-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Hawks Are Circling

US TSYS: Hawks Are Circling, BoE Hikes, ECB Ups Inflation Forecast

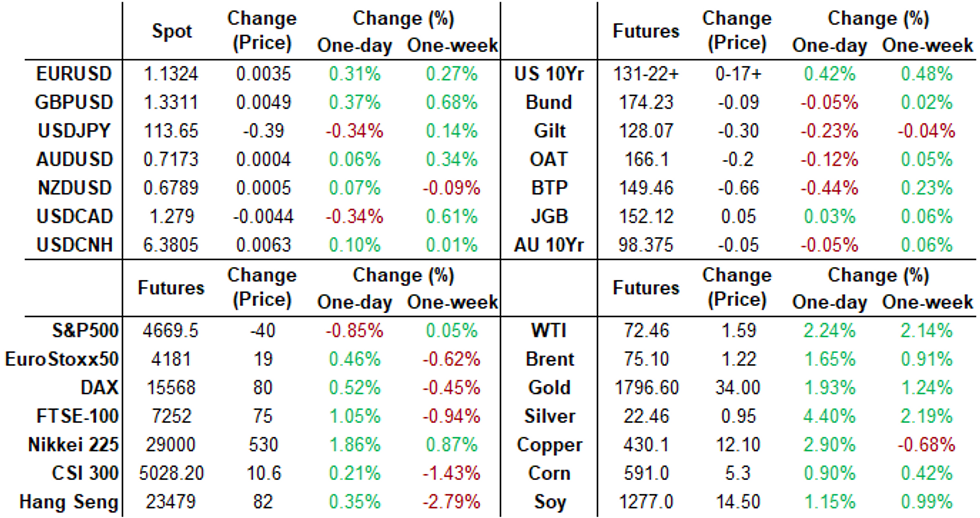

Tsys trading mostly higher (30Y-ultra weaker amid decent steepener flow since Wed's FOMC), near top end session range -- a stark contrast from session lows after the BoE and ECB policy annc's.

- Yield curves steepened but were off highs as long end partially recovered from post BoE/ECB policy selling. Fading the move, trading desks report central bank selling in 2s-3s and couple waves of buying in 30s, foreign real money selling 5s. Large steepener Blocks (5s and 10s vs. 30Y Ultra) since late Wednesday setting the tone after months of flattening.

- Misc acct buying in 2s-10s during early London trade evaporated on BoE rate hike to .25 followed by additional selling on ECB annc (steady, raises APP pace). Trading desks noted fast$, bank and dealer acct selling in long end initially, prop selling 10s, flattener unwinds (5s and 10s vs 30s).

- Aside the 2x taper acceleration, Chair Powell said rate liftoff could start after Mar22 (if warranted, etc), the FOMC shifted dot-plot to three hikes in 2022 and 2023. Forward guidance siphoned more aggressive rate hike pricing out of Eurodollar futures w/ Reds-Blues +0.080-0.120. Inversion of EDZ4 vs. futures out to EDM6 has waned as policy shock/error is quickly receding. EDZ4 (98.375) remains inverted through EDU5 (98.38).

- The 2-Yr yield is down 4.2bps at 0.6209%, 5-Yr is down 7.3bps at 1.1718%, 10-Yr is down 3.9bps at 1.4173%, and 30-Yr is down 0.3bps at 1.8565%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00175 at 0.07638% (+0.00413/wk)

- 1 Month -0.00475 to 0.10388% (-0.00475/wk)

- 3 Month -0.00200 to 0.21363% (+0.01538/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01000 to 0.31150% (+0.02325/wk)

- 1 Year +0.00775 to 0.52463% (+0.01525/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.05%, $959B

- Broad General Collateral Rate (BGCR): 0.05%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $337B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, appr $1.601B accepted vs. $4.693B submission

- TIPS 1Y-7.5Y, appr $1.501B accepted vs. $2.570B submission

- Next scheduled purchase

- Fri 12/17 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B vs. $1.600B prior

