-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Track Higher Equities

US TSY SUMMARY

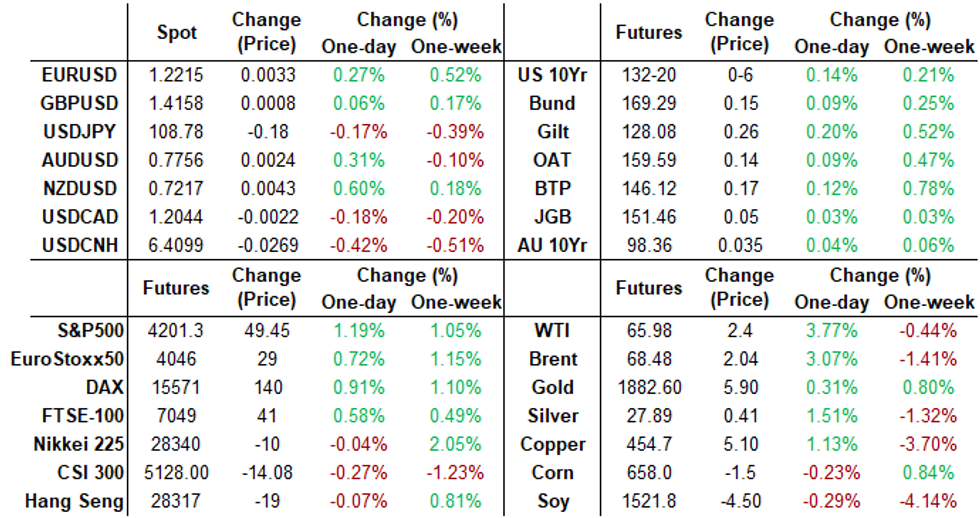

Rates tracked equities higher in early trade Monday, no obvious driver at play on a light data week opener.- Heavy volumes on net tied to pick-up in June/Sep quarterly rolling ahead Friday's first notice date. Take away the roll volume and June 10Y futures traded just over 1M. 5Y roll outpaced 10s with over 1.1M by the close.

