-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bullard Tempers the Inner Hawk

US TSY SUMMARY

Generally sedate, sideways trade since mid-morning, futures trading near session lows by the bell, yld curves regaining some ground after last week's post-FOMC bull flattening slip to 110.568 low from 142.541 high last week Monday.

- Tsy bonds extend lows after holding narrow/lower range for appr 4 hours heading into the NY open -- well off early overnight highs. Yld curves bounced after the steady bull flattening since last week's FOMC and hawkish pivot.

- Heavy overnight volumes (TYU >850k by the open; 1.7M after the close) after Tsys ground higher during Asia hours, only to reverse the move during the cross-over to London trade.

- 30YY currently 2.1083% +.0957 (2.1083%H, 1.9259%L)

- 10YY currently 1.4381% +.0455 (1.4903%H, 1.3526%L)

- Contributing to the bounce in yld curves: Bullard softened last week's more hawkish tone somewhat: "I think markets themselves are a little bit confused about the recent moves. I do think we're going to allow inflation to be above target...that has to get priced in."

- Mixed flow on session, decent corporate issuance hedging added to volumes.

- The 2-Yr yield is down 0.2bps at 0.2522%, 5-Yr is up 1bps at 0.8844%, 10-Yr is up 4.2bps at 1.4802%, and 30-Yr is up 8.3bps at 2.0954%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00425 at 0.08475% (+0.02513 total last wk)

- 1 Month +0.00488 to 0.09588% (+0.01812 total last wk)

- 3 Month +0.00300 to 0.13788% (+0.01600 total last wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month +0.00750 to 0.16375% (+0.00375 total last wk)

- 1 Year +0.01075 to 0.25088% (+0.00075 total last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $224B

- Secured Overnight Financing Rate (SOFR): 0.05%, $921B

- Broad General Collateral Rate (BGCR): 0.05%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $342B

- (rate, volume levels reflect prior session)

- Tsys 10Y-22.5Y, $1.401B accepted vs. $3.996B submission

- Next scheduled purchases:

- Tue 6/22 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 6/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 6/24 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/25 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo

NY Fed reverse repo usage climbs to new record high of $765.141B from 68 counterparties, compares to last Thu's record high of $755.8B in the aftermath of FOMC's IOER technical adjustment to 0.15% from 0.10%.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Gold Dec 77 puts, 11.0 vs. 98.21

- Block, 50,964 Blue Sep 98.62 puts, 22.5 vs. 98.53/0.61%

- +8,000 Green Jul 86 puts, 1.0

- +4,000 Green Sep 87 puts, 6.5 vs. 98.965/0.26%

- -10,000 Blue Dec 75/88 call over risk reversals, 3.5 vs. 98.46/0.31%

- -20,000 short Sep 95/96/97 put flys, 3.5

- -20,000 Blue Jul 86/87 put spds 7.5 over 88 calls vs. 98.555/0.27%

- Overnight trade

- 7,000 Mar'22 99.81/99.87/99.93 call flys

- 27,000 Mar'22 99.81/99.87 call spds

- 30,000 short Sep 96 puts, 7.5

- 10,000 short Sep 96/97 put spds

- 15,000 Blue Dec 76/80 3x2 put spds

- 1,500 Blue Sep 77/80/81/83 put condors

- 4,500 Gold Dec 77/80 put spds

- +10,000 TYN 129.5/TYQ 130 put spds, 7

- +11,000 TYN 130.5/131 put spds, 2

- +5,000 TYN 131.5/131.75/132 put trees

- -2,000 TYN 131.25/132 call spds, 37

- +8,000 TYN 131/132.5 call spds, 58

- Overnight trade

- +10,000 TYQ 131.5/132.5 2x1 put spds, 2

- 2,200 TYU 129/131 put spds vs. 134 calls

- 3,800 FVN 122.25/122.75/123.25 put flys

EGBs-GILTS CASH CLOSE: Reversal Sees Bear Steepening Curves

Core FI faded early gains, with the UK and German curves bear steepening Monday.

- Periphery EGB spreads tightened, while French OATs outperformed following weak results for Le Pen in weekend regional elections.

- Bunds weakened on headlines that German gov't net borrowing would hit ~E100bn next year (this had already been reported last week so unclear why there was a reaction).

- ECB Pres Lagarde said US inflation spillovers to the Eurozone are seen as being limited, while tightening market rates would pose a risk to the recovery. Meanwhile, ECB net asset purchases bounced back last week, with PEPP buys at a 4-week high of E19.4B.

