-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bond Bid Evaporates Post Home Sales

US TSYS: Early Bond Bid Evaporates, US$ Climbs Back To Nov 2020 levels

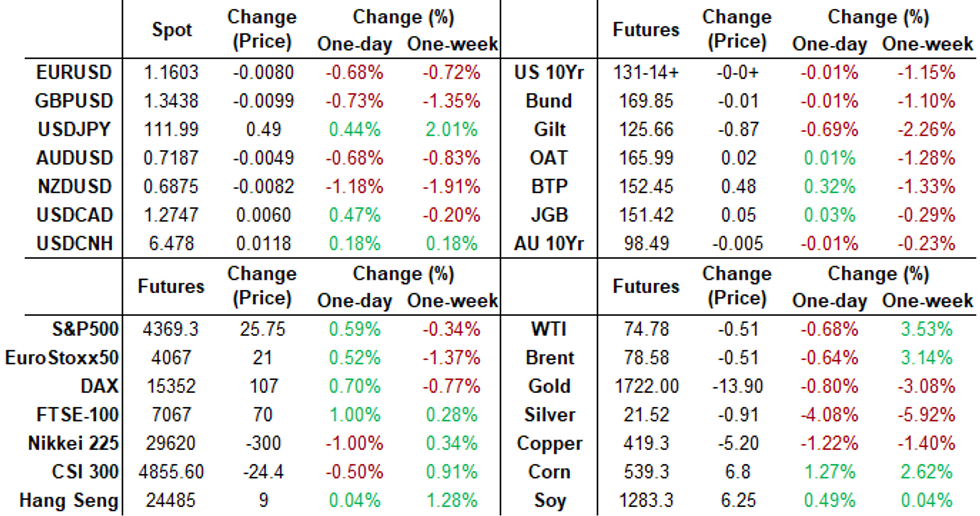

Rates finish mixed, yield curves reversed early flattening as long end support continued to evaporate after August pending home sales beat expectations 119.5 vs. 110.5 in Jul: +8.1% vs. +1.3% est.- Equities held modest gains, while USD climbed to Nov 2020 lvl -- historical tie-in to election just coincidence. Steady climb on same underlying catalyst behind curve steepening: Fed decision prompting markets to price in sooner, steeper policy normalization.

- No Market reaction on more or less consensus policy remarks as Philly Fed Pres Harker (non voter) penciling in first Covid-era interest rate increase for late next year or early 2023, after QE tapering is complete. Harker added that "it will soon be time" to begin to wind down the USD120B monthly asset purchase program, as QE kept markets functioning during the crisis but "aren't doing much -- or anything -- to ameliorate" labor shortages.

- SF Fed Daly sees by the end of this year, while conditions for raising near-zero interest rates will likely remain out of reach through 2022.

