-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI ASIA MARKETS ANALYSIS: Debating Taper Debate, June Minutes

US TSY SUMMARY: June FOMC Minutes Shed Little Light on Taper Timing

Another session for declining Tsy ylds last seen mid February: 10YY 1.2946% low; 30YY 1.9169% low, and no single driver to pin it on. Sources suggested several factors including stimulus tailwinds starting to fade, Covid Delta variant angst, short squeeze weaker oil, "bland" employment and ISM metrics in addition to slow-down in Asian markets creating more pain for large short positions.- No significant data on the day, rates held narrow range off late morning highs ahead the June FOMC minutes that shed little extra light on timing of tapering. Gist: voting members debated the debate over when it would be appropriate to begin tapering. It feels like it could be a long, hot summer.

- Decent Tsy and Eurodollar option volumes reported: some carry-over upside call buying early followed by better low delta put buying and conditional bear curve flatteners on the day.

- Near $14B in swappable corporate issuance generated some hedging volume in the second half.

- The 2-Yr yield is down 0.4bps at 0.2141%, 5-Yr is down 1.5bps at 0.782%, 10-Yr is down 2.9bps at 1.3196%, and 30-Yr is down 3.2bps at 1.9423%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00350 at 0.08513% (+0.00463/wk)

- 1 Month +0.00075 to 0.10288% (+0.00000/wk)

- 3 Month -0.01100 to 0.12388% (-0.01400/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00413 to 0.16225% (-0.00075/wk)

- 1 Year -0.00187 to 0.24038% (-0.00413/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $76B

- Daily Overnight Bank Funding Rate: 0.08% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.05%, $934B

- Broad General Collateral Rate (BGCR): 0.05%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $324B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.566B submission

- Next scheduled purchases:

- Thu 7/8 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Fri 7/9 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

NY Fed reverse repo usage climbs to $785.720B from 65 counterparties vs. $772.581B on Tuesday. Compares to record high of $991.939B on June 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Update +40,000 Green Sep 87/90 put spds vs Blue Sep 82/85 put spds, 0.5 net debit on conditional bear curve flattener

- +7,000 short Mar 96/97 call spds, 3.5

- -5,000 Blue Jul 98.62/98.75 strangles, 6.25

- +10,000 Green Dec 98.62/98.87 put spds 3.5 over Green Dec 99.12 calls

- +10,000 Blue Dec 98.25/98.75 put spds 0.5-.75 over Green Dec 98.62/99.12 put

- Block, +20,000 short Sep 95/96/97 put flys, 2.5, +5k more pit

- Overnight trade

- +20,000 Green Mar 82 puts, 7.0

- +6,750 Blue Mar 80 puts, 10.0

- +8,000 Green Jul 99.12 calls, 2.0

- 2,500 Red Mar 92/96 put spds vs. Gold Sep 83 puts

- 17,000 Green Dec 92/93 call spds

- 5,000 Green Dec 88 puts

- 9,000 Blue Aug 88 calls

- 2,000 Sep 99.81/99.87 put spds

- +2,000 USQ 160/161 put spds, 13

- +2,000 TYQ 133.5/133.75 strangles, 55

- +12,000 FVU 121.25/121.75 put spds, 1

- Update, +10,000 FVU 122.75/123.25 put spds, 7 vs. 123-26.75

- +2,400 USU 173/176 1x2 call spds, 1 cr

- +4,000 FVQ 122.25/122.75/123.25 put flys, 2

- +7,500 TYQ 130.5 puts, 1

- Overnight trade

- +3,000 USU 163 calls 200

- 5,000 USU 176 calls

- 3,000 USQ 159.5/160.5 put spds, 11

EGBs-GILTS CASH CLOSE: Another Long-End Rally

The German and UK long-ends saw another impressive rally Wednesday, with yields hitting multi-month lows, though periphery spreads widened.

- For the 2nd consecutive session, the impressive rally had no single catalyst. Concerns over weaker growth on the Delta COVID variant appeared to weigh, and the USD strengthened, but with equities rallying, it once again wasn't a risk-off session.

- An FT report that the ECB could issue conclusions on its Strategy Review as soon as tomorrow garnered attention; MNI cited sources that no announcement will be made today.

- Today saw the UK have a strong sale of linkers (GBP0.6bln), with Germany allotting E3.9bln of Bobl. Thursday sees Ireland sell up to E1.5bln of IGB.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.676%, 5-Yr is up 2.7bps at -0.594%, 10-Yr is down 3bps at -0.298%, and 30-Yr is down 3.7bps at 0.187%.

