-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Speak: Second Verse Same as First

US TSY SUMMARY: Frmr NY Fed Dudley: Don't Focus To Much on One Fed Pres

After some light two way after a flurry of mixed data (higher initial/lower continuing claims, better revisions on durables spurred some selling), Tsys extended highs before trimming gains -- kicking off a session of see-saw trade. Focus turned to half-dozen Fed speakers on the day, and final leg Tsy supply: $62B 7Y note.- Fed-speak really didn't break any new ground -- largely repeating already voiced opinions. Former NY Fed pres Bill Dudley did weigh in, however, suggesting the "FED WILL BE 'PRETTY PATIENT' HERE" and not to "PUT TOO MUCH WEIGHT ON WHAT ONE FED PRESIDENT SAY."

- No reacts in rates, but lent to some interest in reading at least: bipartisan infrastructure agreement reached, and Mexico hiked rates .25 to 4.25%.

- Decent Tsy auction: $62B 7Y note (91282CCH2) auction trades through with high yield of 1.264% vs. 1.267% WI. Tsys holding off session highs so far -- little reaction. Bid-to-cover: 2.36x vs. 2.26x 5 month avg, Indirect take-up of 59.97 well over the 5 month average of 55.19% but well shy of Jan's 64.09%. Primary dealer take-up 18.69% well below 25.23% 5 month avg (compares to February's >1Y high of 39.80%.) Direct take-up climbs to 21.34 vs. 19.53% 5M avg. The next 7Y auction is tentatively scheduled for July 29.

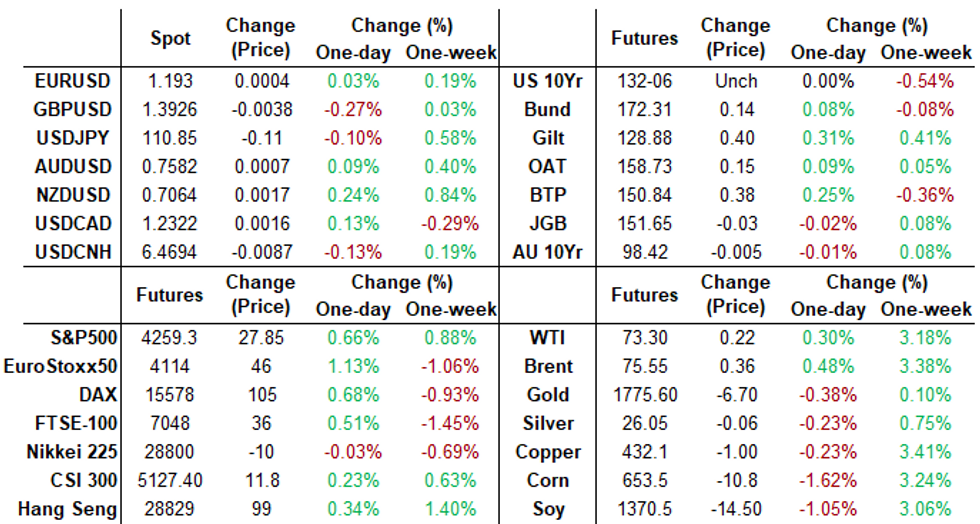

- The 2-Yr yield is up 0.4bps at 0.2661%, 5-Yr is up 2.4bps at 0.9054%, 10-Yr is up 0.2bps at 1.4868%, and 30-Yr is down 1.1bps at 2.0974%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00025 at 0.08500% (+0.00450/wk)

- 1 Month +0.00350 to 0.09500% (+0.00400/wk)

- 3 Month -0.00125 to 0.14600% (+0.01112/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month +0.00587 to 0.16525% (+0.00900/wk)

- 1 Year +0.00413 to 0.24763% (+0.00750/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $71B

- Daily Overnight Bank Funding Rate: 0.08% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.05%, $835B

- Broad General Collateral Rate (BGCR): 0.05%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.631B submission

- Next scheduled purchase:

- Fri 6/25 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Repo and Reverse Repo Operations

NY Fed reverse repo usage makes another new record high of $813.573B from 73 counterparties. Compares to Tue's record of $791.605B -- continued knock-on effect of FOMC's IOER technical adjustment to 0.15% from 0.10%.

