-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI ASIA MARKETS ANALYSIS: +1M Apr NFP Not Enough to Taper

US TSY SUMMARY: Exogenous Factors Upset Calm Ahead April Jobs Report

Choppy day for US FI rates, several exogenous events at play early in the session, while anticipation over whether Fri's April employment report will turn out to be a "monster" or not. First, the exogenous factors:

- Pre-open chop after the BoE anncd steady rate, slowed the pace of QE but no tapering. Bonds surged to pre-open highs and quickly evaporated with futures gradually extended session lows by midmorning.

- Rates surged again on of all things .. headlines over fishing rights around Jersey Island with both UK and France briefly sending navy vessels to the region (much more to the story including Brexit differences, threats of cutting off power to the island etc).

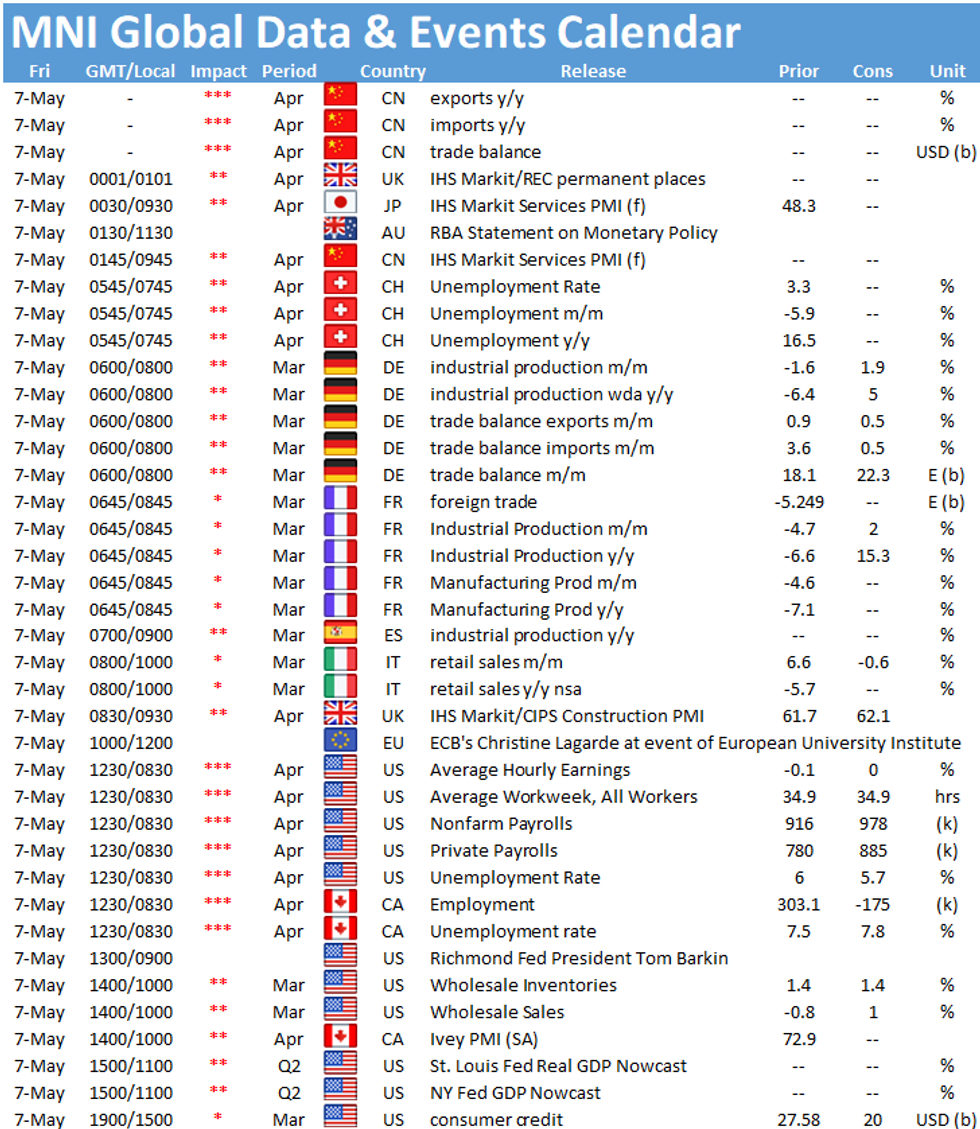

- Tsys see-sawed near top end of range as the Jersey dust-up settled and focus turned to Fri's employ data: mean estimate now +1.0M jobs (73 estimates from +700k low to +2.1M high. Atl Fed Bostic est's +1M job gains for April -- good, but not enough to get him to green-light tapering bond buying, unlike Dallas Fed Kaplan.

- Couple highlights in Eurodollars: lead quarterly EDM1 +0.010 to 99.83 after 3M LIBOR set's new all-time low: -0.00788 to 0.16200% (-0.01438/wk). Massive put position build: over +145,000 Blue Sep 80 puts 6-6.5 (if NOT a rate hike play, traders think paper hedging taper bets ahead Jackson Hole in August.