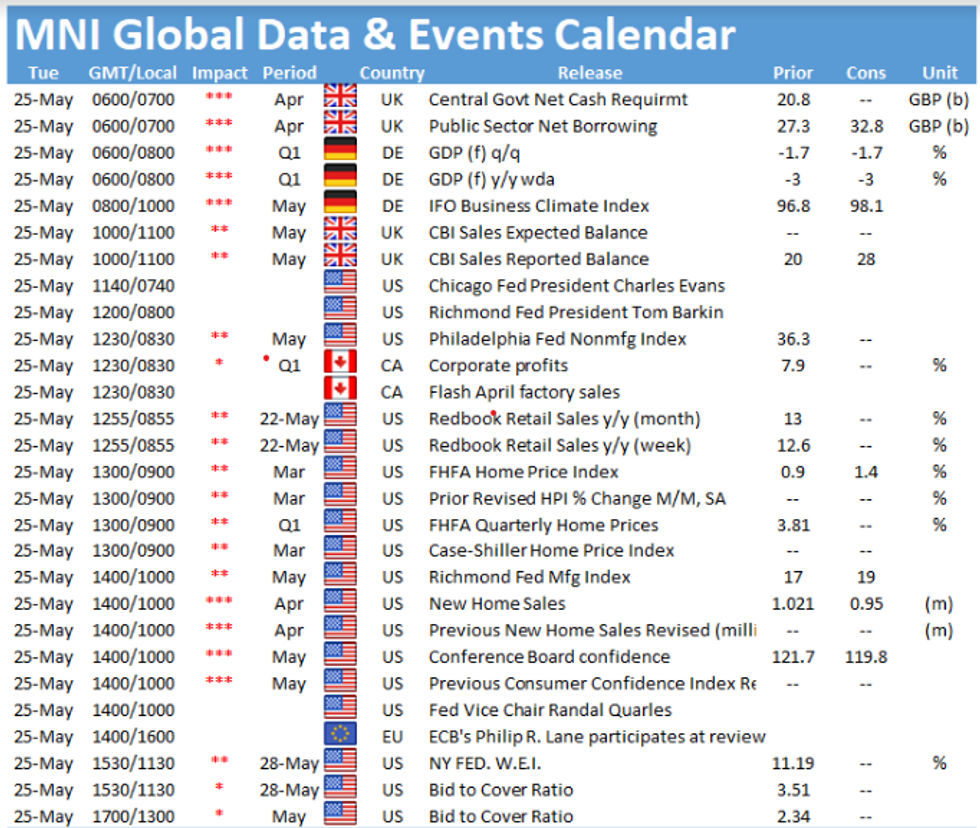

- Data picks up as week progresses, Tuesday focus on a slew of Fed speakers, more housing data, consumer confidence and 2Y Note auction.

- Short FI/FX session Friday ahead extended Memorial Holiday weekend with markets closed Monday.

- The 2-Yr yield is down 0.2bps at 0.1513%, 5-Yr is down 1.5bps at 0.8066%, 10-Yr is down 1.5bps at 1.6063%, and 30-Yr is down 1.4bps at 2.304%

MONTH-END EXTENSIONS/PRELIM: Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.02Y. Note: fairly steady to year ago levels, while MBS extension est gains.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.12 | 0.08 | 0.11 |

| Agencies | 0.04 | 0.11 | 0.01 |

| Credit | 0.10 | 0.08 | 0.08 |

| Govt/Credit | 0.10 | 0.08 | 0.10 |

| MBS | 0.13 | 0.06 | 0.05 |

| Aggregate | 0.11 | 0.08 | 0.09 |

| Long Gov/Cr | 0.10 | 0.09 | 0.10 |

| Iterm Credit | 0.08 | 0.07 | 0.08 |

| Interm Gov | 0.09 | 0.08 | 0.08 |

| Interm Gov | 0.09 | 0.08 | 0.08 |

| High Yield | 0.1 | 0.06 | 0.04 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00050 at 0.05925% (-0.00225 total last wk)

- 1 Month -0.00063 to 0.09100% (-0.00587 total last wk)

- 3 Month -0.00612 to 0.14088% (-0.00813 total last wk) ** (Record Low)

- 6 Month -0.00212 to 0.17663% (-0.00888 total last wk)

- 1 Year -0.00138 to 0.25825% (-0.00625 total last wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $65B

- Daily Overnight Bank Funding Rate: 0.05% volume: $270B

- Secured Overnight Financing Rate (SOFR): 0.01%, $857B

- Broad General Collateral Rate (BGCR): 0.01%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.001B accepted vs. $4.696B submission

- Next scheduled purchases:

- Tue 5/25 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 5/26 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 5/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 short Jul 95/96/97

- Overnight trade

- Block, 8,700 Blue Sep 81/83 put spds, 6.5 vs. 98.53/0.15%

- 4,000 Dec 99.87/99.93 call spds

- 6,000 Sep 99.75/99.81 put spds

- 1,500 Sep 99.75/99.81 2x1 put spds

- +18,000 FVU 120 puts, 3.5

- +4,000 wk4 US 158 calls 5

- +4,000 TYN 133/134 call strip even over -8,000 TYQ 134.5 calls

- +3,500 TYU 133.5 calls, 27

- -1,600 TYQ 131.5/132 strangles, 131 earlier

- +4,000 TYN 130/132 put spds 25 over TYQ 131.5/132 put spds

- another +10,000 wk4 TY 130.5/131 put spds (expire Friday), 2.0

- Overnight trade

- 20,000 wk4 TY 130.5/131 put spds (expire Friday)

EGBs-GILTS CASH CLOSE: UK Curve Sees Bull Flattening

Gilts outperformed Bunds Monday with peripheries fairly flat, on a thin-trading session (volumes running <50% of average) due to the Pentecost holiday observed throughout much of Europe.

