-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Aversion Heats Up

US TSY SUMMARY: Risk Aversion Heats Up, Tsys Surge as Equitys Falter

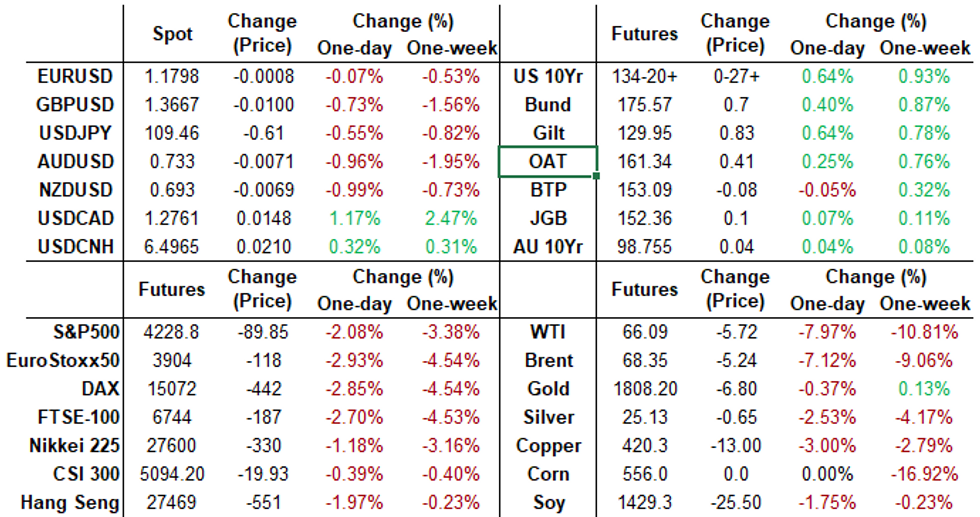

Risk-off tone surged Monday: Tsy futures surged on heavy volumes (TYU1 >2M ) by the close while equities sold off sharply (S&Ps -2.08% in late trade).- Of the various drivers for bid -- global spd of covid delta variant, spike in case counts spurring safe haven buying in EGBs, GBP, Tsys. Note: CDC raised covid related warning to level 4 (highest) to those traveling to the UK even as UK drops virus restrictions. Economic data remains light on wk, Fed in blackout.

- TYU hit high of 134-25.5 well through bull-channel top of 134-03 and 200% fibonacci projection (134-24.5). 10YY fell to 1.739% low, well through 200DMA on move back to mid-Feb levels. Yield curves bull flattened vs. intermediates while longer curves outperformed (5s30s 112.098 late vs 110.188L).

- Early on, sources report prop, real$ and foreign bank buying in 5s-30s, fast$ selling bonds and taking stab at entering steepeners vs. intermediates. Mid- to late morning Flow included ongoing real$, foreign and domestic bank buying in 5s-30s, stops triggered on latest move. Fast$ unwinding tactical shorts.

- The 2-Yr yield is down 1.6bps at 0.2055%, 5-Yr is down 8.7bps at 0.6867%, 10-Yr is down 11.5bps at 1.1756%, and 30-Yr is down 11.1bps at 1.8083%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00025 at 0.08600% (-0.00088 total last wk)

- 1 Month +0.00162 to 0.08525% (-0.01650 total last wk)

- 3 Month +0.00000 to 0.13425% (+0.00562 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00038 to 0.15175% (+0.00112 total last wk)

- 1 Year -0.00050 to 0.24163% (+0.00325 total last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $72B

- Daily Overnight Bank Funding Rate: 0.08% volume: $254B

- Secured Overnight Financing Rate (SOFR): 0.05%, $864B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $339B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.099B submission

- Next scheduled purchases

- Tue 7/20 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 7/21 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 7/22 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $860.468B from 71 counterparties vs. $817.566B on Friday. Remains well off June 30 record high of $991.939B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- +65,000 Blue Aug 98.62 puts, 4.0

- -20,000 short Sep 99.50/99.62/99.75 put flys, 2.5

- +10,000 Blue Dec 97.50/97.75/98.00 put flys, 1.0

- Block 10,000 Blue Aug 98.62/98.75 put strip, 9.0

- Block 10,000 long Green March 99.25 calls, 27.5

- -10,000 Green Dec 98.87/99.00 put spds, 4.0

- +5,000 Blue Dec 92/93/95 call trees, 1.0

- Block, 10,000 short Sep 99.75/Blue Sep 98.25 put spds, 5.5

- 2,000 Blue Sep 98.37/98.62 put spds

- -25,000 Blue Sep 97.75/98.12 put spds w/Blue Sep 97.62/98.25 3x2 put spds, 3.0-2.75 total

