-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bullard Kickstarts Reflation Unwind

US TSY SUMMARY: Bullard Kickstarts Reflation Unwind Theme

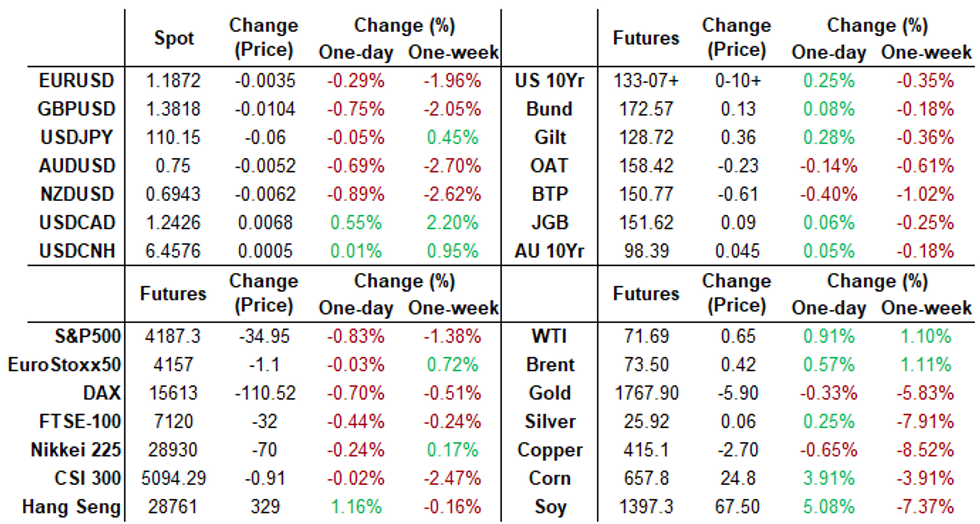

After some early chop w/Tsys and equities reversing late overnight gains, comments from StL Fed pres Bullard on CNBC kickstarted a more hawkish take on FOMC: Bullard DOTS sees liftoff in late 2022, sees Chairman Powell's presser as officially opening the discussion on tapering. Bullard also concerned about feeding into "housing froth", while "leaning toward idea Fed may not need to be in MBS." (MN Fed Kashkari, dove downplayed late: no hike until after 2023).- Curve flattening resumed in earnest as long end bounced/traded higher into late morning. Trading desks reported buy stops and forces steepener unwinds as Bonds continued to charge higher ahead midday. 5s30s slipped to 110.568 low.

- Tsy 30YY fell to 2.002% low, 2.0140% by the close

- Tsy 10YY fell to 1.4364% low, 1.4414% by the close

- Large Spd Volume Continues: Near 33,000 Mar'22/Jun'22 spds traded 0.060 recently, additional trades across Whites pushing volumes over 525k for strip, another 244k in first two Reds (EDU2-EDZ2).

- Carry-over heavy spd activity as prospect of tighter policy sooner than later roils markets: EDU2/EDU3 +4 to .630 Thu, EDU3/EDU4 fell 7.5 to .505, EDH3/EDH4 climbed to 64.5. Blocks: 20k each EDU2/EDU4 and EDZ2EDZ4.

- The 2-Yr yield is up 4.9bps at 0.2581%, 5-Yr is up 0.7bps at 0.8876%, 10-Yr is down 5.4bps at 1.4498%, and 30-Yr is down 7.1bps at 2.0213%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.01725 at 0.08050% (+0.02513/wk)

- 1 Month -0.00238 to 0.09100% (+0.01812/wk)

- 3 Month +0.00038 to 0.13488% (+0.01600/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month -0.00238 to 0.15625% (+0.00375/wk)

- 1 Year -0.00500 to 0.24013% (+0.00075/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08% volume: $226B

- Secured Overnight Financing Rate (SOFR): 0.05%, $998B

- Broad General Collateral Rate (BGCR): 0.05%, $393B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $347B

- (rate, volume levels reflect prior session)

Reminder: The Fed RRP surged to record high $756B yesterday after the Fed's technical adjustment to IOER from 0.10% to 0.15%

- Credit Suisse contributor Zoltan Pozsar says the repriced facility as "too generous" and will quickly become a "big problem for banks" as the "banking system is going from being asset constrained (deposits flooding in, but nowhere to lend them but to the Fed), to being liability constrained (deposits slipping away and nowhere to replace them but in the money market)."

