-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI ASIA MARKETS ANALYSIS: FOMC A Taper We Will Go

FOMC Annc Taper, Tsy Cuts Coupon Sizes

Rates finished weaker after latest FOMC left rate steady while annc taper starting later in November as well as December. Nevertheless, the Fed is "prepared to adjust taper if necessary."

- Transitory inflation language tweaked, with some more explanatory text on why inflation is seen "transitory", but the word itself NOT removed (which would have been more hawkish).

- Extending session lows now after decent two-way post FOMC, Tsy futures saw sharp pick-up in selling with yields climbed (10YY 1.5981%H; 30YY 2.0175%H). Transitory "tweak" saw stocks climb to new all-time highs: ESZ1 4657.0.

- In line with yield curves bouncing steeper: sources reported mix of domestic real$ buying 2s, 3s and 5s, foreign real$ bought 5s, real$ bought 3s5s steepeners.

- First highlights: Rates weaker after better than expected Oct ADP showed private employment gain of 571k vs. +400k est. Quarterly Tsy refunding pared coupon auction sizes $2-$3B.

- Tsy is offering $120 billion of Treasury securities to refund approximately $75.9 billion of privately-held Treasury notes and bonds maturing on November 15, 2021. This issuance will raise new cash of appr $44.1 billion.

- The 2-Yr yield is up 2.6bps at 0.4758%, 5-Yr is up 3.9bps at 1.1865%, 10-Yr is up 4.2bps at 1.591%, and 30-Yr is up 3.6bps at 1.9951%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00162 at 0.07775% (+0.00162/wk)

- 1 Month +0.00462 to 0.08550% (-0.00200/wk)

- 3 Month -0.00525 to 0.13975% (+0.00750/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00225 to 0.21850% (+0.01750/wk)

- 1 Year -0.00075 to 0.35762% (-0.00350/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $264B

- Secured Overnight Financing Rate (SOFR): 0.05%, $910B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $338B

- (rate, volume levels reflect prior session)

- No buy operation due to FOMC annc, two on Thursday

- Next scheduled purchases

- Thu 11/04 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 11/04 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 11/05 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

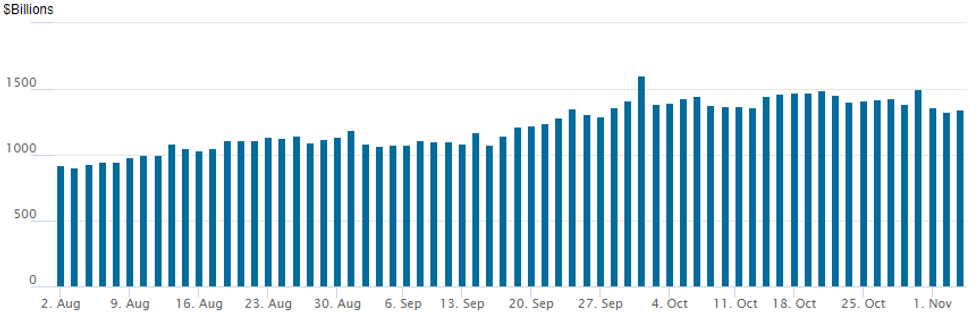

FED Reverse Repo Operation

NY Federal Reserve

NY Fed reverse repo usage climbs to $1,343.985B from 74 counterparties vs. $1,329.913B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Blue Dec 97.75/97.87/98.12 broken put flys, 3.0-3.5

- +4,000 Green Dec 99.00/99.31 strangles, 47.5

- -10,000 short Mar 99.37/Green Mar 98.62 call spds, 11.0 2EH2 over

- +5,000 short Nov 99.37/99.50 call spds

- +5,000 short Jun 98.00/98.62 2x1 put spds, 6.0

- Overnight trade

- 3,750 Green Jan 97.87/98.06/98.25 put flys

- 5,900 Blue Dec 98.50 calls

- 2,950 Red Mar 99.62/99.87 call spds

- 6,000 Mar 99.50 puts, 3.0

- 2,500 short Dec 99.25/99.37/99.50 put flys

- 2,000 TYZ 129.5/130.5 put spds, 20

- 6,000 TYZ 130.5/TYF 129.5 put spds, 16

- 5,000 FVZ 122.25/122.5 1x2 call spds, 0, 2-legs over

- 5,000 wk1 TY 130.25/130.5/131 broken put trees, 1 2-legs over

- Overnight trade

- 2,000 TYZ 129/130/131 put flys, 8

- 7,500 wk1 TY 129.5/wk2 TY 129 put spds

- 7,000 FVZ 120.75 puts, 4.0

EGBs-GILTS CASH CLOSE: ECB Rate Pushback; BoE Eyed

Periphery yields tightened while the Gilt curve underperformed again with notable weakness at the short-end ahead of the US Fed decision after hours and of course the BoE Thursday.

