-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

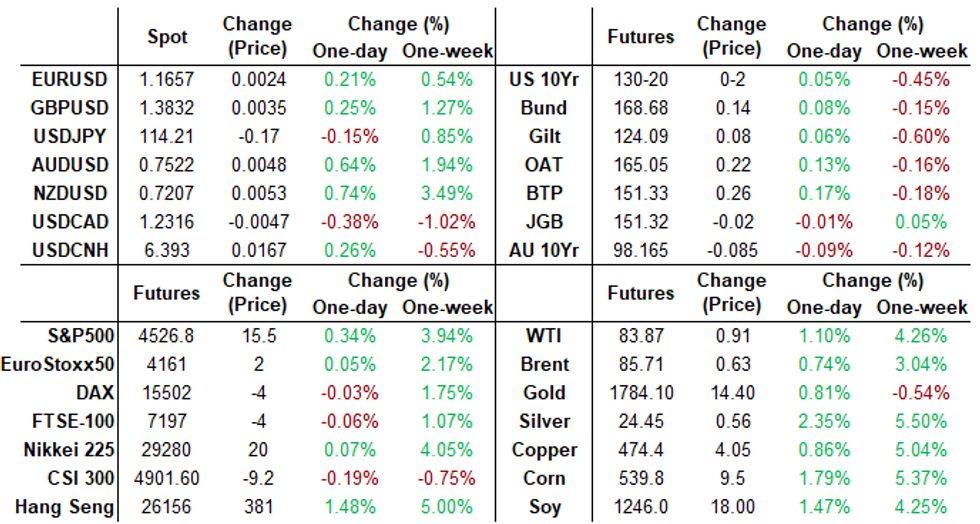

Free AccessMNI ASIA MARKETS ANALYSIS: Bond Weakness Continues

US TSYS: Carry-Over Weakness for Bonds

Carry-over weakness in Bonds continued Wednesday, yield curves bear steepening off Monday's early 2020 lows (5s30s +5.3 Wed to 57.4 after the bell). Bund and Gilt rates traded similarly with short end outperforming as rate hike speculation ebbed.- Inside range day on little substantive data and little to no reaction from Fed speakers. Fed Gov Quarles stating the Fed has not "met more stringent test for rate liftoff" about 24 hours after Fed Gov Waller posited more than just tapering MAY be needed in 2022.

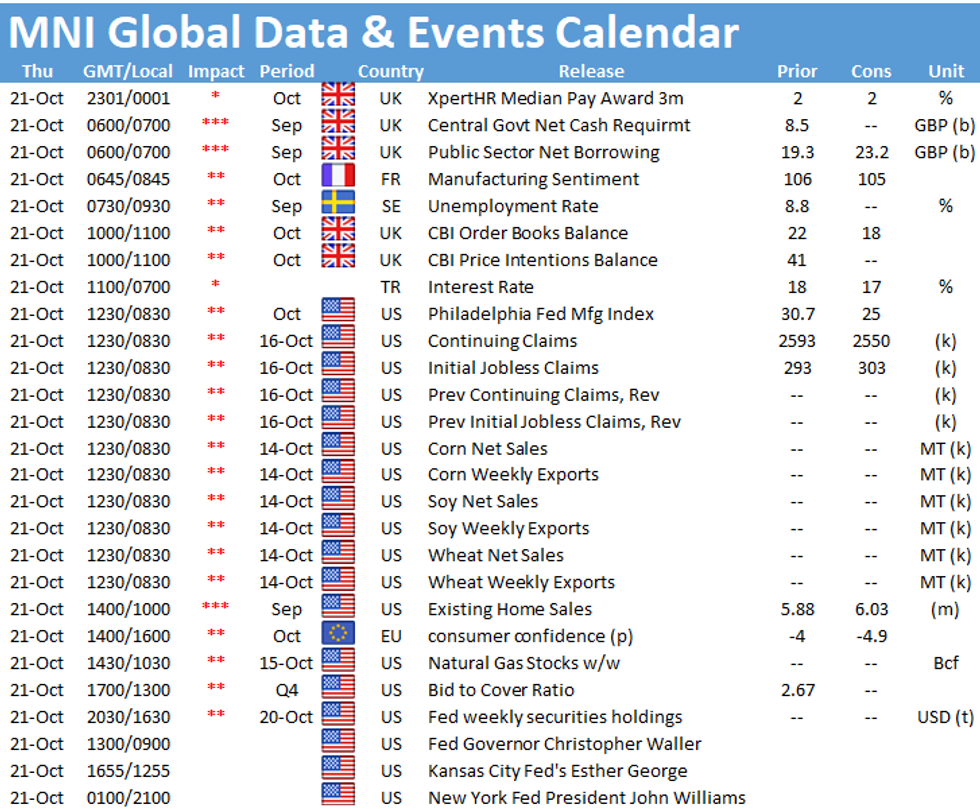

- Weekly claims (+297k est) and existing home sales (6.09M est) on tap Thursday while Fed Gov Waller speaks again on US economy.