- "So the sterilization of reserves begins, and so the o/n RRP facility turns from a largely passive tool that provided an interest rate floor to the deposits that large banks have been pushing away, into an active tool that "sucks" the deposits away that banks decided to retain."

- Quick-take: Zoltan sees LIBOR-OIS re-widening "unless the Fed lowers the o/n RRP rate!"

- Tsys 7Y-10Y, $3.199B accepted vs. $6.905B submission

- Next scheduled purchases:

- Mon 6/21 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 6/22 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 6/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 6/24 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/25 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo -- Off Thu's Record High (but not by much)

NY Fed reverse repo usage dips to $747.121B -- just off Thu's record high of $755.8B in the aftermath of FOMC's IOER technical adjustment to 0.15% from 0.10%.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +15,000 short Mar 96/98 1x2 call spds, 2.5

- -20,000 short Sep 95 puts, 4.0 -- traded 3.0 on over 20k early

- +30,000 Red Dec 90 calls, 56.5-57.0

- +30,000 each short Sep 95/97 and 95/97 put spd strips, 12.5

- +45,000 short Sep 96 puts, 6.5-7.0

- +20,000 short Oct 99.062/99.312 put spds, 2.5

- +1,500 Green Mar 87 straddles, 49.5

- 7,000 short Sep 100 calls, cab

- +21,000 short Sep 95 puts, 3.0

- Overnight trade

- 5,000 Dec 99.75/99.81/100.0 call flys

- 7,000 Dec 99.687 puts, 1.0

- 5,000 short Aug 99.312 puts

- 2,500 Blue Dec 97.50/97.87/98.25 put flys

- 3,500 Green Dec 88/90/92/93 iron condors

- 7,000 USN 159 puts, 20

- 3,800 TYQ 130/131 put spds, 11

- 15,000 TYQ 132 puts, 40

- -10,000 TYN 131 puts, 5, total volume over 18k

- +18,000 FVN 123.75 calls, 3

- +5,000 FVU 124 calls, 17.5-18 overnight

- 1,000 USN 154.5/155.5/156.5/157.5 put condors

BTP underperformance, the story of the day

A fairly busy session but also a puzzling one regarding semi core, with few dislocations.

- Still difficult to pinpoint a clear catalyst for the big underperformance in BTP today.

- This has been the question of the day in the street.

- Some suggestion a possible carry trade, but this has been unclear and unconfirmed

- Next support in the contract comes at 150.11 Low Jun 8 and key near-term support

- The spread versus the German 10yr has now widened by 6.7bps, moving from a 101.1828 low yesterday to 107.8517 today..

- Italy's Draghi also said that The European growth is bouncing back.

- And although the midday headline may have helped the downside momentum in BTP, the contract was under pressure from the open.

- Looking ahead, after market RATING:

- Fitch on Slovenia (current rating: A; Outlook Stable) & the United Kingdom (current rating: AA-; Outlook Negative)

- Moody's on Luxembourg (current rating: Aaa; Outlook Stable) & Slovakia (current rating: A2; Outlook Stable)

OPTIONS/EGBs

- +25,000 Aug Bund 170/175 put over risk reversals, 2-4

- 2LZ1 99.62/99.75cs, bought for 1.5 in 2.5k

- EURUSD (UEAZ1) Dec21 1.1750 put, bought for 0.01040 in 792 lots (160 days to expiry, underlying trades at 1.19635)

FOREX: Greenback Steamrolls Higher, Extending Post-Fed Rally

- One-way traffic in currency markets Friday saw the USD rally further, putting the USD Index at new multi-month highs and within range of the March highs of 93.44. These USD gains were mostly felt against NOK, NZD and GBP, which underperformed all others in G10.

