-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Appetite Retreats

US Tsy Summary: Tsy Yields in Decline

- Rates finish strong, near highs set in late morning trade, with futures trading sideways from midday through the close. Robust volumes as US markets return from 4th of July holiday, specific drivers for the rally were elusive.

- Risk-off opinion garnered some attention as Covid-19 Delta variant's resistance to vaccines contributed to the support. Others pointed to release of June FOMC minutes tomorrow for round of position squaring/current bid.

- 30Y Bond climbed to post-FOMC levels (before sharp June 21 sell-off) in early trade as 30YY dipped to 1.9712%, 10YY to 1.3498%.

- Tsys extended session highs post-data, June ISM services slips to 4M low. Tsy 10Y futures breached second resistance (133-06.5, June 11 high and bull trigger) to 133-12.5 high. Yield curves mostly flatter, 5s30s resisting move, +0.554 to 118.698.

- Bullish option flow centered around put and put spd unwinds and buying calls outright and on spd.

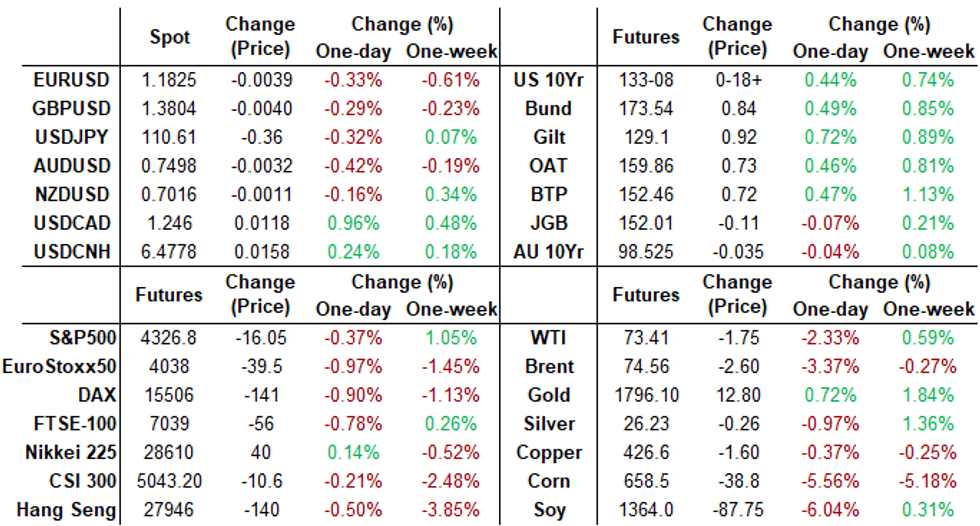

- The 2-Yr yield is down 1.4bps at 0.2199%, 5-Yr is down 5.3bps at 0.8045%, 10-Yr is down 6.1bps at 1.3632%, and 30-Yr is down 4.2bps at 1.9983%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00113 at 0.08163% (+0.00113/wk)

- 1 Month -0.00200 to 0.10213% (-0.00075/wk)

- 3 Month -0.00312 to 0.13488% (-0.00300/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00388 to 0.16638% (+0.00338/wk)

- 1 Year +0.00100 to 0.24225% (-0.00225/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $81B

- Daily Overnight Bank Funding Rate: 0.08% volume: $242B

- Secured Overnight Financing Rate (SOFR): 0.05%, $910B

- Broad General Collateral Rate (BGCR): 0.05%, $352B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $315B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $40.051B submission

- Next scheduled purchases:

- Wed 7/7 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 7/8 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Fri 7/9 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

Well off last Wednesday's record high of $991.939B, NY Fed reverse repo usage climbs to $772.581B from 66 counterparties Tuesday vs. $731.504B on Friday.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Blue Sep 98.87 calls, 4.5 vs. 98.63/0.20%