- Tsys that had surged back to early session highs ahead the 20Y auction, sold off after the $24B 20Y Bond auction re-open (912810TA6) tailed: drawing a high yield of 2.100% (1.795% last month) vs. 2.070% WI. Bid-to-cover 2.25 vs. 2.36 in September.

- Beige Book: "MOST DISTRICTS REPORTED `SIGNIFICANTLY ELEVATED' PRICES", while "LABOR SHORTAGE WEIGHED ON GROWTH, WORKER TURNOVER HIGH".

- After the bell, 2-Yr yield is down 2.2bps at 0.3732%, 5-Yr is down 1.6bps at 1.1456%, 10-Yr is down 0.3bps at 1.6338%, and 30-Yr is up 2.4bps at 2.1091%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00150 at 0.07325% (+0.00012/wk)

- 1 Month +0.00012 to 0.08575% (+0.00538/wk)

- 3 Month -0.00125 to 0.12825% (+0.00462/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00300 to 0.17050% (+0.01000/wk)

- 1 Year +0.00462 to 0.29675% (+0.01712/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $269B

- Secured Overnight Financing Rate (SOFR): 0.03%, $875B

- Broad General Collateral Rate (BGCR): 0.05%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $359B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchase

- Tsys 7Y-10Y, $3.201B accepted vs. $8.333B submission

- Next scheduled purchases

- Thu 10/21 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 10/22 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

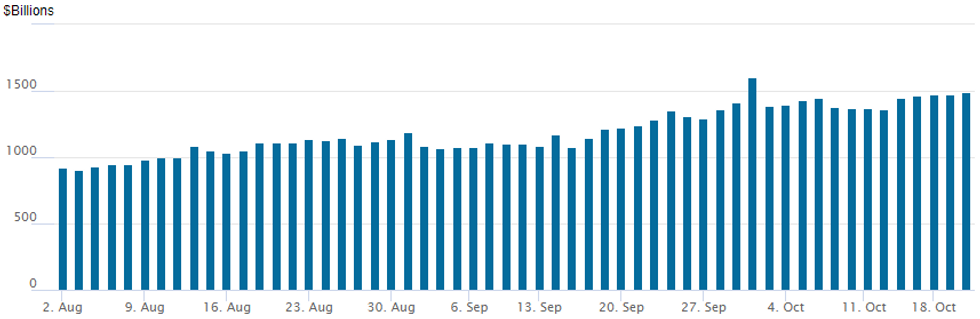

FED Reverse Repo Operation Second Highest on Record

NY Federal Reserve

NY Fed reverse repo usage recedes slightly -- to $1,493.961B from 78 counterparties vs. $1,470.739B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Red Dec'22 99.00 puts, 13.0 vs. 99.315/0.30%

- -10,000 short Jun 99.00 puts, 25.5 vs. 98.94/0.55%

- +20,000 short Dec 99.50/99.62/99.75 put flys, 1.5

- Overnight trade

- +45,000 Mar 99.50/99.62 put spds, 1.0

- +5,500 Mar 99.50/99.62/99.68/99.75 put condors, 0.5

- -18,000 short Dec 99.37/99.50/99.62 put flys, 2.0

- 4,000 short Jan 98.75/99.00 put spds

- 4,000 Nov 99.75/99.81 put spds

- -4,000 TYZ 130.5 straddles, 127

- +1,700 FVZ 120.5/121.5 2x1 put spds, 6.5

- Overnight trade

- +10,500 FVX 121.5 puts, 1, 121-29.5 ref

EGBs-GILTS CASH CLOSE: Short-End Sell-Off Relents

Bund and Gilt yields closed lower for the first time since last Thursday, with the short end outperforming as rate hike speculation took a step back.

- A miss on UK inflation at the beginning of the session set a slightly more dovish tone than seen previously in the week, with curves bull steepening.

- Periphery spreads fell with the exception of Greece.

- The biggest headline of the session was the unexpected resignation of Bundesbank President Weidmann, effective at the end of this year (successor to be decided by the next government).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.3bps at -0.658%, 5-Yr is down 3.3bps at -0.473%, 10-Yr is down 2bps at -0.126%, and 30-Yr is down 0.5bps at 0.291%.

- UK: The 2-Yr yield is down 4.9bps at 0.684%, 5-Yr is down 4.2bps at 0.818%, 10-Yr is down 2.1bps at 1.148%, and 30-Yr is up 1.5bps at 1.387%.