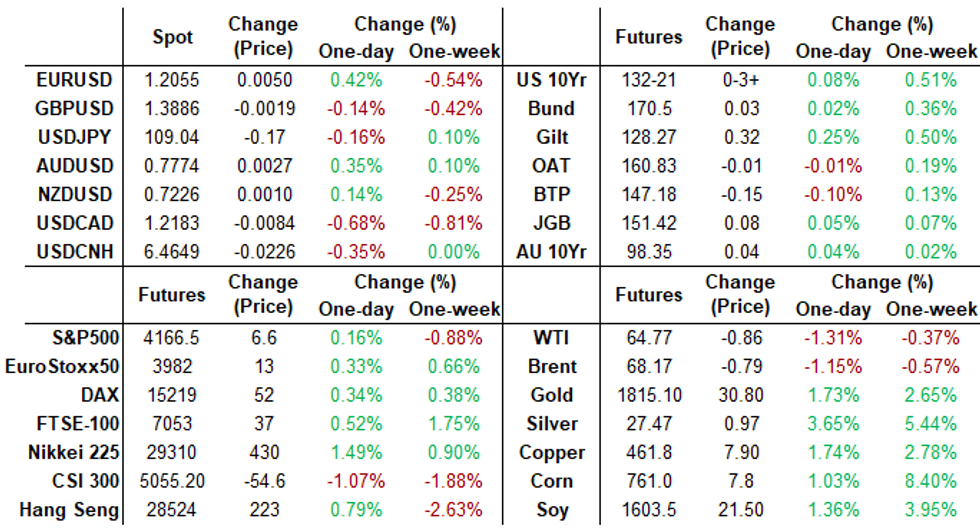

- The 2-Yr yield is up 0.4bps at 0.1546%, 5-Yr is up 0bps at 0.7933%, 10-Yr is down 0.9bps at 1.5572%, and 30-Yr is down 1.1bps at 2.2319%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00363 at 0.06425% (-0.00700/wk)

- 1 Month -0.01050 to 0.09513% (-0.01212/wk)

- 3 Month -0.00788 to 0.16200% (-0.01438/wk) ** (NEW Record Low)

- 6 Month -0.00050 to 0.20013% (-0.00475/wk)

- 1 Year -0.00550 to 0.27350% (-0.00763/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $73B

- Daily Overnight Bank Funding Rate: 0.05% volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.01%, $841B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $343B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.677B submission

- Next week's schedule

- Mon 5/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 5/11 1010-1030ET: TIPS 1-7.5Y, appr $2.425B

- Wed 5/12 1500ET Update NY Fed Operational Purchase Schedule

US TSYS/OVERNIGHT REPO

Largely steady to prior session lvls, 10s and 30s continue to lead specials. Other current levels: T-Bills: 1M 0.0025%, 3M 0.0101%, 6M 0.0330%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.00% |

| 3Y | -0.03% | -0.09% |

| 5Y | -0.01% | -0.06% |

| 7Y | -0.01% | 0.00% |

| 10Y | -0.12% | -0.09% |

| 30Y | -0.12% | -0.08% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +145,000 Blue Sep 80 puts, 6.0-6.5