- Block, total -10,000 short Dec 99.12/99.50 3x2 put spds, 11.0

- +5,000 Blue Dec 80/82 put spds, 5.0

- +10,000 short Dec 99.68/99.75 call spds, 1.25

- -5,000 Blue Aug 98.25/98.37 put spds, 1.75

- +10,000 Sep 99.81/99.87 1x2 call spds, 3.5

- +7,500 Green Oct 98.56/98.75 put spds, 4.75

- Overnight trade

- 2,000 Blue Jul 82 puts cab

- 2,000 short Oct 99.37/99.43/99.50 put flys

- 1,750 Gold Sep 97.62/98.00 3x2 put spds vs. Gold Sep 98.625 calls x2

- -5,000 TYU 130/131.5/133/133.5 broken put condors, 1

- -5,000 FVU 121.25/122.25/123.25 put flys, 7.5-8

- +4,200 wk2 TY 132.5/132.75 put spds, 2

- -1,000 USU 158 puts, 40

- -6,000 TYU 130/131/133/133.5 broken put condors, 9

- 5,000 wk3 TY 132.75/133.25 1x2 call spds

- +3,000 TYQ 130 puts, 1

- +5,000 FVU 121.25/122.25/123.25 put flys, 11

- Overnight trade

- +10,000 wk2 TY 131.75 puts, 1

- 3,600 TYQ 133.5calls, 7

- +3,500 TYU 127/128 put spds

- 2,000 USQ/USU 158 put spds

EGBs-GILTS CASH CLOSE: Long End Rallies Hard

Core European FI rallied strongly Tuesday, taking their cue from US Treasuries. Risk appetite faded in the European afternoon, with equities slipping but periphery spreads holding in.

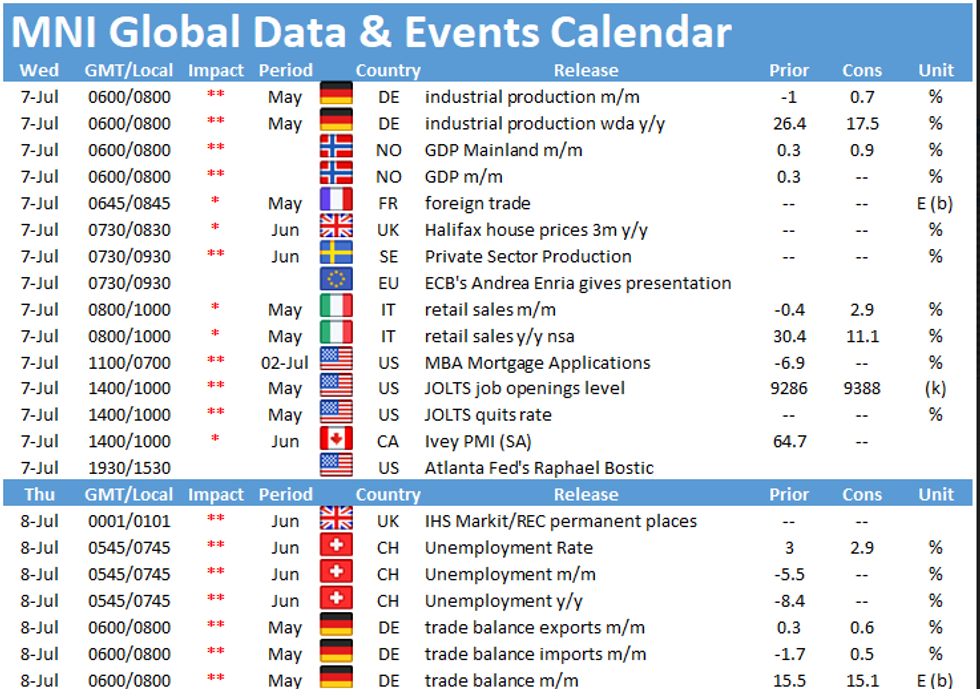

- UK and German 30 Yrs rallied 7+bps. Multiple catalysts for the safe-haven strength: multi-year highs in oil reversed sharply, the dollar strengthened, and data was on the soft side.

- German factory orders unexpectedly contracted sharply in May and ZEW expectations dipped more than expected, while the US Services ISM missed expectations.

- Supply today was UK (Gilts, GBP4.25bn), Germany (ILBs,EUR475mn allotted), France (E5bln of syndicated LT OAT).

- Wednesday sees German IP and Italy retail sales data; UK sells GBP0.6bln of linkers and Germany sells E5bln of Bobl.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 1.8bps at -0.678%, 5-Yr is down 3.7bps at -0.621%, 10-Yr is down 5.8bps at -0.268%, and 30-Yr is down 7.4bps at 0.224%.

- UK: The 2-Yr yield is down 0.6bps at 0.051%, 5-Yr is down 3.6bps at 0.278%, 10-Yr is down 8bps at 0.634%, and 30-Yr is down 7.1bps at 1.165%.