MONTH-END EXTENSION: PRELIMINARY Barclays/Bbg Extension Estimates for US

PRELIMINARY forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.01Y; US Gov infl-linked -0.4Y.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.11 | 0.04 | 0.06 |

| Credit | 0.05 | 0.12 | 0.09 |

| Govt/Credit | 0.07 | 0.10 | 0.09 |

| MBS | 0.11 | 0.06 | 0.08 |

| Aggregate | 0.08 | 0.09 | 0.09 |

| Long Gov/Cr | 0.07 | 0.09 | 0.12 |

| Iterm Credit | 0.07 | 0.10 | 0.10 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.09 | 0.08 |

| High Yield | 0.07 | 0.11 | 0.09 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -40,000 short Sep 99.75 puts 19-19.5 over +10,000 Dec 99.37 puts

- -5,000 Jun 95/Red Sep93 put strip, 11.75-12

- +5,000 Jun 99.87/100.12 call spds, 1

- +2,000 short Mar 93 straddles, 34.0

- +1,000 Green Dec 99.88 straddles, 38

- +5,000 Green Dec 98.37/95.50/98.62 put flys, 1.0 vs. 98.855/0.05%

- +2,500 Gold Dec 97.62/98.12 put spds, 14.5

- +5,000 short Mar 96 calls, 4.5 vs. 99.37/0.22%

- Overnight trade

- +35,000 Green Oct 85/87 put spds, 6.5

- 3,000 Green Dec 98.62/98.87/99.12 put flys

- +8,000 Blue Dec 80/82 put spds, 6.5

- 6,000 short Sep 86 puts

- +6,500 short Dec 92/93/95 put flys, 1.5

- +12,000 Mar 100 calls, 1.0

- +5,000 Sep 99.75/99.81 put spds, 0.5

- Block, 5,647 short Sep 99.68/99.75/99.87 broken call flys, 1.0 wings over

- -3,000 TYQ 132.5/134 call spds 21 vs. 132-03.5/0.30%

- +1,000 TYU 132 straddles, 156

- +4,200 FVQ 123.25/123.5 strangles 32.5-33.0

- +3,200 TYU 131 puts, 30 -- total volume >15.4k

- +6,000 FVU 121.25/122 2x1 put spds, 0.5

- -5,000 FVQ 123.5 calls, 14.5-15

- 5,000 TYU 131 puts, 33

- Overnight trade

- Block, -13,125 TYQ 129 puts, 1

- +6,000 TYU 129.5/130.5 put spds, 12

- +4,500 FVU 121.25/122 2x1 put spds, 0.5

EGBs-GILTS CASH CLOSE: BoE Not Hawkish Enough For Gilt Bears

Gilts outperformed on BoE day, with the Bank defying those who had positioned for a hawkish surprise.

- The BoE decision was in line with expectations (no change in policy, 8-1 vote to maintain QE policy, with the departing Haldane dissenting). Gilts rallied, and with Bunds stalling, the UK/ German spread is now at tightest levels since February.

- Periphery spreads tightened slightly, led by BTPs (which had underperformed Wednesday).

- French business confidence and German IFO data exceeded expectations.

- The only supply was Italy selling E6bln of new 7Y CCTeu floater via syndication. Tomorrow they sell E3.75B of short-term BTP and BTPei.

German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.651%, 5-Yr is down 0.1bps at -0.569%, 10-Yr is down 0.7bps at -0.185%, and 30-Yr is down 0.2bps at 0.306%.

- UK: The 2-Yr yield is down 1.6bps at 0.073%, 5-Yr is down 3bps at 0.354%, 10-Yr is down 3.6bps at 0.744%, and 30-Yr is down 3.5bps at 1.245%.

- Italian BTP spread down 2bps at 105.3bps /Spanish down 1.1bps at 61.7bps

OPTIONS/EUROPE SUMMARY: More Sterling Steepeners

Thursday's options flow included:

- DUU1 112.10/112.00 1x2 put spread sold at flat in 5.5k

- RXQ1 173c, sold at 35 in 1k

- 0LN1 99.50p sold at 1.5 in 7k

- 0LN1 99.62p sold at 6.75 in 4.5k (ref 99.57)

- 0LV1C 99.62c vs 2LV1C 99.50, sold the 1yr at 0.5 and 0.25 in 7k

- 2LZ1 99.37c v 3LZ1 99.25c, bought the 2yr for -075 in 2k. This was also bought yesterday in 5k

FOREX: Muted Action in G10 FX, GBP Softer Following BOE

- G10 FX broadly held narrow ranges on Thursday. Initial greenback weakness overall was pared approaching the London WMR fix, leaving the dollar index unchanged from Wednesday's close.

- GBPUSD was sold down below 1.39 following the Bank of England decision and statement. It said growing inflation would surpass 3% as the UK economy reopens, but the climb further above its 2% target would only be "temporary". There are little signs in the minutes or statement that the MPC is considering an early end to QE, potentially weighing on Sterling, currently down 0.31%.

- For cable, our technical team still see a bearish threat present with GBPUSD trading through the 100-DMA, reinforcing current negative conditions. Scope is seen for an extension lower towards 1.3717, Apr 14 low.