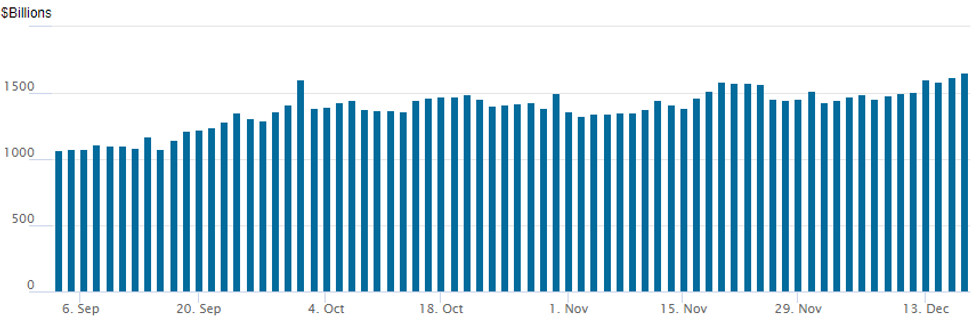

FED Reverse Repo Operation, Second Consecutive Record High

NY Federal Rserve/MNI

NY Fed reverse repo usage climbs to second consecutive all-time high of $1,657.626B from 78 counterparties after Wednesday's $1,621.097B beat prior record high of 1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -5,000 short Jun 98.00/98.62 2x1 put spds, 11.25

- Block, +10,000 Green Mar 78/81 put spds, 4

- +10,000 short Mar 99.25/99.50 call spds, 3.0

- Block, -20,000 EDZ 99.00 straddles, 50.5-50.0, appr -40k on day

- Block, +10,000 Mar 99.43/99.56/99.68 put flys, 3.0 at 0855:49ET (99.67 ref)

- Block, +10,000 Dec 99.18/99.43/99.68/99.93 put condors, 7 at 0808:29ET

- +12,800 TYG 132.5 calls, 13, total volume just over 29.3k lifted the offer, currently 13 bid vs. massive 400k+ 14 offer

- over +12,900 FVG 121.5 calls, 20, total 28.9k/day

- 25,000 TYG 132 calls, 17-20

- +12,500 TYF 130 puts, 3 vs. 131-00/0.10%, total volume >50.8k

- 6,900 TYG 128/129 put spds, 5

- 2,000 FVF 121.5/121.75 call spds earlier

- Overnight trade

- 20,000 TYF 132.5 calls, 1

- over 12,200 FVG 121.5 calls, 12.5-13.5

- 3,000 TYH 132 calls, 29

EGBs-GILTS CASH CLOSE: BoE Steals The Show

Gilts underperformed Bunds Thursday, with Greece outperforming among periphery EGBs, amid one of the busiest 24 hours in recent memory for central bank decisions.

- After the Fed took a hawkish turn Weds evening, the BoE surprised many today by hiking Bank rate 15bp; this was followed by the ECB's announcement it was ending net PEPP purchases in March 2022 but will reinvest until at least Oct 2024 and keep APP purchases (beginning Q2 2022) open-ended.

- The UK curve flattened sharply with the short end selling off, though this reversed, with yields ending the day higher in parallel. The German curve steepened all day. GGBs easily outperformed, with the ECB announcing that they could be the beneficiary of flexible PEPP reinvestment policy.

- Weak PMI data and Omicron headlines were largely shrugged off.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at -0.69%, 5-Yr is unchanged at -0.583%, 10-Yr is up 1.2bps at -0.348%, and 30-Yr is up 4.1bps at -0.005%.

- UK: The 2-Yr yield is up 1.9bps at 0.508%, 5-Yr is up 2.1bps at 0.61%, 10-Yr is up 2.1bps at 0.757%, and 30-Yr is up 1.5bps at 0.918%.

- Italian BTP spread up 4.3bps at 132.2bps / Greek down 3bps at 156.3bps

Limited Flow Despite Central Bank Action

Thursday's Europe rates / bond options flow included:

- RXG2 172.50/ RXF2 172 put diagonal bought for 35 in 2.9k

- 0RH2 100.12/99.87ps, bought for 3.75 in 3k

FOREX: EUR and GBP Rise After Central Bank Decisions, USD Weakness Prevails

- The greenback slipped another half a percent following yesterday’s reversal lower after the FOMC statement and press conference. The DXY weakness was aided by falls in both USDJPY and USDCHF as global equities retraced gains.

- Central bank decisions were again the story of the day on Thursday. The Norges Bank kicked things off lifting the key rate by 25bps. Initial weakness for EURNOK, trading down to 10.12, has largely reversed course throughout the afternoon and the NOK remains broadly unchanged.

- The Bank of England then gave GBP a shot in the arm with a rate hike that was not expected by the majority of surveyed analysts. Cable jumped from 1.3280 to highs of 1.3368 in very quick fashion.

- This area essentially capped the topside with GBP grinding lower throughout the remainder of the session. Resistance was broken at 1.3308, the 20-day EMA signalling a short-term reversal of the bearish technical outlook and therefore tomorrows price action may be significant for the short-term momentum.

- Next up was the ECB and while broadly in line with expectations, importantly for monetary policy, the inflation forecast was revised up over the horizon, suggesting a hike in 2023 is still feasible.