- Italian BTP spread down 0.3bps at 101.2bps/ Spanish up 0.4bps at 61.2bps

OPTIONS/EUROPE SUMMARY: Downside In Sterling

Tuesday's options flow included:

- 3RU1 100.25/100.37cs vs 100.12/100ps, bought the cs for 0.75 in 4k (ref 100.19)

- LU1 99.87/100.00/100.125c fly, sold at 3.5 in 10k

- 0LZ1 99.375/99.125 ps bought for 2.25 in 7.5k (ref 99.56)

- 0LZ1 99.50/99.375 ps bought for 3 in 3k

- 3LZ1 99.00/98.50ps 1x2, bought for 6 in 5k

FOREX: Risk Off Prompts Flight To Safety

- Weakness across all three major US equity indices follows increased concern over the more transmissible delta COVID variant, bolstering the US dollar as US market participants returned from a National Holiday.

- Initial overnight greenback weakness was firmly reversed as oil markets began to turnaround with signs of stress following the OPEC+ deal falling through. Additionally, softer US ISM services data further soured sentiment, sparking another leg higher in the dollar and particular weakness in some emerging market FX.

- In the G10 space, NOK and CAD are the biggest laggards, on the back of the oil move. USDNOK resides 1.45% higher.

- USDCAD rose to the best levels since late April, posting a high just shy of the 1.25 mark, which coincides with a Fibonacci retracement. A break would open 1.2653, Apr 21 high and an important resistance. Initial firm support lies at 1.2253, Jun 23 low.

- Elsewhere, EURUSD and GBPUSD had strong reversals lower from their highs and are down 0.35%. EURUSD printed a fresh 1-pip low from Friday, reversing the entire move following the release of US non-farm payrolls last week.

- AUD and NZD, after being the biggest beneficiaries during the Asia session, also significantly retreated, dropping in the region of 1.5%. BRL had the largest move in EM, where the external and domestic environment amplified losses of 1.85%.

- Undoubtedly, Wednesday's focus will be on the release of the FOMC minutes.

FOREX/Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850-70(E822mln), $1.1917-24(E1.5bln), $1.1935-50(E1.1bln)

- USD/JPY: Y109.00($1.1bln), Y109.50-57($738mln), Y111.00($1.1bln), Y111.50($1.1bln-USD calls)

- AUD/USD: $0.7575-80(A$552mln)

- NZD/USD: $0.7140(N$1.1bln-NZD calls), $0.7170-85(N$1.1bln-NZD calls)

- USD/CAD: C$1.2560-70($785mln)

PIPELINE: Banks Kick-Off July Issuance

July kicks off with $8B high-grade issuance

- Date $MM Issuer (Priced *, Launch #)

- 07/06 $3.25B #Nomura $1.25B 5Y +85, $1B 7Y +105, $1B 10Y +125

- 07/06 $1.75B #Mizuho Fncl Grp $1.1B 6Y +75, $11Y +100a

- 07/06 $1.7B #Bank of Montreal $1.15B 3Y +27, $550M 3Y FRN/SOFR+32

- 07/06 $800M *Korea Gas $450M 5Y +37.5, $350M 10Y +65

- 07/06 $500M *Hongkong Land Co 10Y +90

- 07/06 $Benchmark Beijing Capital Development investor call

- 07/06 $Benchmark Mitsubishi 5Y investor call

- Expected second half of week:

- 07/07 $500M EIB 7Y FRN/SOFR+25a

- 07/07 $Benchmark KFW 3Y -1a

EQUITIES: Indices Soft, But Lockdown Themes Outperform

- Headline indices all traded lower Tuesday, with the e-mini S&P rolling well off the alltime highs posted in early Asia hours. Bluechips led the way lower, with the Dow Jones Industrial Average falling 1% or more at some points of the session to narrow the gap with 50-dma support.

- Weakness across all three major US equity indices follows increased concern over the more transmissible delta variant of COVID as well as a weaker-than-expected ISM services index. This translated to outperformance in lockdown-themed trades including Zoom Communications and Amazon and a bias for risk-off, which flattened the Treasury curve and worked in favour of the US dollar.

- Continental markets were similarly weak, with Germany's DAX and Spain's IBEX-35 leading with losses of 1% apiece.

COMMODITIES: Oil Hits Reverse as OPEC Effect Fades, Variants in Focus

- Both WTI and Brent crude futures started the session well, with both benchmarks touching new cycle highs as the collapse of the prelim OPEC+ deal supported prices in the early hours. This was short-lived, however, with equity weakness and broader risk-off prompted a decent reversal that sent global oil benchmarks into negative territory.

- Concerns over the more transmissible Delta COVID variant and a re-emerging preference for lockdown themed trades (Zoom & Amazon, for example, both traded very strongly) worked against energy, with weakness observed across the futures curve.

- Gold saw initial support to show above the $1,800/oz handle, touching $1815.1 before mean reversion sank in to put the yellow metal flat ahead of the close.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.