- Some pushback against ECB rate hike pricing by Lagarde and Villeroy helped boost the EGB space, with Italy and Greece outperforming on the periphery. A strong US ISM Services reading in the afternoon pulled Global FI weaker though.

- Overall, fairly subdued session volume-wise by recent standards, with many on the sidelines pre-Fed / BoE.

- A very mixed outlook for Thursday's BoE, with a majority of analysts seeing a 15bp hike tomorrow, but a large plurality seeing December or later (see the MNI Preview).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at -0.654%, 5-Yr is unchanged at -0.475%, 10-Yr is down 0.3bps at -0.168%, and 30-Yr is down 2.8bps at 0.148%.

- UK: The 2-Yr yield is up 3.7bps at 0.707%, 5-Yr is up 2.4bps at 0.845%, 10-Yr is up 3.6bps at 1.075%, and 30-Yr is up 3bps at 1.203%.

- Italian BTP spread down 2.3bps at 121.5bps / Greek down 2.6bps at 136.9bps

EGB Options: A Bet On No 2021 BoE Hikes

Wednesday's Europe bond / rates options flow included:

- OEZ1 134.0/133.5 put spread bought for 12.5 in 4.85k

- OEZ1 134.50/133.50 put spread bought for 30.5 in 2k

- RXZ1 171.5c, bought for 16 in 3k

- LZ1 99.75 calls bought for 1.5 in 10k. This is a BoE play, just ahead of the meeting Thursday - going for no hikes this year, although just short of the December meeting on the 16th, with expiry on Dec 15.

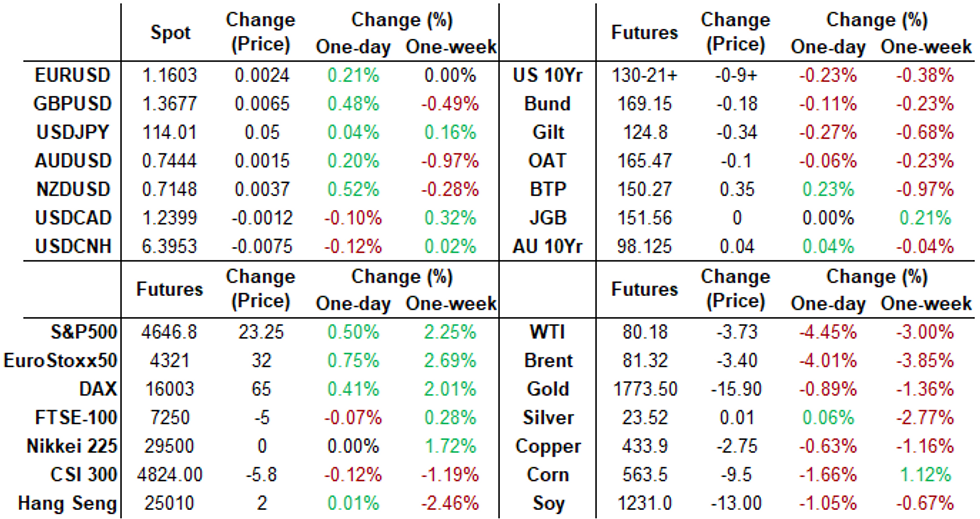

FOREX: Dollar Whipsaws But Ends Lower Following Fed Press Conference

- Immediate price action saw the greenback kneejerk lower following the release of the November FOMC statement. The USD retreated roughly 30 pips before immediately finding support.

- Heading into the press conference the dollar fully retraced and made new highs post the release, however, the rejuvenation was short-lived and the dollar once again traded with an offered tone, eventually making fresh session lows.

- With the continued buoyancy in equity markets, risk-tied currencies are back on the front foot, with NZDUSD leading the charge, up 0.77%. In emerging markets there was a considerable near 2% turnaround after rejecting the late march highs above 20.97.

- EURUSD reacted in tandem with the magnitude of moves seen in broad dollar indices, to trade back above 1.16, up a quarter point on Wednesday. USDJPY particularly lacked direction, spending the majority of the day trading either side of unchanged around the 1.1400 mark.

- Elsewhere cable remained well bid throughout the majority of the day, with multiple lows beneath 1.3610 potentially signalling a short-term inflection point. On the upside, key short-term resistance has been defined at 1.3835, Oct 20 high where a break would instead confirm a resumption of the recent upleg and open 1.3913 once again, Sep 14 high.