- BOE officials addressed the TSC; main messages were that UK may needs "modest" monetary tightening (Saunders), inflation rise this year looks temporary (Gov Bailey). The ECB reported that net asset purchases remained steady last week, with PEPP buys up slightly.

- EU-Belarus tensions were an undercurrent for most of the day, but market implications were limited.

- No data and no bond issuance today; Netherlands sells up to E2bln of 2047 DSL Tuesday, while UK likely to sell new 0.125% Sep-39 Gilt linker via syndication.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.2bps at -0.656%, 5-Yr is down 0.9bps at -0.53%, 10-Yr is down 1bps at -0.14%, and 30-Yr is down 0.3bps at 0.419%.

- UK: The 2-Yr yield is down 1bps at 0.032%, 5-Yr is down 1.6bps at 0.339%, 10-Yr is down 1.9bps at 0.811%, and 30-Yr is down 2.4bps at 1.359%.

- Italian BTP spread up 0.2bps at 116.4bps / Spanish spread unch at 68.3bps

OPTIONS: EUROPE SUMMARY: Mixed Rates Trade

Monday's options flow included:

- RXN1 167.5p, sold at 9 in 5k

- 2RH2 100.00/25/62 broken c fly 1x2.5x1.5, bought for 1.25 in 4k

- 0LZ1 99.62/75/100c fly bought for 2.25 in 6.5k

- 2LN1 9925/9912ps 1x1.25 vs 9962 c, bought the ps for flat in 3k

FOREX: Bitcoin Carnage: Easy Gains, Easy Losses

- Despite the constant flow of global macro and geopolitical news, the recent carnage in the cryptocurrency market stole the 'show' in the past two weeks with Bitcoin experiencing a 50-percent drawdown from peak to trough.

- It is interesting to see that some media news and market participants have been surprised by the plunge in the crypo market; however, it is important to recall that the recent consolidation comes after a fifteen-fold rise in the price (from its low reached in March 2020 to its record high of 64,870 in mid-March).

- We know that one fundamental rule in finance is 'Easy gains come with easy losses'; there has never been an asset in history of finance that has continuously trended higher without ever experiencing a moderate to significant drawdown.

- This chart (Bitcoin in log term) shows that periods of significant appreciation in Bitcoin prices have generally been followed by short periods of sharp consolidation.

- For instance, Bitcoin experienced three significant drawdowns (of 35%, 40% and 26%, respectively) during the 2017 rally, and then was eventually followed by a LT retracement of 84% in 2018.

- 2021: is it just a short-term retracement or the start of a LT bear consolidation?

FX OPTIONS: Expiries for May25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-1.2105(E1.3bln-E1.2bln of EUR puts), $1.2150-60(E517mln), $1.2215-25(E535mln), $1.2260-75(E1.1bln)

- USD/JPY: Y107.50-60($1.1bln), Y107.85-108.05($1.5bln)

COMMODITIES: Oil Extends Bounce, Opens 5% Gap With Friday lows

- Both WTI and Brent crude futures traded solidly higher Monday, with both benchmarks registering gains of 3% apiece to extend the bounce from Friday's lows. Much of the price action last week had been dictated by the possibility of an Iranian sanctions deal, however differences cited this morning between the two sides underpinned a recovery in the energy complex.

- Monday's rally in WTI crude futures brings the benchmark within range of the next key resistance at the 2.00 proj of Mar 23 - 30 - Apr 5 price swing at $67.25 mark.

- Precious metals traded steady, with spot gold and silver both in minor positive territory. The modestly lower USD index was largely responsible, although sliding US Treasury yields were also a contributory factor.

EQUITIES

Key late session market levels:

- DJIA up 234.78 points (0.69%) at 34440.36

- S&P E-Mini Future up 51 points (1.23%) at 4202.75

- Nasdaq up 228 points (1.7%) at 13699

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.