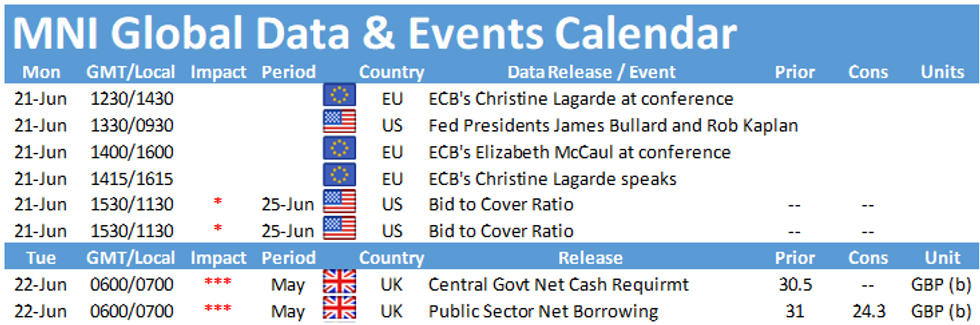

- Evidence of the FOMC's tilting hawkish bias further emerged as St Louis Fed's Bullard stated that it may become appropriate for the Fed to begin hiking interest rates next year in the face of above-target inflation. Bullard said "I put us starting in late 2022" when talking about rate liftoff.

- GBP/USD underperformed throughout following a set of weaker-than-expected retail sales figures. Retail sales fell 1.4% on the month, well below the expected gain of 1.5%, raising questions about the UK's post-pandemic recovery, which has been fuelled by solid consumption. By-election results in the UK also went against the ruling Conservative party, adding additional pressure to GBP/USD. The pair touched 1.3785 Friday, the lowest level since mid-April.

- Focus in the coming week turns to the Bank of England rate decision, German IFO figures and the May personal income/spending data from the US.

FOREX/Expiries for Jun21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E565mln), $1.1940(E553mln)

- USD/JPY: Y110.00($1.0bln)

PIPELINE: High-Grade Issuance Over $24B/Wk

$3.15B Priced Thursday; $24.05B/wk- Date $MM Issuer (Priced *, Launch #)

- 06/17 $1B *Kenya 2034 Bond 6.3%

- 06/17 $800M *GXO Logistics 5Y +85a, 10Y +120a

- 06/17 $750M *Eagle Materials 10Y +110

- 06/17 $600M *Sun Communities 10Y +125

EQUITIES: Equities Sag as Rate Rise Fears Prompt Jitters

- Equity markets across Europe and the US fell Friday, with the S&P 500 shedding close to 1%. The Dow Jones underperformed, with the index falling over 1.25% thanks to sizeable drops in Goldman Sachs, UnitedHealth and American Express.

- All sectors traded in the red, but losses were led by financials as bank stocks suffered under the pressure of a flatter US yield curve. Consumer discretionary firms posted the shallowest decline, falling 0.2% into the close.

- European stocks fell more sharply than their US counterparts, with the peripheral Italian and Spanish markets dropping close to 2% apiece, while the DAX and EuroStoxx50 shed 1.8%.

COMMODITIES: Oil Bounces, Eyes Iran Poll and Gulf Weather

- Having underperformed following the more hawkish-than-expected Fed rate decision on Wednesday, both WTI and Brent crude futures bounced Friday, with traders eyeing the presidential election in Iran and inclement weather developing in the Gulf of Mexico.

- This weekend's Iranian Presidential election results are expected to show a victory for Ebrahim Raisi, a more hardline leader relative to outgoing Rouhani. Markets are attempting to gauge the ramifications for any Iranian nuclear deal, with Axios reporting that the US is looking to secure a deal ahead of the new President's inauguration.

- Spot gold was broadly unchanged ahead of the close, holding above the Thursday low of $1767.3. The week's decline has been sizeable, with the weekly candle looking troubling for bulls. $1756.2 marks first support ahead of Fib support at $1733.5.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.