- The strongest performers were SEK and NOK, firming roughly 0.35% with the latter benefitting from oil prices continuing to consolidate gains, following the recent strong rally.

- Emerging market currency indices continued to unwind the post FOMC losses, with notable moves in MXN (+1.28%), BRL (+1.14%) and RUB (+0.56%). The JPMorgan EM CCY index rose 0.35%.

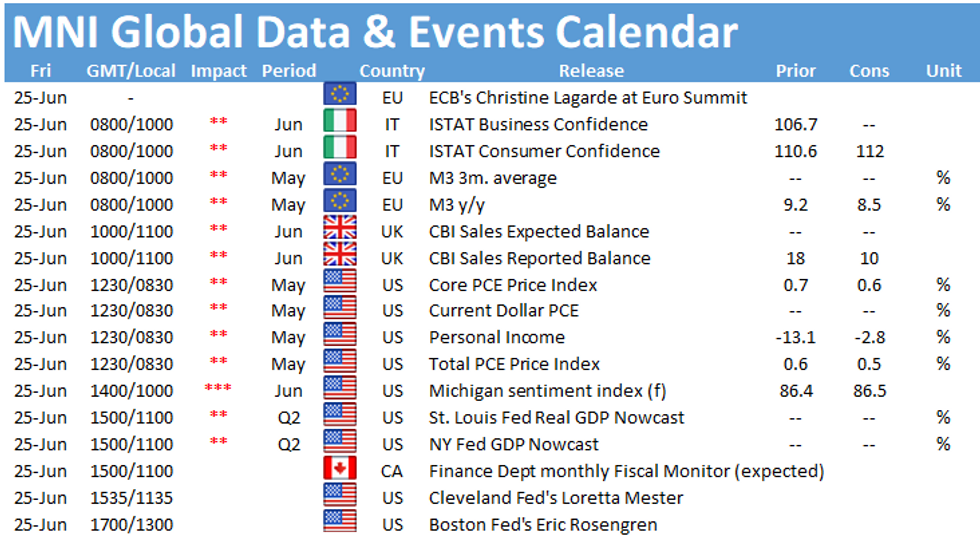

- The main data point for Friday will be the US PCE and personal income/spending figures for May, followed by Uni of Michigan Sentiment data to close out the week.

FOREX/Expiries for Jun25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E933mln), $1.1895-05(E595mln), $1.1950-65(E910mln), $1.2085(E543mln)

- USD/JPY: Y110.00($593mln), Y110.50($834mln), Y111.00($1.5bln)

- EUR/GBP: Gbp0.8500(E1.1bln-EUR puts)

- USD/CHF: Chf0.8900($1.0bln-USD puts)

- AUD/USD: $0.7500-05(A$559mln)

- USD/CNY: Cny6.50($640mln), Cny6.55($500mln)

PIPELINE: Issuance Slow-Down

Only $3.8B high-grade corporate issuance to price Thursday- Date $MM Issuer (Priced *, Launch #)

- 06/24 $1.8B #Centene Corp 7Y +2.45%

- 06/24 $1.5B #Enbridge $1B 12Y +105, $00M 30Y +130

- 06/24 $500M #Athene Global Funding 5Y +72

EQUITIES: Small Uplift in Stocks as Biden Secures Infrastructure Package

- Wires confirm that Biden has secured an infrastructure package with bipartisan support. Seems some compromises have been made on both sides, with Biden acknowledging that neither side got what they wanted, with Biden making serious compromises on human infrastructure.

- Republican senator Portman also states that the deal is a good compromise that will help the American people. Portman also discloses that there are no new taxes.

- Small uplift in equity markets on the back of those headlines, with the e-mini S&P now trading within 3 points or so of the earlier session highs.

- This news wasn't a huge surprise, with senators and press trailing the news late yesterday and overnight. Nonetheless, a big moment for Biden, who Politico report will now be holding an 'Infrastructure Ceremony' later today

COMMODITIES: NatGas At New Highs

- Oil markets were mixed Thursday, with WTI and Brent crude futures trading either side of the Wednesday close. Trading in NatGas futures was more eventful, with NatGas hitting new weekly and cycle highs at highs at $3.43 on the back of a smaller build than expected in the weekly storage change data. Jun 18 figures saw a build of 55BCF vs. Exp. 64BCF.

- Precious metals were largely non-directional, seeing little read through from a fresh rally in stocks, which saw the S&P 500 strike another intraday record high. This keeps gold's directional parameters in tact at $1761.1 support and the 100-dma target at $1783.0.

- Focus Friday turns to US PCE and personal income/spending numbers for May.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.