-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ylds Up Ahead ADP Private Employment

US TSYS: Waiting for Wed's ADP Private Employ Data

Tsys trade weaker after the bell, off midday lows on decent volumes with London back from summer bank holiday. Dec took lead quarterly (Sep expire late September) bounced briefly after the MNI Chicago Business Barometer fell 6.6 points in August to 66.8, the lowest reading since June after climbing to a two-month high in July.- Futures extended session lows into midday, TYZ breaking channel support of 133-17 that had provided support a number of times since April.

- A clear break lower would highlight an important reversal. Bulls will be looking for the channel to hold and for price to extend the recent climb, initially towards 134-19+. Yield curves not surprisingly bear steepened.

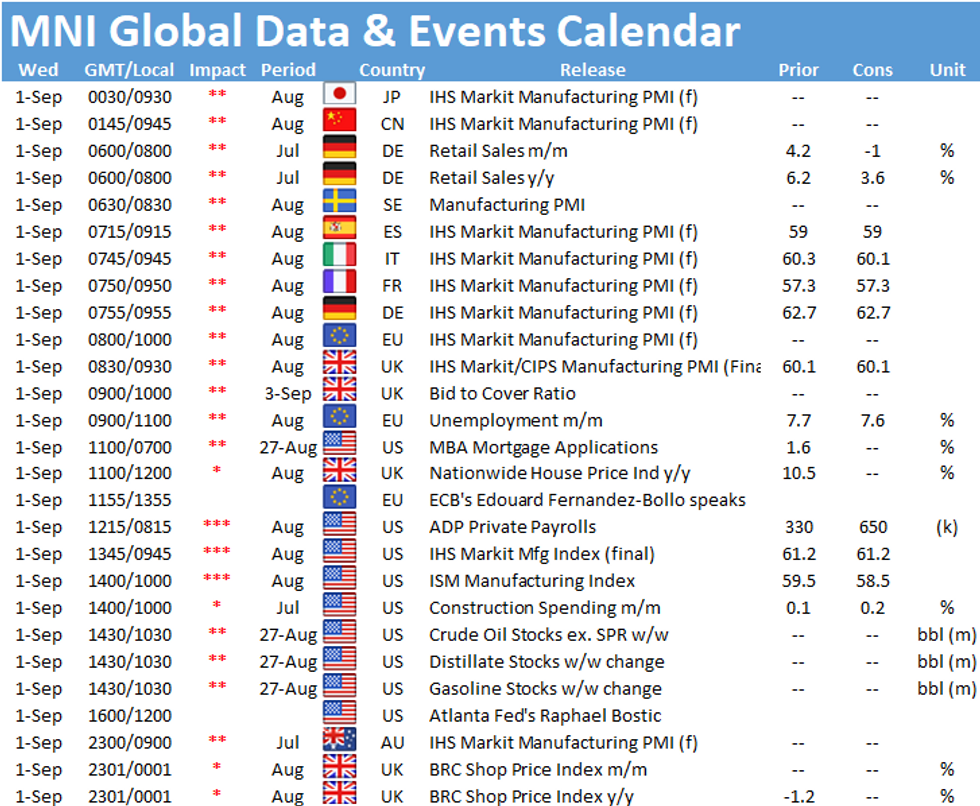

- Focus on Wednesday's ADP private employ data (+625k est vs. +330k prior) a precursor to Friday's August non-farm payrolls (+750k est vs. +943k prior).

