-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bond Yields Back to Late Nov Lvls

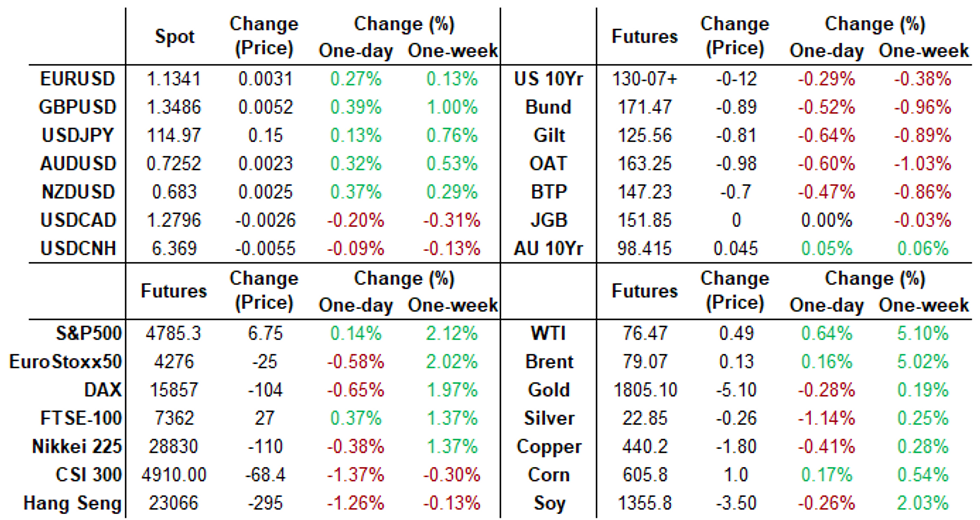

US TSYS: Bond Yields Back to Late Nov Levels

Better Tsy volumes with London back on line, and session still went out with a whimper. Thin year-end participation as Bond yds climbed back to late Nov levels.- Tsys gapped lower on the open, rebounded on air ahead the Nov adv goods trade deficit ($97.8B), wholesale inv +1.2 %, retail +2.0%.

- Modest bounce off session lows on Block buy of 2,000 WNH2 194-26, well through the 194-21 post time offer at 0947:31ET. Renewed selling in TYH2 after 130-07.5 first support breached, 130-03 low. Sell-off coincided with round of selling in equities after ESH2 made new ATH Tue: 4797.0.

- Tsy futures extend session lows after final coupon sale of 2021 trades weak: $56B 7Y note auction (91282CDP3): 1.480% high yield vs. 1.457% WI; 2.21x bid-to-cover lowest since Feb (five auction avg: 2.30x). Indirect take-up 59.25% vs. Nov's 59.29%

- Thursday last full session of 2021, data on tap:

- 0830 Jobless Claims (205k, 207k)

- 0830 Continuing Claims (1.859M, 1.875M)

- 0945 MNI Chicago PMI (61.8, 62.0)

- US Pres Biden, Russia Pres Putin to hold telephone talks Thursday over Ukraine tensions, no set time.

- The 2-Yr yield is down 0.2bps at 0.748%, 5-Yr is up 4.6bps at 1.2905%, 10-Yr is up 5.7bps at 1.5375%, and 30-Yr is up 4.9bps at 1.9491%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N +0.00300 at 0.07275% (-0.00450 total last wk)

- 1 Month +0.00300 to 0.10425% (-0.00125 total last wk)

- 3 Month +0.00588 to 0.22375% (+0.00525 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01113 to 0.35438% (+0.03050 total last wk)

- 1 Year +0.01887 to 0.58600% (+0.03750 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $247B

- Secured Overnight Financing Rate (SOFR): 0.04%, $844B

- Broad General Collateral Rate (BGCR): 0.05%, $328B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $315B

- (rate, volume levels reflect prior session)

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

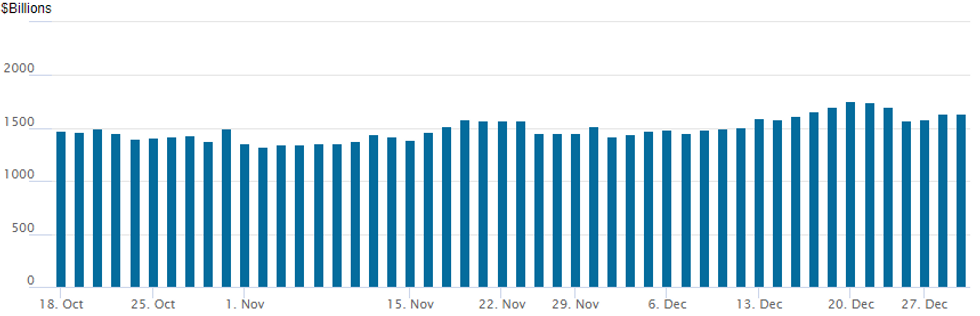

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,642.506B from 84 counterparties vs. $1,637.064B Tuesday. Record high of $1,758.041B posted Monday, December 20.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -4,000 Sep 99.50/99.75 put spds, 20.75