- The EUR remained buoyed following a breach of 1.1300 during the European morning and extended on gains toward 1.1360 as Lagarde spoke. Technically, the pair remains in a range and below 1.1383, Nov 30 high. A break of this resistance would signal potential for a stronger recovery towards 1.1429, the 50-day EMA.

- Today’s retracement in equities lent support to both the Japanese Yen and the Swiss Franc. USDJPY was unable to remain above 114 and once back below, shot down an additional 40 pips to 113.60. Upside momentum for the pair had been limited by the broad dollar weakness and the reversal in equities was all the pair needed to gravitate lower. In tandem CHF topped the G10 leaderboard, rising 0.6% back below 0.9200.

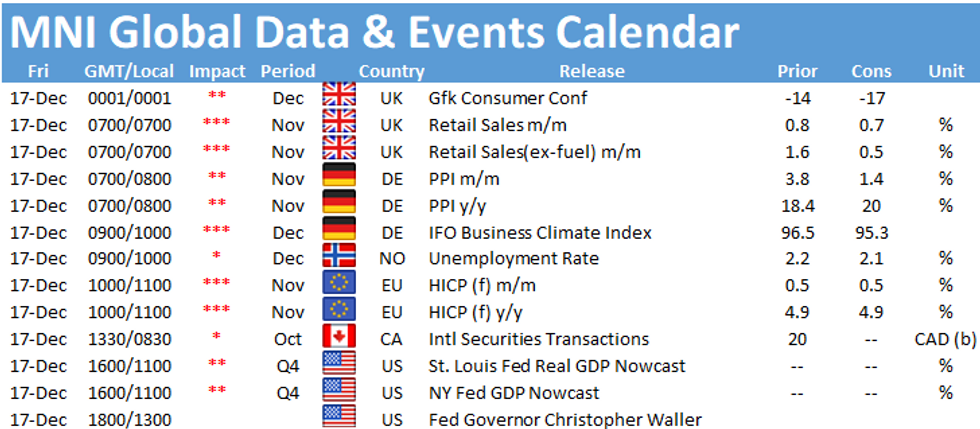

- Overnight we will have the Bank of Japan decision, before UK retail sales and German IFO data finish off the week.

FX: Expiries for Dec17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E2.4bln), $1.1300(E2.5bln), $1.1340-50(E1.4bln), $1.1380-00(E4.4bln), $1.1415-25(E1.37bln), $1.1450(E2.1bln), $1.1500(E1.2bln)

- USD/JPY: Y113.00($1.8bln), Y113.50-75($3.0bln), Y113.90-05($1.9bln), Y114.50($1.3bln)

- GBP/USD: $1.3200-10(Gbp1.1bln), $1.3250(Gbp1.5bln), $1.3300-20(Gbp1.1bln), $1.3350(Gbp1.1bln)

- EUR/GBP: Gbp0.8400(E2.0bln), Gbp0.8540-50(E1.1bln)

- USD/CAD: C$1.2730-50($1.0bln), C$1.2850($826mln), C$1.2900($785mln)

- USD/CNY: Cny6.3700($675mln), Cny6.4000($1.4bln)

EQUITIES: Wall Street Mixed as Global CBs Join Tightening Wave

- Following the resolutely positive finish to the Wall Street session Wednesday, Wall Street was more mixed into the Thursday close as global central banks joined the wave of tightening. Both the Norges Bank and the Bank of England raised interest rates, weighing slightly on stocks. The e-mini S&P faded off a post-Fed high of 4752.50 to trade either side of the 4700 level, but the NASDAQ Composite was hardest hit, dropping close to 1.5%.

- The tech sector was a laggard, with semiconductors suffering alongside software names. Apple was also a notable underperformer, reversing close to the entirety of the post-Fed gains.

COMMODITIES: WTI, Brent Build on Dollar Weakness

- WTI and Brent crude futures traded through the Thursday highs, extending post-Fed outperformance as the USD softened following hawkish turnouts from the European, UK and Norwegian central banks. The USD Index dropped to the lowest level since the beginning of December, priming USD-denominated commodities for a rally.

- For WTI, clearance of $73.34, Dec 9 high and $74.12, the 50-day EMA would reinstate a bullish focus and open $78.65, the Nov 26 low. Moving average studies are pointing south. This suggests short-term gains are corrective.

- Elsewhere for gold, initial resistance at $1794.5, Dec 1 high, gave way. A confirmed break here would warn of a developing base and provide a bullish signal. Weakness below Wednesday's low would resume bearish pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.