-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Housing Tailwind for Rates

US TSY SUMMARY

Rates and equities reverted back to negative correlation for the day, rates near highs after the bell (bonds lead, curves bull flattening) while equities pared early gains/traded weaker in the second half (eminis -6.0 after rates close).

- Modest support after flurry of housing data (new home sales decline 5.9%/Apr), consumer confidence (117.2 for May vs 117.5 in Apr). Fed speakers

Clarida at crypto conf: (PUTTING A LOT OF WEIGHT ON INFLATION EXPECTATIONS" Bbg, adding "MAY COME A TIME AT UPCOMING

MEETINGS TO TALK TAPER." - Strong $60B 2Y note (91282CCD1) auction trades through with high yield of 0.152% vs. 0.160% WI, strongest in over a year. Tsy futures gain slightly, extend duration..

- Bid-to-cover 2.74x, highest since Aug '20, compares to 2.49x 5 month average.

- Indirects take-up climbs to 57.06% vs. 43.35% in April; direct bidder take-up at 18.03% vs. 18.42% last month, primary dealer take-up of 24.91% well below 5-month average of 32.15%.

- Heavy Jun/Sep quarterly Tsy futures roll volume near 7M ahead Friday's first notice when Sep takes lead contract. Roll appr 60% complete after the bell.

- The 2-Yr yield is down 0.6bps at 0.1433%, 5-Yr is down 3.2bps at 0.771%, 10-Yr is down 4.1bps at 1.5604%, and 30-Yr is down 4.3bps at 2.2562%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00138 at 0.06063% (+0.00088/wk)

- 1 Month -0.00100 to 0.09000% (-0.00163/wk)

- 3 Month -0.00238 to 0.13850% (-0.00850/wk) ** (Record Low)

- 6 Month +0.00012 to 0.17675% (-0.00200/wk)

- 1 Year -0.00225 to 0.25600% (-0.00363/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $64B

- Daily Overnight Bank Funding Rate: 0.05% volume: $265B

- Secured Overnight Financing Rate (SOFR): 0.01%, $858B

- Broad General Collateral Rate (BGCR): 0.01%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- Tsys 10Y-22.5Y, $1.401B accepted vs. $5.084B submission

- Next scheduled purchases:

- Wed 5/26 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 5/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

MONTH-END EXTENSIONS/PRELIM: Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.02Y. Note: fairly steady to year ago levels, while MBS extension est gains.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.12 | 0.08 | 0.11 |

| Agencies | 0.04 | 0.11 | 0.01 |

| Credit | 0.10 | 0.08 | 0.08 |

| Govt/Credit | 0.10 | 0.08 | 0.10 |

| MBS | 0.13 | 0.06 | 0.05 |

| Aggregate | 0.11 | 0.08 | 0.09 |

| Long Gov/Cr | 0.10 | 0.09 | 0.10 |

| Iterm Credit | 0.08 | 0.07 | 0.08 |

| Interm Gov | 0.09 | 0.08 | 0.08 |

| Interm Gov | 0.09 | 0.08 | 0.08 |

| High Yield | 0.1 | 0.06 | 0.04 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +11,000 Green Jun 93 puts, 3.0