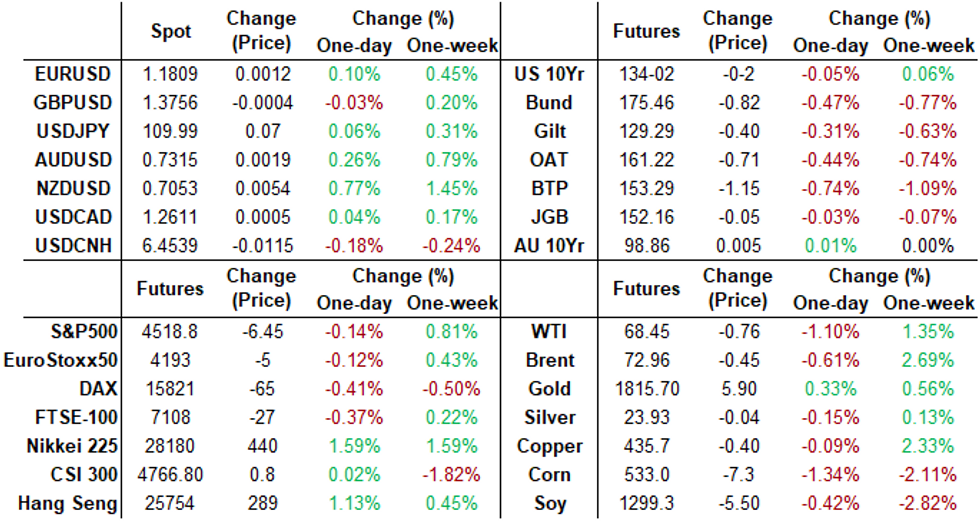

- The 2-Yr yield is up 0.6bps at 0.2074%, 5-Yr is up 0.5bps at 0.7724%, 10-Yr is up 2.4bps at 1.302%, and 30-Yr is up 2.9bps at 1.9249%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N -0.00275 at 0.07338% (-0.00125 total last wk)

- 1 Month -0.00350 to 0.08250% (+0.00012 total last wk)

- 3 Month -0.00025 to 0.11963% (-0.00850 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00513 to 0.14963% (+0.00213 total last wk)

- 1 Year -0.00725 to 0.22788% (-0.00150 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.05%, $885B

- Broad General Collateral Rate (BGCR): 0.05%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $349B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.650B submission

- Next scheduled purchases

- Wed 9/01 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 9/02 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

FED: REVERSE REPO OPERATION, New Record High

NY Fed reverse repo usage climbs to new record high of 1,189.616B from 82 counter-parties vs. $1,140.711B on Monday. Prior record high of $1,147.089B set Wednesday, Aug 25.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Dec 99.37 puts, cab

- +5,000 Jun/Red Sep/Red Dec 100 call strip, 3.75

- -10,000 short Sep 99.68/99.75 call spds, 3.75

- -4,000 Green Dec 98.43/98.68/98.75/99.0 put condors, 5.25 legged

- +5,000 Dec 99.37/Mar 99.25 put strip, 0.75

- Overnight trade

- +6,500 short Dec 99.56/99.62/99.68 call trees, 1.5 vs. 99.545 to .55/0.11%

- -5,000 Green Sep 99.00/99.12 2x1 put spds, 1.5 vs. 99.185/0.10%

- -5,000 Blue Dec 98.25/98.50 put spds, 6.0

- 11,200 TYV 130.75/131.75/132.75 put flys

- scale buyer +9,000 TYZ 136 calls, 19-18

- +2,500 TYV 132.5/133 put spds 1 over TYV 134/134.5 call spds

- +3,500 FVV 123 puts, 6.5-6.0

- 2,000 TYV 133.5 straddles, 110

- -3,000 TYV 132.75/133.75 strangles, 48

- -4,000 TYX 132/135 strangles, 39 vs. 133-21

- Overnight trade

- +5,000 FVV 123 puts, 6-6.5

- +1,500 TYV 131.5 puts, 6

EGBs-GILTS CASH CLOSE: ECB Hawks Hold Sway

Bunds and Gilts weakened sharply in afternoon trade Tuesday, with periphery spreads widening (10Y BTPs just off the August wides).

- EGB weakness was driven by both inflation breakevens and real rates; Gilts followed suit.

- Eurozone Aug inflation came in at 3% Y/Y, higher than expected and the highest print since 2011. Accordingly, ECB hawks Holzmann and Knot set a bearish tone, pointing to scope for a reduction of central bank stimulus as the COVID crisis abates.

- Earlier, Netherlands sold E2bln of DSL and Italy E7.75bln of BTP/CCTeu. Wednesday sees issuance from: ESM, Germany, Greece, and the UK; also final European PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.3bps at -0.713%, 5-Yr is up 3.9bps at -0.678%, 10-Yr is up 5.6bps at -0.383%, and 30-Yr is up 6.1bps at 0.092%.

- UK: The 2-Yr yield is up 10bps at 0.219%, 5-Yr is up 9.2bps at 0.383%, 10-Yr is up 13.6bps at 0.714%, and 30-Yr is up 5.7bps at 1.056%.