- -25,000 short Sep 81 calls, 1.0-0.5

- +7,000 Green Dec 92/93/95/96 call condors, 3.0

- Update, 12,000 Mar 99.75/99.812 1x3 call spds, 2cr

- +2,500 long Green Mar 80 puts. 27.0

- +4,250 Blue Jun 87 puts, 14.0

- +1,700 Green Dec 90 straddles, 44.0

- +5,000 Blue May 98.50/98.62 put spds, 2.25

- +5,000 Sep 99.812/99.875 1x2 call spds, 0.5

- -2,000 Green May 93 straddles, 7.5

- +2,000 Blue Jun 83/85 3x2 put spds, 2.0

- Overnight trade

- +12,000 Jun 99.687/99.75/99.812 put flys, 0.5

- +20,000 Jun/Sep 99.812 put spds, 1.5

- 7,500 Sep 99.75/99.812 1x3 call spds

- 7,500 Mar 99.75/99.812 1x3 call spds

- +4,000 Red Jun 92/95 put spds, 1.5

- +5,000 Blue Sep 80/82 put spds, 5.0

- +2,500 Blue Sep 81/83 put spds .5cr vs. 87/90 call spd

- +3,000 Blue Dec 80/82 put spds 1.0 over 87/90 call spd

- +3,000 Blue Mar 75/77 put spds 0.0 over 88/91 call spds

Treasury Options:

- 3,000 122.25/123 put spds vs. FVU 124.25/125 call spds

- 3,000 TYM 131.75/132.5 3x1 put spds, 7

- +1,000 TYN 129/130/131/131.5 broken put condors, 1 and bid for another 4k

- +1,200 TYU 129/130 put spds, 15

- +23,000 wk2 133.25 calls, 9

- +10,000 wk1 TY 131.75 puts, 2

- +1,000 USM 162/164 call spds, 6

- Overnight trade

- +20,000 TYM 130 puts, 2

EGBs-GILTS CASH CLOSE: Price Swings Both Ways As Markets Digest BoE

Gilts swung in both directions following the BoE's decision to slow asset purchases while downplaying it as an active policy shift. After initially dropping sharply, Gilt yields rose to session highs, before eventually moving lower again later in the afternoon as equities bounced.

- EGBs saw a bit of selling interest in the afternoon (possibly ahead of Friday's U.S. payrolls data), but again, recovered later in the session.

- Notably BTP yields / spreads rose, with both Bloomberg and Reuters separately citing speculation from market sources over a potential new 30-Yr bond syndication (no confirmation as yet).

- German Mar factory orders beat expectations.

- Supply was from France (OATs, EUR10.4bn) and Spain (Bono/Oblis/ObliEi, EUR5.4bn).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.4bps at -0.691%, 5-Yr is up 0.4bps at -0.599%, 10-Yr is up 0.3bps at -0.225%, and 30-Yr is up 1bps at 0.341%.

- UK: The 2-Yr yield is down 1.5bps at 0.039%, 5-Yr is down 2.5bps at 0.334%, 10-Yr is down 2.7bps at 0.792%, and 30-Yr is down 0.8bps at 1.318%.

- Italian BTP spread up 1.6bps at 114.2bps/ Spanish spread up 0.3bps at 68.2bps

OPTIONS/EUROPE SUMMARY: Plenty Of Longer-Dated Euribor Intrigue

Thursday's options flow included:

- 0RH2 100.375/100.50^^ bought for 11.5 in 2k

- 0RH2 100.375/100.50 c1x3, buys the 1 receiving 0.5 in 10k

- 2RZ1 100.375^ bought for 14.5 in 3k and 20 in 2k

- 3RZ1 100.37/99.50 RR, bought the put for half in 20k (ref 100.125)

- 3RZ1 99.87/75/62/32 broken put condor, bought for 0.5 in 2.5k

- RXM1 172.00 calls trade for 17 in 5k (some suggest sold)

FOREX: BOE Sparks Volatile Session For Cable, CAD firmer Once More

- Unchanged policy from the BOE sparked a very brief GBP selloff to 1.3858 amid outside expectations the MPC might look to trim purchases. As the dust settled Cable reversed and USD weakness prompted a sharp reversal to intraday highs of 1.3940, before retreating once again.