- -15,000 Blue Sep 98.12/98.37 put spds, 6.0

- +3,000 gold Oct 70/72/75 2x3x1 put flys, 5.0

- +5,000 Jun/Sep 98 put calendar spds, 1

- -3,000 Red Mar 97/98 1x2 call spds, 1.75, 1-leg over

- Overnight trade

- +2,500 Gold Sep 78/81 put spds even over 82/85 call spd

- +2,000 Red Sep 95/96/97 put flys, 1.0 vs. 99.70/0.10%

- 3,000 TYQ 130/131.5/132 put trees w/TYN 1030 puts, 2.0

- Update, +8,700 FVN 124/124.5 call spds, 8.5

- Overnight trade

- +21,000 wk4 TY 131/131.25 put spds, 1 vs. 132-02 to -02.5

- 2,000 TYN 129/130/131 put flys

- 3,000 TYN 128/129 put spds

- 3,700 TYN 131 puts

- Block: -5,000 FVN 124 calls, 11

- +5,500 FVN 124/124.5 call spds, 8.5

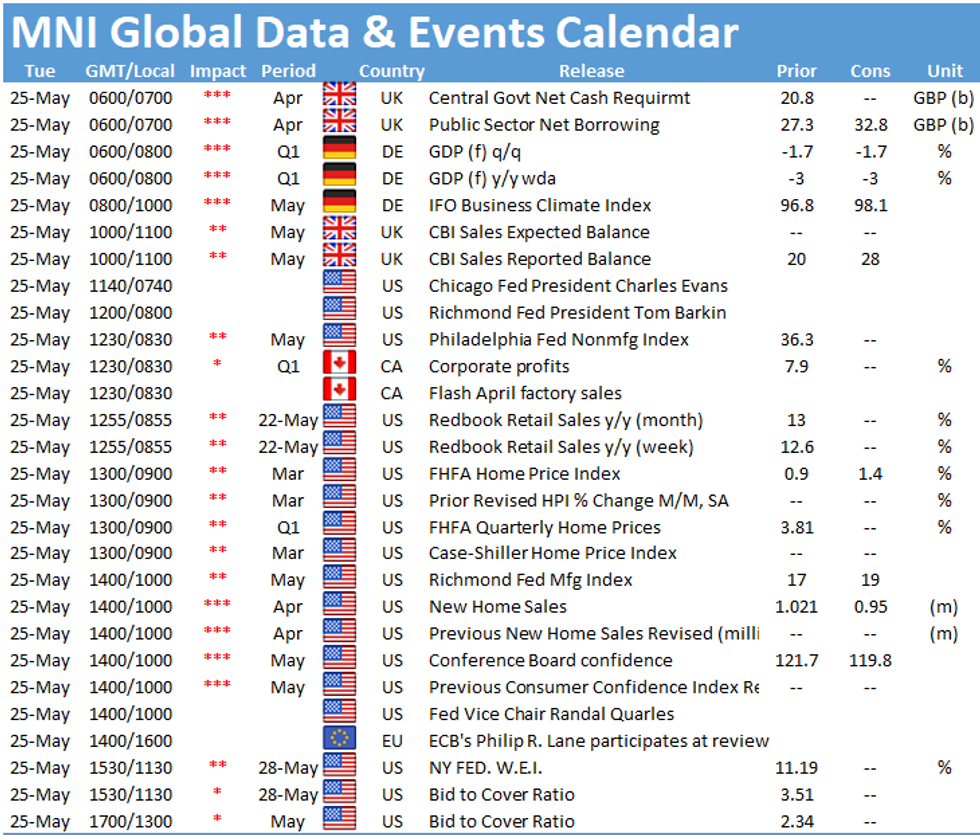

EGBs-GILTS CASH CLOSE: Villeroy Comments Help Underpin Afternoon Gains

Bunds and Gilts bull flattened Tuesday with periphery spreads compressing sharply. Gains were posted mainly in the afternoon.

- ECB's Villeroy said ECB can be patient as inflation is low; and that the idea of reducing the pace of PEPP buys in Q3 is "purely speculative" - helping boost the space, but particularly BTPs.

- In supply, UK sold GBP4bln of Mar-39 Gilt linker via syndication - which saw record demand and the highest amount in cash terms for a linker syndication; EU tapped Apr-36 bond for E460mln; Dutch sold E1.7bln of Jan-47 DSL at auction.

- German IFO slightly beat expectations; UK public sector borrowing lower than expected.

- On Weds, Italy sells up to E4.75bln of short-term BTP and BTPei; Germany sells E2.5bln of Bund. We get French confidence data and another appearance by Villeroy.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.7bps at -0.663%, 5-Yr is down 2.3bps at -0.553%, 10-Yr is down 2.7bps at -0.167%, and 30-Yr is down 2.3bps at 0.396%.

- UK: The 2-Yr yield is down 1.6bps at 0.016%, 5-Yr is down 1.8bps at 0.321%, 10-Yr is down 2.5bps at 0.786%, and 30-Yr is down 3.9bps at 1.32%.

- Italian BTP spread down 3.8bps at 112.6bps / Spanish spread down 2.3bps at 66bps

OPTIONS/EUROPE SUMMARY: Eyeing Positive Bund Yields

Tuesday's options flow included:

- RXN1 170.50/171.50/172.50c fly, sold at 19 in 1.5k (profit taking)

- RXN1 168p bought for 8 and 9 in 6k, (targets positive yields)