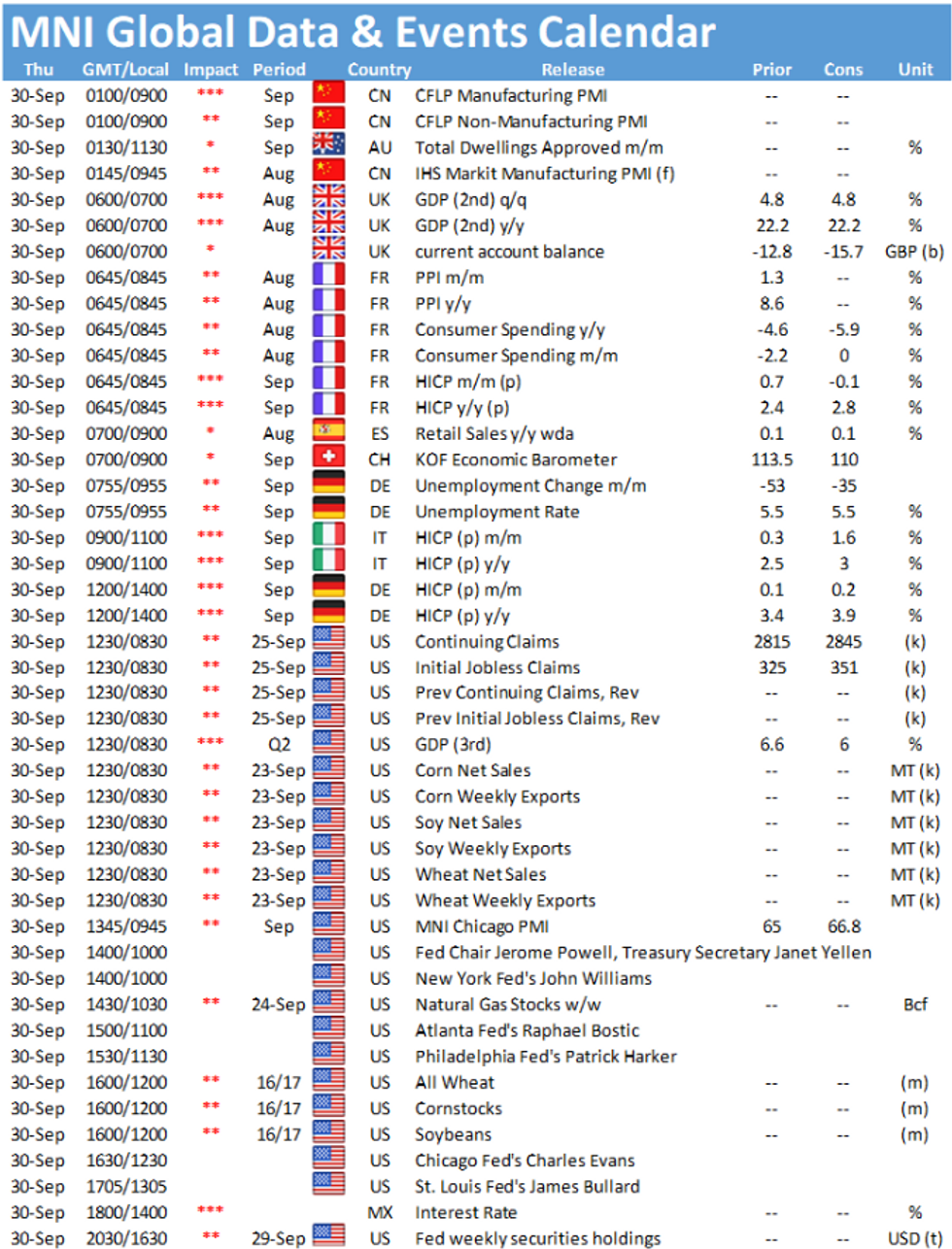

- Focus on Thu's weekly claims, GDP and at least seven additional Fed speakers Thu including Fed Chair Powell &Tsy Sec Yellen House Panel testimony.

- The 2-Yr yield is down 0.4bps at 0.297%, 5-Yr is down 0.8bps at 1.0115%, 10-Yr is up 0.7bps at 1.5444%, and 30-Yr is up 0.9bps at 2.0953%.

MONTH-END EXTENSIONS: PRELIMINARY Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.02Y, real extension 0.04Y; US Gov inflation linked 0.01Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.07 | 0.09 | 0.1 |

| Agencies | 0.08 | 0.06 | 0.05 |

| Credit | 0.09 | 0.12 | 0.11 |

| Govt/Credit | 0.07 | 0.1 | 0.09 |

| MBS | 0.09 | 0.07 | 0.09 |

| Aggregate | 0.09 | 0.09 | 0.09 |

| Long Gov/Cr | 0.06 | 0.08 | 0.12 |

| Iterm Credit | 0.07 | 0.1 | 0.1 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.12 | 0.12 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements- O/N -0.00138 at 0.07025% (-0.00225/wk)