- Italian BTP spread down 1.4bps at 104bps / Spanish down 0.4bps at 63bps

EGB Options: Fading UK Rate Hikes

Wednesday's Europe bonds / rates options flow included:

- ERU3 100.00/99.75 1x2 put spread bought for 8.5 in 2k (+2 leg)

- SFIH2 99.70 calls bought for 2.25 in 30k

- SFIH2 99.30/99.40/99.50/99.60 call condor bought for 2.25 in 9k

FOREX: AUD and NZD Extend Positive Trend

- Antipodean FX continued its appreciating trend on Wednesday amid a slightly weaker dollar index. Positive risk sentiment continued to filter through to risk-tied FX with both AUDUSD and NZDUSD rising over 0.5%.

- NZDUSD completes a six-day winning streak which has seen the pair extend through the September peak to print fresh four-month highs above 0.7200. Further strength will bring the May highs at 0.7316 into focus.

- GBP had a fairly volatile session and saw a strong bounce off the lows throughout the latter half of Wednesday. Initially, a lower-than-expected CPI print prompted steady selling during European hours down to a low of 1.3742. However, dip buying proved powerful enough to reverse all the way to session highs above 1.3830 and keep the bullish theme intact. The recent break higher opens 1.3913, Sep 14 high.

- In emerging markets, USDTRY fell close to 1% after failing above 9.35 for the second consecutive session. Potential profit taking in play ahead of tomorrow's CBRT decision where the consensus expectation is for the central bank to cut rates by 100bps for the second consecutive meeting amid considerable background political pressure.

- US data on Thursday includes Philly fed Manufacturing Index alongside Initial Jobless Claims which should precede comments by Fed's Waller. Capping off Thursday schedule will be RBA Governor Lowe due to participate in a panel discussion.

FX: Expiries for Oct21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1734-40(E1.4bln)

- EUR/GBP: Gbp0.8460(E610mln)

- USD/JPY: Y115.30($610mln)

- AUD/USD: $0.7470-75(A$726mln)

- NZD/USD: $0.6950(N$2.3bln)

- USD/CAD: C$1.2650($1.0bln)

- USD/CNY: Cny6.4300($505mln), Cny6.4400($1.2bln)

PIPELINE: $4.5B Taiwan Semiconductor Mfg 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/20 $4.5B #TSMC (Taiwan Semiconductor Mfg) $1.25B 5Y +60, $1.25B 10Y +90, $1B 20Y +110, $1B 30Y +120

- 10/20 $1.5B #Bank of NY Mellon $700M 3Y+17, $400M 3Y FRN/SOFR+20, $400M 7.25Y +45

- 10/20 $1B *Citigroup PerpNC5 preferred 4.15%

- 10/20 $1B *Finnvera WNG 5Y +23

- Expected Thursday:

- 10/21 $Benchmark CADES (Caisse d'Amortissement de la Dette Sociale) 5Y +6

EQUITIES: S&P 500 Narrows in on ATH as Earnings Add Another Tailwind

- Wall Street traded uniformly positively Wednesday, with the S&P 500 adding just shy of 0.5% to narrow in on the all-time highs posted back in early September. The cash index showed above the record closing level, but in futures terms the e-mini S&P has around 17 points further to run before record highs in play.

- Earnings added another tailwind to equities, with the likes of Verizon Communications and Abbott Labs rallying sharply after their reports. This put utilities and healthcare sectors at the top of the sector breakdown, with tech firms the sole laggard.

- Europe was similarly positive, but gains were more modest, with the EuroStoxx50 adding just over 0.1% while the CAC-40 outperformed to close higher by 0.5%.

- Focus remains on earnings, with Thursday's highlights including Intel, AT&T, Union Pacific and Southwest Airlines. Full schedule with timings and expectations here: https://marketnews.com/mni-us-earnings-schedule-fo...

COMMODITIES: WTI, Brent Surge as Stockpiles Dwindle

- A uniformly positive set of DoE crude oil inventories numbers boosted WTI and Brent crude futures back into positive territory after a relatively saggy start. The weekly DoE release saw an unexpected draw in reserves for headline crude (-431k vs. Exp. +1.28mln) and both distillates and gasoline stocks saw a far larger draw than expected.

- The release saw a solid $2/bbl rally in Nov21 WTI futures, allowing the energy complex to retain its currently bullish stature. The focus is on $85.01 next, a Fibonacci projection.

- Gold traded well Wednesday, breaking back above the 50-dma, which continues to provide an anchor for prices. Key short-term resistance has been defined at $1800.6, the Oct 14 high. A resumption of weakness would expose support at $1746.0, Oct 6 low and clearance of this level would reinforce a bearish threat and attention would turn to $1721.7, Sep 29 low. For bulls, a break of $1800.6 is required to reinstate the recent bullish theme.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.