- 3RM1 100.37/50cs bought for 0.25 in 4k

- 3LM1 99.12/25/37c fly, bought for 5 in 3k

- LU1 99.87/100.00/100.12c fly 1x3x2, sold at 4 in 7.1k

- 0LZ1 99.625/99.75/100.00 broken call fly bought for 2.5 in 20k

- 2LZ1 99.375/99.50/99.62c ladder, bought for 1 in 2k

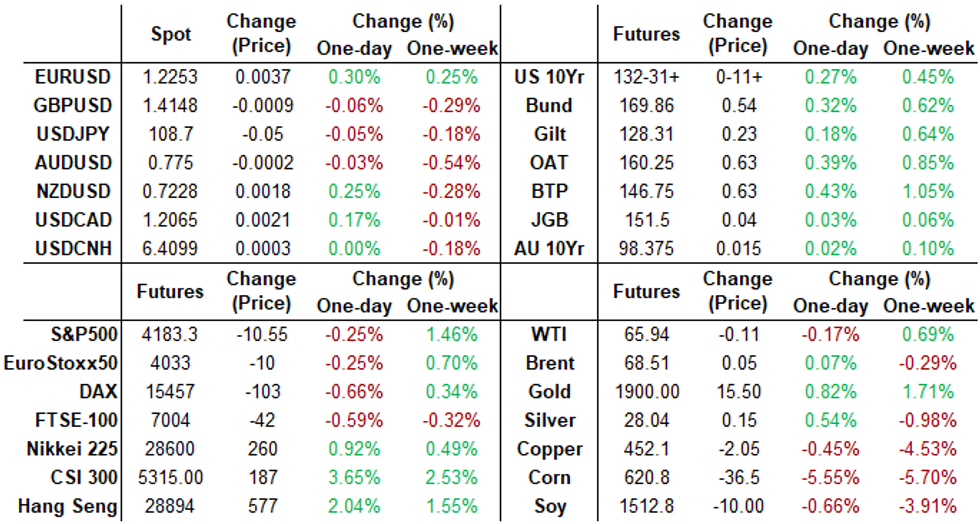

FOREX: Greenback Regains Posture in NY Hours

- Having traded poorly for much of the morning, the USD regained some posture throughout NY hours, helping drag EUR/USD off the day's best levels of 1.2266. An appearance from Fed's Clarida may have elicited some USD buying, as he stated that there may be a time in upcoming meetings when the Fed can discuss the scaling back of asset purchases.

- The JPY traded poorly throughout, falling against most others in G10 as global equity markets made headway toward all time highs. The S&P 500 cash index traded within 25 points of the early May highs, while the Stoxx 600 in Europe hit another record level. This positive sentiment bled well into EUR/JPY which cleared resistance to trade at 133.61, the highest level since early 2018.

- SEK and NOK were the strongest currencies in G10, while JPY and GBP traded poorly.

- There are no material economic releases Wednesday, keeping focus on central bank policy for now. ECB's Villeroy, Fed's Quarles and BoC's Lane make up the speaker slate.

FX OPTIONS: Expiries for May26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E628mln), $1.2075-90(E1.4bln-EUR puts), $1.2195-10(E876mln), $1.2220-30(E537mln)

- USD/JPY: Y108.00($1.0bln), Y108.25-35($534mln), Y108.80($604mln), Y109.25($725mln), Y109.50($879mln)

- EUR/GBP: Gbp0.8600-15(E1.1bln)

- AUD/USD: $0.7740-50(A$1.2bln-AUD puts), $0.7770-85(A$1.1bln-AUD puts)

- NZD/USD: $0.7205-17(N$599mln)

- USD/CNY: Cny6.35($650mln)

PIPELINE: Get While the Getting's Good, $7B AstraZeneca Launches

AstraZeneca launches $7B over six tranches, drops the 3Y FRN. Chatter had been the pharmaceutical would issue two tranches over 30Y. No investor interest there.

- Date $MM Issuer (Priced *, Launch #)

- 05/25 $7B #AstraZeneca 7pt jumbo: $1.4B 2Y +20, $1.6B 3NC1 +40, $1.25B 5Y +45, $1.25B 7Y +55, $750M 10Y +70, $750M 30Y +80. For comparison: AZN issued $3B last year Aug 3: $1.2B +5Y +55, $1.3B 10Y +85, $500M 30Y +100.

- 05/25 $2.75B Westpac $1.45B 5Y +40, $300M 5Y FRN SOFR+52, $1B 10Y +60

- 05/25 $2.5B #Deutsche Bank $1B 3Y +60, $1.5B 11NC10 +148

- 05/25 $2.3B #Hormel $950M 3NC1 +35, $750M 7Y +52, $600M 30Y +82

- 05/25 $2B *Emirate of Abu Dhabi 7Y +45

- 05/25 $500M *JAB Holdings 30Y +150

- 05/25 $Benchmark AAC Tech 5Y +185a, 10Y +225s

COMMODITIES: Gold Rebound Sets Sights on New Highs

- Gold and silver eschewed early weakness to trade solidly into the Tuesday close. Gold accelerated the day's gains on the way through the mid-May highs at $1890.1 to narrow the gap with the key psychological resistance at $1900 and hit new multi-month highs in the process. Next resistance kicks in at the Jan 8 high of $1917.6.

- Today's gold rally has put the metal's RSI at its most overbought levels of the year, with the indicator ticking above 75 for the first time since August last year.

- In the energy complex, falling Treasury yields and a softer greenback failed to prop up the oil market, as both WTI and Brent crude benchmarks consolidated recent gains. Negotiations over Iranian oil sanctions resumed in Vienna, with markets remained focus on any outcome here.

EQUITIES: Reversing Early Gains

- Equity futures traded particularly well throughout European hours, with the e-mini S&P trading within striking distance of the early May all time highs. Following the opening bell, however, markets consolidated, with indices drifting slightly lower in late trade.

- Slippage in energy and utilities stocks countered the progress made in real estate and industrials, leaving most cash markets broadly unchanged on the day.

- Economic re-opening names continue to outperform, with Carnival, Royal Caribbean and United Airlines among the S&P 500's top performers. Oil & gas names fell as Brent and WTI moderated. ExxonMobil and Occidental Petroleum were among the index's largest decliners.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.