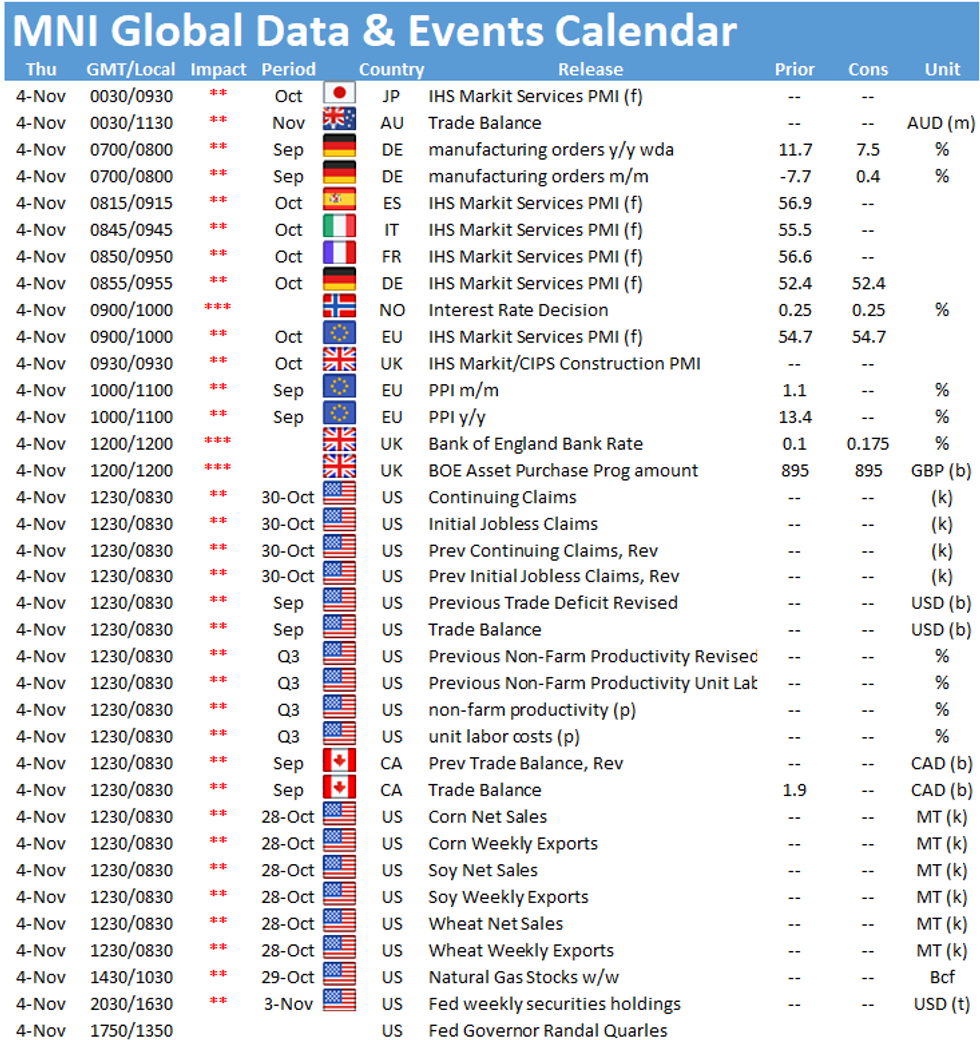

- Aussie retail sales data overnight along with a rate decision from the Norges Bank kicks off the European morning. The focus then turns to the Bank of England Decision, headlining the event risk on Thursday.

EQUITIES

Key late session market levels:

- DJIA up 60.48 points (0.17%) at 36132.48

- S&P E-Mini Future up 21.75 points (0.47%) at 4646.75

- Nasdaq up 131 points (0.8%) at 15783.18

European bourses closing levels:

- EuroStoxx 50 up 13.39 points (0.31%) at 4309.61

- FTSE 100 down 25.92 points (-0.36%) at 7248.89

- German DAX up 5.53 points (0.03%) at 15959.98

- French CAC 40 up 23.62 points (0.34%) at 6950.65

COMMODITIES: Selling Pressure on Gold Remains Elevated As Global Liquidity Continues To Decelerate

- Since it reached its peak in early August 2020, momentum on gold has been bearish, with the precious metal constantly testing lower highs.

- The risk-on environment combined with the deceleration in global liquidity have been two of the main factors explaining the consolidation in gold prices.

- The chart below shows that the annual change in global liquidity (defined as the sum of the major G4 central banks' assets) has shown a strong co-movement with gold prices in the past decade.

- Interestingly, the rise in US break-evens in recent weeks has not generated a strong rally in gold prices, raising concerns that gold may continue to test new lows in the near to medium term.

- Key support to watch on the downside stands at 1,690, which was rejected a few times this year; a break below that level would open the door for a move down to 1,600 (April 2020 lows).

- On the topside, key ST resistance to watch stands at 1,825, which represents its LT downward trending resistance line.

- WTI Crude Oil (front-month) down $3.63 (-4.33%) at $80.23

- Gold is down $19.17 (-1.07%) at $1770.38

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.