- -7,500 Blue Dec 98.25/98.50 call spds 17.0 over Blue Dec 97.75 puts

- +2,500 Blue Sep 98.75 straddles, 29.5

- +5,000 Green Sep 90/91/92 call flys, 2.25 legs

- +3,000 Green Aug 88 puts, 1.5 vs. 99.14/0.12%

- Block, 10,000 short Sep 99.50/99.62/99.75 put flys, 3.0 vs. 99.685/0.20%

- Overnight trade

- +5,000 Gold Sep 97.87/98.00 put spds, 1.0

- +2,750 short Dec 99.50/99.56/99.62 call trees, 1.5

- +2,500 Green Aug 98.93/99.06 put spds, 1.0 over 99.25 calls

- -3,000 TYU 130.5 puts, 4 vs. 134-13/0.20%

- -5,000 TYQ 134/135 call spds, 30

- -1,800 FVQ 124/124.25 call spds, 16.5

- +5,000 TYU 123.25/124.25 put spds 6.5 over TYU 125 calls

- +4,000 TYU 134/137 call spds, 100

- +1,500 USQ 175 calls, 2

- -10,000 TYU 132/133/134/135 put condors, 19

- +10,000 TYQ 132.5 calls from 212-217

- +2,000 FVU 125 calls, 15.5

- +2,600 FVU 124 puts, 19.5

- +5,000 TYU 135.5 calls, 30

- +3,000 TYQ 135.75 calls, 3

- 2,500 TYQ 135/135.75 1x3 call spds

- 7,500 TYU 131/132.5/134/134.5 put condors

- >29,000 TYQ 134.25 calls, 20-21

- Overnight trade

- +3,500 TYU 135 calls, 31

- Block, +7,000 TYU 129.5 puts, 2

- 7,000 TYU 136.5 calls, 8

- -7,500 TYQ 132.5 puts, 1 vs. 133-27.5 to 134-00/0.03-.04%

- +4,000 TYU 134/134.5/135 call trees, 7

- 3,000 TYU 137 calls

- +4,000 FVU 124.25/124.5 call spds, 6.5

EGBs-GILTS CASH CLOSE: Monumental Moves Monday

The recent bull flattening in core European FI accelerated Monday, with longer-end yields having one of their best sessions since March 2020.

- Though there was no data or bond issuance Monday, risk-off was the order of the day, with equity indices dropping 2-3% and periphery spreads wider. Fears of COVID resurgence restraining the recovery was the proximate trigger, with the move accelerating as US traders came in.

- While the move faded a bit in the last two hours of cash trade, we still closed at post-Feb 2021 lows for 10Y Bund and Gilt yields.

- New BoE MPC member Mann said she doesn't expect currently high inflation to persist.

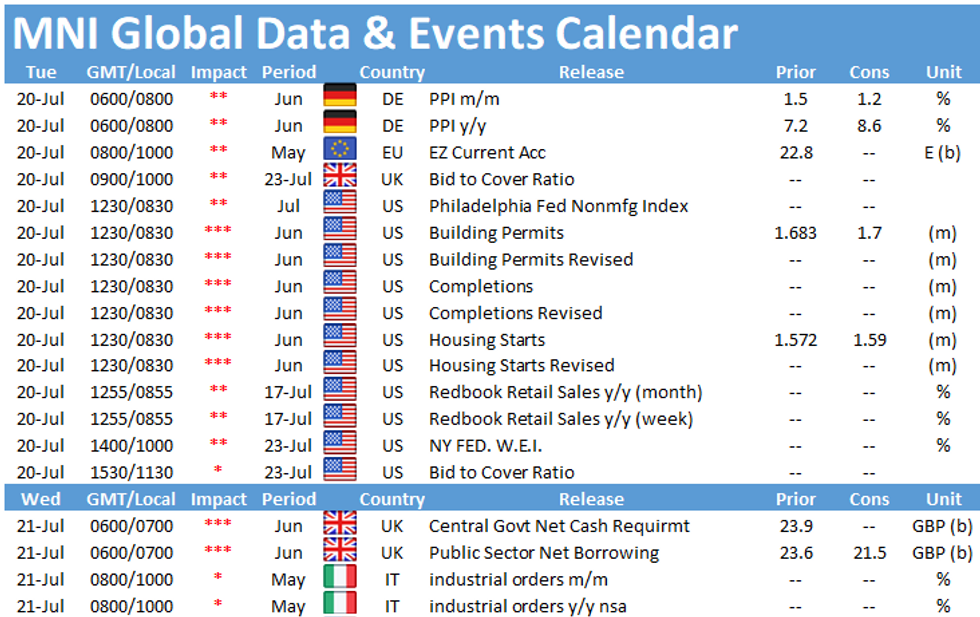

- On Tuesday, ECB's Villeroy speaks, while Germany sells E4bln of Bund and UK sells GBP1.25bln of Oct-71 Gilt.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.691%, 5-Yr is down 2bps at -0.656%, 10-Yr is down 3.3bps at -0.386%, and 30-Yr is down 4.4bps at 0.088%.