- UK: The 2-Yr yield is up 1.1bps at 0.062%, 5-Yr is down 2.3bps at 0.255%, 10-Yr is down 3.4bps at 0.6%, and 30-Yr is down 4.4bps at 1.121%.

- Italian BTP spread up 2.7bps at 103.9bps / Spanish spread up 1.6bps at 62.8bps

OPTIONS/EUROPE SUMMARY: Bobl Short Cover And Euribor Calls

Wednesday's options flow included:

- RXQ1 173/172ps, bought for 16 in 2k

- RXU1 176/176.50/177c fly, 1x3x2 call fly, bought for -2 in 1.5k

- RXV1 173c, sold at 48.5 in 4.6k

- OEQ1 134.25c, bought for 26 in 4.6k (short cover)

- 3RQ1 100.25/100.375 call spread bought for 4.5 in 4k

- 3RU1 100.12/100.25/100.37c fly, sold at 4.5 in 3k

- 2LZ1 99.25/00 ps with 99.12/87ps, bought for 6.5 in 4k

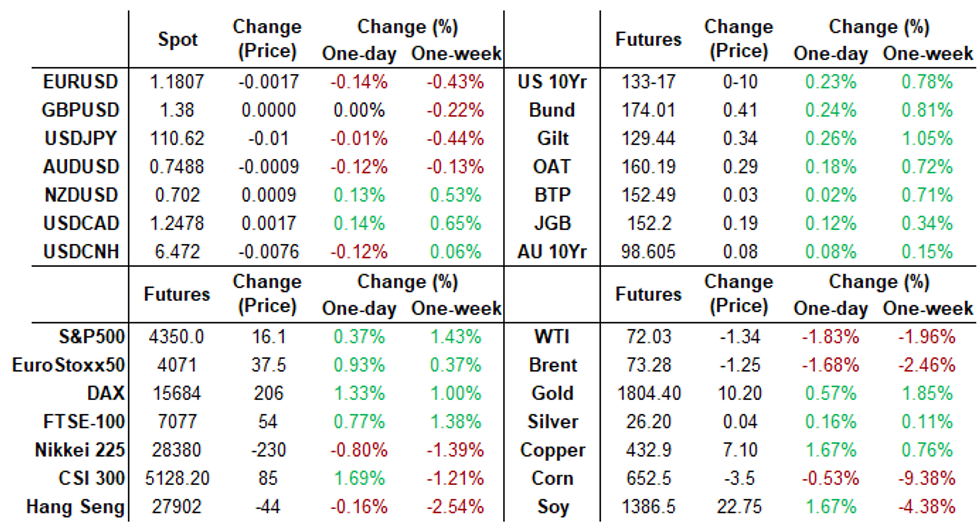

FOREX: Dollar Indices Consolidate Gains

- G10FX remains in fairly close proximity to the prior day's closes. Following Tuesday's strong dollar rally, gains have been consolidated with the DXY up 0.05%.

- EURUSD continued its downward trajectory, breaking 1.18 and confirming bearish technical conditions for the pair and making a new low at 1.1782.

- The clear break of 1.1808 confirms a resumption of the downtrend and maintains the current bearish price sequence of lower lows and lower highs. Price also fell through 1.1795, the Apr 6 low, potentially turning focus to key support at 1.1704, Mar 31 low.

- Small dollar weakness was exhibited during European hours, however, risk-off mode resumed as the US sat down. This weighed heavily on the likes of GBP, AUD, NZD and CAD prompting close to 1% selloffs before recovering slightly heading into the minutes.

- Small negative reaction in the dollar following the release of the minutes, unwinding some of the strength seen within the US session as members reiterated the standard of 'substantial further progress' was generally seen as not having yet been met.

- Overall NZD (+0.33%) outperformed, following the bounce in equities, while weaker oil prices continued to weigh on NOK.

