-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Breaking Down Ahead Remote Symposium

US TSYS: Hawkish Fed Speakers Have Say Ahead Fed Chair Powell on Friday

Rates trading near late session lows after one of the busiest late summer sessions in a long while. Heavy Tsy futures volumes a little deceiving as most tied to the surge in quarterly futures from Sep to Dec ahead first notice on Aug 31. Sep 10Y futures trade over 2.8M by the close, over 1.5M tied to rolls. Even 5s saw over 1.89M by the close -- percentage complete at or near 50%.- Ongoing mkt risk tied to covid (EU WILL DISCUSS THURSDAY REIMPOSING TRAVEL RESTRICTIONS ON U.S., Bbg) and Afghan pullout persist, so why the continued risk-on tone as equities made new highs (ESU1 4497.25)?

- Possibly do to speculation over the KC Fed hosted Jackson Hole eco-symposium scheduled for Friday. Deemed a non-event by some even before it was annc will be remote -- is now generating a lot of buzz with multiple Fed speakers doing interviews on Bbg and CNBC starting Thu morning (KC Fed George kicks things off at 0730ET. Nine hawkish leaning to one degree or another will speak before Fed chair Powell formally gives his presentation at 1000ET Fri (no Q&A).

- Midmorning sell-off accelerated as 10s broke through first support: 133-20: 50D EMA. Aside from the block sales in 5s, 10Y ultras and 30s, sell-side desks report fast$ accts selling in 5s ahead $61B note auction and swap-tied selling in the intermediates. Talk of sell-stops from weak longs and insurance portfolio selling in the long end.

- Tsy futures holding near session lows, little react after $61B 5Y note (91282CCW9) auction tails slightly: .03bp w/ high yield of 0.831% vs. 0.828% WI.

- The 2-Yr yield is up 1.8bps at 0.2406%, 5-Yr is up 1.8bps at 0.8145%, 10-Yr is up 4.4bps at 1.3373%, and 30-Yr is up 3.9bps at 1.955%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00125 at 0.07638% (-0.00100/wk)

- 1 Month -0.00100 to 0.08788% (+0.00200/wk)

- 3 Month +0.00200 to 0.12375% (-0.00462/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00000 to 0.15800% (+0.00537/wk)

- 1 Year +0.00062 to 0.23750% (+0.00088/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $66B

- Daily Overnight Bank Funding Rate: 0.08% volume: $255B

- Secured Overnight Financing Rate (SOFR): 0.05%, $923B

- Broad General Collateral Rate (BGCR): 0.05%, $391B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $363B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $4.404B submission

- Next scheduled purchases

- Thu 8/26 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 8/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, New Record High

NY Fed reverse repo usage climbs to NEW RECORD of 1,147.089B from 77 counter-parties vs. $1,129.737B Tuesday. Prior record high of $1,135.697B set Monday, Aug 23.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -25,000 Blue Sep 98.50/98.75 put over risk reversals, 0.5 vs. 98.685/0.29%

- +15,000 short Nov 99.50/99.62 2x1 put spds, 0.75 -- adds to some +50k this wk

- +5,000 Green Sep 99.25/99.50 call spds, 1

- Overnight trade

- 4,900 Mar 100 calls

- 3,000 Blue Sep 98.37/98.50/98.62 put flys

- 2,500 Jun 99.37/99.5/99.62/99.75 put condors

Treasury Options:

- +7,500 TYZ 136 calls from 17-19

- 35,000 TYU 133 puts, 2 total volume just over 37.1k

- 3,200 TYU 134 calls, 12

- +10,000 FVU 124 calls, 5.5

- Overnight trade

- 9,900 USV 161/163 2x1 put spds

- Block/screen 6,000 USV 160/163 2x1 put spds, 31

- 4,300 TYV 132 puts, 17

- 2,800 FVU 124 straddles, 16.5

- Block, 2,000 USU 169.5 calls, 1

- Block, 2,500 USV 166 calls, 44

FOREX: JPY Weakens As Dollar Holds Steady Before Jackson Hole

- With US equities grinding higher on Wednesday, the Japanese Yen retreated with USDJPY (+0.35%) regaining the 110 handle.

- For bulls, key near-term resistance is unchanged at 110.80, Aug 11 high. A break would ease bearish concerns and instead open key resistance at 111.66, Jul 2 high.

- Firmer risk sentiment evidenced by an extension of the commodities recovery kept Aussie and Kiwi underpinned, rising between 0.3-0.4%.

- EURUSD and GBPUSD have taken out Tuesday's best levels as we approach the close, sending the dollar index into minor negative territory.

- The mixed G10 performance has left the dollar index broadly unchanged for the session as markets await the Jackson Hole Symposium where MNI expect to hear Powell repeat many recent talking points, and provide more clarity on some issues surrounding policy normalization, without pre-committing to a taper timeline.

- The consolidation of most recent oil gains lent further support to NOK topping the G10 pile against the greenback.