- Italian BTP spread up 4.3bps at 109.2bps / Spanish up 0.6bps at 72.1bps

EGB OPTIONS: Oct / Nov Bund Options Mostly Targeting Downside

Tuesday's rates / bond options flow included:

- RXX1 172.0/170.5 1x2 put spread bought for 4 in 2k

- RXV1 174/175cs 1x3, sold at -2 in 2k

- RXV1 172.5/171.5ps, bought for 19 and 20 in 2k

- RXV1 170.5/169ps, 1x2, bought for 5 in 2.5k

- RXV1 172.5/171.5/170.5/168 put condor vs 174.5/176 call spread, bought for 6 in 5,275

- RXZ1 174.50/175.50/176.50/177.50c condor, bought for 20.5 in 4k

- ERM2 100.50/100/99.50p fly, bought for 2.75 in 1k

- 3RH2 100.25/100.37/100.50c fly 1x3x2, bought for 0.75 in 1.5k

- 3RM2 100.25/100.37/100.50c fly 1x3x2, bought for -0.25 in 2.5k

- 3RZ1 100.25/100.12/100p fly, bought for 1.75 in 3k

- 3LZ 9925/00 ps, bought for 7.5 in 5k

FOREX: ECB Support Proves Shortlived for EUR

- Having traded firmer for much of the morning session, particularly against the greenback, the EUR faded into the Tuesday close, shrugging off support from a number of ECB speakers and a multiyear high in Eurozone inflation.

- Eurozone HICP touched a decade high of 3.0%, ahead of analyst expectations, which supported EUR/USD to print a session and multi-week high of 1.1845. The move was bolstered by comments from both ECB's Holzmann and Knot, who talked up the prospect of a reduction in stimulus from the ECB headed into the end of 2021.

- This soon faded, however, with the USD strengthening alongside a modest re-steepening of the US yield curve, putting the USD Index back to flat ahead of the close.

- NZD, AUD were the session's outperformers, while NOK, CAD and GBP declined.

- Australian GDP data for Q2, China's Caixin PMI and the August ISM Manufacturing data from the US are the data highlights Wednesday. ECB's Weidmann and Bostic are both due to be speaking.

FX Expiries for Sep01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E795mln), $1.1825(E648mln)

- USD/JPY: Y109.00($500mln), Y109.40($1.2bln), Y110.00-05($625mln)

- USD/CAD: C$1.2635-45($818mln)

- USD/CNY: Cny6.4750($520mln)

PIPELINE: SEB 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/31 $2B *IFC +5Y +19

- 08/31 $1.5B #SEB $750M 3Y +30, $750M 5Y +45

- 08/31 $Benchmark Canada Pension Plan Inv Brd 5Y +5a

- 08/31 $Benchmark Allianz perp NC6.6Y

- 08/31 $Benchmark Chiba Bank 5Y

- 08/31 $Benchmark Verizon 20Y Green bond chatter

- 08/31 Reverse Yankee: GM issuing 6Y via GBP +140a and 7Y via EUR +115a

- Rolled to Wednesday:

- 09/01 $2B ESM WNG 2Y +1

EQUITIES: US Inches Higher While European Indices Dip Into Close

- Wall Street followed futures into a higher open Tuesday, and managed to recover a mid-session dip lower to head into the close in the green. The US financials and communication services sectors were the outperformers as banks benefited from the re-steepening in the US curve, while healthcare and tech names were among the biggest losers of the day.

- Stocks across Europe were less positive, with most indices slipping into the closing bell to finish with minor losses. underperformance was noted in the UK's FTSE-100, lower by 0.4%, while the EuroStoxx50 held most of its ground, just 2 points lower at the finish of trade.

- The VIX touched a new multi-week low of 15.9 shortly after the opening bell, but pared losses to steer clear of a re-test of the August lows at 15.2 points.

COMMODITIES: Oil Inches Off Recent Highs, But Stays Bullish

- Oil markets saw support into last week's close as Hurricane Ida threatened production across the Gulf of Mexico. This continued to abate throughout the Tuesday session with WTI and Brent futures in modest negative territory. Despite the weakness, WTI remains bullish and traded to a fresh high Monday. The recovery from the Aug 23 low has defined a key short-term support at $61.74, Aug 23 low where a break is required to reinstate a bearish theme.

- Base metals trade under pressure, with the likes of iron ore and copper after disappointing China data overnight. PMIs for both the manufacturing and non-manufacturing sectors deteriorated faster than expected. This has supported the likes of gold and silver, with precious metals also receiving a boost from the weaker greenback.

- Gold remains above its 50-day EMA. The recent break above the average confirms a resumption of the upleg that started Aug 9. This signals scope for a climb towards resistance at $1834.1, Jul 15 high and a bull trigger. On the downside, initial support has been defined at $1774.5, Aug 19 low. A move below this support would be bearish and signal a short-term reversal.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.