- USDCAD downtrend remains intact Thursday, with the pair hitting new cycle lows, breaking the January 2018 lows below 1.2250. This keeps the pair solidly in bear mode after recent weakness.

- MA studies also highlight a downside bias, reinforcing current trend conditions. 1.2239, a Fibonacci projection, gave way, opening vol band support at 1.2143. On the upside, initial resistance is at 1.2365/2419.

- Broad dollar indices weakened by around 0.35% in line with EURUSD firming back to 1.2050. Our analyst notes a bearish theme remains with key resistance being defined at 1.2150, Apr 29 high. A firm support is at 1.2013/1989, the 20 and 50-day EMAs. This zone has been probed, a breach would trigger a stronger sell-off.

- EMFX led gains on Thursday against the dollar with MXN, TRY, BRL and RUB all strengthening between 0.75-1.5%.

FX OPTIONS: Expiries for May07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1895-10(E1.2bln), $1.2025-40(E2.3bln), $1.2100(E749mln)

- USD/JPY: Y106.60($500mln), Y109.00-10($988mln)

- GBP/USD: $1.3900(Gbp842mln)

- EUR/GBP: Gbp0.8650-60(E625mln)

- AUD/USD: $0.7800(A$1.1bln)

- USD/CAD: C$1.2400-20($938mln)

PIPELINE: $1.25B NatWest Markets Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/06 $1.5B *EIB 10Y +10

- 05/06 $1.25B #NatWest Markets $950M 3Y +55, $300M 3Y FRN SOFR+53

- 05/06 $1B Banco Santander Perp NC6 4.75%

- 05/06 $1B #Broadbridge Fncl 10Y +105

- 05/06 $800M *ENN Natural Gas 5NC3 +265

- 05/06 $800M #Weir Group 5Y +145

- 05/06 $700M *NIB 5Y FRN SOFR+19

- 05/06 $Benchmark ORBIA 5Y +115a, 10Y +150a

- 05/06 $Benchmark SVB Fncl 7Y +110a

EQUITIES: Stocks Mixed as Bluechips Gain, Tech Lags

- Equity markets started stubbornly, with the e-mini S&P edging through the overnight and Wednesday lows shortly after the opening bell.

- Fortunes swung slightly after the London close, however, with bluechip stocks - namely consumer staples - helped fuel a mild recovery back toward the Wednesday highs of 4180.

- Consumer staples and financials were among the strongest performing sectors. Post-earnings, Kellogg Co traded very well, with the stock higher by 7% shortly after the open on an upgraded outlook. In contrast, healthcare performed poorly as Pfizer shares shed near 3% after Biden's call to waive COVID vaccine patents.

- NASDAQ futures underperformed the equivalent Dow Jones and S&P contracts, before finding some support at the Jun-21 50-dma at 13,344.

COMMODITIES: Gold Bumped to New Multi-Month Highs

- Spot gold cleared decent resistance layered between the May/April highs at 1796-98 Thursday, hitting the best levels since mid-February. The gains confirm a resumption of the uptrend that started early August where a reversal pattern in the shape of a double bottom began. This pattern was confirmed on Apr 8.

- The move higher paves the way for a climb towards $1818.1, the 50.0% retracement of the Jan 6 - Mar 8 sell-off.

- Energy markets were less fortunate, with the oil price rally seen earlier in the week running out of steam and fading into the close. WTI and Brent crude futures gave back around $1/bbl of the recent rally, running lower despite a pullback in the USD. These relieves some technical indicators that were beginning to err toward overbought, suggesting this may be a pause, rather than an end, to the recent rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.