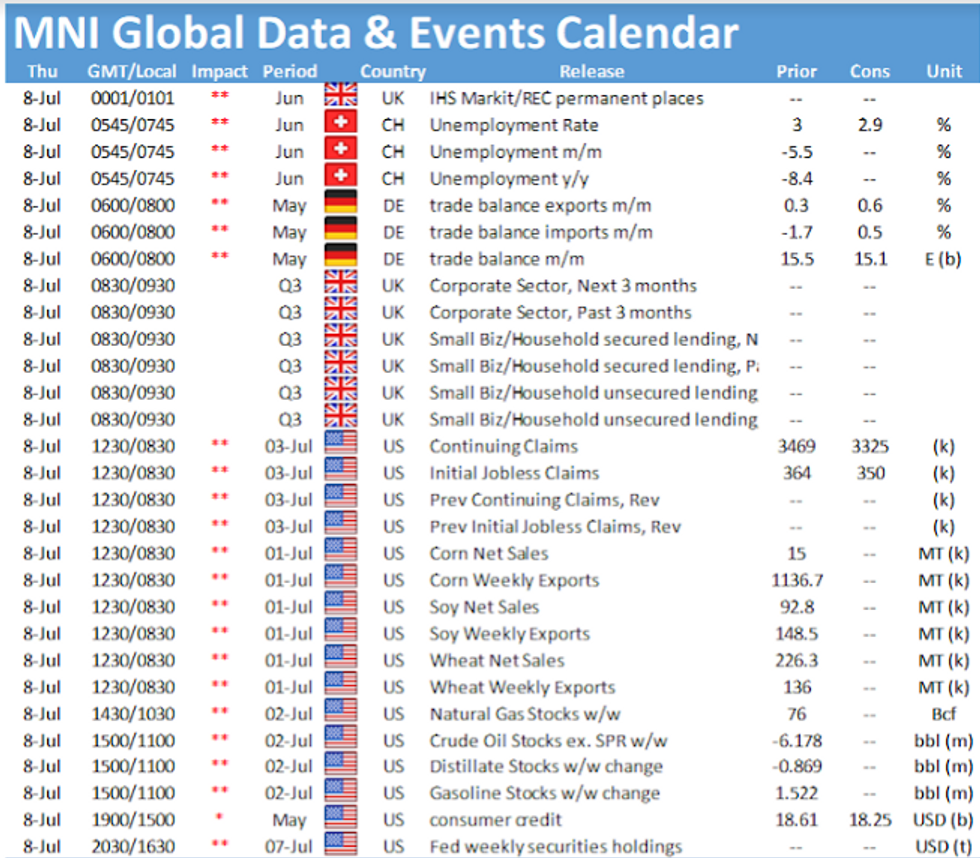

- RBA Gov Lowe is due to speak early on Thursday morning. Later in the day, weekly jobless claims and crude oil inventories headline the docket.

FOREX/Expiries for Jul08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E1.3bln), $1.1800(E514mln), $1.1930-50(E1.9bln)

- USD/JPY: Y110.75-85($849mln), Y111.25($570mln), Y112.00-10($774mln)

- AUD/USD: $0.7515-30(A$1.3bln), $0.7600-05(A$901mln)

- USD/CNY: Cny6.5100($635mln)

PIPELINE: $4B Enel Finance 4Pt Launched

Decent $13.45B total high-grade debt to price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 07/07 $5B *KFW 3Y -3

- 07/07 $4B #Enel Finance $1.25B 5Y +70, $1B 7Y +85, $1B 10Y +100, $750M 20Y +110

- 07/07 $1.2B #Xiaomi $800M 10Y +165, $400M 30Y +220

- 07/07 $1B #PacifiCorp 31Y Green +98

- 07/07 $1B *Gazprom 10Y 3.5%

- 07/07 $750M #Royal Bank of Canada 5Y Green +38

- 07/07 $500M *EIB 7Y FRN/SOFR+25

- Expected latter half of week:

- 07/07 $1B Dexia no-grow 3Y +9a

EQUITIES: Familiar Price Action as Early Dip Retraced Into the Close

- In a similar fashion to Tuesday, US equity markets came under considerable pressure shortly following the opening bell, as stocks followed Treasury yields and oil resumed the recent decline. This prompted the E-mini S&P to make light work of the overnight lows, as oil & gas exploration names led losses. The energy sector was comfortably the poorest performing sector in the US.

- This price action reversed into the close, as was the case on Tuesday, as the buy-the-dip strategy remained dominant. Wednesday's low was comfortably north of the week's lowest levels of 4305.25, which remains the first downside target.

- European markets were similarly positive, helping Germany's DAX to outperform (closing higher by 1.2%), closely followed by the UK's FTSE-100 (+0.7%).

COMMODITIES: Oil Slips For Second Session

- WTI and Brent crude futures sank for a second session Wednesday, opening a decent gap with the OPEC+-inspired cycle highs printed earlier in the week. The downtick accelerated slightly, with markets appearing to speculate that extended discord among OPEC+ members could dent curb compliance, providing a short spell of increased supply in the near-term.

- The DoE Crude Oil Inventories were delayed a day due to Monday's July 4th public holiday, and will take focus Thursday. Markets expect a draw of around 4.5mln bbls.

- Trade in gold and silver was more muted, with the yellow metal trading wholly inside the Tuesday range to keep the directional parameters unchanged. Gold targets $1815/oz on the way higher, with the 100-dma at $1789.7 providing some support.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.