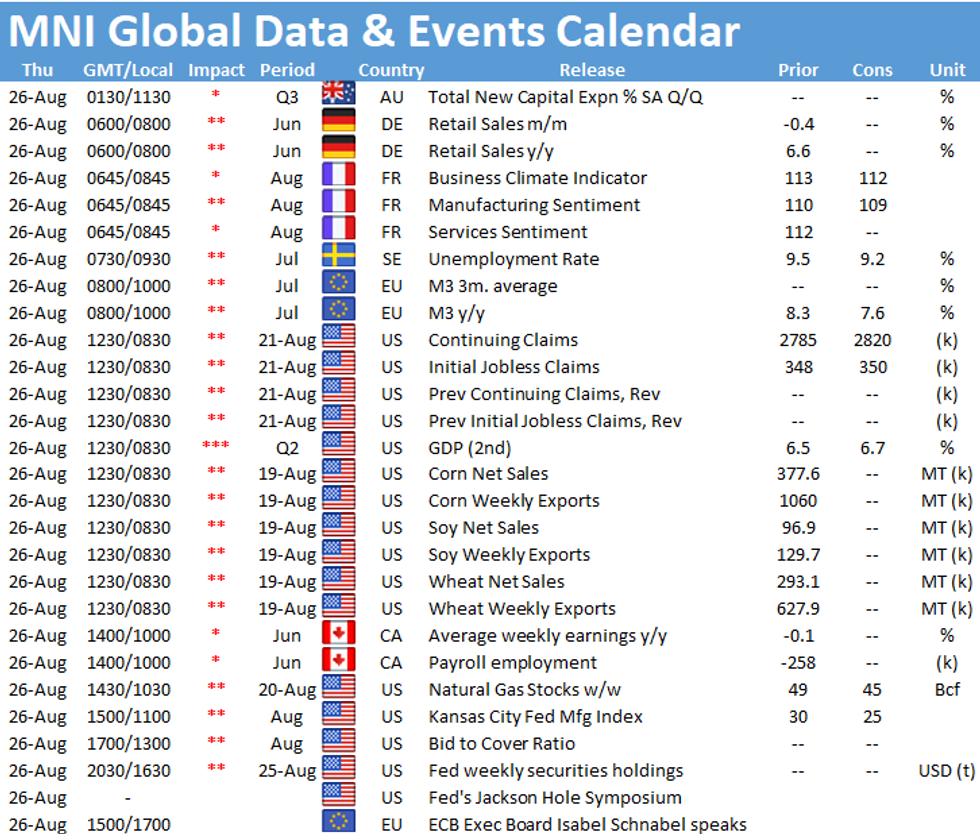

- Tomorrow markets will receive ECB Monetary Policy Meeting Accounts, followed by the second reading of Q2 US GDP. Fed's George, Bullard and Kaplan are currently on Thursday's speaker schedule.

PIPELINE: $1B Municipality Finance Priced

Corporate issuance probably limited to the two below. Issuance has dried up after a healthy start to the month: $89.72 mostly in the first two weeks, a far cry from $204.5B in August 2020. Issuance expected to pick up in September again.

- Date $MM Issuer (Priced *, Launch #)

- 08/25 $1B *Municipality Finance (KUNTA) WNG 5Y +2

- 08/25 $600M *China Merchants $300M 2Y FRN/SOFR+50, 5Y +55

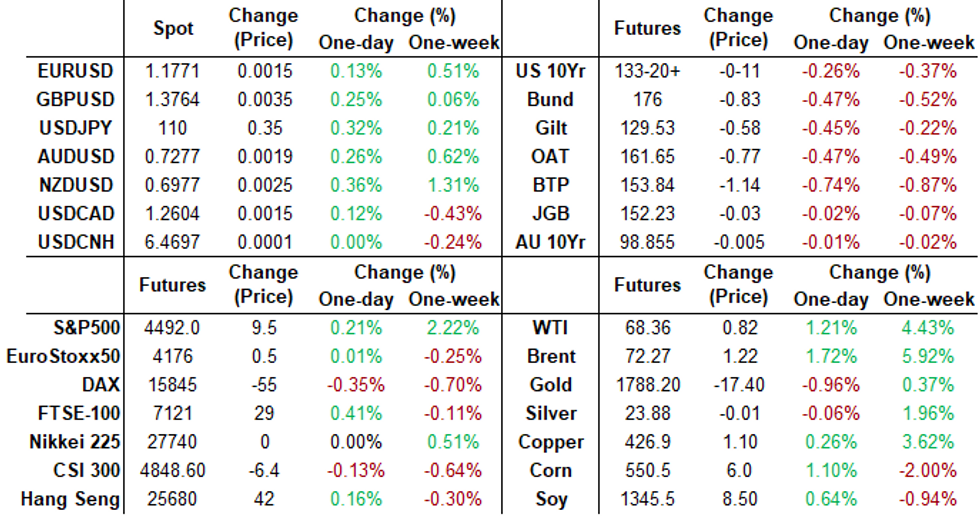

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 71.5 points (0.2%) at 35438.35

- S&P E-Mini Future up 11.5 points (0.26%) at 4493.75

- Nasdaq up 26.9 points (0.2%) at 15046.3

- US 10-Yr yield is up 4.4 bps at 1.3373%

- US Sep 10Y are down 10.5/32 at 133-21

- EURUSD up 0.0016 (0.14%) at 1.1771

- USDJPY up 0.36 (0.33%) at 110.01

- WTI Crude Oil (front-month) up $0.77 (1.14%) at $68.31

- Gold is down $10.56 (-0.59%) at $1792.29

- EuroStoxx 50 up 3.04 points (0.07%) at 4181.12

- FTSE 100 up 24.34 points (0.34%) at 7150.12

- German DAX down 45.19 points (-0.28%) at 15860.66

- French CAC 40 up 12.17 points (0.18%) at 6676.48

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.