- UK: The 2-Yr yield is down 3.7bps at 0.081%, 5-Yr is down 5.2bps at 0.276%, 10-Yr is down 6.6bps at 0.56%, and 30-Yr is down 8.2bps at 1.031%.

- Italian BTP spread up 3.9bps at 109.9bps / Spanish up 2.3bps at 66.3bps

OPTIONS/EUROPE SUMMARY: A Few Blue Put Spreads In Rates

Monday's options flow included:

- RXQ1 174/173ps, bought for 4 in 4.5k (ref 175.28)

- 3RZ1 100.12/99.75ps 1x2, bought for 2.5 in 2.1k

- 3RU1 100.12/99.87ps 1x2, sold at half in 15k

- 2LZ1 98.87/98.75ps, bought for 1.25 in 7k

- 2LZ1 99.37c vs 0LZ1 99.50c, sold the 2yr at half in 11.5k

- 3LZ1 99.37c, bought for 8.5 in 3k (ref 99.225, 34 del)

FOREX: CAD Continues Retreat, Haven Demand For JPY

- Heightened volatility in oil/equity markets provided a nervy backdrop for currency markets to start the week.

- Initially, the greenback was haven of choice with the dollar index firming roughly half a percent throughout European trading hours, however, risk-off flows were superseded by JPY strength in the early stages of Monday's New York session, while also filtering through to EMFX weakness.

- The sharp turnaround in the dollar was attributed to the aggressive move lower in US yields, which prompted EURUSD to entirely erase the day's losses to trade from 1.1764 to 1.1824 in quick fashion before consolidating around the 1.18 mark, as EUR crosses benefited on the day.

- USDJPY took out the most recent support through 109.53, to fresh lows of 109.07 in anticipation of the US cash equity open and despite a mild recovery, remains 0.6% worse off.

- Particular weakness was seen in commodity currencies with antipodeans retreating just shy of 1%, however, the notable laggard was the Canadian dollar. Pressured by the magnitude of the oil price drop (WTI down 7.5%), USDCAD rose to levels not seen since early February, above 1.28. CADJPY stands out, down 1.75% on Monday, but also having matched the April lows at 85.43 as the pair continues its downward trajectory.

- Some late headlines from the CDC raising the Covid warning to level four for travellers to the UK, underscores the heavy price action for the Pound. Moving average studies remain in bear mode for GBPUSD with the technical bear trigger currently being probed at 1.3669, the April 12 low.

- The minutes of the latest RBA meeting will be published overnight, while tomorrow's light US calendar includes US building permits and housing starts.

FOREX/Expiries for Jul20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-70(E765mln), $1.1800-15(E1.6bln), $1.1850-60(E836mln), $1.1880-90(E1.2bln)

- USD/JPY: Y108.70-85($715mln), Y110.00-10($881mln), Y110.50-55($725mln)

- EUR/JPY: Y130.75(E880mln)

- USD/CAD: C$1.2200($832mln)

- USD/CNY: Cny6.4820($1.4bln), Cny6.50($565mln)

PIPELINE: ICBC Priced Earlier

- Date $MM Issuer (Priced *, Launch #)

- 07/19 $600M *ICBC Holdings 3Y +75

- 07/19 $3.1B DirecTV 6NC2 investor calls

- 07/19 $750M Aydem Renewables 5.5NC3 investor calls

- Rolled to Tuesday --

- 07/20 $Benchmark CPPIB Capital 5Y FRN/SOFR +25a

EQUITIES: Sour Session as Stocks Spiral

- Asia-Pac equities set the tone Monday, with weakness in Japanese & Hong Kong stocks bleeding through into the European morning and well into the Wall Street session.

- A resolutely negative open for US cash markets was worsened by a sizeable sell order of close to 2,000 names - the fifth largest sell order of 2021 and the seventh largest of the past twelve months.

- Energy and financials names bore the brunt with soft oil prices working against oil & gas names while financials suffered from the flatter US yield curve. COVID concerns also remained paramount, with United Airlines and Boeing among the worst performers in the S&P500.

- Earnings season takes focus again this week, with Netflix and Philip Morris International both due Tuesday.

COMMODITIES: Oil Slides at Fastest Pace in Months as OPEC+ Finally Fill Gap

- After a failed deal at last month's meeting sent oil markets through an acute spell of strength, OPEC+ finally struck an out-of-cycle agreement to turn on an extra 400,000bpd of extra supply every month from August onwards.

- This boost to supply met soggy demand for growth proxies as equities globally sank sharply. This manifested in a near-8% slide for WTI crude futures, the sharpest decline since the market-breaking drop into negative territory last year.

- WTI crude futures now eye support at the $66.02/bbl 100-dma, with the June rally in prices now all but erased.

- Spot gold and silver were more mixed - gold recovery from early losses below $1800/oz, while silver was harder hit. Silver slipped close to 2.5% on resounding USD strength, failing to catch a tail-wind from any safe haven bid.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.