gold spent Friday in a narrow range, consolidating at marginally lower levels on the week around $1,770 an ounce. The firmer dollar has prompted some weakness, however underlying technical conditions remain bullish. Attention is on the key resistance at $1797.9, Apr 22 high where a break would confirm a resumption of the recent price rally.

- Notably elsewhere, palladium prices breached $3,000/oz for the first time. This extends the rally to over 25% YTD, as the commodity tide continues to lift all boats.

- Cycle highs have been posted in copper, iron ore, soy, corn, lumber and others this week - with Biden's infrastructure plan, the long-awaited post-pandemic economic recovery and a resurgence in Chinese demand all being cited as behind the recent rally and bolstered outlook for the commodity complex.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.