- 1 Month -0.00175 to 0.08238% (-0.00275/wk)

- 3 Month -0.00062 to 0.13088% (-0.00138/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00050 to 0.15738% (+0.00200/wk)

- 1 Year +0.00213 to 0.24063% (+0.01100/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.05%, $883B

- Broad General Collateral Rate (BGCR): 0.05%, $378B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $348B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.937B submission

- Next scheduled purchases

- Thu 9/30 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Fri 10/01 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations, Records Meant To Be Broken

NY Fed reverse repo usage climbs to another new record high: $1,415.840B from 80 counter-parties today vs. yesterday's prior record $1,365.185B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Blue Dec 99.00/99.12 call spds, 3.0 vs. 98.85/0.10%

- 7,000 Red Dec'22 100 calls, 1.0

- +10,000 Nov 99.75 puts, 0.75

- +10,000 Blue Dec 97.87/98.12/98.37 put flys, 5.5

- -2,500 Red Dec'22 99.25/99.50 put spds, 10.25

- -5,000 Red Mar'23 98.87/99.37 put spds 7.5 over Red Sep'22 99.50 puts

- +2,000 Blue Oct 98.62/98.87 call spds, 1.25

- Overnight trade

- 6,250 Green Mar 98.12/Blue Mar 97.62 put calendar spds

- +4,000 short Oct 99.37/99.50/99.62 call flys, 7.5

- +4,000 Blue Dec 97.75/98.12/98.82 broken put flys vs. 98.87 calls, 0.0 net

- 2,000 Blue Feb 97.62/98.00/98.37 put flys

- 9,500 TYX 135 calls, 1

- 2,000 TYZ 130/131 2x1 put spds, 6 net/2-leg over

- -3,000 TYX 130/133.25 strangles, 13.0 131-24 ref

- Overnight trade

- 11,000 TYX 130.25/131.25 put spds vs. 132.5 calls

- -50,000 wk1 TY 132.5/133 call spds, 1, unwinds las Fri's buy at 8

- 3,700 FVX 132.25 calls, 6.5

- Block 5,000 TYX 131.5 puts, 44

EGBs-GILTS CASH CLOSE: Gilts Underperform (Alongside GBP)

Wednesday saw some retracement from Tuesday's yield rises for the most part, but Gilts underperformed Bunds and periphery spreads traded mixed.

- Not much thematically tying moves together (equities bounced, EUR and especially GBP weakened), more of a correction of the previous session's big moves.

- Though UK assets in general appeared weaker with EU tensions (over fishing) and energy supply problems making headlines all day.

- BTPs outperformed the space, with spreads/10Y Bund tightening 1.7bp.

- Supply concluded the week with BTP and Bund sales this morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.688%, 5-Yr is down 0.9bps at -0.558%, 10-Yr is down 1.4bps at -0.213%, and 30-Yr is down 1.3bps at 0.251%.

- UK: The 2-Yr yield is down 0.4bps at 0.405%, 5-Yr is down 0.3bps at 0.625%, 10-Yr is down 0.3bps at 0.991%, and 30-Yr is up 1bps at 1.335%.

- Italian BTP spread down 1.7bps at 103.7bps / Spanish up 1bps at 65.1bps

EGB Options: Mostly Upside In European Rates

Wednesday's European rates/bonds options flow included:

- RXX1 170.5/169.5/168/167p condor, sold at 35 in 20k

- 2RZ1 100.37/100.50cs, bought for 1.25 in 8k

- 0LZ1 99.25/37 cs Strip vs 99.12/9.00ps,strip bought the cs strip for 3 in 25k

- 2LZ1 99.25/99.37/99.50c fly bought for 1.25 in 4k

- SFIM2 99.65/99.75/99.90c fly, bought for 1.25 in another 4k, 8.2k total

FOREX: Sterling Sinks for Second Session

- For the second consecutive session, GBP was traded acutely weak as selling pressure on mounted on the push to fresh 2021 lows. Explanations are broad and varied, with some positing the images of fuel shortages and supply chain woes are raising the spectre of stagflation, however a number of sell-side analysts are pinning price action on month/quarter-end rebalancing, an effect that may persist into the Thursday fix.