- +10,000 Mar 99.56/99.68 2x1 put spds, 3.75

- Seller short Jan 98.31/98.37/98.50/98.62 broken put condor, 1.5

- -10,000 short Jun 98.62 straddles 48.0 (-3k), balance at 47.5

- +1,000 Blue Mar 97.50/97.75 put spds, 1.5 vs. 98.285/0.10%

- Overnight trade

- +5,000 Sep 98.37/98.50/98.75 put flys, 2.5

- 8,000 Sep 98.50 puts

- +3,800 FVG 120.5 puts, 14.5-15.5

- 5,000 TYH 129.5 puts

- 3,000 TYG/TYH 132.5 call calendar spds, 10

- Overnight trade

- -5,000 TYG 130.5/131 call spds, 15

- Block, 5,000 FVG 120.5 puts, 13.5

FOREX: EURUSD Pops As Greenback Wilts Approaching Month/Year-End

- Despite the early broad based dollar strength on Wednesday, the greenback had a powerful turnaround. The dollar index fell from 96.40 highs all the way to 95.80 as value date month-end fixing approached.

- EURUSD very firmly off the lows, regaining the 1.13 handle and clearing congestion resistance layered between 1.1342-44. The single currency went on to trade 1.1369 ahead of the fix before retreating and settling around 30 points lower.

- With the December highs at 1.1360 challenged, the focus turns to key resistance at 1.1383, Nov 30 high. A break of this hurdle is required to signal a stronger recovery.

- The move lower in the US dollar also benefitted AUD, NZD, GBP and CAD. AUDUSD came within touching distance of 0.7275, a Fibonacci retracement. For bulls, the clear break of 0.7224 signalled a resumption of short-term bullish activity as the pair continues to edge away from strong medium-term support just below the 0.70 mark.

- Resilient US equity markets bolstered USDJPY, briefly breaching the 115 mark. The break of the 114.25 hurdle last week strengthened bullish technical conditions for USDJPY, signalling potential for a stronger rally. The Nov 24 High at 115.52 remains a key resistance and the bull trigger.

- Swiss KOF Economic barometer tomorrow morning before US employment claims and the MNI Chicago PMI headline the US docket.

FX: Expiries for Dec30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1284-90(E589mln), $1.1330-40(E771mln)

- EUR/GBP: Gbp0.8375(E541mln), Gbp0.8635(E583mln)

EQUITIES: Stocks on Solid Footing for Year-End

- While cash equity markets were mixed at the close, global stocks remain solid into year-end, with the e-mini S&P holding just below the all-time highs posted Tuesday as well as psychological resistance at the 4,800 mark. The Dow Jones Industrial Average outperformed slightly, while the NASDAQ was the laggard.

- Across the S&P 500, the strength in consumer staples, health care and real estate was countered by weaker energy, communication services and tech stocks to put the index broadly flat on the day.

- Sentiment across Europe was slightly more fragile, with continental markets in the red - although the UK's FTSE-100 outperformed to finish with gains of just shy of 0.7%. Strength across the likes of Diageo, Glencore and Experian boosted the index.

COMMODITIES: Oil Slips Despite Bullish US Inventory Data

- Crude oil futures have fully retraced a bid seen after bullish DOE US inventory data for an important holiday week, potentially correlated with some weakness in equities.

- WTI had increased more than 2% on larger-than-expected US crude oil, gasoline and distillate inventory drawdowns (crude -3576k vs -3166k expected).

- As it is, WTI is down -0.4% at $75.7, back where it was in earlier US trading although remains near month highs after last week’s bullish run.

- Amidst low volumes, the most active strikes today for the G2 (Feb’22) contract have all been calls: $85/bbl, $80/bbl and $77/bbl respectively.

- Brent is -0.7% at $78.4, off an intraday high of $80.17 yet also remains near month highs.

- OPEC+ next meets on Jan 4 to decide whether to go ahead with the 400kbpd increase in Feb.

- Goldman Sachs expects US crude prices going higher in 2022, with prices needing to stay high to spur supply.

OUTLOOK: Thu Look Ahead: Weekly Claims, Chicago PMI

- US Data/Speaker Calendar (prior, estimate)

- Dec-30 0830 Initial Jobless Claims (205k, 207k)

- Dec-30 0830 Continuing Claims (1.859M, 1.875M)

- Dec-30 0945 MNI Chicago PMI (61.8, 62.0)

- Dec-30 1130 US Tsy $50B 4W, $40B 8Y bill auctions

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.