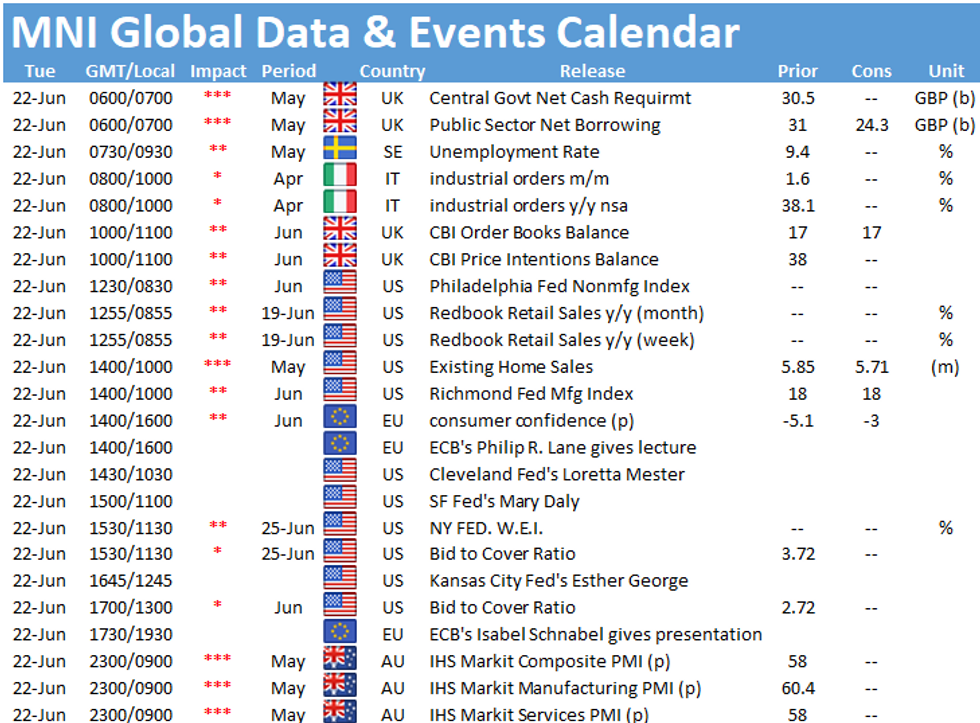

- Tuesday sees UK fiscal data and a few ECB speakers; the Netherlands sells up to E2bln of DSL. Note Spain announced 10-Yr syndication.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is up 1.5bps at -0.652%, 5-Yr is up 2.7bps at -0.561%, 10-Yr is up 2.9bps at -0.171%, and 30-Yr is up 5.2bps at 0.303%.

- UK: The 2-Yr yield is down 0.5bps at 0.125%, 5-Yr is up 0.4bps at 0.385%, 10-Yr is up 1.7bps at 0.769%, and 30-Yr is up 2.2bps at 1.227%.

- Italian BTP spread down 2.5bps at 104.7bps/ Spanish down 3bps at 62.5bps

OPTIONS/EUROPE SUMMARY: Summer Bund Puts And Some SONIA

Monday's options flow included:

- RXN1 172/173ps 1x2, bought for 9 in 1k

- RXQ1 171.50/170.50ps 1x1.5, bought for 9.5 in 2k

- RXQ1 170.5/170.0/169.5/168.5p condor, bought for 1 in 1.5k

- SFIH2 (SONIA) 99.70/99.65/99.60p ladder, bought for -0.25 in 2k

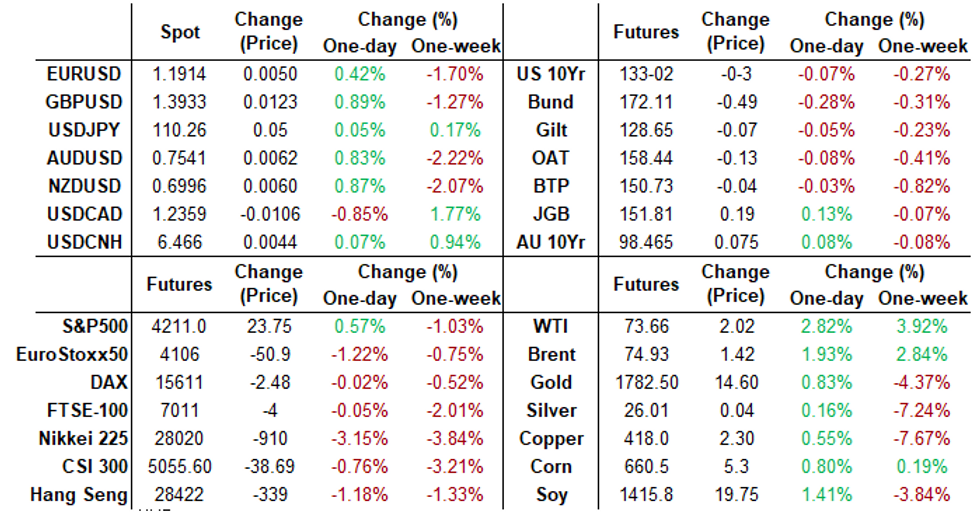

FOREX: Greenback Steadily Pares Friday Gains

- The US dollar retreated for the first time in seven sessions on Monday, closely linked to a gradual recovery in equities. The DXY retreated from a 10-week high, dropping 0.4%, currently hovering just above the Friday lows of 91.81.

- After matching Friday's low at 1.1848, EURUSD was well supported throughout both the European and US sessions, grinding back above 1.19 to advance 0.5% on the day. The focus is on 1.1837, a Fibonacci retracement where a break would open 1.1704, the Mar 31 low and a key support. On the upside, initial firm resistance is at 1.2006, the Jun 17 high.

- Larger gains were seen in risk-tied currencies with AUD, NZD, CAD and GBP all firming around 0.85%. The Japanese Yen was broadly unchanged, owing to buoyant risk sentiment also putting a solid bid in cross-JPY.

- NOK notably strengthened 1.05% against the dollar, with the uptick in oil adding a tailwind for the Krone. The advance was closely matched in the EM space, with ZAR and BRL both firming around 1%.

- Tomorrow, FED Chair Powell is due to testify on the Fed's emergency lending programs and current policies before the House Select Subcommittee.

- A light data day on Tuesday before Flash PMI's headline Wednesday's docket.

FOREX/Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2175(E536mln), $1.2220-25(E1.4bln-EUR puts)

- USD/CNY: Cny6.28($600mln), Cny6.35($600mln)

PIPELINE: Decent Start to Week

At least $8.15B high-grade issuance Monday, still waiting for JP Morgan- Date $MM Issuer (Priced *, Launch #)

- 06/21 $2.5B #HCA Inc $1B 10Y +95, $1.5B 30Y +140

- 06/21 $2.5B #Martin Marietta $700M 2NC1 +40, $900M 10Y +92, $900M 30Y +112

- 06/21 $2.15B #Bank of Nova Scotia $750M 2NC1 FRN/SOFR+28, $750M 5Y +48, $650M 5Y FRN/SOFR, 10Y +68

- 06/21 $800M #Brighthouse Fncl $450M 2Y +35, $350M 7Y +78

- 06/21 $650M #PPL electric Utilities 3NC1 FRN/SOFR+33

- 06/21 $Benchmark JP Morgan 4NC3 +50, 4NC3 FRN SOFR

- 06/21 $Benchmark BNP Paribas -- green bond investor call

- On tap for Tuesday:

- 06/22 $1B PSP Capital 5Y +9a

EQUITIES: Stocks Shake Off Unsteady Start

- Stock markets globally started Monday poorly, with futures all down sharply in initial Monday trade. This sentiment soon reversed, however, with a swift recovery in US equities helping underpin a global rebound. The Sep-21 E-mini S&P topped out at 4209.75. The Friday high at 4220.00 remains the next level to look out for.

- Energy names are driving markets higher here, with the sector higher by 3.3% in the S&P500, as new cycle highs for WTI crude futures underpin (recall BofA this morning upped their forecast for crude to $100/bbl next year).

- Industrials and financials are similarly firm, the latter benefiting from the modest re-steeping of the Treasury curve.

- A break north of 4220.00 for the e-mini S&P exposes the Jun 15 high at 4258.25 ahead of 4264.41, the 1.618 proj of Mar 25 - May 10 - 13 price swing

COMMDITIES: Oil Resumes Uptick as Raisi Seen Complicating Iran Nuclear Deal

- Oil markets were initially non-directional following Iranian election results that came in largely inline with expectations, with Ebrahim Raisi winning comfortably. Oil began to tick higher, however, as markets carefully eyed the President-Elect's first comments, oil traded more warily.

- Analysts are concerned that rights groups in the US could lean on negotiators to impose stricter demands on the lifting of Iranian sanctions given Raisi's alleged involvement in a series of mass killings and crackdowns.

- Elsewhere, Bank of America upped their oil call to be one of the most bullish on energy on the street, with the bank citing pent-up demand and a lack of mass transit capacity driving up private car use. As such, the Bank see WTI crude rising to as much as $100/bbl next year.

- Gold and silver both traded firmer Monday, with a weaker greenback helping relieve some of the recent downside pressure. Next level in gold sits at $1797.3.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.