- NZD was the sole currency to underperform GBP Wednesday, with a return lower for equities and commodity markets undermining high beta FX and growth proxies. The price action put NZD/USD within range of the 2021 lows printed back in August at $0.6805.

- The pervasive risk-off sentiment helped underpin greenback gains, resulting in the USD Index hitting the best levels since last November's Presidential election.

- The US MNI Chicago Business Barometer, Japanese industrial production & retail sales data, China's September manufacturing and non-manufacturing PMI, Italian CPI and the weekly jobless claims release are highlights Thursday.

- Central bank speaker events remain frantic, with Fed's Powell appearing again in front of lawmakers as well as speeches from Williams, Bostic, Harker, Evans and Bullard.

FOREX: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E511mln), $1.1650-54(E621mln), $1.1700(E1.8bln)

- USD/JPY: Y110.00($1.3bln), Y110.30-40($1.5bln), Y111.00($775mln)

- GBP/USD: $1.3640-50(Gbp1.2bln)

- AUD/USD: $0.7200-10(A$643mln)

- USD/CAD: C$1.2675($520mln), C$1.2740-55($2.2bln)

- USD/CNY: Cny6.4490($826mln)

PIPELINE: Over $6B Corporate Debt Issued Wednesday

$6.25B to Price Wednesday; $28.6B/wk

- Date $MM Issuer (Priced *, Launch #)

- 09/29 $1.5B #Enbridge $500M each: 2Y +30, $5Y +60, 08/01/51 tap +125

- 09/29 $1.25B *SEK (Swedish Export Cr) 3Y SOFR +17

- 09/29 $1.15B #Athene $650M 5Y +73, $500M 5Y FRN/SOFR, 10Y +110

- 09/29 $1B #Everest Reinsurance 31Y +115

- 09/29 $750M *APICORP 5Y Green +40

- 09/29 $600M #Bank of Nova Scotia 60NC5 3.625%

EQUITIES: Bounce Proves Short-Lived as Equities Begin to Creep Lower

- European markets opened well on Wednesday morning, reflecting a bounce off the week's lowest levels and a stabilization of the risk outlook. Wall Street followed suit, with the hardest hit tech names leading the recovery and prompting the NASDAQ to show decent early outperformance.

- These patterns soon reversed following the London close, with the familiar theme of value over growth re-emerging to pressure indices back toward the week's lower levels. The softening of price action was less dramatic than earlier in the week, with no new lows being printed, but continues to show that a rally back toward early September's alltime highs could be difficult absent fresh macro catalysts.

- The materials sector was the poorest performer in the S&P 500 thanks to a stalling in the recent commodities rally - with mining and exploration firms the hardest hit. The likes of Freeport McMoRan and Newmont Mining were off close to 2% apiece.

- Utilities and consumer staples - typical defensive names - were the firmest, underlining the still-fragile nature of markets.

COMMODITIES: Silver Slips as Metals Suffer From USD Strength

- A particularly solid session for the greenback worked against commodity markets from energy to metals. The USD strength kept a lid on the still-bullish energy contracts, resulting in Brent and WTI circling just below recent cycle bests.

- Despite the edge off highs for oil, dips are considered corrective and a bullish theme remains intact. Last week's break of $73.58, the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards $80.00 further out.

- Silver was among the contracts hit the hardest, with the metal slipping over 4% on the session to touch levels not seen since the run-up in July last year. Silver underperformed gold to such an extent that the gold/silver ratio hit fresh 2021 highs, with silver under additional pressure as demand for industrial metals continues to normalize.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.